Table of Contents

Introduction

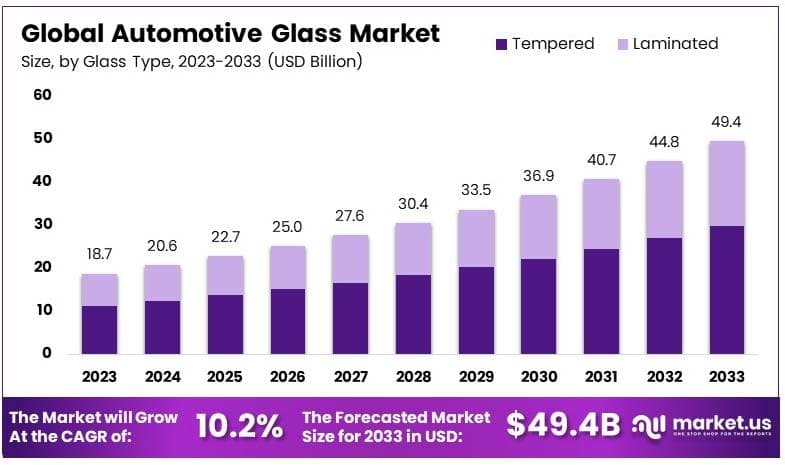

The Global Automotive Glass Market is projected to reach a value of approximately USD 49.4 billion by 2033, up from USD 18.7 billion in 2023, reflecting a compound annual growth rate (CAGR) of 10.2% during the forecast period from 2024 to 2033.

The automotive glass market refers to the sector involved in the manufacturing, distribution, and installation of glass components used in vehicles, including windshields, side windows, rear windows, and sunroofs. This market is primarily driven by the demand for vehicle safety, comfort, and aesthetics, with glass playing a critical role in both vehicle performance and driver/passenger experience. The market has seen steady growth, primarily due to the increasing vehicle production and the rising trend of electric vehicles (EVs), which require specialized glass for enhanced energy efficiency and lightweight design.

Additionally, advancements in automotive glass technology, such as the integration of smart glass and tempered safety glass, have further fueled market expansion. The growing consumer preference for advanced safety features, like driver assistance systems that rely on high-quality glass sensors, has also spurred demand. Opportunities in the market lie in the expansion of repair and replacement services, as well as the rising adoption of eco-friendly materials in automotive manufacturing.

Core Findings

- The global Automotive Glass Market was valued at USD 18.7 billion in 2023 and is projected to reach USD 49.4 billion by 2033, growing at a CAGR of 10.2%.

- Tempered Glass led the glass type segment in 2023, holding a 60.1% market share, driven by its superior durability and safety features.

- Windshields accounted for 34.1% of the market share in 2023, primarily due to their critical role in vehicle safety and visibility.

- Electrochromic Glass dominated the technology segment in 2023 with a market share of over 83%, thanks to its adaptive light-filtering capabilities.

- Suspended Particle Device (SPD) Glass experienced the highest CAGR of 15.0% in 2023, driven by increasing adoption in premium vehicles.

- Asia-Pacific (APAC) held the largest regional market share in 2023 at 52.6%, contributing USD 9.84 billion, supported by a significant automotive manufacturing base in the region.

Key Segments Analysis

In the automotive glass market, tempered glass dominates with a 60.1% share in 2023, due to its durability and safety features. It is known for its ability to shatter into small, blunt pieces that reduce injury risks, making it ideal for side and rear windows. The production process enhances its strength, providing impact and temperature resistance. Laminated glass, though a smaller segment, is used mainly in windshields because it prevents glass from scattering during an accident, offering additional passenger protection.

Windshields hold the largest application share of 34.1% in 2023. They protect passengers from external elements and contribute to the structural integrity of the vehicle during accidents. Windshields also influence vehicle aerodynamics and aesthetics, impacting fuel efficiency and driving experience. Technological advancements like ADAS integration require high-quality windshield glass to ensure visibility and precise data projection. Other applications such as backlite, side mirrors, and sunroofs enhance vehicle design and passenger comfort.

Electrochromic glass holds an 83% share in 2023, due to its adaptability and energy efficiency. This technology allows glass to adjust its light transmission properties, enhancing comfort and protecting interiors from UV damage. It is especially useful for sunroofs and rear windows. SPD glass, while a smaller segment, is expected to grow at a 15.0% CAGR until 2033. Its rapid light-dark switching ability improves passenger comfort by controlling light exposure in varying conditions.

Passenger cars lead the market with a 57.8% share, driven by high production volumes and diverse glass requirements. They use automotive glass in areas such as windshields, side and rear windows, and features like sunroofs. The demand is fueled by innovations in design and increasing consumer expectations for safety and comfort. Light commercial vehicles, including vans and small trucks, require durable glass for business use, while heavy commercial vehicles, like buses and trucks, prioritize safety and visibility.

OEMs dominate the distribution channel with an 85.6% share due to their role in vehicle production, where glass is integrated during manufacturing. OEMs ensure that glass meets the necessary safety and design standards. The aftermarket replacement glass segment plays a key role in replacing damaged or upgraded glass, driven by the need for high-quality replacements as vehicles age.

Asia Pacific Automotive Glass Market

The Asia Pacific region is the largest and most dominant market for automotive glass, commanding a significant share of 52.6% in 2023, valued at approximately USD 9.84 billion. This dominance can be attributed to the rapid growth of the automotive industry in countries such as China, Japan, and India, which are major producers and consumers of automobiles globally.

The increasing demand for both passenger and commercial vehicles, coupled with technological advancements in vehicle manufacturing, is driving the robust growth of the automotive glass market in the region. Furthermore, the expansion of the electric vehicle (EV) sector, which requires advanced glazing solutions, is further augmenting market demand.

China, as a manufacturing hub and the largest consumer market for automobiles, plays a pivotal role in the region’s automotive glass market, accounting for a substantial portion of the revenue. Additionally, the rising middle-class population and increasing disposable income in emerging economies like India and Southeast Asia are contributing to the escalating demand for automotive products, including high-quality glass.

As a result, Asia Pacific is expected to continue its market leadership, leveraging both the increasing production capacity and the expanding consumer base. With a favorable business environment and ongoing investments in infrastructure and manufacturing, the region is poised to maintain its dominant position in the global automotive glass market.

Top Use Cases

- Windshields: Windshields serve as a primary safety feature, offering protection to vehicle occupants by reducing the risk of injury during collisions. According to industry estimates, windshields account for approximately 35% of all automotive glass usage in vehicles. Modern windshields are often equipped with features such as built-in sensors, heads-up displays, and integrated heating elements to enhance driver safety and comfort.

- Side and Rear Windows: Side and rear windows are essential for driver visibility, safety, and comfort. These windows are typically made from tempered glass, which provides enhanced durability and resistance to breakage. In passenger cars, side windows contribute to 25-30% of the total automotive glass usage, with rear windows accounting for another 15-20%. As vehicles become more sophisticated, side windows now often include acoustic and UV-protective coatings to improve passenger comfort.

- Sunroofs and Panoramic Roofs: Sunroofs and panoramic roofs offer enhanced aesthetics and open-air experiences for passengers. This segment of automotive glass has gained popularity, particularly in premium vehicles. Manufacturers are integrating advanced glass technologies like electrochromic glass, which allows users to adjust the transparency of the roof for better heat and glare control.

- Automotive Mirrors: Automotive mirrors, including rear-view mirrors and side mirrors, are crucial for driver visibility and safety. Over 95% of rear-view mirrors are made of glass, and the use of self-dimming or electrochromic glass in mirrors has seen rapid adoption in higher-end models. These mirrors automatically adjust to light changes, reducing glare from headlights. The mirror segment is expected to account for a significant portion of the automotive glass market, with growth rates around 4.5% annually.

- Advanced Driver-Assistance Systems (ADAS): The integration of automotive glass with ADAS technologies is increasing rapidly. Windshields and other glass components now often include embedded cameras, sensors, and radar systems that aid in functions like lane-keeping assist, collision detection, and adaptive cruise control. This trend is driven by the increasing adoption of electric and autonomous vehicles.

Major Challenges

- Manufacturing Costs: The production of advanced automotive glass, particularly for applications such as laminated glass, sunroofs, and ADAS-integrated components, involves complex processes and high material costs. For instance, the cost of producing windshields with integrated sensors and cameras can be up to 40% higher than that of traditional windshields. As a result, the increasing demand for such sophisticated products is driving up manufacturing costs. Manufacturers are working to optimize production processes, but cost efficiency remains a challenge.

- Sustainability and Environmental Impact: Automotive glass production involves energy-intensive processes, contributing to environmental concerns. The need for recycling and eco-friendly production methods is gaining importance. Glass production alone can account for up to 10% of the total energy consumed in the automotive manufacturing process. To address these concerns, companies are investing in the development of more sustainable glass materials and recycling technologies. However, the adoption of these technologies is still limited, especially in mass production settings.

- Safety and Regulatory Compliance: Automotive glass must adhere to strict safety and regulatory standards. The evolving nature of these regulations, particularly related to crash resistance and the integration of advanced driver-assistance systems (ADAS), presents a significant challenge for manufacturers. In regions such as the European Union and North America, glass products must comply with regulations regarding their optical properties, impact resistance, and safety features. Adhering to these standards without compromising on cost or design remains a major obstacle for the industry.

- Vehicle Weight Reduction: As the automotive industry moves toward producing lighter, more fuel-efficient vehicles, reducing the weight of components like glass has become a key challenge. The demand for lightweight automotive glass, particularly in electric vehicles, is growing, but it must maintain its structural integrity and safety standards. For example, automotive glass needs to be lightweight yet strong enough to resist impact. Achieving this balance is a complex task for manufacturers, as lighter materials can increase the risk of damage during accidents.

- Supply Chain Disruptions: Automotive glass manufacturers face frequent disruptions in their supply chains, especially related to the sourcing of raw materials such as silica and soda ash. The COVID-19 pandemic highlighted the vulnerability of global supply chains, with shortages of raw materials and delays in production causing significant setbacks. Additionally, geopolitical tensions and trade restrictions can further complicate the procurement process, affecting production timelines and costs. The industry continues to explore strategies to mitigate these risks, but disruptions remain a persistent challenge.

Key Player Analysis

- Dura Automotive Systems: Dura Automotive Systems is a prominent player in the automotive glass sector, specializing in the manufacturing of innovative glass products, including tempered and laminated glass for vehicles. The company has a significant presence in North America and Europe, providing glass components to major OEMs and Tier 1 suppliers. The company is known for its strong focus on enhancing the structural integrity of automotive glass, contributing to safety and performance.

- Saint-Gobain S.A.: Saint-Gobain, a French multinational, is a global leader in the automotive glass market, offering a wide range of products such as windshield glass, windows, and acoustic solutions for vehicles. The company is known for its technological advancements in glass production, particularly in terms of lightweight and energy-efficient materials.

- Fuyao Glass Industry Group Co. Ltd.: Fuyao Glass, headquartered in China, is one of the largest manufacturers of automotive glass globally. The company supplies both original equipment manufacturers (OEMs) and the aftermarket with a broad spectrum of glass products. Fuyao’s focus on innovation has led to advanced glass solutions, such as solar control glass.

- Guardian Industries Corporation: Guardian Industries, a subsidiary of Koch Industries, is a key player in the global automotive glass market, providing both laminated and tempered glass for vehicles. Guardian is known for its cutting-edge glass technologies that offer solutions such as increased durability, sound insulation, and UV protection.

- AGC Ltd.: AGC Ltd. (Asahi Glass Co.), based in Japan, is a leading global manufacturer of automotive glass, producing products such as windshields, side windows, and rear windows for a wide range of automotive applications. AGC has a strong market presence in both OEM and aftermarket sectors. The company focuses heavily on R&D to develop lightweight and energy-efficient glass solutions.

Recent Developments

- In 2023, Autoneum successfully completed the acquisition of Borgers’ automotive division, which became official on April 1, 2023, following approval from antitrust authorities. This acquisition expands Autoneum’s global footprint, increasing its total number of production facilities to 67 and its workforce to around 16,100 employees in 24 countries. This move strengthens the company’s leadership in sustainable acoustic and thermal management for the automotive industry. A capital increase of approximately CHF 100 million was approved by shareholders in March 2023 to support the financing of the acquisition.

- In July 2024, Xinyi Glass Holdings Limited, a prominent manufacturer of automobile and architectural glass, released its interim financial results for the first half of the year. Despite challenges from decreased demand in some sectors, the company demonstrated resilience, posting a slight drop in revenue by 6.4% to HK$11.8 billion. However, it saw a significant increase in both gross profit (up 10.6%) and net profit (up 27.1%), highlighting the effectiveness of its cost management strategies. Gross profit margin also improved to 34.3%, up from 29% in the same period last year.

- In October 2024, NSG Group will present its latest glass innovations at Glasstec, the leading global trade fair for the glass industry, taking place in Düsseldorf from October 22 to October 25, 2024. The group, known for the Pilkington brand, will display new advancements in glass technology at their booth in Hall 10, Stand G20.

- In 2024, Borealis introduced a new glass-fiber reinforced polypropylene (PP) material, Borcycle™ GD3600SY, with 65% post-consumer recycled content. The material is designed for use in high-performance automotive applications and will first be implemented in automotive interiors through a collaboration with Plastivaloire, a thermoplastic injection specialist, and Stellantis, a major global automotive manufacturer.

Conclusion

The automotive glass market is poised for substantial growth over the coming decade, driven by advancements in glass technologies, increasing vehicle production, and a growing demand for safety, comfort, and energy efficiency. As manufacturers focus on integrating innovative features like advanced driver-assistance systems (ADAS), electrochromic glass, and lightweight materials, the industry is witnessing significant transformations.

While challenges such as rising production costs, regulatory compliance, and supply chain disruptions persist, opportunities in emerging markets and the adoption of eco-friendly solutions offer avenues for continued expansion. The market’s trajectory suggests a steady increase in demand for high-quality, technologically advanced automotive glass, aligning with the broader trends in vehicle electrification and enhanced consumer safety expectations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)