Table of Contents

Introduction

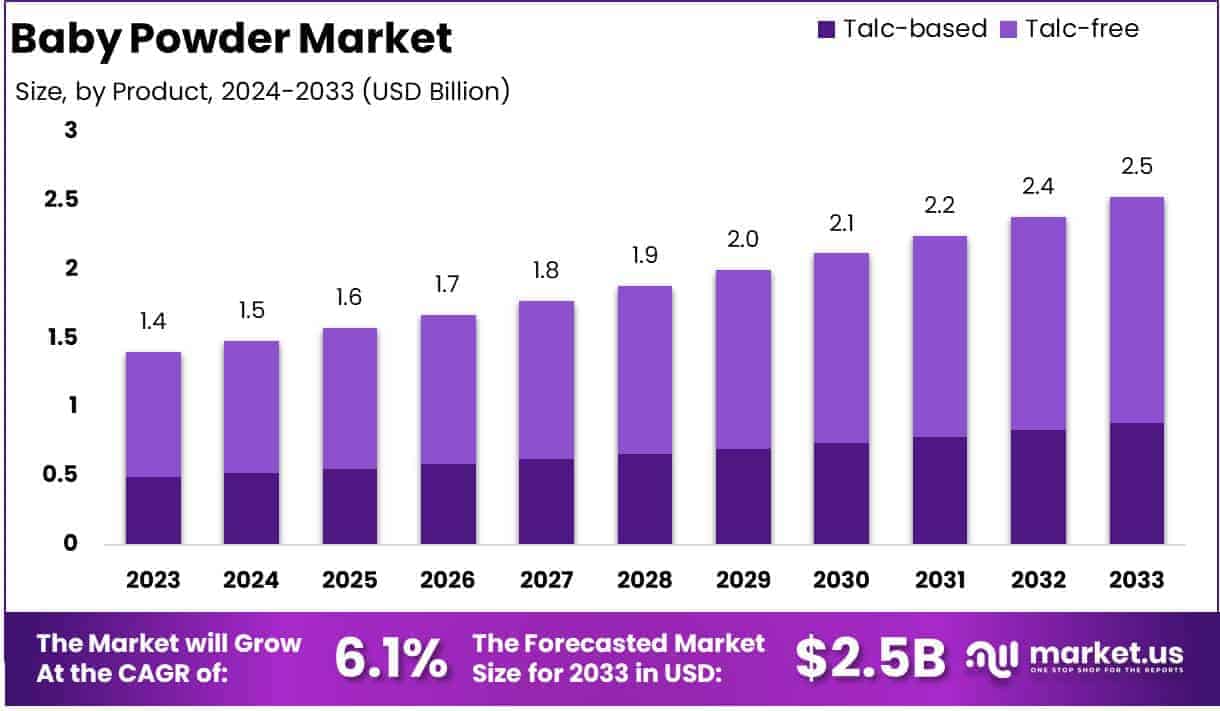

The Global Baby Powder Market is projected to reach approximately USD 2.5 billion by 2033, up from USD 1.4 billion in 2023, with a compound annual growth rate (CAGR) of 6.1% during the forecast period from 2024 to 2033.

Baby powder is a personal care product primarily used to absorb moisture, reduce friction, and keep the skin dry, often formulated with talc or cornstarch. The baby powder market refers to the global industry involved in the production and distribution of these powders, catering to infants, children, and adults seeking skin care and hygiene solutions. Market growth is driven by increasing awareness of baby skin care, rising disposable incomes, and growing demand for premium and organic baby care products.

The rising number of newborns, coupled with changing consumer preferences towards natural and hypoallergenic formulations, significantly contributes to the market’s expansion. Furthermore, the growing focus on dermatologically tested products and the popularity of multi-functional baby powders with additional skincare benefits offer new growth avenues. As parents and caregivers seek more skin-friendly and safe options, there is an opportunity for brands to innovate and target niche segments, particularly in emerging economies where baby care markets are rapidly evolving.

Key Takeaways

- The global baby powder market is expected to grow from USD 1.4 billion in 2023 to USD 2.5 billion by 2033, with a CAGR of 6.1% from 2024 to 2033.

- Talc-free baby powder holds a dominant market share of over 65% in 2023, fueled by increasing consumer preference for health-conscious products.

- Offline distribution channels lead the market, accounting for over 69% of the share, due to their accessibility and immediate product availability.

- The Asia-Pacific region is the largest market, representing 47% of global market share, driven by high birth rates and rising disposable incomes in key countries.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | US$ 1.4 Bn |

| Forecast Revenue (2033) | US$ 2.5 Bn |

| CAGR (2024-2033) | 6.1% |

| Segments Covered | By Product (Talc-based, Talc-free), By Distribution Channel (Online, Offline) |

| Competitive Landscape | Baby Forest, California Baby, Church & Dwight, Clorox, Cooney Medical, GLUKi Organics, Himalaya Wellness, Johnson & Johnson, Kimberly-Clark, Pigeon, Prestige Consumer Healthcare, Procter & Gamble |

Key Segments Analysis

In 2023, talc-free baby powder dominated the market with over 65% share, driven by growing consumer concerns about the health risks of talc-based products and a shift towards natural, hypoallergenic alternatives. These powders, often made with cornstarch and organic ingredients, are seen as safer for infant skin and align with the increasing demand for clean, sustainable personal care products. Meanwhile, talc-based powders, which now account for less than 35% of the market, have declined due to concerns over potential health risks, such as respiratory issues and carcinogenicity. Despite this, talc-based products continue to be used in cost-sensitive markets, with manufacturers focusing on innovation and safety improvements.

In 2023, the offline distribution channel dominated the baby powder market, capturing over 69% of the market share, with brick-and-mortar stores like supermarkets, hypermarkets, and pharmacies being the primary shopping venues. These channels offer immediate product availability, tactile evaluation, and personalized experiences, which are highly valued by parents. Their extensive presence in both urban and rural areas, coupled with in-store promotions, further reinforces their popularity. In contrast, the online channel, accounting for less than 31% of the market, is growing rapidly, driven by increased internet penetration, convenience, competitive pricing, and the ability to access customer reviews, appealing to tech-savvy and busy consumers.

Emerging Trends

- Natural & Organic Ingredients: Consumers are increasingly leaning towards baby powders made with natural and organic ingredients. Products free from synthetic chemicals and fragrances are gaining popularity, as parents are more conscious about the potential impact of chemical-based products on their baby’s health. For example, powders with ingredients like cornstarch and chamomile are becoming preferred choices.

- Talc-Free Products: Talc-free baby powders are emerging as a major trend due to growing concerns about the safety of talcum powder, which has been linked to health issues such as ovarian cancer. As a result, manufacturers are increasingly focusing on creating talc-free alternatives using safer substances like cornstarch and arrowroot.

- Eco-friendly Packaging: Sustainability is driving changes in packaging. Baby powder brands are adopting eco-friendly packaging solutions, such as recyclable or biodegradable materials. This trend is fueled by the increasing demand from environmentally-conscious consumers who prefer products with minimal environmental impact.

- Multifunctional Products: There is a growing trend towards multifunctional baby powders. Some brands are expanding their offerings to include products that serve multiple purposes, such as baby powders that double as soothing lotions or skin protectants. These products cater to parents looking for convenience and efficiency.

- E-commerce Growth: With the rise of online shopping, e-commerce platforms are becoming a major channel for baby powder sales. More parents are purchasing baby care products online, driven by the convenience, availability of reviews, and wider selection. As a result, many brands are investing in stronger online retail strategies to meet this demand.

Top Use Cases

- Diaper Rash Prevention: Baby powder is widely used to prevent diaper rashes by absorbing excess moisture and reducing friction. It helps keep the baby’s skin dry and smooth, reducing the likelihood of irritation and rashes that are common in infants.

- Soothing Skin Irritations: Baby powder is used to soothe minor skin irritations, including heat rashes and chafing. The powder helps to cool the skin and prevent further irritation by absorbing sweat and moisture.

- Shampoo Alternative for Babies: Some parents use baby powder as a dry shampoo alternative for their babies. It is applied to the scalp to absorb excess oils and freshen up the hair, particularly for newborns who might not yet require frequent washing.

- In Between Baths for Freshness: Baby powder is often used between baths to keep babies feeling fresh and dry. It helps in controlling body odors and absorbing moisture, especially in areas like the neck and folds of skin.

- Adult Use for Skin Care: Baby powder is also gaining popularity among adults for personal care. It is commonly used by individuals to prevent sweating or chafing during exercise or in hot weather. Many people also use it for added comfort and freshness in areas prone to moisture buildup, like underarms and feet.

Major Challenges

- Health & Safety Concerns over Talc: A significant challenge in the baby powder market is the ongoing controversy surrounding the use of talcum powder. Multiple lawsuits have raised concerns about the potential risks of talc-based products, particularly related to cancer, leading to declining consumer confidence in talc-based powders.

- Stringent Regulatory Standards: The baby powder market faces strict regulations regarding product safety and ingredients, particularly with baby care products. Compliance with these regulatory standards can be costly and time-consuming for manufacturers, especially when it comes to proving the safety of ingredients like talc or synthetic fragrances.

- Rising Competition from Natural Alternatives: With the growing demand for organic and natural products, baby powder manufacturers face intense competition from natural alternatives, such as cornstarch-based powders. These alternatives are perceived as safer, which can put pressure on traditional talc-based products in the market.

- Price Sensitivity in Emerging Markets: In emerging markets, price sensitivity remains a major challenge. Many consumers in these regions are highly price-conscious, making it difficult for premium baby powder brands to gain traction. Additionally, low-cost alternatives often dominate, forcing premium brands to rethink their pricing strategies.

- Consumer Perception & Trust Issues: In the wake of lawsuits and product recalls related to baby powders, rebuilding consumer trust has become a significant challenge for many brands. The negative publicity surrounding certain ingredients, particularly talc, has left a lasting impact on the reputation of baby powder products, creating a barrier to market growth.

Top Opportunities

- Increasing Demand for Chemical-Free Products: There is a rising opportunity in catering to health-conscious parents seeking baby care products without harmful chemicals. Products with natural ingredients such as organic cornstarch or chamomile are gaining traction, offering brands an opportunity to target this growing niche.

- Expansion in Emerging Markets: As income levels rise and middle-class populations grow in emerging markets, there is a significant opportunity for baby powder manufacturers to expand their presence. Increased urbanization and changing lifestyles in these regions are driving the demand for convenience-oriented baby care products, including baby powders.

- Product Innovation & Diversification: Companies can tap into opportunities by innovating and diversifying their product offerings. Creating value-added baby powders, such as those infused with aloe vera or lavender for added skin benefits, can help attract parents who are looking for multifunctional and soothing products.

- Leveraging E-commerce for Growth: The continued growth of e-commerce presents a significant opportunity for baby powder brands to reach a larger audience. Brands that establish a strong online presence can tap into a growing segment of tech-savvy, convenience-driven parents who prefer online shopping for baby products.

- Sustainability Initiatives: With increasing consumer interest in sustainability, brands that adopt eco-friendly packaging and commit to environmentally conscious practices have the opportunity to stand out. The demand for products with minimal environmental impact, including recyclable or biodegradable packaging, is expected to continue rising.

Regional Analysis

Asia-Pacific Region: Dominating the Baby Powder Market with 47% Market Share in 2023

The Asia-Pacific region is the leading contributor to the global baby powder market, commanding a dominant share of 47%, valued at approximately USD 0.658 billion in 2023. This region’s significant market share is driven by a combination of factors, including the growing population, rising awareness of baby care products, and increasing disposable incomes in key markets such as China, India, Japan, and Southeast Asia. In countries like India and China, the demand for baby care products, particularly baby powders, has surged due to the large and young population, coupled with increasing urbanization and changing consumer lifestyles.

The Asia-Pacific market is also benefiting from the growing middle-class population, which is becoming more inclined toward premium baby care products. The widespread availability of a range of baby powder products, including both chemical-based and natural options, has further spurred market growth. Additionally, the region’s preference for affordable yet effective baby care solutions makes it an attractive segment for both global and local brands.

Recent Developments

- In 2023, Johnson & Johnson (NYSE: JNJ) announced that its subsidiary, Red River Talc LLC, filed a voluntary prepackaged Chapter 11 bankruptcy case in the U.S. Bankruptcy Court for the Southern District of Texas. The case aims to resolve all current and future claims related to ovarian cancer from cosmetic talc litigation against the Company and its affiliates in the United States.

- In 2024, Reckitt Benckiser Group Plc (Reckitt plc) revealed its strategy to transform the company into a leading global consumer health and hygiene organization. The plan includes refining its brand portfolio and simplifying its structure to enhance long-term shareholder value.

- In 2024, FirstCry, an Indian baby products retailer, saw its shares surge by 40% during its debut trade in Bengaluru. Investors are optimistic about the rapidly growing childcare market in India, which is the world’s most populous country.

Conclusion

The global baby powder market is poised for continued growth, driven by increasing consumer demand for safer, natural, and multifunctional products. As more parents prioritize the health and well-being of their children, the shift towards talc-free and organic formulations is becoming a key trend, offering opportunities for brands to innovate and differentiate.

Additionally, the expansion of e-commerce and rising disposable incomes in emerging markets present significant avenues for growth, particularly in regions like Asia-Pacific. However, challenges such as regulatory concerns and price sensitivity in developing markets remain, requiring brands to adapt their strategies to meet evolving consumer expectations and maintain trust. The future of the baby powder market hinges on addressing these challenges while capitalizing on trends that prioritize safety, sustainability, and convenience.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)