Table of Contents

Introduction

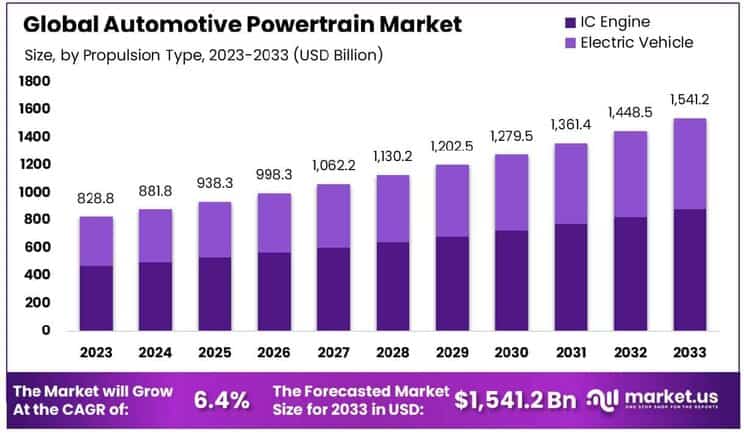

The Global Automotive Powertrain Market is projected to reach approximately USD 1,541.2 billion by 2033, up from USD 828.8 billion in 2023, growing at a compound annual growth rate (CAGR) of 6.4% during the forecast period from 2024 to 2033.

The Automotive Powertrain refers to the components that generate power and deliver it to the wheels of a vehicle, including the engine, transmission, driveshafts, and differential. It plays a critical role in the vehicle’s performance, fuel efficiency, and emissions. The Automotive Powertrain Market encompasses the design, manufacturing, and sale of these systems, which are integral to the functioning of all types of vehicles, including internal combustion engine (ICE), hybrid, and electric vehicles (EVs).

The market has witnessed substantial growth driven by factors such as the increasing demand for fuel-efficient and low-emission vehicles, advancements in electric mobility, and the shift towards hybrid powertrains. Regulatory pressure to reduce carbon emissions and the push for greener transportation further fuel market expansion. With growing adoption of electric vehicles and technological innovations in powertrain systems, the market presents significant opportunities for manufacturers, suppliers, and startups focusing on efficiency, sustainability, and performance improvements.

Key Takeaways

- The global automotive powertrain market is projected to reach USD 1,541.2 billion by 2033, up from USD 828.8 billion in 2023, growing at a CAGR of 6.40%.

- In 2023, propulsion type accounts for 87.5% of the market share, highlighting its dominance in the sector.

- Passenger vehicles hold a significant market share, with more than 75.1% of the total market in 2023.

- The Asia-Pacific region leads the global automotive powertrain market with a commanding 61.6% share in 2023, driving innovation and growth in the industry.

Key Segments Analysis

The Automotive Powertrain Market is predominantly driven by traditional propulsion types, with Internal Combustion (IC) Engine vehicles such as gasoline, diesel, and natural gas holding an 87.5% market share, reflecting the current infrastructure and consumer preferences. However, the Electric Vehicle (EV) segment, including Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), is gaining traction, signaling a shift towards more sustainable and eco-friendly transportation alternatives.

In 2023, Passenger Vehicles dominated the market with over 75.1% share, driven by growing consumer demand for personal mobility and advancements in electric and hybrid vehicle technologies, supported by investments in EV infrastructure and favorable government policies. The Commercial Vehicle segment, though smaller, saw significant growth due to increased demand for transportation and logistics services, with innovations in fuel efficiency and emissions reduction in heavy-duty vehicles supporting its expansion toward more sustainable solutions.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 828.8 Billion |

| Forecast Revenue (2033) | USD 1,541.2 Billion |

| CAGR (2024-2033) | 6.4% |

| Segments Covered | By Propulsion Type(IC Engine, Gasoline, Diesel, Natural Gas Vehicle, Electric Vehicle, BEV, PHEV), By Vehicle Type(Passenger Vehicle, Commercial Vehicle) |

| Competitive Landscape | NIDEC CORPORATION, Mitsubishi Electric Corporation, Continental AG, ZF Friedrichshafen AG, BorgWarner Inc., Magna International Inc., VALEO, Schaeffler AG, Marelli Holdings Co., Ltd., Robert Bosch GmbH |

Emerging Trends

- Electrification of Powertrains: A significant shift toward electric powertrains is underway. Many automakers are transitioning from internal combustion engines (ICE) to electric motors, in response to stricter emissions regulations and growing consumer demand for greener vehicles. This transition is evident in electric vehicle (EV) and hybrid electric vehicle (HEV) development.

- Integration of Advanced Transmission Systems: Newer powertrains are incorporating advanced transmission systems like continuously variable transmissions (CVTs) and dual-clutch transmissions (DCTs). These systems offer smoother gear shifts and higher fuel efficiency. As the focus on performance and fuel economy intensifies, these technologies are expected to become more prevalent in both traditional and electric powertrains.

- Hydrogen Fuel Cell Technology: The exploration of hydrogen fuel cells is gaining momentum as an alternative to traditional gasoline and diesel engines. Hydrogen-powered vehicles produce zero emissions, with water vapor as the only by-product, making them a promising option for reducing carbon footprints in the transportation sector. This technology is especially relevant for heavy-duty and long-distance applications, where battery capacity and charging times remain limitations.

- Software-Driven Powertrain Management: Automotive powertrains are becoming increasingly dependent on software to optimize performance. The role of advanced algorithms and artificial intelligence (AI) in powertrain management is growing. These technologies allow for real-time adjustments to improve fuel efficiency, manage power distribution, and enhance overall driving dynamics.

- Shift Toward Lightweight Materials: To improve efficiency and reduce energy consumption, automotive manufacturers are increasingly using lightweight materials such as aluminum, carbon fiber, and high-strength steel in powertrain components. This shift helps reduce vehicle weight, which directly contributes to improved fuel efficiency and performance, especially in electric and hybrid vehicles.

Top Use Cases

- Electric Vehicles (EVs): Powertrains in EVs are designed to replace the conventional internal combustion engines. With EV sales growing rapidly, particularly in Europe and China, automakers are investing in more efficient electric powertrains. For instance, electric motors provide instant torque, offering a smoother and faster driving experience compared to traditional gasoline-powered engines.

- Hybrid and Plug-In Hybrid Vehicles (HEVs and PHEVs): Hybrid vehicles, which combine electric motors with internal combustion engines, are a popular choice for those seeking better fuel efficiency without the range anxiety associated with full electric vehicles. The powertrain system in these vehicles switches between the electric motor and the gasoline engine based on driving conditions, enhancing fuel economy.

- Light Duty Trucks and SUVs: The rise in demand for light-duty trucks and SUVs equipped with advanced powertrain systems is one of the major trends. These vehicles often feature turbocharged engines, hybrid or plug-in hybrid powertrains, improving fuel efficiency while maintaining performance. According to recent data, the demand for hybrid powertrains in light-duty trucks has increased by nearly 25% in the last five years.

- Autonomous Vehicles: Powertrains in autonomous vehicles are being designed to support the increased load from the sensors and processing units required for self-driving technology. This includes specialized powertrains for fully autonomous electric vehicles, designed to provide enhanced control and energy efficiency for a more stable ride and lower maintenance costs.

- Heavy-Duty Trucks: In heavy-duty commercial vehicles, powertrains are evolving to include alternative fuel technologies, including natural gas and hydrogen fuel cells. These vehicles are being used in logistics and long-haul applications. The growing need for cleaner, more efficient trucks is pushing the adoption of these powertrains for better fuel economy, reduced emissions, and lower operational costs.

Major Challenges

- Battery Life and Charging Infrastructure: As electric powertrains become more common, battery life and the availability of fast-charging infrastructure remain significant challenges. For example, although advancements have been made in lithium-ion batteries, the average driving range of EVs still lags behind gasoline-powered vehicles. Many regions still lack sufficient charging stations, creating barriers to EV adoption.

- Cost of Advanced Materials: The adoption of advanced materials such as carbon fiber, aluminum, and high-strength steel in powertrains is increasing, but their high cost poses a challenge. These materials, though beneficial for reducing weight and increasing fuel efficiency, drive up the cost of manufacturing and, in turn, the price of vehicles.

- Emissions Regulations and Compliance: Stringent emissions regulations, particularly in regions like Europe and North America, are driving the development of cleaner powertrain technologies. However, meeting these standards often requires substantial investment in R&D and could lead to increased production costs. Automakers must balance compliance with maintaining cost-effective production methods.

- Consumer Perception of Electric Powertrains: Although there is growing awareness of the environmental benefits of EVs, a large segment of consumers still views electric powertrains as less reliable or convenient compared to traditional combustion engines. This perception is largely due to concerns about charging time, battery life, and driving range, which continue to be hurdles for widespread adoption.

- Technological Integration and Compatibility: Integrating new powertrain technologies with existing vehicle systems is often a complex and costly process. Legacy automakers face challenges in updating their manufacturing lines, supply chains, and engineering systems to support new powertrain configurations. Additionally, harmonizing electric powertrains with autonomous driving systems and AI-driven software creates further technical and cost-related difficulties.

Top Opportunities

- Growth of Electric Powertrain Market: As governments worldwide set more ambitious goals for reducing carbon emissions, the electric powertrain market presents vast opportunities. Automakers are investing heavily in the development of more energy-efficient batteries, improved power electronics, and fast-charging networks. This trend is expected to increase the adoption rate of EVs significantly over the next decade.

- Adoption of Hydrogen Powertrains: The growing interest in hydrogen fuel cell technology is another promising opportunity. With zero emissions and quick refueling times, hydrogen fuel cell powertrains are poised to disrupt the heavy-duty vehicle market. Several countries have set long-term goals to develop hydrogen refueling infrastructure, which will accelerate the adoption of hydrogen-powered trucks and buses.

- Investment in Smart Powertrain Systems: The integration of AI and machine learning to optimize vehicle performance is a significant opportunity for powertrain development. Powertrain systems that can adjust to driving habits, road conditions, and other variables in real-time promise to improve fuel efficiency, reduce emissions, and enhance overall vehicle performance.

- Customization and Modular Powertrain Designs: With the increasing demand for personalized vehicles, modular powertrain designs offer opportunities for manufacturers to offer customizable solutions. These designs enable carmakers to tailor powertrains based on the specific needs of consumers, whether for performance, fuel efficiency, or environmental friendliness.

- Expansion in Emerging Markets: The rising demand for automobiles in emerging markets, especially in Asia-Pacific and Latin America, presents significant growth opportunities. As these regions embrace cleaner technologies and modernize their automotive industries, there is increased demand for advanced powertrain systems in both passenger cars and commercial vehicles.

Key Player Analysis

- NIDEC CORPORATION: Nidec Corporation is a major player in the automotive powertrain market, primarily known for its development of electric motors. The company’s products are used in various automotive applications, including electric vehicles (EVs), power steering, and drive systems. Their motor technologies are crucial for the growing EV sector, with Nidec’s electric vehicle motor solutions seeing robust demand. Source: Nidec Official Website.

- Mitsubishi Electric Corporation: Mitsubishi Electric is another key player in the automotive powertrain market, providing advanced electrical components and systems. The company specializes in inverters, power control units, and electronic powertrains for EVs and hybrids. Their innovative products help drive efficiency and reliability in automotive powertrains, focusing on electric and hybrid vehicle solutions.

- Continental AG: Continental AG is a global leader in automotive technologies and powertrain solutions. The company’s diverse offerings include transmission components, sensors, and electric powertrain systems. The company has made significant investments in developing electric and hybrid powertrain systems, catering to the rising demand for sustainable mobility. Source: Continental AG Official Website.

- ZF Friedrichshafen AG: ZF Friedrichshafen AG is a top supplier of driveline and chassis technology, with a major focus on electric mobility and powertrain systems. The company is known for its electric drive systems, hybrid transmissions, and efficient driveline technologies that support the shift to electric vehicles. ZF is actively expanding its portfolio in electric vehicle powertrains.

- BorgWarner Inc.: BorgWarner is a leading supplier of advanced powertrain technologies, specializing in electric propulsion, thermal management, and electric vehicle powertrains. BorgWarner’s products are designed to improve fuel efficiency, performance, and emissions reductions, supporting the automotive industry’s shift towards electrification.

Regional Analysis

The Asia-Pacific region dominates the global automotive powertrain market, accounting for 61.6% of the market share in 2023. This dominance is driven by the region’s strong automotive manufacturing base, with key players in China, Japan, South Korea, and India. China’s robust automotive industry, coupled with significant investments in electric and hybrid powertrain technologies, plays a crucial role in the market’s growth. The region benefits from favorable government policies promoting electric vehicles (EVs) and eco-friendly mobility solutions, along with increasing disposable income and urbanization. These factors contribute to rising demand for fuel-efficient and high-performance powertrains, ensuring that Asia-Pacific will continue to lead global market expansion in the coming years.

Recent Developments

- In 2024, Sage Automotive Interiors teamed up with NFW, a startup from Peoria, Illinois, known for its plant-based, plastic-free leather alternative for automotive interiors. This partnership aims to help global car manufacturers reduce their environmental impact by advancing sustainable solutions throughout the automotive lifecycle.

- In June 2023, Steelcase showcased its latest workplace solutions at NeoCon 2023, focusing on creating more diverse, sustainable, and vibrant work environments. As hybrid work continues to evolve, Steelcase is pushing the conversation beyond where people work, focusing on how work can better support employees both inside and outside the office.

- In 2024, Mercedes-Benz, a leader in automotive innovation for over 140 years, provided a glimpse into the future of mobility through its VISION EQXX technology program. The company is pushing the boundaries of efficiency and safety, with ongoing research into groundbreaking technologies that promise a more sustainable, safer, and personalized driving experience.

- In July 2024, BASF introduced Haptex® 4.0, a revolutionary polyurethane material for synthetic leather. This 100% recyclable solution eliminates the need for layer separation during recycling, making it possible to recycle synthetic leather with polyethylene terephthalate (PET) fabric together, significantly enhancing the sustainability of automotive interiors.

Conclusion

the automotive powertrain market is poised for significant growth in the coming years, driven by the increasing demand for more fuel-efficient, sustainable, and high-performance vehicles. As the industry shifts towards electrification and hybrid powertrains, manufacturers are focusing on technological advancements that improve vehicle efficiency, reduce emissions, and enhance overall performance. With rising consumer interest in electric vehicles, supportive regulatory frameworks, and ongoing innovations in powertrain technologies, the market is expected to expand rapidly. Key opportunities lie in the development of next-generation electric and hybrid systems, as well as improving integration across vehicle types to meet the evolving demands of the global automotive landscape. The future of the automotive powertrain sector is increasingly centered around efficiency, sustainability, and the transition to greener mobility solutions.

Take advantage of our unbeatable offer - buy now!

Discuss Your Needs With Our Analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)