Table of Contents

Introduction

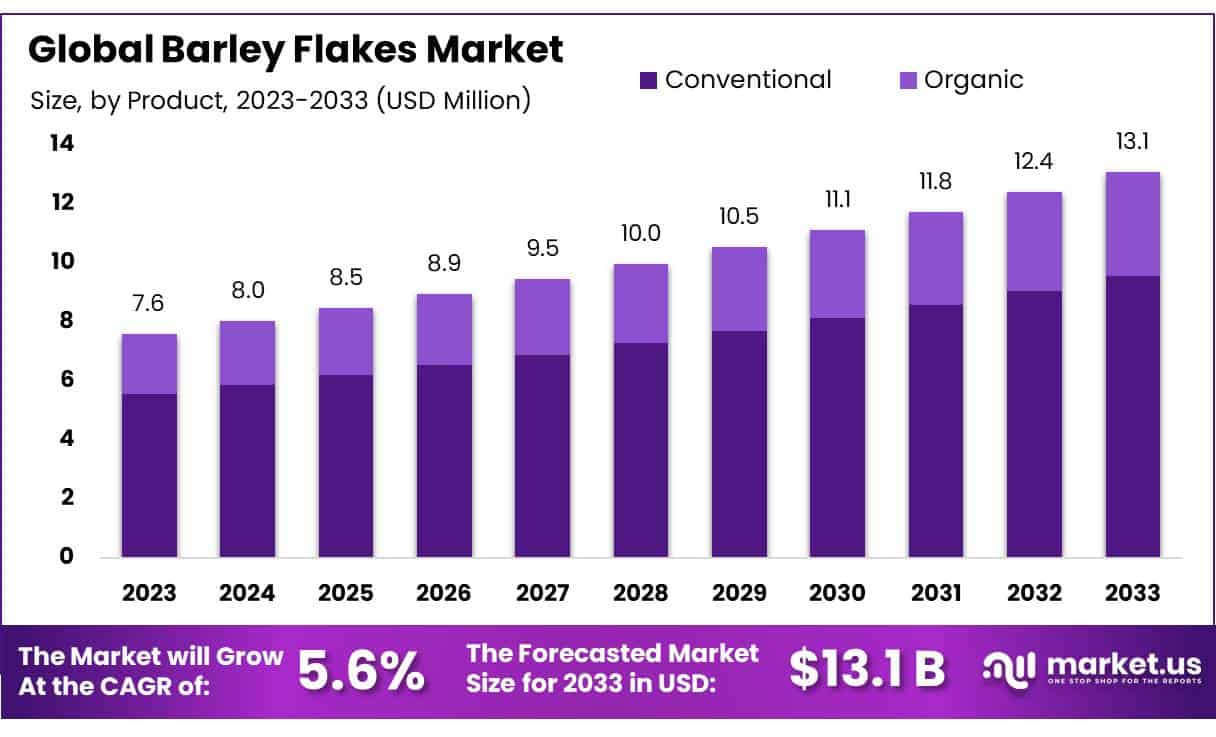

New York, NY – February 13, 2025 – The Global Barley Flakes Market is witnessing significant growth and is projected to be valued at around USD 13.1 billion by 2033, up from USD 7.6 billion in 2023, expanding at a compound annual growth rate (CAGR) of 5.6% over the next decade.

This increase is primarily driven by the growing consumer awareness of the health benefits associated with barley flakes, including their high fiber content and potential to lower cholesterol. As a versatile ingredient, barley flakes are gaining popularity in various food applications, from breakfast cereals to baking products, appealing to a broad range of health-conscious consumers.

The market’s expansion is further supported by opportunities for new product developments and innovations, particularly in the realm of gluten-free and organic products. Additionally, the rising trend of plant-based diets and clean eating habits is pushing the demand for barley flakes, positioning them as a favorable choice in the global health food market. This growth trajectory underscores the market’s dynamic nature and highlights significant opportunities for industry stakeholders to invest in product diversity and global market penetration strategies to tap into emerging consumer segments.

Key Takeaways

- Barley Flakes Market size is expected to be worth around USD 13.1 Bn by 2033, from USD 7.6 Bn in 2023, growing at a CAGR of 5.6%.

- The conventional barley flakes segment held a dominant position in the market, capturing more than 74.3% of the market share.

- whole grain barley flakes held a dominant position in the market, securing over 64.4% of the market share.

- pouches held a dominant market position in the barley flakes packaging sector, capturing more than 43.3% of the market share.

- household segment held a dominant market position in the barley flakes market, capturing more than 52.3% of the overall share.

- supermarkets and hypermarkets held a dominant market position in the distribution of barley flakes, capturing more than 53.2% of the market share.

- Asia Pacific (APAC) stands out as the dominating region, holding a significant 44.5% market share, valued at USD 3.6 billion.

Report Scope

| Market Value (2024) | USD 7.6 Billion |

| Forecast Revenue (2034) | USD 13.1 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Product (Conventional, Organic), By Nature (Whole Grain, Pearled), By Packaging Type (Pouches, Boxes, Bulk Packaging), By End-Use (Household, Food Processing Industry, Foodservice/HoReCa, Animal Husbandry, Others), By Distribution Channel (Convenience Stores, Supermarket/Hypermarket, Online, Others) |

| Competitive Landscape | Bob’s Red Mill Natural Foods, Briess Malt & Ingredients, CEREAL FOOD MANUFACTURING CO, Dun & Bradstreet, Inc., Grain Millers, Inc., Holland & Barrett, Honeyville, Inc., Kellogg, King Arthur Flour Company, Inc., Nature’s Path Foods, Inc., Nestlé, Post Holdings, Inc., Shiloh Farms, The Quaker Oats Company, Vitasana Foods Pvt Ltd, WK Kellogg Co |

Emerging Trends

- Health and Convenience Driving Growth: The rise in health consciousness and the need for convenient, quick-to-prepare food options are boosting the popularity of barley flakes. They are increasingly included in healthy breakfast options and snacks due to their high nutritional content.

- Preference for Organic Products: There’s a growing demand for organic barley flakes, driven by consumer preferences for health benefits and clean labels. This segment is expanding rapidly, with consumers opting for products free from synthetic pesticides and fertilizers.

- Expansion in E-commerce: Online sales channels are witnessing significant growth, thanks to the convenience of shopping from home and the ability to easily compare prices and products. This trend is expected to continue, enhancing the accessibility of barley flakes to a wider audience.

- Innovative Product Launches: Companies are introducing new barley flake products with added health benefits, targeting health-conscious consumers. This includes blends with other grains and enhanced nutritional profiles to appeal to a broader market.

Use Cases

- Breakfast Cereals and Porridge: Barley flakes are a popular choice for breakfast cereals due to their high nutritional value, including fiber, vitamins, and minerals. They can be cooked similarly to oatmeal or mixed into cold cereals for added texture and health benefits.

- Baking Ingredient: Barley flakes are used in baking to add texture and nutritional value to bread, muffins, and cookies. Their ability to blend well with other ingredients makes them a versatile choice for health-conscious bakers.

- Health and Nutrition Products: With the rising demand for nutritious and health-boosting foods, barley flakes are increasingly used in products targeting health-conscious consumers, including those on plant-based diets. They are also utilized in dietary supplements for fiber enrichment.

- Snack Foods: Barley flakes are incorporated into granola bars, snack mixes, and other ready-to-eat products. They provide a satisfying crunch and are valued for their whole-grain nutrition, making them a staple in healthy snacking options.

- Foodservice Applications: In the food service industry, barley flakes are used in soups, stews, and as a base for savory dishes, offering chefs a nutritious and easy-to-prepare ingredient that enhances the overall health profile of meals.

Major Challenges

- Supply Chain Disruptions: Barley flakes production often faces logistical hurdles, such as transportation issues or raw material shortages, which can hinder timely distribution and increase costs.

- High Competition: Barley flakes compete with many other grains like oats and quinoa in the health food market. This competition can make it hard for barley flakes to capture a larger market share.

- Consumer Awareness: Not all consumers are aware of the benefits of barley flakes, making it a less popular choice compared to other breakfast options like oatmeal or cereal.

- Quality Consistency: Ensuring consistent quality in barley flakes is challenging. Variability in the quality of barley due to agricultural factors can affect the final product’s texture and taste.

- Regulatory Challenges: Navigating the food regulations that vary by region can be complex and costly. Compliance with these regulations is essential but can be a significant hurdle for producers.

Market Growth Opportunities

- Health and Wellness Trends: Increasing consumer awareness about health and wellness benefits, particularly relating to high fiber and nutrient-rich foods like barley flakes, presents a growth opportunity. This trend is driven by consumers seeking healthy, nutritious breakfast and snack options.

- Organic and Clean Label Products: There is a growing demand for organic barley flakes, boosted by consumer preferences for products free from synthetic pesticides and artificial ingredients. This segment is expected to grow rapidly, tapping into the broader trend towards natural and sustainable food choices.

- Plant-Based Diet Adaptation: With the rise in vegan and plant-based diets, barley flakes are well-positioned as a nutritious plant-based food option. This provides an opportunity for market expansion into new consumer segments looking for plant-based whole-grain options.

- Innovative Product Offerings: Introducing innovative barley flake-based products, such as gluten-free options and flavored varieties, can cater to diverse consumer tastes and dietary needs. This diversification can help penetrate new market segments and increase consumer engagement.

- Expansion in Emerging Markets: Increasing living standards and adoption of Western dietary trends in regions like Asia Pacific offer significant growth potential. Localized marketing strategies and expanding distribution channels in these regions could drive higher consumption of barley flakes.

Recent Developments

1. Bob’s Red Mill Natural Foods

- Recent Developments:

- Innovation: In 2023, Bob’s Red Mill expanded its product line to include organic barley flakes, targeting health-conscious consumers. The company emphasized the nutritional benefits of barley, such as high fiber and protein content, aligning with the growing demand for whole grains.

- Partnerships: In 2022, Bob’s Red Mill partnered with several farm cooperatives to source non-GMO and organic barley, ensuring sustainable and traceable supply chains.

- Contribution to Barley Flakes Sector: The company’s focus on organic and non-GMO barley flakes has strengthened its position in the health food market, promoting barley as a versatile ingredient for breakfast cereals, baking, and snacks.

2. Briess Malt & Ingredients

- Recent Developments:

- Innovation: In 2023, Briess launched a new line of roasted barley flakes, targeting the craft brewing and distilling industries. These flakes are designed to enhance flavor profiles in beers and spirits.

- Contribution to Barley Flakes Sector: Briess’s innovations in roasted barley flakes have expanded the use of barley beyond traditional food applications, creating new opportunities in the beverage industry.

3. CEREAL FOOD MANUFACTURING CO

- Recent Developments:

- Acquisitions: In 2023, the company acquired a smaller barley processing firm to expand its portfolio of barley-based products, including barley flakes for breakfast cereals.

- Partnerships: Partnered with a major retail chain in 2022 to launch a co-branded line of barley flakes and granola products.

- Contribution to Barley Flakes Sector: The acquisition and partnerships have increased the availability of barley flakes in retail markets, making them more accessible to consumers.

4. Dun & Bradstreet, Inc.

- Recent Developments:

- Data Services: In 2023, Dun & Bradstreet launched a new analytics platform that provides insights into the barley supply chain, helping businesses optimize sourcing and production.

- Partnerships: Collaborated with agricultural trade associations in 2022 to improve data transparency in the barley industry.

- Contribution to Barley Flakes Sector: While not directly involved in production, Dun & Bradstreet’s data services have supported companies in the barley flakes sector by improving supply chain efficiency and market intelligence.

5. Grain Millers, Inc.

- Recent Developments:

- Innovation: In 2023, Grain Millers introduced a new extrusion technology for producing barley flakes, reducing processing time and energy consumption.

- Contribution to Barley Flakes Sector: Grain Millers’ innovations and investments have improved the quality and sustainability of barley flakes, supporting the growing demand for healthy and eco-friendly food products.

Conclusion

Barley Flakes are poised for significant growth due to their nutritional benefits and alignment with current health and dietary trends. As consumers increasingly seek out healthy, convenient, and versatile food options, barley flakes stand out for their high fiber content, essential minerals, and adaptability in various recipes. The market is further driven by a growing preference for organic and clean-label products. To capitalize on these opportunities, producers can focus on innovative product development and expanding into emerging markets where health-conscious trends are gaining momentum. With strategic marketing and expanded distribution channels, barley flakes can achieve greater market penetration and consumer acceptance globally.