Table of Contents

Introduction

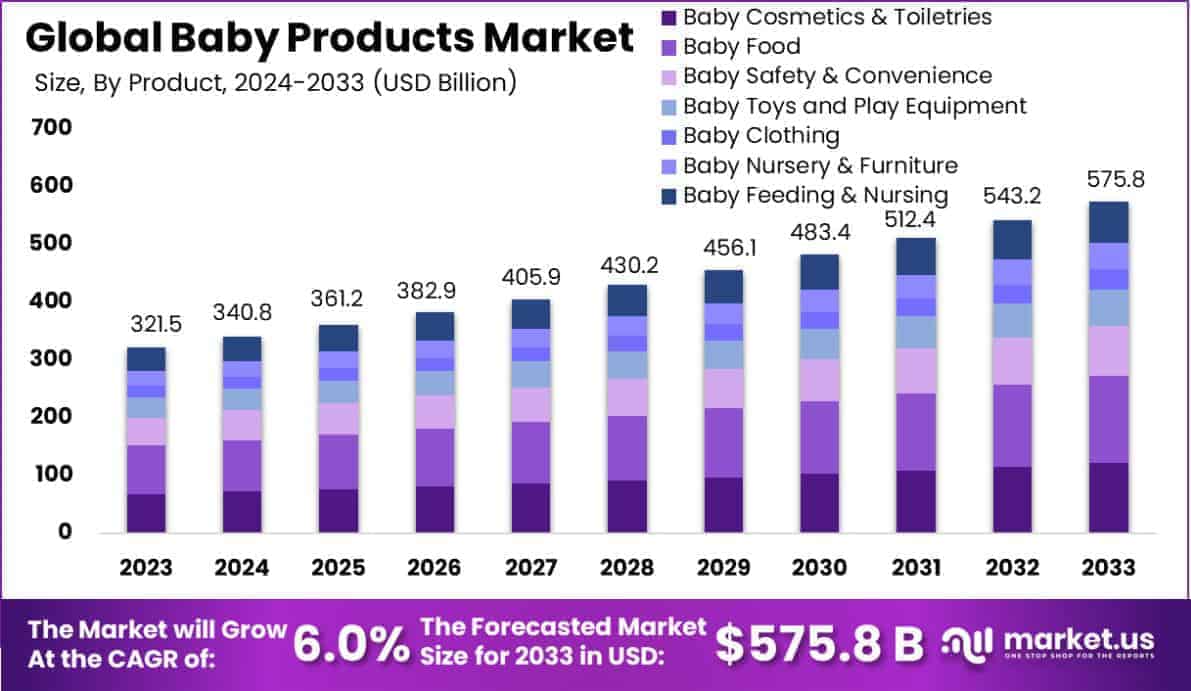

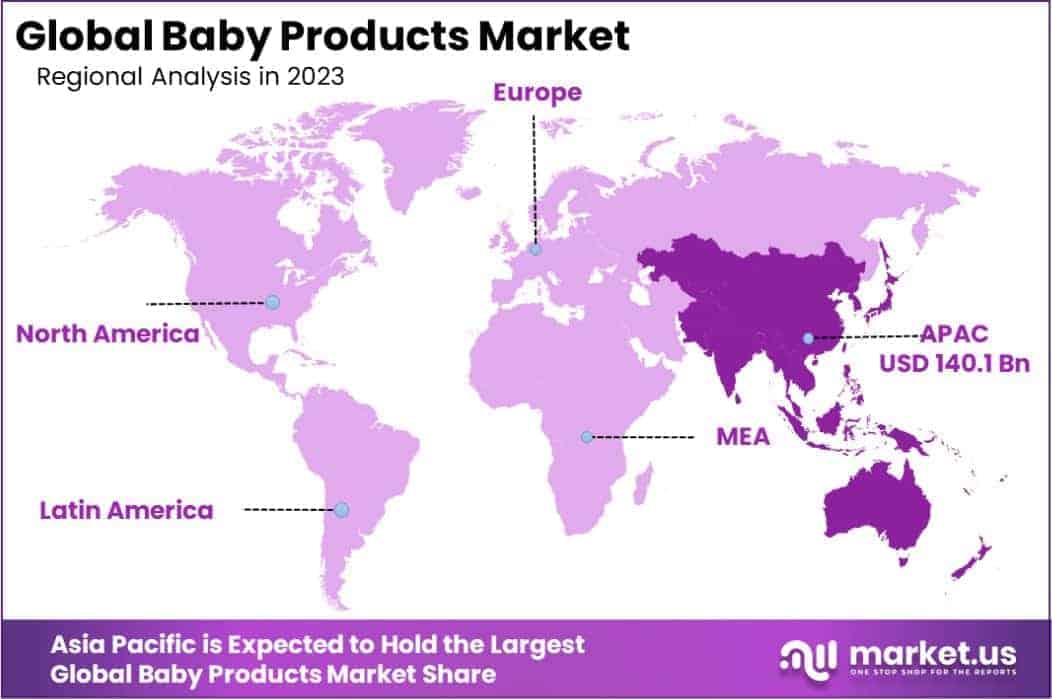

The global baby products market is projected to reach a valuation of approximately USD 575.8 billion by 2033, up from USD 321.5 billion in 2023, reflecting a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific region emerged as the dominant player, capturing a significant 43.6% share of the market and generating USD 140.1 billion in revenue.

Baby products encompass a wide range of items specifically designed for infants and toddlers, aimed at ensuring their safety, health, comfort, and development. These products include essential categories such as diapers, baby food, baby skincare, feeding bottles, toys, strollers, car seats, and clothing. They cater to the unique needs of babies while providing convenience and peace of mind to parents. Innovations in materials, design, and functionality are continually shaping this category, ensuring products meet both regulatory standards and consumer expectations for quality and safety.

The baby products market refers to the global industry that manufactures, distributes, and sells products tailored to the needs of infants, toddlers, and young children. This market includes both consumable goods, such as diapers and baby formula, and durable goods, such as strollers, cribs, and baby monitors. The market is driven by a combination of demographic trends, including birth rates and parental spending patterns, alongside evolving consumer preferences toward premium and sustainable products. With an increasing number of working parents and a rising focus on child well-being, the market has grown into a dynamic, competitive landscape.

The growth of the baby products market is fueled by several interconnected factors. Firstly, rising disposable incomes in emerging economies have empowered parents to spend more on high-quality baby products. Secondly, heightened awareness around infant health and hygiene, coupled with advancements in pediatric healthcare, has led to increased demand for specialized products.

Thirdly, urbanization and the growth of dual-income households have driven demand for time-saving and convenient solutions, such as prepackaged baby food and easy-to-use strollers. Additionally, the growing influence of digital platforms and e-commerce has expanded product accessibility, enabling brands to penetrate untapped markets more efficiently.

Demand in the baby products market is strongly influenced by parental priorities, lifestyle shifts, and societal norms. The rising preference for organic, chemical-free, and eco-friendly products reflects the growing emphasis on sustainability and infant safety. Similarly, the convenience factor plays a pivotal role, with parents seeking user-friendly and multifunctional items. Regions with growing populations, particularly in Asia-Pacific and parts of Africa, are experiencing higher demand due to increased birth rates. Meanwhile, in developed markets, premiumization trends and brand loyalty drive consistent consumer engagement.

The baby products market presents significant opportunities for innovation, particularly in sustainability and technology integration. For example, the rising demand for eco-friendly diapers, biodegradable wipes, and organic skincare products offers a lucrative avenue for brands to capture environmentally conscious consumers.

Additionally, smart baby monitoring devices, AI-enabled parenting tools, and subscription-based delivery models are gaining traction, offering companies new ways to create value. Expanding e-commerce penetration in emerging markets also provides access to previously underserved regions, unlocking growth potential for brands that can establish a strong online presence.

Key Takeaways

- The baby products market is projected to grow from USD 321.5 billion in 2023 to USD 575.8 billion by 2033, at a CAGR of 6.0%. Below are the key insights shaping the market

- Baby food dominated the market in 2023 with a 26.2% share. Growing awareness about infant nutrition and the demand for organic, fortified, and ready-to-eat baby food options are driving this segment.

- The Mass segment held a commanding 77.2% share of the market in 2023. Affordable pricing and accessibility are the primary reasons for this dominance.

- Hypermarkets and supermarkets accounted for 37.2% of the distribution channel share in 2023. Their dominance is driven by the convenience of finding a wide range of baby care products in one location.

- Asia Pacific emerged as the largest regional market in 2023, holding a 43.6% share and generating USD 140.1 billion in revenue.

Baby Products Statistics

- Around 60% of parents shop online for baby care products monthly.

- U.S. infant product sales increased by 5% recently.

- E-commerce contributes nearly 30% to global baby product sales.

- Baby skincare products represent 20% of total baby product sales.

- Eco-friendly baby products are preferred by 64% of parents.

- Natural and organic baby care saw a 28% rise in 2023.

- A baby uses over 2,700 diapers in the first year, costing about $550 annually.

- Subscription services for baby essentials gained 18% more users last year.

- Compact and travel-friendly baby gear demand grew by 15% in 2023.

- Parents spent an average of $2,500 on baby needs in their child’s first year.

- Over 70% of parents relied on social media and reviews for product decisions in 2023.

- Interactive learning toys captured 35% of the toy market in 2023.

- Organic cotton baby clothes made up 30% of baby clothing sales in 2023.

- Plant-based baby formula sales increased by 15% in 2023, driven by health-conscious choices.

Emerging Trends

- Eco-Friendly and Sustainable Products: Parents are increasingly prioritizing sustainability, driving demand for eco-friendly baby products such as biodegradable diapers, organic baby food, and bamboo-based clothing. Recent studies show that over 60% of millennial parents prefer products that minimize environmental impact, highlighting a shift toward conscious consumption.

- Smart Baby Products: The integration of technology into baby products is accelerating. From baby monitors with AI-based sleep tracking to smart bottles that measure feeding patterns, connected devices are becoming a norm. Reports indicate that the smart baby product market has seen a notable rise, with wearables like baby fitness trackers gaining traction.

- Focus on Safety Standards: Parents are increasingly aware of product safety. This has led to higher demand for products meeting rigorous certifications such as BPA-free materials in bottles and car seats adhering to strict crash-test ratings. Safety-first innovations, such as temperature-sensitive spoons, are being widely adopted.

- Gender-Neutral Designs: The rise in gender-neutral parenting is influencing product design. Products such as strollers, clothing, and toys are moving away from stereotypical pink or blue tones to more neutral and inclusive aesthetics. Surveys suggest nearly 45% of parents opt for gender-neutral baby gear to promote inclusivity and practicality.

- Rise of Subscription Services: Subscription-based models for baby essentials, such as diaper delivery or curated toy boxes, are gaining popularity. These services save time and ensure convenience, particularly for working parents. Recent data indicates a 25% rise in the adoption of such services in urban markets over the past five years.

Top Use Cases

- Supporting Baby Health and Nutrition: Products such as organic baby food, fortified formula, and baby supplements are key for supporting growth and immunity. For example, the demand for organic baby food grew by over 30% in the last decade as parents seek healthier options for their children.

- Enhanced Sleep Solutions: Sleep aids like white-noise machines, ergonomic cribs, and weighted blankets are widely used to improve infant sleep quality. Research indicates that 70% of new parents report sleep-related challenges, making sleep-related products highly relevant.

- Mobility and Outdoor Convenience: Strollers, carriers, and car seats are essential for ensuring safety and convenience during travel. Innovations in lightweight strollers and foldable carriers are particularly valuable for urban parents, with more than 50% of families in cities relying on these products for daily commutes.

- Early Learning and Development: Interactive toys, sensory play mats, and early-learning kits help support cognitive and motor skill development in infants. Studies reveal that 80% of brain development happens by the age of three, making these products essential for early education.

- Hygiene and Skincare: Baby-specific hygiene products, including mild shampoos, soaps, and skin creams, cater to sensitive baby skin. The use of hypoallergenic and chemical-free formulations has surged, with baby wipes alone seeing annual sales exceeding 10 billion units globally.

Major Challenges

- Cost Sensitivity Among Consumers: Many parents face financial constraints, leading to challenges in purchasing premium baby products. A 2023 report highlighted that more than 40% of parents actively seek discounts or choose lower-cost alternatives, affecting profitability for manufacturers of high-end products.

- Regulatory Compliance: Baby products are subject to strict safety regulations that vary by region. For instance, toys and feeding bottles must meet specific chemical and safety standards. Failure to comply can lead to product recalls, fines, and reputational damage for companies.

- Counterfeit Products: The rise of counterfeit baby products, particularly in online marketplaces, poses significant risks to both consumers and legitimate manufacturers. In 2022, counterfeit goods were estimated to account for 5–10% of all baby product sales globally, raising safety and trust concerns.

- Distribution Challenges in Rural Markets: Access to high-quality baby products remains limited in rural areas due to poor infrastructure and logistical hurdles. Around 20% of rural parents report relying on generic, locally made alternatives, impacting market penetration for branded products.

- Sustainability-Related Costs: While eco-friendly products are in demand, manufacturing them involves higher costs due to the use of sustainable materials and ethical processes. This often translates to higher retail prices, making it challenging to appeal to cost-sensitive consumers.

Top Opportunities

- Expanding in Emerging Markets: Countries in Asia and Africa are witnessing higher birth rates and growing middle-class populations. For example, India alone accounts for 20% of global births annually, presenting vast opportunities for affordable, high-quality baby products.

- Customization and Personalization: The trend of personalized baby products, such as customized clothing, engraved toys, or tailored feeding plans, is on the rise. Research shows that 35% of parents are willing to pay extra for customized solutions that cater to their child’s specific needs.

- Growth in E-Commerce: Online platforms are becoming the go-to source for baby products due to convenience and wider product variety. With over 50% of baby products now being purchased online in developed markets, expanding digital sales channels is a key opportunity for growth.

- Integration of AI and IoT: The adoption of AI and IoT in baby products is still in its early stages but holds vast potential. Products like smart cribs that adjust rocking speed or AI-powered cameras for advanced monitoring are creating new possibilities for innovation.

- Wellness-Focused Offerings: Parents are increasingly investing in wellness products like probiotics, aromatherapy diffusers, and yoga mats for babies. A study revealed that wellness-focused baby products grew by 18% in popularity over the last five years, driven by a global focus on health and mindfulness.

Key Player Analysis

- Johnson & Johnson Services, Inc.: Johnson & Johnson is a globally recognized leader in baby care, with its baby products division generating significant revenue annually. The company’s baby care segment earned approximately USD 1.56 billion in 2023, driven by its iconic product lines such as Johnson’s Baby Shampoo and Baby Lotion. Johnson & Johnson focuses on dermatologically tested, hypoallergenic products, appealing to parents who prioritize safety and quality. Its extensive global reach and trusted brand equity have helped it maintain a dominant position in both developed and emerging markets.

- Procter & Gamble (P&G) Co.: Procter & Gamble is another key player, primarily recognized for its Pampers brand, which is the market leader in baby diapers globally. The company’s baby care segment contributed over USD 3 billion to its revenue in 2023, fueled by continuous innovation in diaper technology, such as improved absorbency and eco-friendly materials. P&G’s strategic investments in digital marketing and e-commerce channels have enabled it to expand its customer base across urban and rural regions.

- Kimberly-Clark (KCWW): Kimberly-Clark is a prominent name in the baby products sector, with its Huggies brand being a strong competitor in the global diaper market. The company reported approximately USD 2.8 billion in revenue from its baby and childcare segment in 2023. Kimberly-Clark’s focus on product diversification, such as biodegradable diapers and premium wipes, aligns with the growing demand for sustainable and high-quality baby care solutions. Its partnerships with hospitals and healthcare providers further strengthen its brand positioning.

- Honasa Consumer Pvt. Ltd.: Honasa Consumer Pvt. Ltd., the parent company of Mamaearth, has emerged as a major disruptor in the baby products market. The company reported a revenue of over USD 130 million in 2023, with significant contributions from its baby care line. Honasa’s emphasis on toxin-free, organic, and sustainable products resonates well with millennial parents. Its success is driven by digital-first marketing strategies and rapid penetration in Tier-2 and Tier-3 cities in India, where awareness around organic baby care products is growing.

- The Himalaya Drug Company: The Himalaya Drug Company, known for its natural and herbal products, is a key player in the baby care market, particularly in Asia. Its baby care division, which includes products like Himalaya Baby Powder and Baby Cream, contributed over USD 250 million in revenue in 2023. The company’s strategy of leveraging Ayurveda and natural ingredients appeals to health-conscious consumers. Himalaya also benefits from strong retail and online distribution networks, ensuring consistent product availability across multiple geographies.

Future Outlook of the Baby Products Industry

The baby products industry is poised for robust growth, driven by rising birth rates in emerging economies, increased disposable income, and growing parental awareness of product quality and safety. The global shift towards sustainable and organic products is reshaping the industry, with eco-friendly baby goods gaining traction among millennial and Gen Z parents.

In 2023, the sector saw significant funding activity, including DTC brand Coterie’s $23.8 million funding round for its eco-friendly diapers, and the $10 million Series A funding raised by Mushie, a baby essentials brand focused on sustainability. Additionally, major acquisitions like Reckitt Benckiser’s sale of its Infant Formula business to KKR for $2.2 billion highlight evolving market dynamics. With innovative technology integrations such as smart monitors and app-connected devices, the industry is becoming increasingly tech-centric. This trajectory indicates continued opportunities for investment and innovation in baby products to meet shifting consumer demands.

Asia-Pacific Baby Products Market

Asia-Pacific Leads Baby Products Market with Largest Market Share at 43.6%

In 2023, Asia-Pacific emerged as the dominant region in the baby products market, accounting for 43.6% of the global market share and generating a substantial market value of USD 140.1 billion. This regional leadership is driven by a combination of favorable demographic trends, rising disposable incomes, and an increasing focus on child health and wellness. Countries such as China and India, which together represent a significant proportion of the global population, have experienced a steady increase in birth rates and urbanization.

Additionally, growing awareness among parents regarding premium baby care products and safety standards has spurred demand for high-quality offerings in this region. Rapid e-commerce adoption has further expanded market accessibility, particularly in emerging economies. With strong economic growth and a substantial consumer base, Asia-Pacific is expected to remain a key driver of innovation and revenue growth in the baby products market.

Recent Developments

- In 2023, Kenvue Inc. (NYSE: KVUE) celebrated its official separation from Johnson & Johnson, establishing itself as an independent company with a focus on consumer health. Thibaut Mongon, CEO of Kenvue, expressed gratitude to the team for achieving this milestone and highlighted the company’s commitment to innovation and care solutions. Johnson & Johnson retained a 9.5% stake in Kenvue following an exchange offer that was oversubscribed by 4.2 times.

- In 2023, Dyper introduced a redesigned diaper with fully recyclable kraft paper packaging, produced in North America. This innovation aims to tackle plastic waste in the diapering industry, where most disposable diapers rely heavily on plastic. The move reflects Dyper’s commitment to sustainability and addressing the environmental impact of single-use products and packaging waste.

- In May 2023, Neptune Wellness Solutions Inc. announced an agreement to secure the purchase price for acquiring the remaining 49.9% of Sprout Organics. The transaction is subject to funding arrangements, Board approval, and exercising the call option. This acquisition aligns with Neptune’s strategy to grow its portfolio of plant-based and sustainable brands.

Conclusion

The global baby products market is poised for sustained growth, driven by evolving parental preferences, rising disposable incomes, and increasing awareness of infant health and safety. As parents prioritize high-quality, sustainable, and convenient solutions for their children, the demand for innovative and eco-friendly products is expected to rise. Technological advancements, such as smart baby products and personalized offerings, are reshaping the market, catering to modern families’ needs.

Meanwhile, the growing penetration of e-commerce is enhancing accessibility, particularly in emerging markets, creating new opportunities for brands to expand their reach. Despite challenges such as regulatory compliance and cost sensitivities, the market remains dynamic, with significant potential for companies to leverage sustainability, digitalization, and premiumization trends to drive long-term growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)