Table of Contents

Introduction

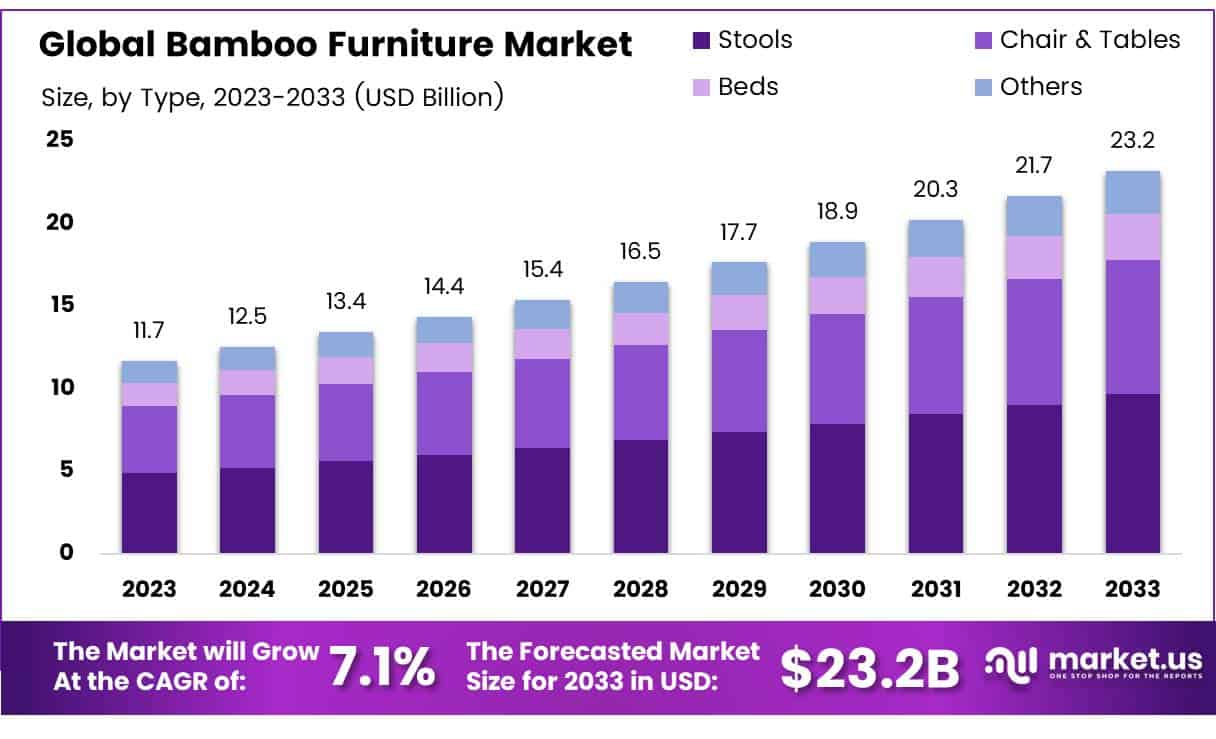

The Global bamboo furniture market was valued at USD 11.7 billion in 2023 and is projected to reach approximately USD 23.2 billion by 2033. The market is expected to expand at a compound annual growth rate (CAGR) of 7.1% during the forecast period from 2024 to 2033.

Bamboo furniture refers to home and commercial furnishings made primarily from bamboo, a fast-growing, renewable grass known for its strength, durability, and environmental benefits. Unlike traditional hardwood, bamboo matures in 3–5 years, making it a highly sustainable alternative in the global furniture industry.

The bamboo furniture market comprises the production, distribution, and sale of bamboo-based products such as chairs, tables, beds, cabinets, and decorative items. This market is driven by a rising consumer preference for eco-friendly and biodegradable materials, coupled with an increasing focus on sustainable interior design solutions. Growth factors include heightened awareness of climate change, deforestation concerns, and stringent regulations on conventional wood harvesting, all of which have accelerated the demand for low-impact materials like bamboo.

Additionally, bamboo’s natural aesthetics, termite resistance, and mechanical strength contribute to its growing appeal across residential, hospitality, and office segments. Consumer demand is particularly high in Asia-Pacific due to traditional usage and regional availability, while North America and Europe are experiencing robust adoption driven by green building standards and ethical consumerism. Technological advancements in bamboo processing and composite manufacturing have further enabled the development of more durable and stylish furniture designs, widening its application scope.

A key opportunity lies in the premium and modular furniture categories, where bamboo’s lightweight and customizable properties align well with modern living trends. Moreover, the rise of online retail and the global popularity of minimalist and Scandinavian-style interiors are expected to unlock new market potentials for bamboo furniture, especially among environmentally conscious urban consumers.

Key Takeaways

- The global bamboo furniture market was valued at USD 11.7 billion in 2023 and is anticipated to reach USD 23.2 billion by 2033, expanding at a compound annual growth rate (CAGR) of 7.1% during the forecast period.

- The stools segment emerged as the leading product category, capturing a market share of 43.6% in 2023. The dominance of this segment is attributed to the rising demand for multi-functional, space-saving, and sustainable seating solutions, particularly in urban and compact living spaces.

- The residential sector accounted for the largest share of 74.6% in the global market in 2023. This dominance is driven by the growing consumer preference for sustainable home furnishings, along with increasing awareness of environmental conservation and the benefits of biodegradable and renewable furniture materials.

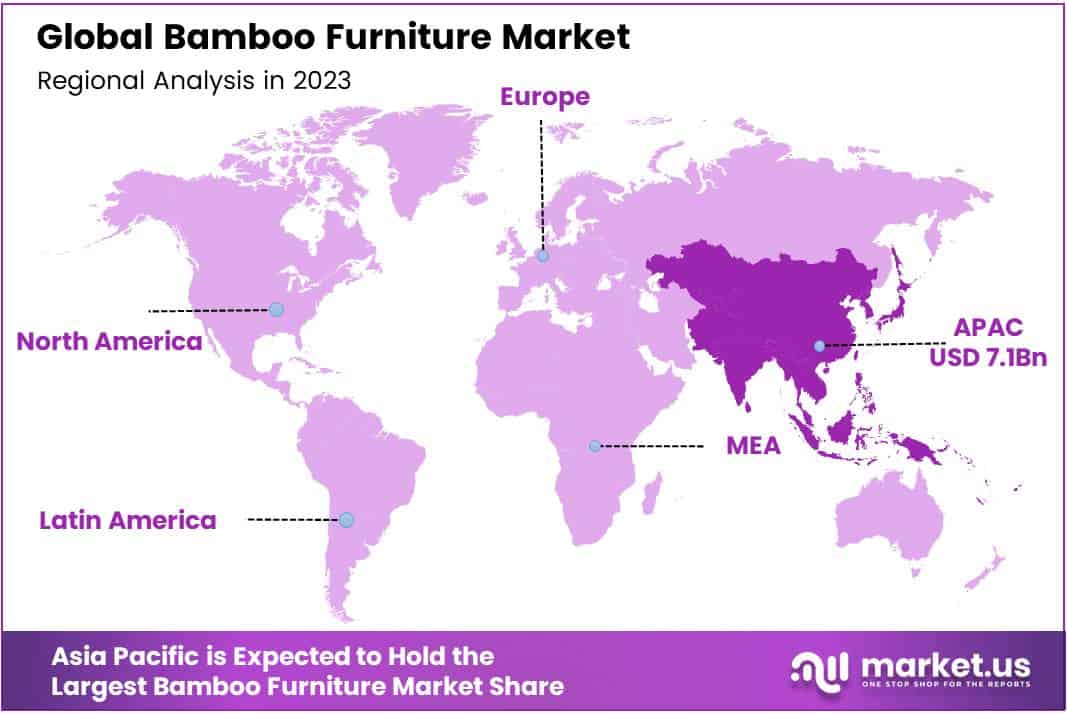

- The Asia Pacific region led the global bamboo furniture market, holding a 61.6% share, which equated to a market value of approximately USD 7.13 billion in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 11.7 Billion |

| Forecast Revenue (2033) | USD 23.2 Billion |

| CAGR (2024-2033) | 7.1% |

| Segments Covered | By Type (Stools, Chair & Tables, Beds, Others), By End-use (Residential, Commercial) |

| Competitive Landscape | Greenington., Zhenghe Ruichang Industrial Art Co., Ltd, Zoco Home, BAMBOO VILLAGE COMPANY Ltd., MOSO Bamboo, Tine K Home A/S, Haiku Designs, Lene Bjerre Design INT, IKEA Systems B. V. |

Emerging Trends

- Smart Integration: Bamboo furniture is increasingly incorporating smart features such as USB charging ports and LED lighting systems, aligning with the growing demand for multifunctional home furnishings.

- Hybrid Material Designs: Designers are combining bamboo with materials like glass, metal, and fabrics to create hybrid furniture pieces that enhance both aesthetics and durability.

- 3D Printing and Advanced Manufacturing: Innovations in manufacturing, including the use of 3D printing and advanced composite materials, are enabling more intricate and customized bamboo furniture designs.

- Luxury Market Expansion: There is a noticeable shift towards high-end bamboo furniture, with consumers seeking premium finishes and intricate designs that reflect luxury and sustainability.

- E-commerce Growth: The online retail segment for bamboo furniture is expanding, offering consumers a wider variety of options and greater convenience in purchasing sustainable furniture.

Top Use Cases

- Residential Furniture: Bamboo furniture is widely used in homes for its aesthetic appeal and sustainability, with the residential segment accounting for over 74% of the market share in 2023.

- Hospitality Industry: Hotels, cafes, and restaurants are adopting bamboo furniture for its durability and eco-friendly image, enhancing their brand’s commitment to sustainability.

- Outdoor Settings: Bamboo’s natural resistance to elements makes it suitable for outdoor furniture, including garden chairs and patio tables, catering to the growing demand for outdoor living spaces.

- Healthcare Facilities: Innovations have led to the development of bamboo furniture for hospitals, offering cost-effective and sustainable solutions for healthcare environments.

- Office Spaces: Bamboo furniture is being incorporated into office designs, providing a sustainable and aesthetically pleasing alternative to traditional office furnishings.

Major Challenges

- Climate Sensitivity: Bamboo furniture is susceptible to damage from excessive moisture and dampness, limiting its use in certain climates and affecting its longevity.

- Consumer Awareness: There is a lack of widespread consumer knowledge about the benefits and durability of bamboo furniture, hindering its adoption in some markets.

- Perception Issues: Bamboo furniture is sometimes perceived as less durable or inferior compared to traditional hardwood furniture, affecting consumer preferences.

- Supply Chain Limitations: The bamboo furniture industry faces challenges in scaling production and ensuring a consistent supply of high-quality raw materials.

- Standardization and Regulation: The lack of standardized regulations and quality benchmarks for bamboo furniture can lead to inconsistencies in product quality and consumer trust.

Top Opportunities

- Market Expansion in Asia-Pacific: Countries like China and India, holding over 61% of the market share in 2023, present significant growth opportunities due to abundant bamboo resources and increasing demand for sustainable furniture.

- Product Diversification: Expanding beyond traditional furniture to include bamboo-based home decor and accessories can tap into new consumer segments and increase market share.

- Collaborations with Designers: Partnering with architects and interior designers can lead to innovative bamboo furniture designs, appealing to a broader customer base seeking unique and sustainable options.

- Technological Advancements: Incorporating smart features and leveraging advanced manufacturing techniques can enhance the functionality and appeal of bamboo furniture, meeting modern consumer expectations.

- Sustainability Initiatives: Aligning with global sustainability goals and promoting bamboo furniture as an eco-friendly alternative can attract environmentally conscious consumers and support market growth.

Key Player Analysis

In 2024, the competitive landscape of the global bamboo furniture market is shaped by a mix of established international players and regionally strong manufacturers. Companies such as Greenington and Haiku Designs are recognized for their sustainable product lines and contemporary designs, leveraging North American consumer preferences for eco-conscious furniture. Zhenghe Ruichang Industrial Art Co., Ltd and BAMBOO VILLAGE COMPANY Ltd., based in Asia, have capitalized on cost-effective manufacturing and deep-rooted supply chains, allowing them to dominate export markets.

Zoco Home, Tine K Home A/S, and Lene Bjerre Design INT, with roots in Europe, cater to premium lifestyle consumers, aligning bamboo aesthetics with Scandinavian design principles. MOSO Bamboo, known for innovation in material development, integrates advanced processing techniques to enhance product durability. Meanwhile, IKEA Systems B.V. plays a pivotal role by mainstreaming bamboo furniture globally through its affordable, sustainable product ranges, thereby expanding consumer accessibility and accelerating market growth.

Top Key Players in the Market

- Greenington.

- Zhenghe Ruichang Industrial Art Co., Ltd

- Zoco Home

- BAMBOO VILLAGE COMPANY Ltd.

- MOSO Bamboo

- Tine K Home A/S

- Haiku Designs

- Lene Bjerre Design INT

- IKEA Systems B. V.

Regional Analysis

Asia Pacific Leads the Bamboo Furniture Market with Largest Market Share of 61.6% in 2024

In 2024, Asia Pacific emerged as the dominant region in the global bamboo furniture market, accounting for the largest market share of 61.6%, valued at approximately USD 7.13 billion. This significant regional dominance can be attributed to the abundance of raw bamboo resources, strong craftsmanship traditions, and the presence of leading bamboo furniture manufacturers in countries such as China, India, Vietnam, and Indonesia. Moreover, increasing domestic demand driven by a growing preference for eco-friendly and sustainable home décor solutions has reinforced the region’s leadership. China, being the world’s largest producer of bamboo, plays a central role in shaping market dynamics by offering cost-effective production and a well-established supply chain.

The regional growth is further supported by favorable government initiatives promoting sustainable furniture manufacturing, coupled with rising urbanization and an expanding middle-class population seeking natural and biodegradable home furnishings. Additionally, the integration of bamboo furniture in the booming e-commerce and export markets across Asia Pacific has amplified its global reach. The regional market is also benefiting from increasing investments in design innovation and sustainable product development.

However, the export competitiveness of Asian bamboo furniture manufacturers has encountered challenges due to U.S. tariffs on Chinese-origin furniture products, including those made from bamboo. These trade restrictions have led to supply chain adjustments and a moderate shift in export patterns toward alternative markets such as Europe and Southeast Asia. Despite these barriers, Asia Pacific continues to lead globally, supported by its deep-rooted production infrastructure, labor availability, and material efficiency. Overall, the region’s prominence is expected to remain intact, bolstered by both domestic consumption and a strong emphasis on green furniture solutions.

Recent Developments

- In 2023, HNI Corporation finalized the acquisition of Kimball International, strengthening its position in the commercial furniture sector. This move brought together two companies with shared values and a strong presence in workplace, healthcare, and hospitality solutions. The merger created a broader product lineup to meet changing market needs after the pandemic, especially in flexible and hybrid workspace solutions.

- In 2024, Nick Scali entered the UK market by acquiring Fabb Furniture, known locally as Anglia Home Furnishings. This marked Nick Scali’s first international expansion, adding a well-recognized UK retail brand to its portfolio. The acquisition included secured debt arrangements and set the stage for growth beyond Australia.

- In 2024, Herman Miller introduced a bamboo-based upholstery option for its classic Eames Lounge Chair and Ottoman. This update aligned with the company’s long-standing focus on sustainability and responsible materials. The addition of bamboo complements earlier innovations, such as recycled and ocean-bound plastics in other iconic designs.

- In 2023, Furniture of America completed its relocation to a new and larger headquarters in Southern California. This transition supported the company’s continued expansion since 2005, offering more space for operations. The new facilities now include over 2 million square feet of combined warehouse space across five buildings, helping FOA better serve its growing customer base.

Conclusion

The global bamboo furniture market is experiencing steady growth, driven by increasing consumer awareness of sustainability and the environmental advantages of bamboo as a renewable resource. Bamboo’s rapid growth rate, strength, and aesthetic appeal make it an attractive alternative to traditional hardwoods. The market is further supported by governmental initiatives promoting eco-friendly materials and innovations in bamboo processing techniques. Asia-Pacific remains the leading region, benefiting from abundant bamboo resources and established manufacturing capabilities. As consumers continue to prioritize sustainable living, the demand for bamboo furniture is expected to rise, offering opportunities for expansion in both residential and commercial sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)