Table of Contents

Introduction

The Global Automotive Plastics Market is projected to reach a value of approximately USD 58.0 billion by 2034, up from USD 33.0 billion in 2024. This represents a compound annual growth rate (CAGR) of 5.8% during the forecast period from 2025 to 2034.

The automotive plastics market refers to the use of polymer materials in the design and manufacture of automotive components, which significantly reduce vehicle weight, enhance fuel efficiency, and provide design flexibility.

Automotive plastics are employed in various applications including interior and exterior trim, bumpers, dashboards, seating, and under-the-hood parts, due to their versatility, durability, and cost-effectiveness. The market for automotive plastics has witnessed substantial growth driven by the increasing demand for lightweight materials, regulatory pressures to improve fuel efficiency, and consumer preferences for enhanced vehicle aesthetics.

In recent years, the adoption of electric vehicles (EVs) has further fueled this demand as automakers strive to optimize vehicle performance while reducing carbon footprints. The market is also experiencing growth due to advancements in polymer technologies, which have expanded the range of automotive applications for plastics.

Key growth factors include the ongoing trend towards vehicle electrification, which has led to a surge in demand for lighter materials to offset the weight of electric batteries, and rising environmental concerns, prompting manufacturers to focus on sustainable materials.

Additionally, innovations in bioplastics and recycling technologies are presenting new opportunities for the automotive plastics market. Increasing regulatory pressure on vehicle emissions and stricter safety standards are anticipated to drive further adoption of plastics in automotive manufacturing.

Opportunities within the market are further bolstered by the potential for emerging markets, where rising disposable incomes and automotive production growth are expected to increase the demand for plastic-based automotive components.

Key Takeaways

- The global automotive plastics market is projected to grow from USD 33.0 billion in 2024 to USD 58.0 billion by 2034, at a CAGR of 5.8% during the forecast period (2025-2034).

- Polypropylene (PP) resin holds the largest market share at over 33.1% in 2024, driven by its lightweight, cost-effective, and chemically resistant properties.

- Injection molding remains the most widely used processing technique, capturing more than 53.9% of the market share in 2024, owing to its efficiency, precision, and versatility in manufacturing complex, high-volume components.

- The interior furnishing segment dominates the market, with a share of over 43.2% in 2024, fueled by rising demand for lightweight, durable, and visually appealing materials for automotive interiors.

- Passenger cars lead the market, holding over 39.3% of the share in 2024, reflecting the growing need for lightweight materials that contribute to enhanced fuel efficiency, safety, and design aesthetics.

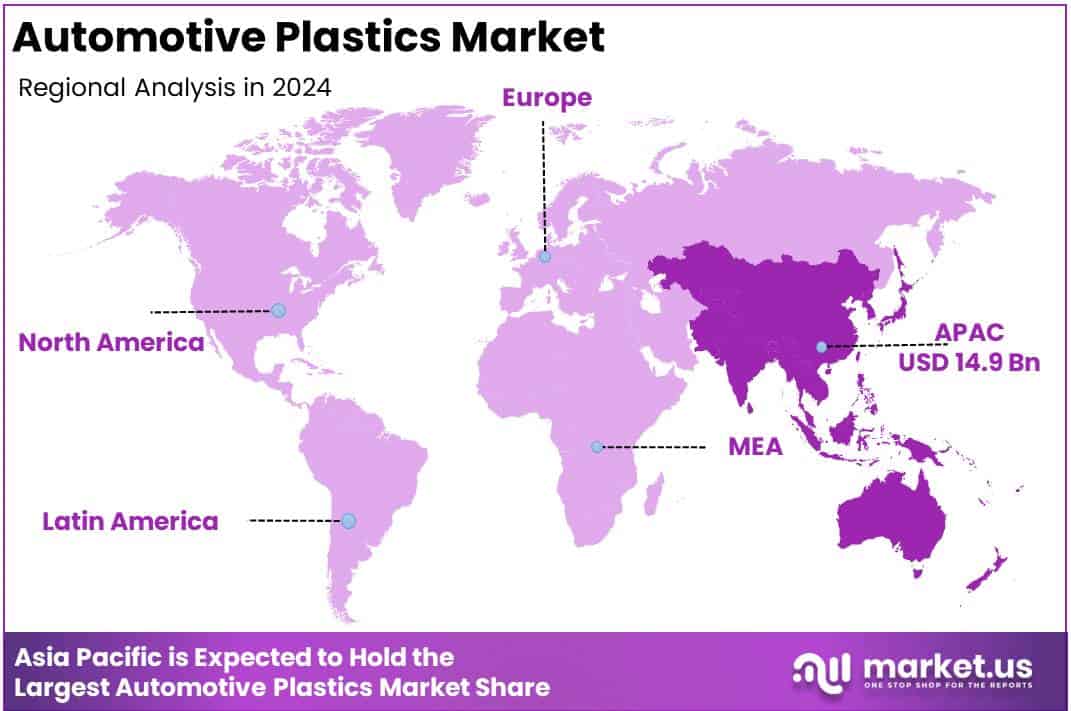

- The Asia Pacific region leads the global automotive plastics market, accounting for 45.2% of the market share, valued at USD 14.9 billion in 2024, driven by strong automotive production and demand in key markets such as China and Japan.

Segmentation Details Analysis 2024

| Segmentation Type | Dominating Segment | 2024 |

|---|---|---|

| By Product Type | Polypropylene (PP) | 33.1% |

| By Process Type | Injection molding | 53.9% |

| By Application | Interior Furnishing | 43.2% |

| By Vehicle Type | Passenger cars | 39.3% |

| Regional Analysis | Asia Pacific | 42% |

Emerging Trends

- Shift Toward Lightweight Materials: The automotive industry is increasingly adopting lightweight materials, including plastics, to improve fuel efficiency and reduce emissions. Plastics offer significant weight savings compared to metals, making them crucial for the development of lighter, more fuel-efficient vehicles.

- Sustainability and Recyclability: The demand for sustainable automotive plastics has risen sharply. Manufacturers are focusing on developing recyclable and biodegradable plastics to reduce environmental impact. This trend is driven by regulatory pressures and consumer demand for greener alternatives.

- Integration of Advanced Polymers: The use of advanced polymers such as polycarbonate, polypropylene, and thermoplastic elastomers has grown in automotive applications. These materials offer superior performance, including high durability, resistance to heat, and design flexibility.

- Increased Use of Plastic in Interior Components: Plastic parts are increasingly being used in interior components, such as dashboards, seating, and trim. The design flexibility, cost-effectiveness, and weight reduction advantages of plastics have contributed to this shift.

- Adoption of Electric Vehicles (EVs): The growth of electric vehicles is driving the demand for specialized automotive plastics that can withstand the high-performance demands of electric powertrains. Plastics are used in battery casings, wiring insulation, and other key EV components.

Top Use Cases

- Exterior Components: Plastics are commonly used for bumpers, side panels, and hoods in vehicle exteriors. Their lightweight nature and resistance to corrosion make them an ideal material for these parts.

- Under-the-Hood Applications: Automotive plastics are increasingly used in under-the-hood components such as engine covers, air intake systems, and reservoirs. These parts benefit from plastics’ heat resistance, which enhances vehicle durability.

- Interior Components: The use of plastics in interiors, such as dashboards, door panels, and seat cushions, has become widespread. They offer a combination of durability, flexibility, and aesthetic appeal, making them ideal for vehicle interiors.

- Electrical Wiring and Insulation: With the rise of electric vehicles, plastics are used extensively in electrical systems. They provide insulation for wiring, ensuring safe and efficient power distribution within the vehicle.

- Safety Features: Plastics are increasingly being used in safety components such as airbags, seat belts, and impact-resistant structures. Their energy-absorbing properties contribute to improved vehicle safety.

Major Challenges

- Cost and Material Sourcing: The cost of advanced automotive plastics can be higher than traditional materials like metals. Additionally, securing a consistent supply of high-quality plastic resins can be challenging, especially as demand rises.

- Recycling and End-of-Life Management: While plastics can be recycled, the processes for doing so effectively in the automotive industry remain underdeveloped. A lack of standardized recycling systems poses challenges to creating a circular economy.

- Environmental Concerns: Despite advances in recyclable plastics, the environmental impact of plastics remains a significant concern. The accumulation of non-recyclable plastic waste poses long-term challenges for both manufacturers and consumers.

- Technological Barriers in Production: The development and production of advanced polymers for automotive applications can be technologically complex and expensive. The high precision required in manufacturing poses a barrier for many manufacturers.

- Regulatory Pressures: Governments worldwide are tightening regulations on the use of plastics due to their environmental impact. Compliance with these regulations can be costly and time-consuming for manufacturers, particularly in regions with stringent environmental policies.

Top Opportunities

- Innovation in Bioplastics: The market presents significant opportunities for bioplastics, which are derived from renewable sources. These materials are increasingly seen as an alternative to traditional plastics and can reduce the environmental footprint of automotive manufacturing.

- Growth of Electric Vehicle Market: As the electric vehicle (EV) market expands, so does the demand for lightweight materials, including plastics. Plastics play a key role in EV designs, offering weight reduction without compromising performance.

- Automated Manufacturing: The rise of automated manufacturing processes presents an opportunity to improve the efficiency and consistency of plastic parts production. Automation can help drive down costs and improve quality, creating significant advantages in the automotive plastics market.

- Expanding Use in Autonomous Vehicles: As autonomous vehicles continue to develop, the need for advanced materials, including plastics, is expected to rise. Plastics’ ability to be molded into intricate shapes offers flexibility for the complex designs required by autonomous systems.

- Collaborations in Research and Development: Ongoing R&D in the automotive plastics space presents opportunities for collaboration between automotive manufacturers and material suppliers. By working together, these stakeholders can develop new, high-performance plastics that meet the specific needs of the automotive industry.

Key Player Analysis

In 2024, key players in the global automotive plastics market are expected to drive continued innovation and competition, leveraging their advanced manufacturing capabilities and extensive product portfolios. Companies such as BASF SE and Covestro AG are well-positioned to capitalize on the growing demand for lightweight, high-performance materials that support automotive fuel efficiency and sustainability.

Evonik Industries AG and Dow, Inc. are anticipated to strengthen their market presence through the development of specialized polymers and composites that meet the stringent requirements of modern automotive applications. Meanwhile, SABIC and Borealis AG are expected to focus on expanding their offerings of sustainable, recyclable plastics, aligning with the automotive industry’s shift toward more eco-friendly solutions.

Furthermore, players like Magna International, Inc. and Grupo Antolin will likely emphasize innovation in interior and structural components, contributing to the overall growth of the market. These companies are poised to enhance the adoption of advanced materials in the evolving automotive sector.

Top Key Players in the Market

- Akzo Nobel N.V.

- BASF SE

- Covestro AG

- Evonik Industries AG

- Adient plc

- Magna International, Inc.

- Momentive Performance Materials, Inc.

- SABIC

- Dow, Inc.

- Borealis AG

- Hanwha Azdel Inc.

- Grupo Antolin

Regional Analysis

Asia-Pacific Dominating Region in Automotive Plastics Market with 45.2% Share in 2024

The Asia-Pacific region is expected to maintain its position as the leading market for automotive plastics, accounting for approximately 45.2% of the global market share in 2024, valued at USD 14.9 billion. This growth can be attributed to the strong automotive manufacturing base in countries such as China, Japan, and South Korea, where demand for lightweight, fuel-efficient vehicles is driving the adoption of advanced plastics.

The region’s dominance is further supported by the increasing production of electric vehicles (EVs) and the growing focus on reducing vehicle weight to improve fuel efficiency and meet stringent environmental regulations. The extensive use of automotive plastics in interior and exterior components, along with their versatility and cost-effectiveness, has fueled their widespread adoption across various vehicle segments. The presence of key market players and a robust automotive supply chain infrastructure in this region also contribute to its continued leadership in the automotive plastics market.

Recent Developments

- In March 2023, BASF unveiled its new Ultramid® Deep Gloss grade, designed for highly glossy automotive interior components, marking its first application in the garnish of the Toyota Prius. The new technology eliminates the need for solvent painting, enhancing production efficiency by utilizing pre-colored plastic resins that are directly molded into the desired color and finish.

- In October 2024, Celanese Corporation will present its innovative engineered material solutions for electric vehicles (EVs) at the Battery Show North America in Detroit. The company continues to drive advancements in EV technology by emphasizing safety, efficiency, and sustainability. At booth #5215, Celanese will demonstrate the value of early collaboration with advanced mobility customers to optimize materials, reduce costs, and minimize risks in the production process.

- In 2025, Röchling Automotive, in partnership with Mercedes-Benz, Bond Laminates by Envalior, and Valmet, developed a lightweight thermoplastic composite rooftop beam for the Mercedes-Benz CLE Cabrio. The new design improves vehicle aesthetics and reduces weight compared to traditional materials, contributing to enhanced vehicle performance and sustainability. Röchling oversaw the production, with Envalior leading the CAE simulation process.

- In 2024, General Motors and EVgo reached a milestone by surpassing 2,000 co-branded public fast charging stations in the U.S. This achievement strengthens GM’s commitment to making electric vehicles more accessible and practical for American drivers, further solidifying its position as a major player in the EV infrastructure market.

- In 2024, OKE Group GmbH, based in Germany, acquired Polymerica Limited Company, marking a significant expansion into North America and Eastern Europe. With the acquisition of Global Enterprises, OKE strengthens its presence in the automotive industry, enhancing its capacity to manufacture automotive interior parts across key locations in the U.S., Mexico, and Romania.

Conclusion

The automotive plastics market is poised for substantial growth, driven by the increasing demand for lightweight materials, environmental sustainability, and the rise of electric vehicles. With continued advancements in polymer technology, plastics are becoming integral to both traditional and electric vehicle designs, offering benefits such as reduced weight, improved fuel efficiency, and enhanced performance. As automakers focus on meeting stringent regulatory standards and consumer preferences for eco-friendly solutions, the market is expected to see sustained innovation and collaboration across industry players. While challenges like cost, material sourcing, and recycling remain, emerging trends and technological breakthroughs provide significant opportunities for growth and transformation in the automotive plastics sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)