Table of Contents

Introduction

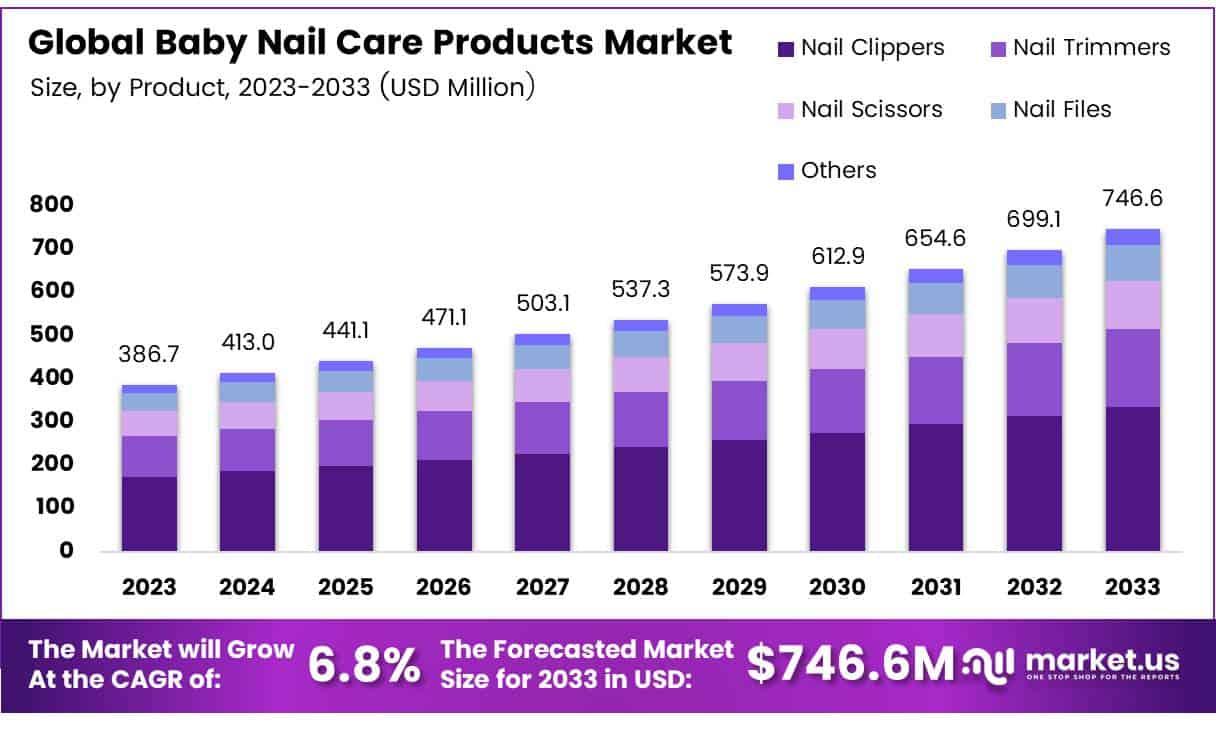

The Global Baby Nail Care Products Market is projected to reach a value of approximately USD 746.6 million by 2033, up from USD 386.7 million in 2023, reflecting a compound annual growth rate (CAGR) of 6.8% during the forecast period from 2024 to 2033.

Baby nail care products refer to specialized grooming items designed to safely and gently maintain the nails of infants and toddlers. These products typically include baby nail clippers, nail files, scissors, and various creams or oils formulated to protect the sensitive skin around the nails. The Baby Nail Care Products Market encompasses the range of products designed for the maintenance and safety of baby nails, targeted at parents and caregivers seeking high-quality and safe solutions for their infants’ grooming needs.

This market has seen steady growth due to several key factors, including increased awareness of child health and hygiene among parents, the rising number of newborns, and growing disposable incomes, which enable families to invest in specialized baby care products. Moreover, a surge in parental concern regarding the safety and comfort of baby grooming tools has led to the introduction of innovative, ergonomically designed, and hypoallergenic products.

The demand for these products is largely driven by the increasing trend of health-conscious parents who prioritize organic and non-toxic materials in baby care. Furthermore, the growing penetration of e-commerce platforms allows for greater accessibility to baby nail care products, contributing to market expansion.

The market also presents substantial opportunities for growth through product innovations, such as incorporating natural and safe ingredients in nail care creams or creating multi-functional grooming kits. Additionally, as baby care products are often seen as essential for new parents, there is a strong potential for sustained demand in both developed and emerging markets, further driving the market’s trajectory.

Key Takeaways

- The global baby nail care products market is expected to reach USD 746.6 million by 2033, expanding at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2033.

- In 2023, nail clippers held the largest share of the product segment, accounting for 39.1% of the market.

- Offline Distribution Channels Lead Sales: Offline retail channels captured a 59.1% share of the distribution segment in 2023.

- Asia Pacific Emerges as the Largest Regional Market: The Asia Pacific (APAC) region accounted for the highest market share, contributing 35.7% or USD 135.3 million in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 386.7 million |

| Forecast Revenue (2033) | USD 746.6 million |

| CAGR (2024-2033) | 6.8% |

| Segments Covered | By Product (Nail Clippers, Nail Trimmers, Nail Scissors, Nail Files, Others), By Distribution Channel (Offline, Online) |

| Competitive Landscape | Mayborn Group Limited (Tommee Tippee), Little Martin’s Drawer, Béaba, Chicco, Pigeon, Safety 1st, Fridababy, LLC., The First Years, Philips Avent, PIYO PIYO |

Emerging Trends

- Integration of Safety Features: Modern baby nail care tools increasingly incorporate safety enhancements such as rounded edges, ergonomic grips, and protective guards. These features aim to minimize the risk of accidental injuries during grooming. The growing emphasis on infant safety has led to a higher demand for such thoughtfully designed products.

- Digital Influence on Consumer Behavior : Social media platforms like Instagram and YouTube have become influential in shaping parental purchasing decisions. Product demonstrations, reviews, and endorsements by parenting influencers contribute to increased awareness and trust in baby nail care products.

- Preference for Organic and Herbal Products: There is a rising demand for baby care items formulated with natural and organic ingredients. Parents are increasingly cautious about synthetic substances, leading to a preference for products that are gentle and free from harmful chemicals.

- Aesthetic and Functional Product Design: Manufacturers are focusing on creating baby nail care products that are both visually appealing and functional. Features like vibrant colors and user-friendly designs enhance the grooming experience for both parents and infants.

- Growth in E-commerce Channels: The convenience of online shopping has led to a significant increase in the sale of baby nail care products through e-commerce platforms. Parents benefit from the ability to compare products, read reviews, and have items delivered directly to their homes.

Top Use Cases

- Routine Infant Grooming: Regular trimming of a baby’s nails is essential to prevent self-inflicted scratches and maintain hygiene. Specialized tools designed for delicate infant nails facilitate safe grooming practices.

- Post-Bath Nail Care: After bathing, a baby’s nails are softer and more pliable, making it an ideal time for trimming. Using appropriate nail care tools during this period reduces the risk of injury.

- Inclusion in Baby Care Kits: Baby nail care products are often included in comprehensive baby grooming kits, providing parents with essential tools for overall infant hygiene.

- Hospital and Maternity Ward Use: Healthcare facilities utilize baby nail care tools to ensure newborns’ nails are properly trimmed before discharge, promoting safety from the outset.

- Gift Sets for New Parents: Baby nail care items are commonly featured in gift sets for new parents, emphasizing the importance of comprehensive infant care.

Major Challenges

- Regulatory Compliance Across Regions: Navigating varying safety and quality standards across different countries poses a significant challenge for manufacturers aiming to enter new markets.

- Market Saturation with Unbranded Products: The presence of numerous unbranded or lesser-known products in the market creates intense competition, making it difficult for established brands to maintain market share.

- Price Sensitivity Among Consumers: Many parents are budget-conscious, leading to a preference for more affordable options, which can impact the sales of premium baby nail care products.

- Limited Awareness in Emerging Markets: In certain developing regions, there is a lack of awareness regarding the importance of specialized baby nail care, hindering market growth potential.

- Distribution Challenges in Rural Areas: Ensuring the availability of baby nail care products in remote or rural locations remains a logistical hurdle for many companies.

Top Opportunities

- Regulatory Compliance Across Regions: Navigating varying safety and quality standards across different countries poses a significant challenge for manufacturers aiming to enter new markets.

- Market Saturation with Unbranded Products: The presence of numerous unbranded or lesser-known products in the market creates intense competition, making it difficult for established brands to maintain market share.

- Price Sensitivity Among Consumers: Many parents are budget-conscious, leading to a preference for more affordable options, which can impact the sales of premium baby nail care products.

- Limited Awareness in Emerging Markets: In certain developing regions, there is a lack of awareness regarding the importance of specialized baby nail care, hindering market growth potential.

- Distribution Challenges in Rural Areas: Ensuring the availability of baby nail care products in remote or rural locations remains a logistical hurdle for many companies.

Key Player Analysis

In 2024, key players in the Global Baby Nail Care Products Market are strategically leveraging brand equity, product innovation, and global distribution to enhance market presence. Mayborn Group Limited (Tommee Tippee) and Philips Avent continue to lead through advanced grooming kits integrated with ergonomic designs tailored for infant safety. Little Martin’s Drawer has strengthened its niche appeal with electric nail trimmers, gaining popularity for convenience among tech-savvy parents.

Chicco and Pigeon, backed by longstanding trust in baby care, maintain stronghold positions in Asia and Europe through diversified product offerings. Béaba and Fridababy, LLC. emphasize aesthetics and functionality, appealing to modern parents seeking premium products. Safety 1st and The First Years focus on affordability and availability, capitalizing on mass retail channels. Meanwhile, PIYO PIYO reinforces its brand in Asia through culturally tailored designs. Competitive dynamics in 2024 are defined by innovation, safety certifications, and expanding e-commerce footprints across key regional markets.

Top Key Players in the Market

- Mayborn Group Limited (Tommee Tippee)

- Little Martin’s Drawer

- Béaba

- Chicco

- Pigeon

- Safety 1st

- Fridababy, LLC.

- The First Years

- Philips Avent

- PIYO PIYO

Regional Analysis

Asia Pacific Leads Baby Nail Care Products Market with Largest Market Share of 35.7% in 2024

In 2024, Asia Pacific has emerged as the leading region in the global baby nail care products market, accounting for the largest market share of 35.7%. The regional market value reached USD 135.3 million in the same year, driven by rising consumer awareness regarding infant hygiene and increasing expenditure on baby care essentials. The growing population of infants across emerging economies such as China and India, coupled with the rising penetration of baby grooming products through both offline and online retail channels, has further supported market expansion within the region.

The dominance of Asia Pacific in this segment is also supported by increased adoption of safe and innovative baby grooming tools by new-age parents. Manufacturers are investing in product development tailored to regional consumer preferences, which has contributed to the consistent demand. Moreover, the increasing focus on child wellness and hygiene, alongside supportive demographic trends, reinforces the region’s position as the key contributor to overall global revenue in the baby nail care products market.

The imposition of tariffs by the United States on various imported consumer products, including baby items, has had a notable impact on the pricing and availability of baby nail care products. These tariffs have increased the overall cost of goods sourced from countries such as China, where a significant share of baby grooming tools is manufactured. Consequently, U.S. consumers are experiencing elevated retail prices, which may lead to moderated demand within the domestic market. This tariff environment has also introduced supply chain uncertainties, affecting import volumes and potentially influencing the competitive landscape of the global baby nail care products industry.

Recent Developments

- In 2024, Millenium Babycares received $14.5 million in funding from Bharat Value Fund. The investment will support the company in expanding its factory operations and growing its presence in local and overseas markets. The funds are expected to help the brand meet rising demand and strengthen its distribution network.

- In 2024, All Things Baby secured ₹30 crore in Series A funding to grow its digital baby product platform. Based in Mumbai, the company offers selected items for infants and mothers, bringing together both Indian and global brands. The new capital will be used to improve services and widen product availability across more cities.

Conclusion

The global baby nail care products market is poised for steady expansion, driven by heightened parental awareness of infant hygiene, innovations in product safety and design, and the increasing accessibility of these products through both offline and online retail channels. The Asia Pacific region, particularly countries like India and China, is anticipated to maintain its leading position, supported by high birth rates and growing consumer spending on baby care essentials. Manufacturers are focusing on developing ergonomic, safe, and user-friendly grooming tools to meet the evolving demands of modern parents. The integration of digital platforms and social media is further influencing consumer behavior, enhancing product visibility, and fostering informed purchasing decisions. As the market continues to evolve, companies that prioritize safety, innovation, and effective distribution strategies are expected to achieve sustained growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)