Table of Contents

Introduction

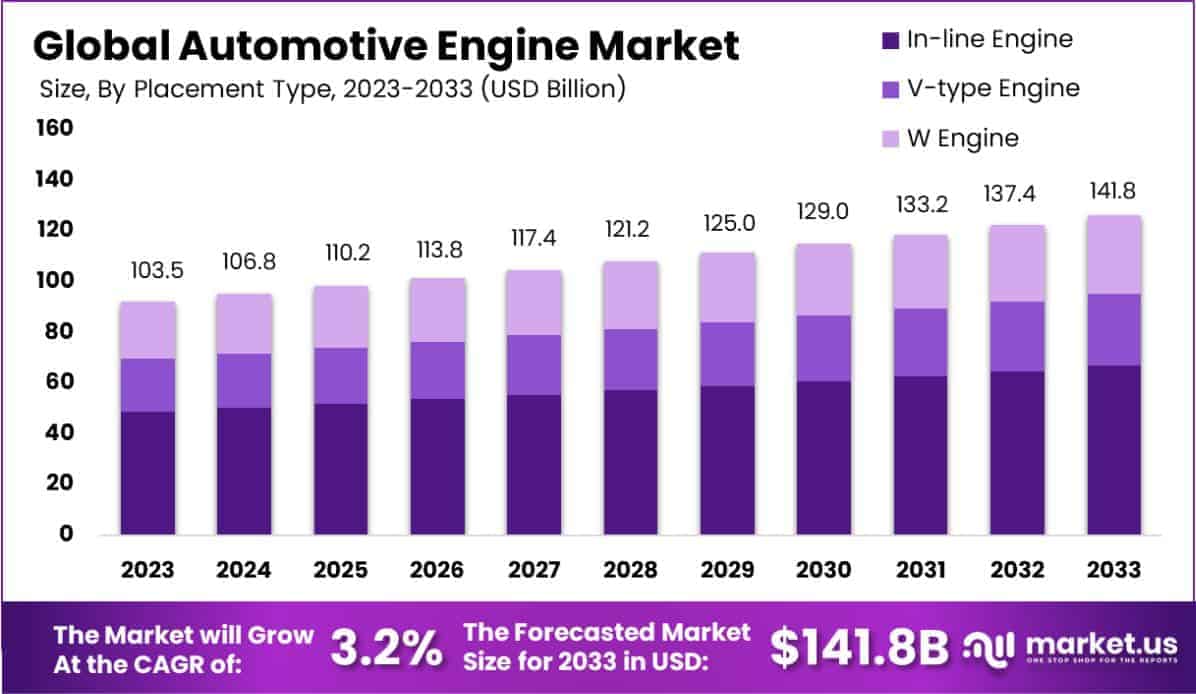

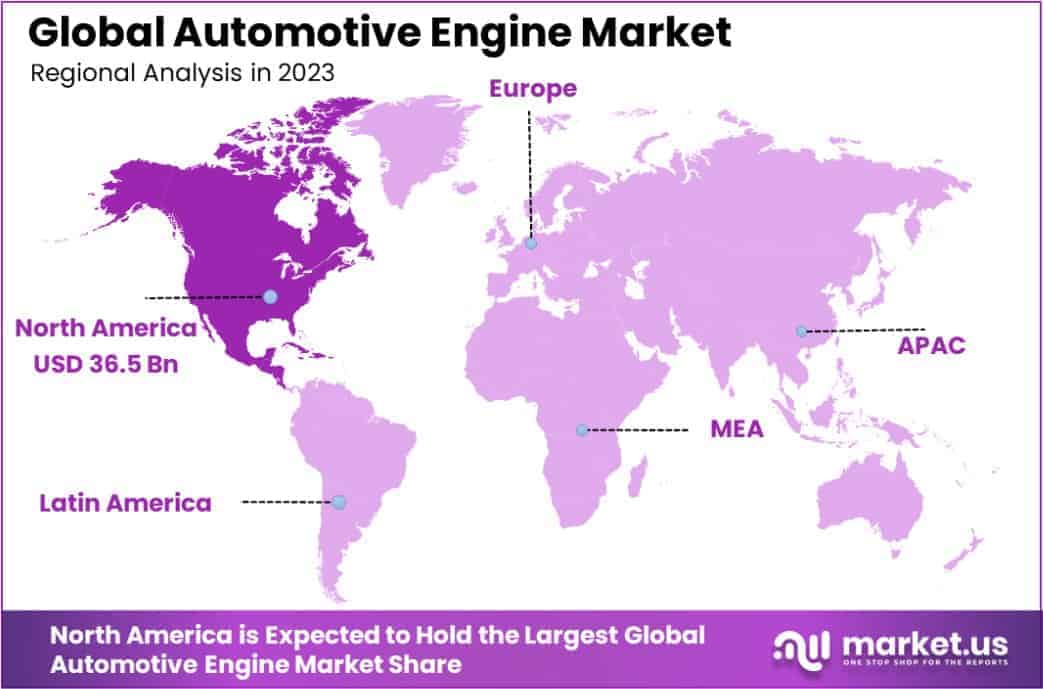

The Global Automotive Engine Market is projected to expand from USD 103.5 billion in 2023 to USD 141.8 billion by 2033, at a compound annual growth rate (CAGR) of 3.2% during the forecast period from 2024 to 2033. In 2023, North America held the largest share of this market, accounting for 35.3% and generating USD 36.5 billion in revenue.

An automotive engine is the power-generating component of a vehicle, converting fuel energy into mechanical motion to drive the vehicle. The automotive engine market encompasses the development, production, and sale of engines across various vehicle types, including internal combustion engines (ICE), hybrid engines, and electric powertrains. Growth in this market is fueled by advancements in engine technologies, rising vehicle production, and stringent government regulations promoting fuel efficiency and reduced emissions.

Increasing consumer demand for high-performance and fuel-efficient vehicles is further driving innovation, particularly in electric and hybrid engine technologies. Emerging markets, such as those in Asia-Pacific and Latin America, present lucrative opportunities due to rising disposable incomes, urbanization, and expanding automotive manufacturing bases. Additionally, the transition towards sustainability and electrification offers opportunities for growth, as automotive manufacturers invest heavily in research and development to meet the evolving regulatory and consumer demands in the global market.

Key Takeaways

- The Global Automotive Engine Market is projected to grow from USD 103.5 billion in 2023 to USD 141.8 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 3.2% during the forecast period from 2024 to 2033.

- In 2023, the In-line Engine was the leading segment in the Placement Type category of the Automotive Engine Market, capturing a 47.2% share.

- Gasoline engines dominated the Fuel Type segment of the Automotive Engine Market in 2023, holding a 38% market share.

- Passenger Vehicles maintained a dominant position in the by-vehicle type segment of the Automotive Engine Market in 2023, with a 65.2% share.

- North America was the leading region in the Automotive Engine Market in 2023, with a 35.3% market share and generating USD 36.5 billion in revenue.

Key Segments Analysis

In 2023, the In-line Engine dominated the Automotive Engine Market with a 47.2% share, owing to its streamlined design, efficiency, and cost-effectiveness. Its versatility across various vehicle segments, from economy to premium models, makes it a favored choice among manufacturers. The V-type Engine followed with a significant market share, appreciated for its compact design and power output, making it ideal for performance-focused vehicles. Meanwhile, the W Engine carved out a niche in luxury and high-end sports cars due to its high-performance capabilities. The In-line Engine’s dominance is expected to continue, driven by its simpler construction, lower manufacturing costs, and adaptability. In contrast, V-type and W Engines will remain in demand for specific performance and luxury applications.

Gasoline engines led the market in the By Fuel Type segment, capturing a 38% share in 2023. Their dominance is rooted in the widespread availability of gasoline and an established global infrastructure, ensuring their continued preference. Diesel engines also held a significant share, particularly in commercial vehicles, where efficiency and durability are key factors. Other Fuel Types, including hybrid and electric engines, are gaining market traction as the industry pivots towards sustainability and alternative fuel technologies. While gasoline engines currently dominate due to their lower initial costs and widespread acceptance, stricter environmental regulations and advancements in electric and hybrid technologies are expected to drive a gradual market shift toward greener alternatives.

Passenger Vehicles commanded a 65.2% market share in 2023, driven by the global demand for personal transportation and a wide range of offerings from entry-level to premium models. Light Commercial Vehicles (LCVs) also held a notable share, reflecting their growing popularity for urban logistics and small business applications due to their versatility and economic efficiency. Heavy Commercial Vehicles (HCVs), although smaller in market share, are indispensable in sectors such as construction, mining, and large-scale logistics, where robust and high-performing engines are critical. Passenger vehicles are expected to maintain their dominance, supported by innovations in fuel efficiency and emission reduction. Simultaneously, the growing needs of urbanization and infrastructure development will continue to drive demand for both LCVs and HCVs.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 103.5 Billion |

| Forecast Revenue (2033) | USD 141.8 Billion |

| CAGR (2024-2033) | 3.2% |

| Segments Covered | By Placement Type(In-line Engine, V-type Engine, W Engine), By Fuel Type(Gasoline, Diesel, Other Fuel Types), By Vehicle Type(Passenger Vehicles, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)) |

| Competitive Landscape | AB Volvo, Cummins Inc., Fiat Automobiles S.p.A, Volkswagen AG, Ford Motor Co., Mitsubishi Heavy Industries, Ltd., General Motors, Honda Motor Co., Ltd., Mercedes-Benz, Renault Group, Toyota Motor Corporation, Honda Motor Co., Ltd, Hyundai Motor Company, Scania AB, Toyota Motor Corp., Other Key Players |

Emerging Trends

- Electrification of Engines: There’s a significant shift towards electric and hybrid engines in response to global demands for reducing carbon emissions. This transition is driven by advancements in battery technology and governmental environmental policies.

- Engine Downsizing: Automakers are focusing on developing smaller, more efficient engines without compromising on performance. Technologies such as turbocharging and advanced fuel injection systems are pivotal in achieving these goals.

- Use of AI and Machine Learning: Integration of artificial intelligence in automotive engines is enhancing diagnostics, performance, and fuel efficiency. This tech trend is redefining how engine management systems operate, leading to smarter and more responsive vehicles.

- Lightweight Materials: The use of high-strength but lightweight materials in engine manufacture is improving overall vehicle fuel efficiency and reducing emissions, aligning with stricter environmental standards.

- Software-Defined Vehicles: The automotive industry is increasingly adopting a software-centric approach, where the value of a vehicle is defined more by its software capabilities than its mechanical components. This trend is accelerating with the advent of over-the-air updates and connected vehicle technologies

Top Use Cases

- Hybrid Technologies: Modern engines are increasingly hybridized, combining traditional combustion mechanisms with electric power to enhance fuel efficiency and reduce emissions.

- Advanced Driver-Assistance Systems (ADAS): Engines are now integral to systems that enhance vehicle safety and driving dynamics, supporting features like automatic braking, lane keeping, and adaptive cruise control.

- Performance Optimization: With the integration of advanced electronics and software, engines can dynamically adjust settings for optimal performance based on real-time data and driving conditions.

- Energy Recovery Systems: Modern automotive engines incorporate systems like regenerative braking which helps in conserving energy and improving overall efficiency.

- Connected Features: Engines are equipped to interface with various sensors and systems that facilitate connected features in vehicles, enhancing both operational efficiency and user experience.

Major Challenges

- Emission Regulations: Strict global emission standards are compelling manufacturers to invest heavily in R&D to develop engines that comply with these regulations, increasing production costs.

- Shift to Electric Vehicles (EVs): The growing popularity of EVs poses a significant challenge to the demand for traditional internal combustion engines, impacting manufacturers who are yet to transition fully.

- Raw Material Price Volatility: Fluctuations in the prices of essential raw materials impact the stability of supply chains and increase production costs, affecting profitability and pricing strategies.

- Technological Adaptation: Rapid technological changes require constant updates and adaptations in engine design and functionality, posing a challenge in terms of speed and cost of innovation.

- Supply Chain Disruptions: Global disruptions in supply chains, whether due to pandemics or political instability, pose significant risks to engine production timelines and cost efficiency

Top Opportunities

- Hybrid and Alternative Fuel Vehicles: As environmental regulations tighten, there is significant growth potential in hybrid and alternative fuel technologies, which require sophisticated engine designs.

- Emerging Markets: Increasing vehicle sales in emerging markets present a lucrative opportunity for engine manufacturers to expand their presence and increase market share.

- Fuel Efficiency Innovations: Developing engines that provide better fuel economy without sacrificing performance is a key area of opportunity, driven by consumer and regulatory demands.

- Technological Advancements: Innovations in engine technology, such as improved turbochargers and fuel injection systems, offer substantial growth prospects by enhancing engine efficiency and performance.

- Regenerative Technologies: Investing in technologies that allow for energy recovery and increased operational efficiency of vehicles is another area ripe for growth

Key Player Analysis

- AB Volvo: Known for its commitment to sustainability, AB Volvo is focusing on electric and hybrid engines, aligning with global efforts to reduce carbon emissions. Their strategic initiatives are particularly tailored to meet stringent emissions regulations, positioning them strongly in markets that are environmentally conscious.

- Cummins Inc.: Cummins is renowned for its diesel and natural gas engines and is making strides in the electrified power systems to cater to the growing demand for environmentally friendly solutions. In 2023, they continue to lead with innovations that enhance fuel efficiency and reduce emissions, thus bolstering their presence in the industrial and commercial transportation sectors.

- Fiat Automobiles S.p.A: As part of the larger Stellantis group, Fiat is enhancing its engine efficiency by incorporating hybrid technologies into its models. This strategy helps them stay competitive in regions with evolving consumer preferences and stringent regulatory landscapes.

- Volkswagen AG: Volkswagen is actively pursuing advancements in engine technology with a strong emphasis on reducing emissions. Their engines are designed to be powerful yet fuel-efficient, meeting the high standards required in various global markets.

- Ford Motor Company: Ford is focusing on turbocharging and direct fuel injection technologies to improve engine efficiency and performance. These technologies are part of Ford’s broader strategy to meet the global demand for high-performance yet environmentally friendly vehicles.

Regional Analysis

North America Leads Automotive Engine Market with Largest Market Share of 35.3% in 2023

North America emerged as the dominant region in the global automotive engine market in 2023, capturing a substantial market share of 35.3% and generating a valuation of USD 36.5 billion. The region’s leadership is driven by its robust automotive industry, advanced manufacturing capabilities, and significant investments in research and development for fuel-efficient and environmentally friendly engine technologies.

The United States, as the region’s key contributor, accounts for a significant portion of automotive engine production and consumption, supported by the presence of major global automotive manufacturers and an increasing demand for electric and hybrid vehicles. Furthermore, the adoption of stringent emission regulations in countries like the U.S. and Canada has spurred innovation in engine design and development. These factors collectively reinforce North America’s position as the leading region in the automotive engine market, setting a benchmark for technological advancements and market growth.

Recent Developments

- In 2024, JSW Group partnered with the Odisha government to invest ₹40,000 crore in electric vehicle and battery production, including a 50 GWh battery plant, lithium refinery, and component manufacturing units in Cuttack and Paradeep.

- In 2024, Nissan, Honda, and Mitsubishi Motors signed an MOU to explore Mitsubishi’s participation in a joint holding company aimed at business integration and synergy sharing.

- In 2024, Aramco, through its subsidiary, acquired a 10% stake in Horse Powertrain Limited to advance hybrid and internal combustion powertrain technologies and support emission-reduction efforts in mobility.

- In 2025, Xpeng and Volkswagen expanded their collaboration to build an extensive EV charging network in China, enabling access to 20,000 ultra-fast charging points across 420 cities and driving EV adoption.

- In 2024, Stellantis and Leapmotor formed a joint venture to launch affordable EVs in global markets, starting in Europe by Q4 2024, leveraging Stellantis’ investment of €1.5 billion and Leapmotor’s expertise.

Conclusion

The automotive engine market is undergoing significant transformation, driven by technological advancements and shifting consumer preferences. The increasing adoption of electric and hybrid vehicles is reshaping the landscape, prompting manufacturers to innovate and adapt. Despite challenges such as stringent emission regulations and the volatility of raw material prices, the market is poised for steady growth in the coming years. To remain competitive, industry players must focus on developing efficient, sustainable, and cost-effective engine solutions that meet evolving environmental standards and consumer demands.