Table of Contents

Introduction

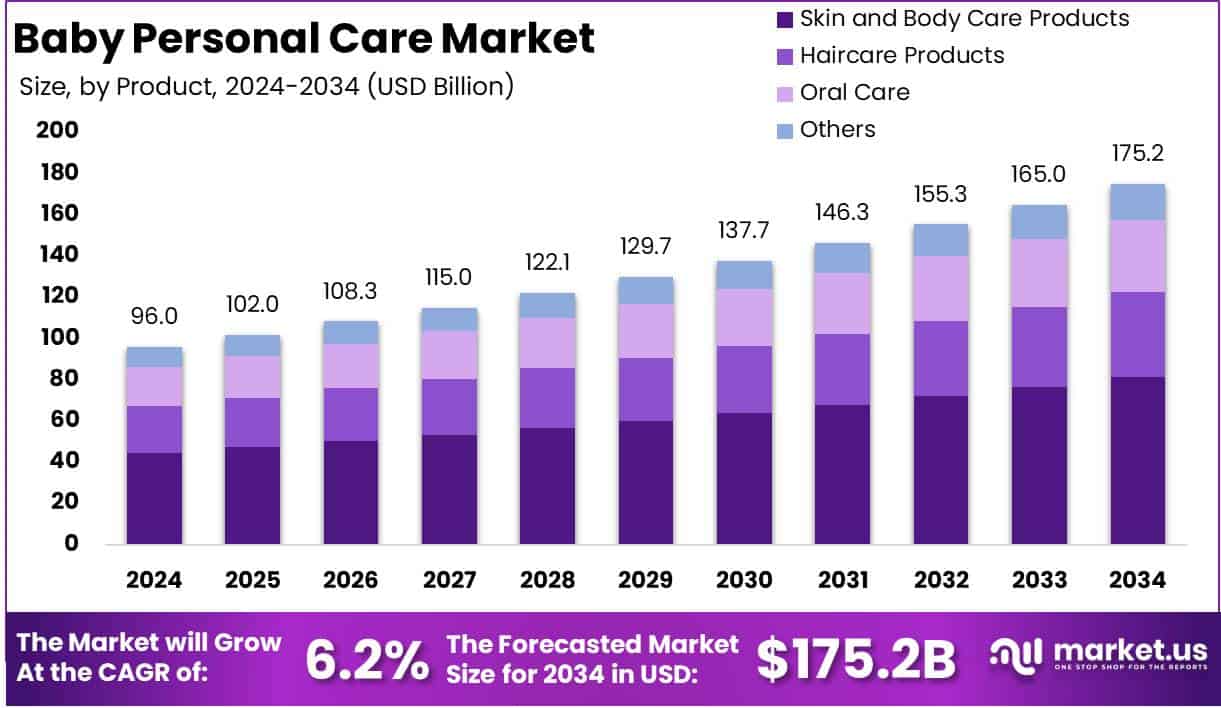

The Global Baby Personal Care Market is projected to reach approximately USD 175.2 billion by 2034, increasing from USD 96.0 billion in 2024. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2025 to 2034.

The Baby Personal Care market encompasses a wide range of products designed specifically for the hygiene, grooming, and skincare needs of infants and young children. This market includes items such as shampoos, lotions, oils, soaps, diapers, baby wipes, and creams, formulated to meet the delicate skin requirements of babies while ensuring safety and gentle care. The global Baby Personal Care market has been experiencing significant growth, driven by increasing awareness among parents regarding the importance of safe and organic products for their infants.

Growing disposable incomes, particularly in emerging economies, coupled with an expanding middle-class population, have led to a surge in the demand for premium, organic, and chemical-free baby care products. The rising number of working parents has also contributed to an increased demand for convenient baby care solutions such as wipes, diapers, and ready-to-use lotions, which offer ease of use and effective results.

Additionally, the growing focus on dermatologically tested products, coupled with the influence of social media and celebrity endorsements, is driving consumer preference towards higher-quality products. Opportunities within the market are also abundant, particularly in the development of eco-friendly and sustainable product lines as consumer interest in sustainability grows. Manufacturers are further exploring potential in emerging markets, where rapid urbanization and rising income levels offer a significant untapped consumer base. Overall, the Baby Personal Care market is set to continue its upward trajectory, with an emphasis on innovation, safety, and sustainability being key drivers of growth.

Key Takeaways

- The Global baby personal care market is projected to reach a value of approximately USD 175.2 billion by 2034, up from USD 96.0 billion in 2024, representing a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2025 to 2034..

- Skin and body care products are the leading category in the market, accounting for over 46.4% of the market share in 2024.

- The mass segment is the dominant price category, holding more than 63% of the market share in 2024.

- Girls represent the largest demographic in the market, with a share exceeding 45% in 2024.

- North America is the leading regional market, contributing 44% of the global market share, valued at USD 42.2 billion in 2024.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 96.0 Billion |

| Forecast Revenue (2034) | USD 175.2 Billion |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Product (Skin and Body Care Products (Lotions, Creams, Oils, Powders, Soaps & Bath Washes, Others), Haircare Products (Shampoos & Conditioners, Hair Oils, Others), Oral Care, Others), By Price (Mass, Premium), By Gender (Boys, Girls, Unisex) |

| Competitive Landscape | Bio Veda Action Research, Johnson & Johnson, Kimberly-Clark Corp., Me n Moms Pvt Ltd., Mothercare IN Ltd., Nestle SA, Pigeon Corp., The Himalaya Drug Co., The Procter & Gamble Co., Unilever |

Emerging Trends

- Sustainability and Eco-Friendly Products: There is a growing demand for baby personal care items that are environmentally friendly, such as biodegradable diapers and organic baby food. Studies indicate that over 60% of millennial parents prefer products that minimize environmental impact, highlighting a shift toward conscious consumption.

- Smart Baby Products: The integration of technology into baby care is accelerating. Devices like AI-based sleep trackers and smart feeding bottles are becoming common, enhancing convenience for parents. Reports show a notable rise in the smart baby product market, with wearables like baby fitness trackers gaining traction.

- Premium and Organic Offerings: Parents are increasingly prioritizing quality over cost, leading to a surge in demand for premium and organic baby care products. This trend is driven by higher disposable incomes and a growing middle class, with a willingness to invest in high-quality products that ensure safety and comfort for infants.

- E-Commerce Growth: The rise of online shopping platforms has significantly impacted the baby personal care market. E-commerce contributes nearly 30% to global baby product sales, providing consumers with a variety of options and a convenient shopping experience.

- Subscription Services: Subscription models for baby essentials are gaining popularity, offering parents convenience and cost savings. Subscription services for baby essentials gained 18% more users last year, reflecting a shift toward recurring delivery models.

Top Use Cases

- Diapering: Diapers are vital for infant hygiene and comfort. The demand for high-quality diapers is rising due to their convenience, skin protection, and moisture absorption. Innovations, such as eco-friendly options and advanced materials, are driving market growth.

- Feeding: Baby feeding bottles and accessories are crucial for infant nutrition. The baby food segment is expected to dominate the global market over the forecast period, driven by increasing awareness about infant nutrition.

- Bathing and Skincare: Products such as baby shampoos, lotions, and soaps are vital for maintaining skin health. The baby skincare segment is a significant contributor to the overall baby care products market.

- Health and Safety: Items like baby wipes, thermometers, and safety gates are essential for ensuring the well-being of infants. The increasing number of working mothers has led to a higher demand for such products.

- Clothing and Accessories: Baby apparel, including clothing and footwear, plays a significant role in the market. The baby apparel segment is expected to witness considerable growth, driven by rising disposable incomes and changing lifestyles.

Major Challenges

- Safety Concerns: Ensuring the safety of ingredients in baby personal care products is paramount. Parents are increasingly vigilant about potential allergens and harmful chemicals, posing challenges for manufacturers.

- Regulatory Compliance: Adhering to stringent regulations across different regions can be complex. Manufacturers must navigate various standards to ensure product safety and quality.

- Supply Chain Disruptions: Global events can lead to disruptions in the supply chain, affecting the availability and cost of raw materials for baby personal care products.

- Price Sensitivity: While there is a demand for premium products, a significant portion of consumers remains price-sensitive, requiring manufacturers to balance quality and affordability.

- Market Competition: The market is highly competitive, with numerous brands vying for consumer attention. Differentiating products and building brand loyalty are ongoing challenges.

Top Opportunities

- Organic Product Development: Developing and marketing organic and natural baby personal care products can cater to the growing demand for safer and eco-friendly options.

- E-commerce Expansion: Enhancing online sales channels and digital marketing strategies can tap into the increasing number of consumers shopping for baby products online.

- Sustainable Packaging: Investing in sustainable and recyclable packaging can appeal to environmentally conscious consumers and align with global sustainability trends.

- Technological Innovations: Integrating technology into products, such as smart baby monitors and app-connected devices, can offer added value and convenience to parents.

- Emerging Market Penetration: Expanding into emerging markets with rising disposable incomes and increasing birth rates presents significant growth opportunities for baby personal care products.

Segmentation Details

| Segmentation Type | Dominating Segment | 2024 |

|---|---|---|

| By Product | Skin and Body Care Products | 46.4% |

| By Price | Mass | 63% |

| By Gender | Girls | 63% |

| Regional Analysis | North America | 44% |

Key Player Analysis

The global baby personal care market in 2024 is poised for growth, driven by the influence of key industry players. Companies such as Johnson & Johnson, Kimberly-Clark Corp., and Procter & Gamble Co. continue to dominate with their comprehensive product portfolios, strong brand equity, and established global presence. Johnson & Johnson, for instance, leverages its expertise in baby care products and deep consumer trust, while Kimberly-Clark’s Huggies line remains a top choice for diapers and wipes.

Local players like Me n Moms Pvt Ltd. and Mothercare IN Ltd. have carved a niche in emerging markets by offering tailored products suited to regional preferences. Nestlé and Unilever, although primarily known for their food and beverage segments, benefit from their diversified portfolios and strong retail networks, facilitating growth in baby care categories. Emerging brands like Bio Veda Action Research and The Himalaya Drug Co. are gaining traction due to their focus on natural, organic ingredients that appeal to health-conscious consumers. These companies are well-positioned to capitalize on the increasing demand for safe, eco-friendly baby care solutions

Top Market Players

- Bio Veda Action Research

- Johnson & Johnson

- Kimberly-Clark Corp.

- Me n Moms Pvt Ltd.

- Mothercare IN Ltd.

- Nestle SA

- Pigeon Corp.

- The Himalaya Drug Co.

- The Procter & Gamble Co.

- Unilever

Regional Analysis

North America: Dominating the Baby Personal Care Market with the Largest Market Share of 44% in 2024

The North American region is poised to continue its dominance in the global baby personal care market, accounting for an estimated USD 42.2 billion in market value, representing 44% of the total global market share in 2024. This growth can be attributed to the increasing awareness among parents about the importance of personal care for babies, coupled with rising disposable income and improved living standards in the region. The demand for natural, organic, and eco-friendly baby care products is rapidly expanding, further boosting market expansion.

Major players in the industry, particularly those in the United States, are responding to this trend by offering a wide range of baby personal care products, such as lotions, shampoos, and wipes that cater to the growing demand for chemical-free and sustainable options. The ongoing innovations in product formulations and packaging designed to enhance convenience and environmental sustainability are expected to contribute significantly to the market’s continued growth in North America. With these factors combined, North America maintains its position as the leading region in the global baby personal care market.

Recent Developments

- In 2023, Herby Angel successfully raised $2.5 million in its first funding round from JCBL Group. The funds will be used to enhance business expansion, improve technology, and develop new products while increasing marketing efforts. Founded in January 2023, Herby Angel has adopted an omnichannel model, selling products both online and through physical retail outlets. The brand has quickly spread across 13 states, with over 1,300 stores offering its range of health and wellness products. By March 2024, Herby Angel aims to extend its reach to 2,000 retail locations.

- In 2024, The Good Glamm Group completed its acquisition of The Moms Co., fully integrating the brand into its portfolio. This acquisition is part of a broader strategy that includes increased ownership in other companies such as Organic Harvest and Winkl, further expanding its market presence.

- In 2025, Procter & Gamble reported a 2% growth in net sales for the second quarter of fiscal year 2025, reaching $21.9 billion. Organic sales grew by 3%, and earnings per share increased by 34%, largely driven by a previous impairment charge on Gillette’s intangible assets. Core earnings per share grew by 2%.

- In 2024, Luvs, a diaper brand under Procter & Gamble, continued its partnership with Feeding America®, donating over 225,000 diapers to families in need across two U.S. cities. This initiative also included a social giveaway offering a year’s supply of diapers and a donation to a local food bank chosen by the winner.

- In February 2024, Beiersdorf AG announced record sales of €9.5 billion for fiscal year 2023, reflecting a 10.8% organic growth. Despite significant investments, the company saw an increase in operating profit, improving its EBIT margin to 13.4%.

Conclusion

The global baby personal care market is experiencing robust growth, driven by rising parental awareness of safe, organic products, and increasing disposable incomes in emerging economies. Demand for premium, chemical-free products is rising, particularly due to more working parents seeking convenience. Additionally, the market is influenced by trends in sustainability, with eco-friendly products gaining popularity. Manufacturers are focusing on innovation, safety, and sustainability, while tapping into emerging markets to capture new growth opportunities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)