Table of Contents

Introduction

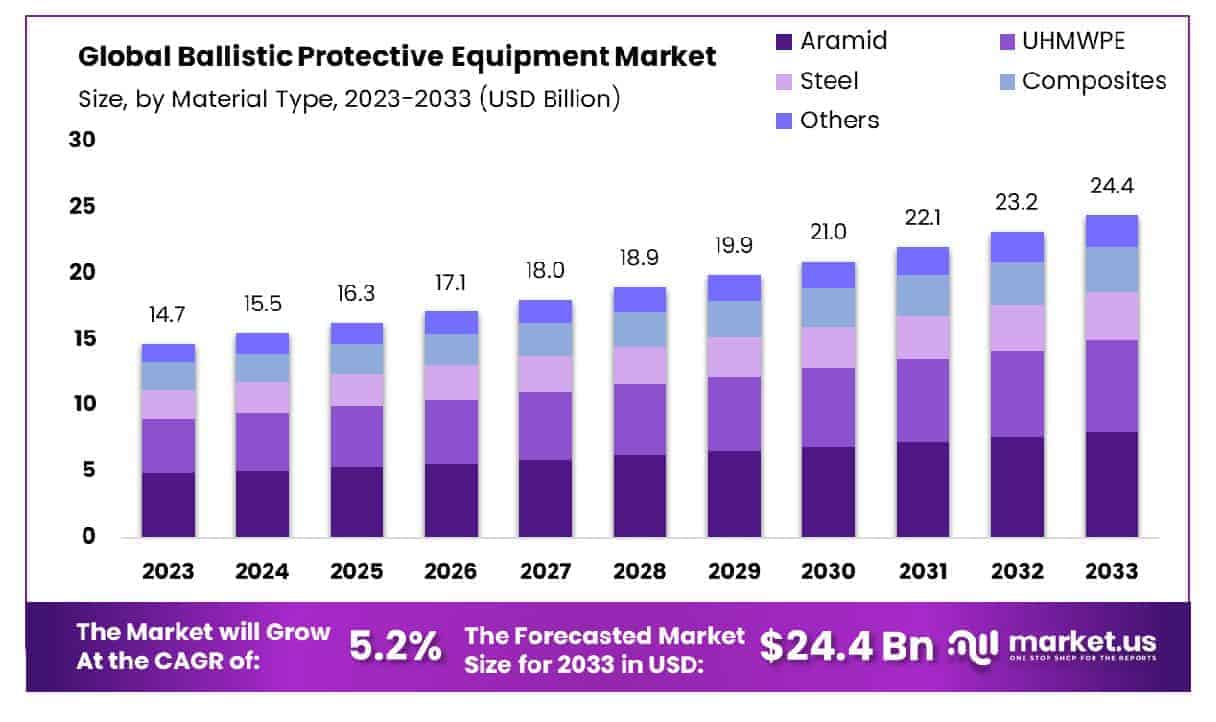

The Global ballistic protective equipment market is projected to reach approximately USD 24.4 billion by 2033, up from USD 14.7 billion in 2023, expanding at a compound annual growth rate (CAGR) of 5.20% from 2024 to 2033.

Ballistic Protective Equipment (BPE) refers to protective gear designed to safeguard individuals from projectile-based threats, such as bullets and shrapnel, through the use of specialized materials and design. This includes personal armor like bulletproof vests, helmets, shields, and armored vehicles that offer varying levels of protection depending on the threat faced. The Ballistic Protective Equipment market encompasses the development, manufacturing, and distribution of these products, which serve a wide array of sectors, including military, law enforcement, private security, and even civilian markets in certain high-risk regions.

The growth of the BPE market is driven by an increasing need for security and defense solutions in the face of rising global conflict, terrorism, and law enforcement requirements. Technological advancements in materials like Kevlar, carbon fiber, and ceramics have significantly enhanced the effectiveness and comfort of ballistic protection, further propelling market expansion. Additionally, increasing demand from emerging economies, where defense spending is rising, and civil unrest is prevalent, presents an opportunity for growth in these regions. The market also benefits from heightened awareness of personal safety and the evolving nature of threats, prompting both government agencies and private organizations to invest in advanced protective measures.

Opportunities within the market exist for manufacturers to innovate in lightweight, flexible, and multi-threat protective gear. Furthermore, the integration of digital technologies such as smart fabrics or sensors for real-time monitoring is expected to provide a competitive edge, further fostering growth within the sector. As global geopolitical tensions remain volatile, the demand for ballistic protective solutions is set to rise, positioning the market for continued expansion.

Key Takeaways

- Ballistic Protective Equipment Market is projected to reach USD 24.4 billion by 2033, up from USD 14.7 billion in 2023, reflecting a CAGR of 5.20% during the forecast period (2024-2033).

- North America holds a substantial 41.6% market share in the Ballistic Protective Equipment sector.

- Aramid materials make up 32.8% of the market, indicating strong demand and usage.

- Soft Armor dominates with 42.6% of the market share, underscoring its prominent role.

- The defense sector remains the leading consumer, accounting for 60.2% of the market, reinforcing its dominant position in the industry.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 14.7 Billion |

| Forecast Revenue (2033) | USD 24.4 Billion |

| CAGR (2024-2033) | 5.20% |

| Segments Covered | By Material Type(Aramid, UHMWPE, Steel, Composites, Others), By Product Type(Hard Armor, Soft Armor, Head Protection), By End-Use(Defense, Commercial, Law Enforcement & Securit) |

| Competitive Landscape | Seyntex N.V., Honeywell International, Inc., Tencate, Rheinmetall AG, Point Blank Enterprise, Inc., Morgan Advanced Materials, ArmorSource LLC, Craig International Ballistics, Survitec Group Ltd, Verseidag-Indutex GmbH, Safe Life Defense, Tactical Assault Gear, Hellweg International Pty. Ltd, MKU Limited, Mehler Vario System |

Key Segments Analysis

In 2023, Aramid dominated the Ballistic Protective Equipment Market, holding a 32.8% share, thanks to its high strength, thermal stability, and excellent strength-to-weight ratio. It is widely used in military and law enforcement gear for its abrasion resistance and effectiveness in life-threatening situations. UHMWPE followed closely due to its lightweight and high energy absorption properties, while steel’s popularity declined due to its weight. Composites, which combine various materials to balance strength, lightness, and flexibility, have also gained significant market traction in modern ballistic protection applications.

In 2023, Soft Armor led the market with a 42.6% share, valued for its flexibility and comfort. It is widely used in law enforcement and security, offering effective protection while maintaining mobility and wearability for prolonged use. Hard Armor, which includes rigid plates for high-caliber protection, remained popular in military and high-risk law enforcement scenarios, despite being heavier. The Head Protection segment, encompassing helmets and other gear, also held significant importance, focusing on safeguarding personnel from head injuries in combat and peacekeeping missions.

Defense dominated the market with a 60.2% share in 2023, driven by the extensive use of ballistic gear in military operations to protect personnel from combat-related hazards. Law Enforcement & Security also represented a substantial market segment, with protective gear essential for officer safety during crime prevention and high-risk situations. The Commercial segment, though smaller, showed growth, fueled by increasing personal security concerns and the demand for protection among civilians, especially in high-crime or unstable regions.

Emerging Trends

- Advanced Materials Usage: The market for ballistic protective equipment is increasingly moving toward the use of advanced materials such as carbon fiber, aramid fibers (e.g., Kevlar), and high-strength polyethylene. These materials offer better protection while reducing weight, which is crucial for comfort and mobility.

- Integration with Wearable Technologies: Ballistic protective gear is being integrated with wearable technologies such as sensors and GPS tracking devices. This integration enhances the capability of the gear by providing real-time monitoring of wearer health, location, and the status of the equipment.

- Customization of Gear: A growing trend is the demand for customizable ballistic protective equipment that can be tailored to specific user requirements. This includes the customization of size, weight, material composition, and features for different operational scenarios.

- Increased Focus on Multi-Threat Protection: There’s a rising demand for protective gear that offers multi-threat protection, including not just ballistic threats, but also knife stabs, blunt force trauma, and even chemical and biological hazards. Manufacturers are designing more versatile gear to address a broader range of potential threats.

- Sustainability in Manufacturing: The increasing emphasis on sustainable manufacturing processes is a key trend. The industry is adopting eco-friendly production methods and materials, which are leading to more sustainable ballistic protective products. Manufacturers are aiming to reduce their environmental footprint without compromising on performance.

Top Use Cases

- Military Applications: Ballistic protective equipment is heavily used by military forces to protect soldiers in combat zones. Helmets, body armor, and shields are critical for minimizing injury from projectiles and explosives.

- Law Enforcement and Security: Law enforcement officers use ballistic vests, helmets, and shields for protection against gunfire and other threats. As active shooter situations increase globally, demand for such equipment has risen.

- Private Security Personnel: Private security firms are increasingly outfitting their personnel with ballistic protection to safeguard against potential violent threats, especially in high-risk areas such as conflict zones or politically unstable regions.

- Civilian Protection in Conflict Zones: In conflict-prone areas, civilians are seeking ballistic protection equipment like body armor and helmets to reduce the risks of injury from violence, making this a growing segment in the market.

- Sports and Tactical Use: Ballistic gear is also being used in extreme sports and tactical training scenarios. This includes protective clothing designed to shield athletes and participants in military or tactical training exercises from injury.

Major Challenges

- High Cost of Production: The production of high-quality ballistic protective gear remains costly, particularly due to the advanced materials required. This can limit widespread access to protective equipment for certain sectors or regions.

- Weight and Comfort: Many protective vests and helmets, although effective in terms of protection, are heavy and can limit the wearer’s comfort and mobility. Striking a balance between protection and comfort remains a challenge for manufacturers.

- Limited Availability of Customizable Products: Not all ballistic protective gear is customizable, and some users require tailored options to meet their specific needs. Limited customization options can hinder broader adoption, especially in specialized security and military applications.

- Regulatory Challenges: Different regions have varying regulations on the types of ballistic protection allowed for civilian use. This regulatory inconsistency can make it difficult for manufacturers to standardize products across markets.

- Maintenance and Durability Issues: Over time, ballistic protective gear can degrade due to environmental factors such as moisture, heat, and general wear and tear. Ensuring long-term durability and reliability for users is a significant challenge in the market.

Top Opportunities

- Rising Demand in Emerging Economies: As security concerns rise globally, particularly in emerging markets, there is significant growth potential for ballistic protective equipment. Countries in the Middle East, Africa, and parts of Asia are seeing increased demand for personal protection gear.

- Technological Advancements: The development of new materials and manufacturing techniques, such as 3D printing and smart textiles, presents an opportunity to improve the performance and cost-effectiveness of ballistic protective equipment.

- Government Contracts and Defense Spending: With increasing defense budgets globally, there is an opportunity for manufacturers to secure government contracts to supply ballistic protection gear to military and law enforcement agencies. This trend is expected to continue as global defense spending rises.

- Integration of Advanced Safety Features: The integration of features such as thermal imaging, communication systems, and health monitoring sensors into protective equipment can offer a significant opportunity for differentiation in the market. These features can add value for end users, especially in military and law enforcement sectors.

- Demand for Lightweight and High-Performance Gear: As demand grows for more mobile and agile protective gear, manufacturers who can develop lighter, stronger products will have a competitive advantage. This can be an opportunity to attract a wider range of consumers, from military personnel to civilian users.

Key Player Analysis

In 2024 and beyond, key players in the Global Ballistic Protective Equipment Market are expected to drive innovation and market growth through advanced technology and strategic expansions. Seyntex N.V. is focusing on lightweight, high-performance materials, positioning itself as a leader in the textile-based protective solutions. Honeywell International, Inc. continues to leverage its advanced materials and integrated systems to meet the growing demand for enhanced ballistic protection. Tencate remains a key player with its durable fabrics used in both military and law enforcement applications.

Rheinmetall AG is expanding its offerings in military-grade equipment, capitalizing on defense sector growth. Point Blank Enterprise, Inc. and ArmorSource LLC are known for producing reliable and cost-effective armor solutions, catering to both military and civilian markets. Meanwhile, companies like Morgan Advanced Materials, Craig International Ballistics, and Survitec Group Ltd are innovating with new materials and manufacturing techniques, further solidifying their presence in the competitive landscape. As global security concerns rise, these players will continue to adapt, offering cutting-edge solutions in ballistic protection.

Top Market Key Players

- Seyntex N.V.

- Honeywell International, Inc.

- Tencate

- Rheinmetall AG

- Point Blank Enterprise, Inc.

- Morgan Advanced Materials

- ArmorSource LLC

- Craig International Ballistics

- Survitec Group Ltd

- Verseidag-Indutex GmbH

- Safe Life Defense

- Tactical Assault Gear

- Hellweg International Pty. Ltd

- MKU Limited

- Mehler Vario System

Regional Analysis

North America: Dominating Region with Largest Market Share in Ballistic Protective Equipment Market (41.6% in 2023)

North America continues to lead the global ballistic protective equipment market, accounting for a dominant share of 41.6% in 2023, with a market value of USD 6.1 billion. This region’s strong market position is attributed to the significant investments in defense and law enforcement sectors, driven by increasing military modernization efforts and rising demand for personal protective gear among first responders.

The United States, in particular, plays a crucial role in this growth, driven by government contracts, military expenditures, and ongoing advancements in ballistic protection technologies. The presence of key industry players, including leading manufacturers and innovators in the ballistic protection field, further supports the region’s dominance. In addition, North America’s sophisticated infrastructure, high levels of military expenditure, and ongoing strategic defense initiatives are expected to sustain this leading position in the coming years.

Recent Developments

- In 2023, DuPont introduced Kevlar® EXO™ aramid fiber, a groundbreaking innovation in fiber technology after more than 50 years of development. This new platform is designed to meet the highest demands of performance and protection in extreme conditions. Its first application, life protection, will offer an unparalleled combination of lightness, flexibility, and safety, marking a new era in protective materials.

- In 2024, BAE Systems entered a strategic partnership with Aerospike to advance data-driven technologies for U.S. Army and other Department of Defense projects. The collaboration, under the Mission Advantage™ program, will enhance real-time data processing and support the Army’s Unified Network and Data Platform. Aerospike’s high-performance database, already used in commercial applications, will help optimize data use for military operations with minimal latency.

- In 2024, GPC Investments, a prominent investment firm, acquired Body Armor Outlet, a top provider of body armor and protective gear for law enforcement, military, and civilians. The acquisition enhances GPC’s defense portfolio, but the transaction details were not disclosed.

- In October 2023, Dyneema®, a brand under Avient Corporation, revealed a next-gen unidirectional material made from their third-generation fiber. The new Dyneema® SB301 offers improved ballistic protection and mobility, making body armor lighter by up to 20% compared to previous versions. This innovation is set to provide significant advancements in the safety of law enforcement officers and military personnel.

Conclusion

The ballistic protective equipment market is poised for steady growth, driven by increasing security needs across military, law enforcement, and civilian sectors, alongside advancements in materials and technology. As global threats evolve and defense budgets rise, demand for more lightweight, versatile, and multi-threat protective gear is expected to continue. Manufacturers are innovating with advanced materials, smart textiles, and integration of digital technologies, which will help address key challenges like weight, comfort, and customization. Emerging economies, in particular, present a significant opportunity for market expansion. With continuous developments in manufacturing techniques and safety features, the market is likely to see enhanced performance and broader adoption, ensuring that ballistic protective equipment remains a crucial component of global security strategies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)