Table of Contents

Introduction

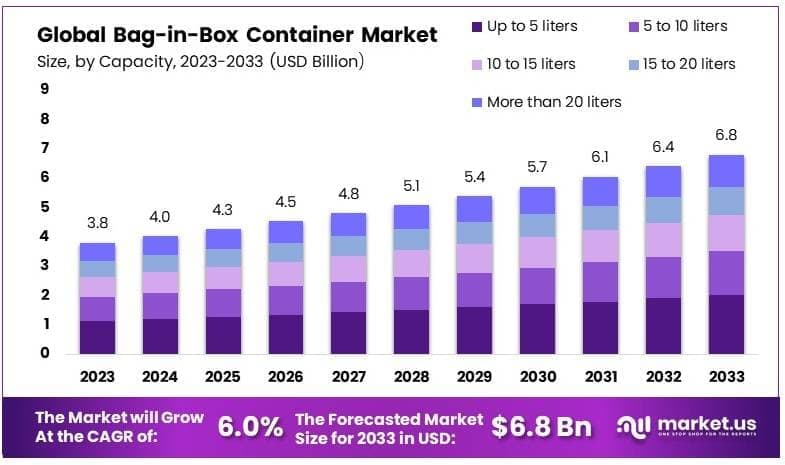

The Global Bag-in-Box Container Market is projected to reach approximately USD 6.8 billion by 2033, expanding from USD 3.8 billion in 2023. The market is expected to grow at a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2024 to 2033.

The Bag-in-Box (BIB) container is a flexible packaging solution consisting of a multi-layered plastic bag enclosed within a corrugated or paperboard box, equipped with a dispensing tap or fitment. This packaging format is widely used for liquid and semi-liquid products such as beverages (wine, juices), liquid food products (edible oils, dairy), industrial fluids, and household products due to its superior product protection, extended shelf life, and ease of dispensing.

The Bag-in-Box Container Market has experienced significant growth driven by the rising preference for sustainable and cost-effective packaging solutions across multiple industries. The market expansion is primarily fueled by increasing demand from the food and beverage sector, particularly in wine packaging, where BIB containers offer a longer shelf life after opening compared to traditional bottles.

Additionally, the shift toward eco-friendly alternatives over rigid plastic packaging, coupled with regulatory support for sustainable packaging materials, has further strengthened market demand. The growing e-commerce sector and the rising penetration of liquid food and beverage home deliveries are also key contributors to the rising adoption of BIB containers.

Moreover, technological advancements in barrier films and dispensing mechanisms have enhanced the container’s durability and product integrity, creating opportunities for manufacturers to cater to high-growth segments such as plant-based beverages, liquid detergents, and personal care products.

The market is also benefiting from the expanding dairy and non-alcoholic beverage industries, particularly in emerging economies, where cost-effective and lightweight packaging is preferred. As sustainability concerns and consumer preferences for convenience packaging continue to rise, the Bag-in-Box container market is expected to witness sustained growth in the coming years.

Key Takeaways

- The Bag-in-Box Container Market was valued at USD 3.8 billion in 2023 and is projected to grow at a CAGR of 6.0%, reaching USD 6.8 billion by 2033.

- The up-to-5-liter segment leads with a 29.6% share, driven by consumer convenience and efficiency.

- The food & beverage sector dominates with a 63.5% share, ensuring safe and efficient packaging solutions.

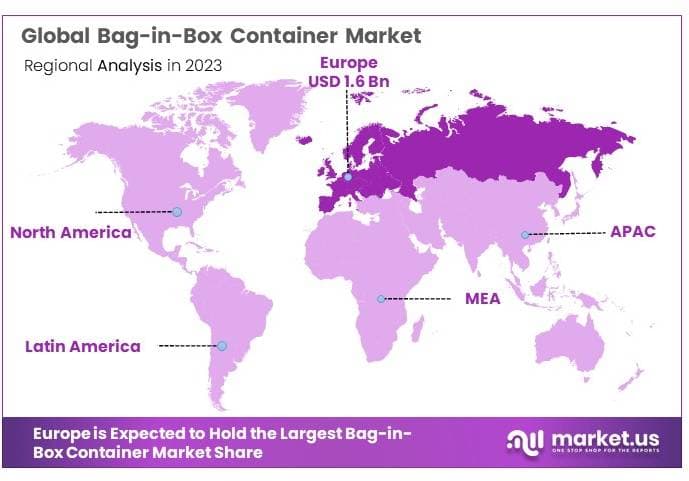

- Europe holds the largest market share at 43.6%, fueled by the rising demand for sustainable packaging solutions.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 3.8 Billion |

| Forecast Revenue (2033) | USD 6.8 Billion |

| CAGR (2024-2033) | 6.0% |

| Segments Covered | By Capacity (Up to 5 liters, 5 to 10 liters, 10 to 15 liters, 15 to 20 liters, More than 20 liters), By Application (Food & Beverage: Alcoholic Beverages – Wine, Beer, Others; Non-Alcoholic Beverages – Soft Drinks, Juices & Flavored Drinks, Water, Others; Others: Tomato Products, Milk & Dairy Products, Liquid Eggs, Edible Oil, Others; Industrial Liquids – Oils, Industrial Fluids, Petroleum Products; Household Products – Household Cleaners, Liquid Detergents, Liquid Soaps & Hand wash, Others) |

| Competitive Landscape | Smurfit Kappa, Amcor Ltd., CDF Corporation, DS Smith, Liquibox, Arlington Packaging (Rental) Limited, CENTRAL PACKAGE & DISPLAY, TPS Rental System Ltd, Scholle IPN, Accurate Box Company, Inc, Optopack Ltd, Zarcos America |

Emerging Trends

- Sustainable Packaging Solutions: There is a growing demand for eco-friendly packaging, leading to increased adoption of BIB containers made from recyclable materials. This shift aligns with global sustainability goals.

- Technological Advancements: Innovations such as intelligent packaging with real-time monitoring are being integrated into BIB containers, enhancing product quality control and consumer engagement.

- Customization and Branding: Companies are leveraging BIB containers for customized packaging solutions, enhancing brand visibility and meeting specific product requirements.

- Expansion into Non-Food Sectors: BIB containers are increasingly used in industries beyond food and beverages, including chemicals and personal care products, due to their versatility and cost-effectiveness.

- E-commerce Growth: The rise of online shopping has boosted the demand for BIB containers, as they offer durable and efficient packaging solutions suitable for home deliveries.

Top Use Cases

- Wine Packaging: BIB containers are extensively used for wine storage and dispensing, offering benefits such as extended shelf life and reduced packaging costs.

- Liquid Food Products: Products like sauces, oils, and syrups are commonly packaged in BIB containers, ensuring freshness and ease of use.

- Dairy Products: BIB containers are utilized for packaging dairy items like milk and cream, providing hygienic and convenient dispensing options.

- Industrial Liquids: Industries use BIB containers for chemicals and lubricants, benefiting from their durability and safe dispensing mechanisms.

- Household Cleaning Products: BIB containers are employed for packaging cleaning agents, offering consumers convenient and controlled usage.

Major Challenges

- Recycling Infrastructure: The lack of established recycling systems for BIB materials in certain regions poses environmental concerns.

- Material Sourcing: Dependence on specific raw materials for BIB production can lead to supply chain vulnerabilities and cost fluctuations.

- Consumer Awareness: Limited consumer knowledge about the benefits and recyclability of BIB containers can hinder market adoption.

- Competition from Traditional Packaging: Established packaging formats may resist transitioning to BIB solutions, affecting market penetration.

- Regulatory Compliance: Navigating varying global regulations regarding packaging materials and recyclability presents challenges for manufacturers.

Top Opportunities

- Sustainable Material Development: Investing in biodegradable and recyclable materials for BIB containers can meet the rising demand for eco-friendly packaging.

- Market Expansion in Emerging Economies: Growing urbanization and changing consumer lifestyles in emerging markets present opportunities for BIB adoption.

- Integration with Smart Technologies: Incorporating features like QR codes and sensors can enhance consumer engagement and product traceability.

- Product Diversification: Expanding BIB applications to new product categories can open additional revenue streams for manufacturers.

- Collaborations for Recycling Initiatives: Partnering with governments and organizations to improve recycling infrastructure can enhance the sustainability profile of BIB containers.

Key Player Analysis

The Global Bag-in-Box Container Market in 2024 is witnessing steady growth, driven by increasing demand for cost-effective, sustainable, and efficient liquid packaging solutions. Smurfit Kappa and Amcor Ltd. continue to dominate the market, leveraging their extensive product portfolios and innovations in sustainable packaging materials. CDF Corporation and DS Smith are focusing on enhancing barrier properties and recyclability to cater to the growing demand for eco-friendly solutions.

Liquibox and Scholle IPN are expanding their global footprint through strategic acquisitions and investments in advanced filling technologies. Arlington Packaging (Rental) Limited and TPS Rental System Ltd are capitalizing on the rental packaging model, offering cost-effective and flexible solutions for bulk liquid transport. CENTRAL PACKAGE & DISPLAY and Accurate Box Company, Inc. are strengthening their presence through customized packaging solutions, while Optopack Ltd and Zarcos America continue to innovate in high-barrier films and aseptic packaging to meet evolving industry requirements.

Market Key Players

- Smurfit Kappa

- Amcor Ltd.

- CDF Corporation

- DS Smith

- Liquibox

- Arlington Packaging (Rental) Limited

- CENTRAL PACKAGE & DISPLAY

- TPS Rental System Ltd

- Scholle IPN

- Accurate Box Company, Inc

- Optopack Ltd

- Zarcos America

Regional Analysis

Europe Leads Bag-in-Box Container Market with Largest Market Share of 43.6% in 2024

Europe is the dominant region in the bag-in-box container market, accounting for 43.6% of the global market share in 2024. The region’s market size is estimated at USD 1.6 billion, driven by strong demand from the food & beverage industry, particularly in wine, dairy, and liquid food packaging applications. Countries such as France, Italy, and Germany play a pivotal role in market expansion due to the rising preference for sustainable and lightweight packaging solutions.

Additionally, stringent environmental regulations promoting recyclable and eco-friendly packaging materials have fueled the adoption of bag-in-box solutions. The presence of key manufacturers, along with continuous innovation in flexible packaging technologies, further strengthens Europe’s market position. The region’s well-established wine industry, particularly in France and Italy, remains a crucial growth driver, with bag-in-box containers gaining preference due to their cost-effectiveness and extended shelf life benefits.

Recent Developments

- In 2023 – SEE (NYSE: SEE) successfully finalized the acquisition of Liquibox for $1.15 billion, inclusive of cash and debt-free terms. This move brings together two major players in the flexible packaging sector, enhancing their shared commitment to growth and innovation. Liquibox, known for its expertise in Bag-in-Box packaging for liquids across food, beverage, consumer goods, and industrial markets, strengthens SEE’s CRYOVAC® brand Fluids & Liquids division. This acquisition not only expands SEE’s technological capabilities but also accelerates its shift toward digital automation in sustainable packaging solutions.

- In 2024 – Mondi partnered with Scan Sverige to advance sustainable packaging solutions by developing a recyclable polypropylene (PP) mono-material pack. HKScan Sweden, a company with over a century of responsible food production experience, integrated Mondi’s WalletPack into its Pärsons brand’s sliced ham, salami, and plant-based product lines starting March 2024. This collaboration reinforces Mondi’s leadership in sustainable and innovative packaging.

- In 2025 – International Paper (NYSE: IP; LSE: IPC) and DS Smith finalized a merger on January 31, 2025, creating a global powerhouse in sustainable packaging, containerboard, and pulp production. The newly formed entity strengthens its presence across North America and EMEA, focusing on delivering sustainable packaging solutions with a strong market impact.

- In 2023 – Smurfit Kappa and WestRock reached a definitive agreement to merge, forming Smurfit WestRock, a global leader in sustainable packaging. This follows their initial announcement on September 7, 2023, regarding a potential combination. The merger brings together two industry giants, leveraging their collective expertise to drive innovation and sustainability in the packaging sector.

Conclusion

The Bag-in-Box (BIB) container market is poised for robust growth, driven by increasing demand for sustainable and cost-effective packaging solutions across various industries. This packaging format offers advantages such as extended shelf life and ease of dispensing, making it particularly popular in the food and beverage sector. Technological advancements in barrier films and dispensing mechanisms have further enhanced product integrity, expanding BIB applications into non-food sectors like chemicals and personal care products. As consumer preferences shift towards eco-friendly and convenient packaging, the BIB container market is expected to continue its upward trajectory in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)