Table of Contents

Introduction

The Global Automotive Interior Leather Market is projected to expand from USD 36.6 Billion in 2023 to approximately USD 71.3 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.90% over the forecast period from 2024 to 2033.

Automotive interior leather refers to the high-quality leather materials used specifically for covering the interiors of vehicles, including seats, dashboards, door panels, and steering wheels. This premium material is favored for its durability, aesthetic appeal, and comfort.

The automotive interior leather market encompasses the production, distribution, and sale of leather materials suited to automotive applications. This market segment is driven by several growth factors, including increasing consumer preference for luxury and premium vehicle interiors, and a growing automotive industry in emerging economies. Demand in the automotive interior leather market is bolstered by the expansion of the global automotive sector and rising consumer expectations for comfort and style in vehicle interiors, which encourages manufacturers to continually innovate and improve leather products.

Opportunities within this market are expanding, particularly as innovations in synthetic and eco-friendly leather alternatives gain traction, catering to the rising environmental concerns and stringent regulations regarding animal products. These factors collectively contribute to the robust dynamics observed within the automotive interior leather market, signaling ongoing growth and transformation in response to evolving consumer trends and environmental considerations.

Key Takeaways

- The Automotive Interior Leather Market is expected to grow from USD 36.6 billion in 2023 to around USD 71.3 billion by 2033, with a CAGR of 6.90% from 2024 to 2033.

- Genuine leather dominates with a 71.5% share due to its durability, comfort, and luxury appeal, while synthetic leather appeals to a wider audience due to affordability and sustainability.

- Luxury cars hold the largest market share at 60.2%, reflecting a preference for quality and prestige. Economic cars are also adopting leather-like materials to boost their value.

- Passenger cars have the largest segment at 46.7%, with demand driven by comfort and luxury. Commercial vehicles are focusing on durability and functional aesthetics.

- Seats and centre stack applications are most prominent, holding a 32% share, emphasizing the importance of comfort and aesthetic appeal in vehicle interiors.

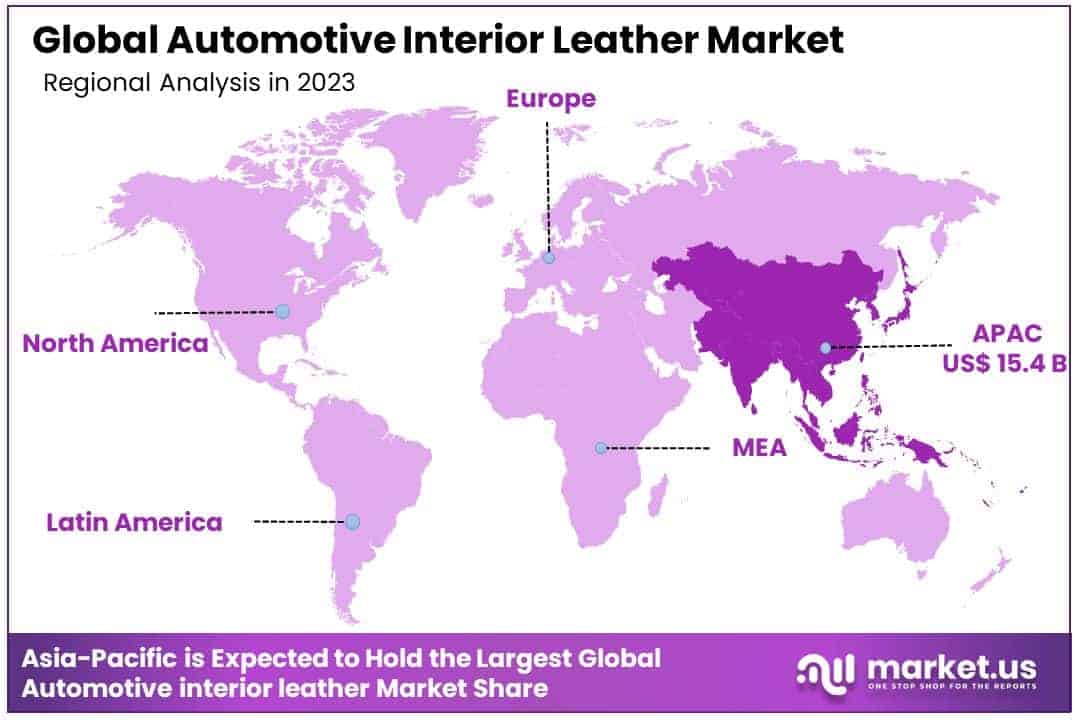

- Asia-Pacific leads the market with a 42.2% share, supported by strong demand for luxury vehicles and a significant number of automotive manufacturers. North America follows with a 24.3% share, also supported by luxury vehicle demand and manufacturing capabilities.

Key Segments Analysis

In the automotive interior leather market, genuine leather dominates with a 71.5% share, prized for its durability, comfort, aesthetic appeal, and luxury status, enhancing the premium feel and traditional appeal of vehicle interiors. Although synthetic leather trails due to its affordability, versatility, and improved quality that rivals genuine leather, it is increasingly chosen for its lower environmental impact and as a cost-effective alternative that still upholds aesthetic values.

Luxury vehicles hold a commanding 60.2% share of the automotive interior leather market, primarily due to their focus on quality, comfort, and prestige that leather interiors provide. These cars cater to consumers seeking exclusivity and personalization, which genuine leather supports by enhancing the sensory and aesthetic aspects of driving. Conversely, the economic car segment is also integrating leather or similar materials to meet the rising demand for premium features in more affordable cars, reflecting a market shift towards democratizing luxury elements traditionally reserved for higher-end models.

In the automotive interior leather market, passenger cars lead with a 46.7% share, primarily due to high production volumes and rising consumer demand for luxury and comfort. Leather interiors enhance the aesthetic and sensory appeal of passenger vehicles, significantly boosting their perceived value. Although light and heavy commercial vehicles (LCVs and HCVs) also use leather, they focus on durability and functionality to withstand commercial use while maintaining a professional look. With an increasing emphasis on brand image and employee comfort in the commercial sector, there is growing potential for market expansion in LCV and HCV segments, driven by innovations in durable and easy-maintenance leather products.

In the automotive interior leather market, seats and the center stack dominate with a 32% share, reflecting their crucial role in enhancing vehicle comfort, functionality, and aesthetic appeal. Leather is not only prized for its luxurious tactile experience in these direct contact areas but also extends to other applications like carpets, headliners, upholstery, seat belts, and door panels. These elements collectively contribute to the market’s growth by adding a cohesive and upscale appearance to the interior. Moreover, advancements in leather treatment and manufacturing have broadened its use throughout vehicle interiors, meeting evolving consumer preferences and opening new opportunities for market expansion as the automotive industry continues to evolve.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 36.6 Billion |

| Forecast Revenue (2033) | USD 71.3 Billion |

| CAGR (2024-2033) | 6.90% |

| Segments Covered | By Material (Genuine, Synthetic), By Car Class (Luxury car, Economic car), By Vehicle type (Passenger car, Light commercial vehicle, Heavy commercial vehicle), By Application (Seats and centre stack, Carpets, Headlines, Upholstery, Seat belt, Door panels) |

| Competitive Landscape | Lear Corporation, Seiren Co, ltd, GST autoleather Inc, Boxmark leather Gmbh and Co kg, Bader Gmbh and Co kg, Katzhin Leather, Inc, Leather resource of America, Wousdorf Leder Schmidt and Co , DK leather Corporation, Scottish Leather Group Limited, Alfatex Italia, Classic Soft trim |

Emerging Trends

- Sustainability and Eco-Innovation: There is a growing emphasis on using sustainable materials in automotive interiors, with companies increasingly incorporating recycled materials and developing metal-free, organic tanning processes like Stahl EasyWhite Tan®. These innovations reduce the environmental impact of leather production, including lower water consumption and waste generation.

- Technological Enhancements: The integration of technology in leather processing is advancing rapidly. Innovations such as Stahl Ympact® coatings are formulated with high levels of renewable content, derived from biomass and recycled plastics, aiming to reduce the fossil-based content of leather goods significantly.

- Customization and Personalization: Premium automotive interiors are increasingly featuring bespoke elements like monogrammed upholstery and customizable color and material selections. This trend caters to luxury consumers looking for personalized interiors that reflect their style and status.

- Shift in Color Preferences: Vehicle interiors are seeing a shift from traditional neutral tones to vibrant and bold color palettes. This change is driven by consumer desire for interiors that reflect personal style and enhance the emotional experience of the vehicle. Warm earth tones and cool blues are popular for creating a sophisticated look, while accent colors are used to highlight technological features.

- Sensory Experience and High-Quality Materials: The tactile and visual appeal of high-quality leather remains a key factor influencing consumer buying decisions. The feel, smell, and appearance of leather are pivotal in creating a luxury feel, which continues to drive demand in the premium segments of the market

Top Use Cases

- Luxury Vehicle Upholstery: Leather is predominantly used in the upholstery of luxury cars, where it is prized for its comfort, aesthetic appeal, and durability. Leather seats, dashboards, and door panels enhance the overall luxury and quality perception of the vehicle.

- Customizable Interiors for Premium Cars: Leather offers extensive customization options in terms of colors, finishes, and embossing, allowing for a personalized interior that caters to individual preferences and luxury standards.

- High-End Public Transport: In luxury buses and private aviation, leather is used to create a comfortable, premium environment for passengers, emphasizing durability and easy maintenance.

- Commercial Vehicles: In commercial vehicle segments, such as executive transport services, leather interiors are utilized to enhance the customer experience and provide an added level of comfort and luxury.

- Show Cars and Concept Vehicles: Leather is often featured in show cars and concept vehicles to showcase future trends and innovative uses of materials in automotive design.

Major Challenges

- Environmental Concerns: The production of leather often involves processes that can be harmful to the environment, including the use of chemicals and high water consumption. There is increasing pressure to develop more sustainable production practices.

- Cost Factors: High-quality leather is expensive, which can increase the overall cost of vehicle production. This makes it challenging to balance between quality and cost-effectiveness in competitive automotive markets.

- Maintenance Requirements: Leather requires regular maintenance to preserve its appearance and durability, which might not be ideal for all consumers, especially in climates where wear and tear due to environmental factors are higher.

- Consumer Shift Towards Vegan Alternatives: There is a growing consumer preference for vegan and synthetic leather alternatives that are perceived as more ethical and sustainable than traditional leather.

- Technological Integration Challenges: Incorporating modern technologies such as smart textiles and sensors into leather without compromising its quality and aesthetic appeal poses significant technical and design challenges.

Top Opportunities

- Innovation in Sustainable Materials: Developing eco-friendly leather alternatives that do not compromise on quality or aesthetics could capture a significant market share, particularly among environmentally conscious consumers.

- Expansion in Emerging Markets: Increasing disposable incomes in regions like Asia-Pacific could drive demand for luxury vehicles with high-quality leather interiors, presenting a significant growth opportunity.

- Technological Advancements: Innovations that integrate technology with traditional leather products, such as smart upholstery that adapts to environmental conditions or user preferences, can create unique selling propositions.

- Increased Demand for Personalization: As consumer demand for personalized and unique vehicle interiors grows, there is a significant opportunity to offer more customization options in leather textures, colors, and finishes.

- Partnerships with Technology Companies: Collaborating with tech companies to enhance the functionality and interactive features of leather interiors could lead to differentiation in a competitive market, enhancing user experience and satisfaction.

Key Player Analysis

- Lear Corporation: Lear stands out for its expansive global reach and a comprehensive range of products enhancing vehicle interiors. With significant revenue and strong production capabilities, it is a leader in the market, known for its innovative leather solutions tailored to modern automotive needs.

- Seiren Co., Ltd: This company excels by blending advanced technology with traditional craftsmanship to produce high-quality, durable, and aesthetically pleasing leather interiors. Seiren has a strong presence in the market and focuses on continuous innovation.

- GST AutoLeather Inc.: Known for its focus on sustainability, GST AutoLeather is dedicated to eco-friendly practices. The company is a significant player in the market, providing high-quality leather that appeals to environmentally conscious consumers.

- Boxmark Leather GmbH & Co KG: Boxmark is another major player, recognized for its wide product range and adherence to stringent regulatory standards. The company uses the latest technology in production and has a broad geographic reach.

- Bader GmbH & Co. KG: Bader is noted for its premium leather products that emphasize both luxury and customization. The company caters to the high-end market segment, offering bespoke solutions that enhance the driving experience by focusing on comfort and style

Regional Analysis

Asia-Pacific Leads Automotive Interior Leather Market with Largest Share of 42.2%

In the automotive interior leather market, Asia-Pacific stands out with a dominant share of 42.2% in 2023, reflecting its pivotal role in this industry. This region’s market valuation reached USD 15.4 billion, underscoring its substantial economic impact and growth trajectory within the automotive sector. Asia-Pacific’s leading position is attributed to several key factors, including significant investments in automotive manufacturing, a robust demand for luxury vehicles, and an increasing consumer preference for high-quality leather interiors. Additionally, the region benefits from the presence of major automotive manufacturers and a well-established supply chain that supports the leather industry. These elements collectively drive the demand for automotive interior leather, ensuring Asia-Pacific’s top spot in the global market landscape.

Recent Developments

- In 2023, Scottish Leather Group inaugurated a revolutionary £14 million ‘super tannery’ in Bridge of Weir, near Paisley, Scotland. This new facility aims to produce leather with a net-zero carbon footprint, serving a broad array of industries including automotive, aviation, and luxury goods. The group is known for supplying premium leather to luxury automotive brands such as Aston Martin and Jaguar Land Rover, as well as to aviation leader British Airways.

- On August 25, 2023, Katzkin, renowned for its bespoke automotive leather interiors, announced the acquisition of Roadwire automotive leather business. This move enhances Katzkin’s ability to cater to a wide range of customers, from OEMs and dealerships to restylers and countless drivers of vehicles equipped with Katzkin interiors.

- On July 17, 2024, Lear Corporation, a leader in automotive technology with a focus on Seating and E-Systems, finalized its acquisition of WIP Industrial Automation. Based in Valladolid, Spain, WIP is noted for its advanced robotics and AI-driven computer vision technology. This acquisition is set to bolster Lear’s manufacturing capabilities, helping it manage challenges such as rising wage costs more efficiently.

- In 2023, Lenzing partnered with Natural Fiber Welding Inc. to integrate TENCEL™ branded fibers into NFW’s innovative plant-based technology, MIRUM®. This collaboration, MIRUM® x TENCEL™, will debut at the international leather fair LINEAPELLE, scheduled for February 21-23, 2023, in Milan, Italy.

Conclusion

The automotive interior leather market is poised for substantial growth over the next decade, fueled by a rising demand for luxury and premium vehicle features. As consumers increasingly seek comfort and style, manufacturers are driven to innovate, offering more sustainable and technologically integrated leather products. The push towards eco-friendly materials, along with advancements in customization and personalization, signifies a dynamic shift in the market. This evolution is particularly pronounced in regions like Asia-Pacific, where economic growth and an expanding automotive industry are key drivers. With ongoing technological advancements and a focus on sustainable practices, the market is expected to continue expanding, providing significant opportunities for both established players and new entrants in the field.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)