Table of Contents

Introduction

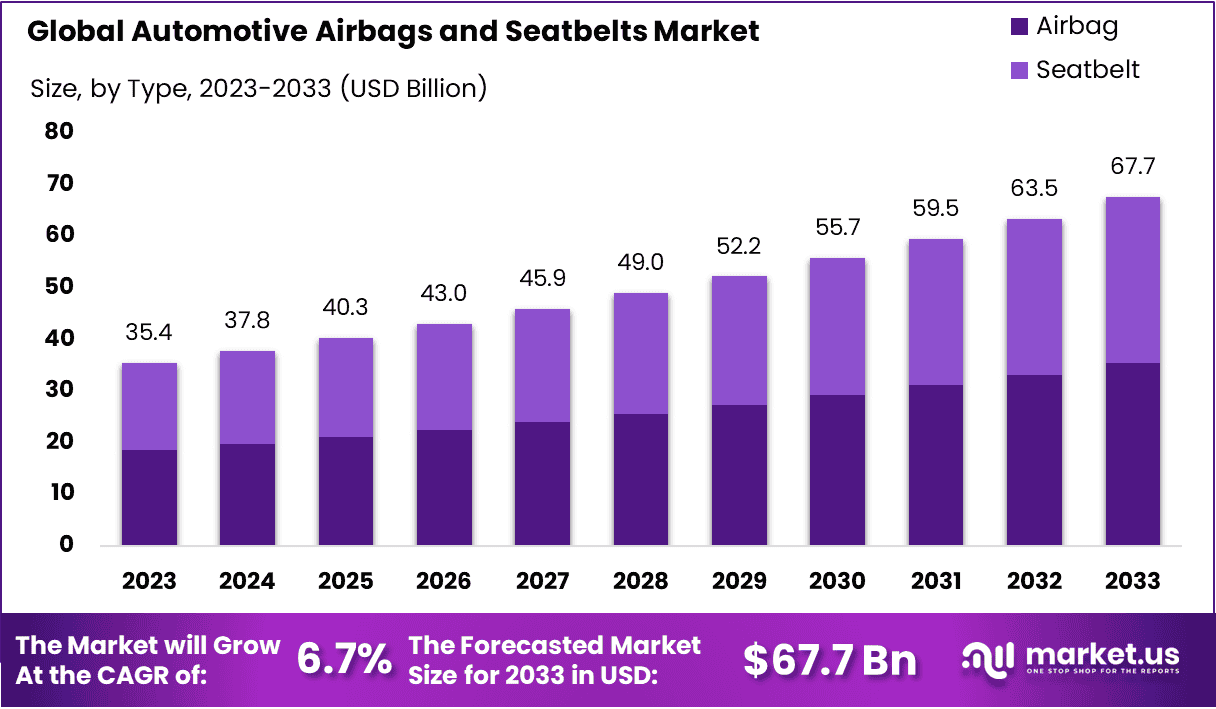

The Global Automotive Airbags and Seatbelts Market is projected to reach a value of approximately USD 67.7 billion by 2033, up from USD 35.4 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 6.7% over the forecast period 2024 to 2033.

Automotive airbags and seatbelts are essential safety components in modern vehicles, designed to protect occupants during collisions by mitigating the impact of crashes. Airbags are inflatable cushions that deploy in milliseconds upon detecting a collision, providing a protective barrier to reduce head, neck, and chest injuries.

Seatbelts, on the other hand, are restraint systems that secure passengers in their seats to prevent ejection or excessive movement during a crash, reducing the risk of serious injuries. Together, these components form a critical part of vehicle safety systems, ensuring compliance with global safety regulations and improving overall occupant protection.

The automotive airbags and seatbelts market refers to the global industry that encompasses the production, distribution, and sales of these safety devices for passenger cars, commercial vehicles, and specialized vehicles. The market is characterized by significant technological advancements, stringent regulatory frameworks, and rising consumer awareness about vehicle safety.

It includes various product types, such as front, side, curtain, and knee airbags, as well as 2-point and 3-point seatbelts. The market is also driven by collaborations between automakers and suppliers to integrate advanced safety solutions, which enhance both vehicle safety ratings and consumer confidence.

Several factors contribute to the robust growth of the automotive airbags and seatbelts market. Key among them is the implementation of stringent safety regulations by governments and automotive safety organizations worldwide, mandating the inclusion of airbags and seatbelts in all vehicles. Growing consumer awareness about road safety and increasing disposable incomes in emerging economies are further propelling market demand.

Additionally, the rise in automotive production, especially in developing regions, and the growing popularity of advanced driver-assistance systems (ADAS) are boosting the adoption of high-performance airbags and seatbelts. Innovations such as smart airbags with adaptive deployment systems and seatbelt pretensioners are also driving market expansion.

Demand for automotive airbags and seatbelts is witnessing sustained growth globally, driven by heightened consumer emphasis on safety and the rising prevalence of road accidents. Developed markets, such as North America and Europe, continue to demonstrate strong demand due to well-established safety standards and high consumer expectations.

Meanwhile, emerging markets in Asia-Pacific and Latin America are experiencing surging demand, fueled by the rapid growth of the automotive sector, increasing vehicle ownership, and evolving safety regulations. The demand is further supported by the electrification of vehicles, as electric vehicles (EVs) require advanced safety solutions tailored to their unique designs.

The automotive airbags and seatbelts market presents significant opportunities for innovation and expansion. The increasing adoption of electric and autonomous vehicles creates a lucrative avenue for the development of next-generation safety systems tailored to these platforms. Additionally, the integration of artificial intelligence and sensor technologies in airbags and seatbelts offers scope for enhanced occupant protection through real-time data processing and adaptive safety mechanisms.

Emerging markets with evolving safety standards provide untapped growth potential for manufacturers, particularly as governments in these regions continue to prioritize road safety initiatives. Furthermore, advancements in lightweight materials and sustainable manufacturing practices align with the growing emphasis on reducing vehicle emissions, opening new pathways for product differentiation and competitive advantage.

Key Takeaways

- The global automotive airbags and seatbelts market is projected to grow from USD 35.4 billion in 2023 to USD 67.7 billion by 2033, with a steady CAGR of 6.7% from 2024 to 2033.

- Airbags lead the market, holding a 52.3% share due to their vital role in protecting passengers during collisions.

- Passenger vehicles account for the largest share (67.5%), driven by stricter safety regulations and growing consumer focus on safety.

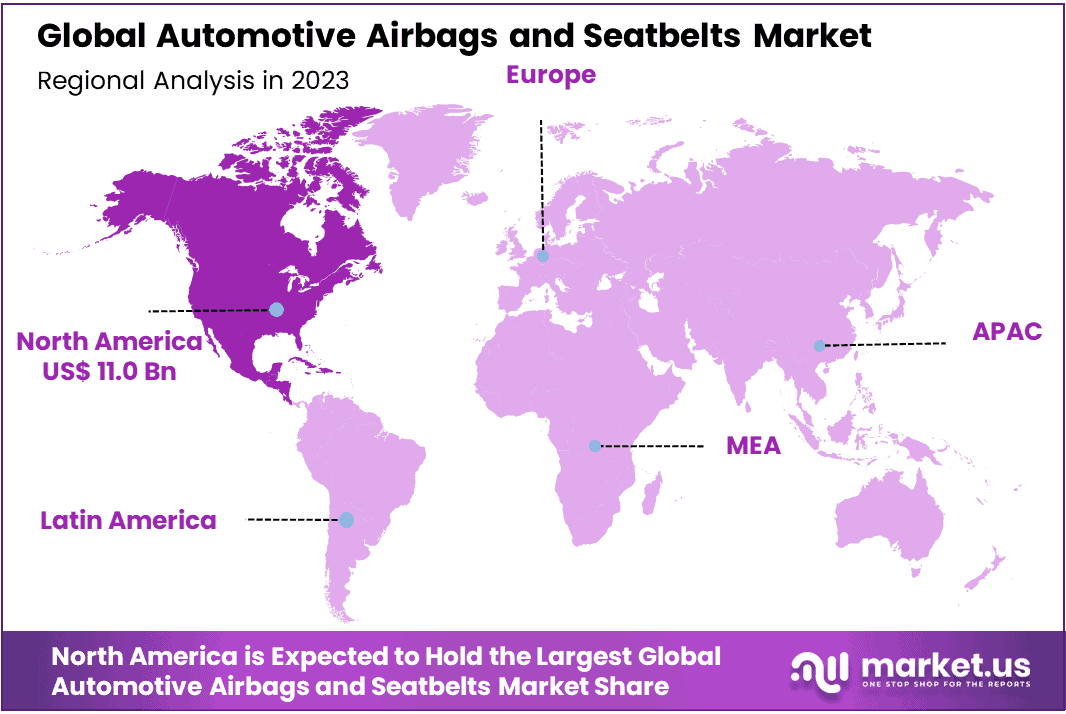

- North America The largest regional market, with a 31.2% share, supported by strict safety laws and advanced vehicle safety standards.

- Europe A significant player with 28.7% of the market, driven by similar strict safety regulations and strong safety requirements.

Automotive Airbags and Seatbelts Statistics

- Airbags reduce fatalities of front-seat passengers older than 13 by 32%.

- Side airbags lower an SUV driver’s risk of death by 52%.

- Airbags and seatbelts combined reduce the risk of death in frontal crashes by 61%.

- Equipping all cars in Argentina, Chile, Mexico, and Brazil with airbags could save 40,000 lives over 14 years.

- Airbags can deploy at speeds as low as 8 miles per hour.

- Wearing a seatbelt as a front-seat passenger decreases the risk of moderate to fatal injuries by 50%.

- Front-seat passengers wearing seatbelts lower their risk of death by 45%.

- Seatbelt use in light trucks reduces the risk of critical injuries by 60%.

- Wearing seat belts saves approximately 15,000 lives annually.

- About 47% of people who die in car crashes were not wearing seatbelts.

- 91% of respondents reported always wearing their seatbelts while driving.

- 9.2% of respondents admit not wearing seatbelts on short trips.

- 20.2% of people incorrectly believe seatbelts are not mandatory in all states.

- Only 6.7% of people think wearing a seatbelt behind their back is safe.

- Buckling up reduces nearly 50% of all automobile-related deaths.

- Over 75% of individuals ejected during fatal crashes die from critical injuries.

- Only 1% of seatbelted passengers are ejected during crashes.

- Among children aged 0 to 4 who die in crashes, 22% were unrestrained.

- Among adults aged 75 and older who die in crashes, 24% were unrestrained.

- 60% of crash deaths in the 25-to-34 age group involve unrestrained passengers.

- Seatbelts reduce moderate to critical injuries by 50% for front-seat passengers.

- 6.1% of 19-to-21-year-olds have the highest rates of seatbelt non-use.

- 6.7% of 22-to-29-year-olds also exhibit high rates of seatbelt non-use.

- 6.9% of people in poor or near-poor areas are less likely to wear seatbelts compared to 5% in middle- or high-income areas.

- Vehicles are 56% safer today, partly due to airbags.

- All modern safety features combined reduce fatalities by 56%.

- Airbags reduce fatalities by 14% when seatbelts are not used.

- Airbags reduce fatalities by an additional 11% when used with seatbelts.

- Side airbags lower a driver’s risk of death in side crashes by 37%.

- Airbags usually inflate within 10 to 20 milliseconds.

- Lap-and-shoulder seatbelt use with airbags reduces death risk in frontal crashes by 61%.

- Airbags save over 2,500 lives annually in the United States.

- Front airbags reduce driver fatalities by 29%.

- Front airbags reduce front-seat passenger fatalities by 32%.

- Side airbags reduce driver deaths by 37% in side crashes.

- Side airbags reduce SUV driver deaths by 52% in side crashes.

- About 98.4% of passenger and commercial vehicles in the U.S. are equipped with airbags.

- Most vehicles without airbags are pre-2000 models.

- Wearing seatbelts alone offers a 50% survival rate in crashes.

- Airbags alone reduce the risk of death by 34%.

Emerging Trends

- Rising Adoption of Advanced Airbag Systems: Automotive manufacturers are integrating advanced airbag systems, such as dual-stage and side curtain airbags, to enhance passenger protection. For instance, side airbags have become standard in over 85% of new vehicles in North America, driven by stricter safety regulations.

- Integration of Smart Safety Technologies: Seatbelts and airbags are being equipped with sensors and electronic controls, enabling smart systems that adjust based on crash severity or passenger weight. For example, pre-tensioner seatbelts that tighten during potential collisions are becoming more common in mid-range vehicles.

- Increased Emphasis on Rear Passenger Safety: Global safety agencies are encouraging the installation of rear-seat airbags and seatbelt reminders. In Europe, the inclusion of rear-seatbelt reminders in vehicles is mandated under Euro NCAP safety requirements, significantly boosting their adoption.

- Focus on Lightweight and Eco-Friendly Materials: Manufacturers are shifting to lightweight materials like nylon and advanced composites for airbags and seatbelts to improve fuel efficiency while maintaining strength. Eco-friendly materials, such as bio-based fabrics, are also gaining traction in line with sustainability goals.

- Growing Popularity of Electric Vehicles (EVs) with Enhanced Safety: The growing demand for EVs has pushed manufacturers to incorporate innovative safety systems, including advanced airbags and multi-point seatbelts. For instance, Tesla and other leading EV brands now feature seatbelt-integrated airbags as part of their safety innovations.

Top Use Cases

- Passenger Protection in High-Speed Collisions: Airbags and seatbelts are critical for reducing fatalities in high-speed crashes. Research shows that airbags reduce driver fatalities by approximately 29%, while wearing seatbelts decreases the risk of death by 45% in front-seat passengers.

- Enhanced Safety for Child Passengers: Seatbelt systems are increasingly paired with child safety seats and airbags designed specifically for children. Innovations like airbag-integrated booster seats protect young passengers in crashes, minimizing head and chest injuries by up to 50%.

- Mitigation of Side-Impact Crash Injuries: Side airbags have proven effective in preventing severe injuries during side-impact collisions. Data indicates that these airbags reduce fatality risks by 37% for car drivers and 52% for SUV occupants during such events.

- Protection During Rollover Accidents: Rollover airbags and seatbelt retractors are specifically designed for vehicles prone to rollovers, such as SUVs and trucks. Studies reveal that seatbelt usage combined with rollover airbags can reduce the risk of ejection during rollovers by up to 80%.

- Safety Enhancements in Autonomous Vehicles: With the rise of self-driving cars, airbags and seatbelts are being adapted for unconventional seating arrangements. For instance, front-facing airbags now protect passengers in reclining seats, ensuring safety in autonomous vehicle designs.

Major Challenges

- High Development and Manufacturing Costs: Developing advanced airbags and seatbelts involves significant R&D expenses, which increase the overall vehicle cost. Manufacturers face challenges balancing affordability while incorporating features like multi-stage airbags and pre-tensioner seatbelts.

- Risk of Airbag Deployment Failures: Despite advancements, incidents of faulty airbag deployments still occur, posing a serious safety threat. For instance, defective airbag inflators caused over 67 million vehicle recalls in the United States in recent years, affecting consumer trust.

- Limited Adoption in Developing Regions: In low-income regions, limited awareness and affordability issues hinder the adoption of modern safety features. For example, only about 20% of vehicles in parts of Africa and South Asia come equipped with advanced airbags or seatbelt reminders.

- Compatibility with Electric Vehicle (EV) Designs: The unique structure of EVs, such as flat floors and unconventional seating layouts, challenges the integration of traditional airbag and seatbelt systems. Designing safety solutions tailored to EV platforms requires additional time and investment.

- Counterfeit and Substandard Products in the Market: The proliferation of counterfeit airbags and seatbelts, particularly in the aftermarket segment, jeopardizes vehicle safety. These substandard products, often sold at lower prices, fail to meet crash safety standards, posing risks to passengers.

Top Opportunities

- Expansion of Safety Regulations Globally: Stricter safety regulations in countries like India, China, and Brazil present opportunities for automakers to expand their portfolios of airbags and seatbelts. For example, India now mandates airbags for the driver and front passenger in all new vehicles.

- Adoption of AI and IoT-Enabled Safety Systems: Integration of artificial intelligence (AI) and Internet of Things (IoT) is driving the development of predictive safety systems. Smart airbags and seatbelts equipped with AI can monitor driver behavior and environmental conditions, significantly enhancing crash prevention.

- Growing Demand for Affordable Safety Features in Emerging Markets: Increasing consumer awareness about vehicle safety in emerging economies presents opportunities for affordable yet effective airbag and seatbelt solutions. Offering cost-effective safety systems could cater to millions of vehicles in these regions.

- Focus on Luxury Vehicle Customization: Luxury car buyers increasingly demand customized airbag and seatbelt solutions. For instance, premium automakers are exploring innovations like adjustable side airbags and seatbelt-integrated airbags to cater to affluent customers seeking personalized safety features.

- Collaboration with Ride-Sharing and Mobility Providers: Partnerships with ride-sharing companies and mobility-as-a-service providers offer opportunities to integrate advanced safety features. Ensuring rear-seat airbags and advanced seatbelt systems in ride-hailing fleets can significantly improve passenger safety.

North America Automotive Airbags and Seatbelts Market

North America Leads Automotive Airbags and Seatbelts Market with Largest Market Share of 31.2%

North America emerged as the leading region in the automotive airbags and seatbelts market in 2023, accounting for the largest market share of 31.2% and generating revenue of approximately USD 11.0 billion. The region’s dominance is driven by stringent government regulations mandating advanced safety systems in vehicles, coupled with the high adoption of premium and electric vehicles that prioritize occupant safety.

Additionally, rising consumer awareness about automotive safety and advancements in airbag and seatbelt technologies have further bolstered market growth in North America. Key automotive markets, including the United States and Canada, are contributing significantly due to their robust vehicle production rates and increasing investments in automotive R&D. This regional stronghold highlights North America’s pivotal role in shaping the global automotive safety landscape.

Key Player Analysis

- Continental AG: Continental AG, a leading German automotive supplier, plays a significant role in the airbags and seatbelts market with its advanced safety technologies. In 2022, the company reported total revenue of €39.4 billion, with a notable portion allocated to its Automotive Technologies segment, which includes passive safety systems. Continental’s focus on integrating sensors with airbags and seatbelt systems enhances vehicle safety and supports the rise of autonomous driving.

- Aptiv Plc: Aptiv Plc, headquartered in Dublin, Ireland, is a pioneer in vehicle safety systems. In 2022, Aptiv’s revenue reached $17.5 billion, with significant investments in passive safety technologies such as airbags and seatbelt systems. The company emphasizes the development of lightweight and energy-efficient systems, contributing to vehicle electrification and sustainability trends.

- Toyoda Gosei: Toyoda Gosei, a Japanese manufacturer, is renowned for its innovative airbags and seatbelt products. The company recorded ¥931 billion (approximately $6.4 billion) in revenue for fiscal 2022, with airbags and seatbelt systems being key contributors. Toyoda Gosei focuses on ultra-compact airbags and energy-absorbing seatbelts, catering to compact and electric vehicle markets.

- Denso Corporation: Denso Corporation, another Japanese leader, integrates safety systems into its comprehensive automotive solutions portfolio. In fiscal 2022, Denso reported revenues of ¥5.6 trillion (approximately $38.5 billion). The company’s focus on active and passive safety systems, including advanced airbags and electronic seatbelt pretensioners, aligns with growing demand for connected vehicles and ADAS technologies.

- ZF Friedrichshafen AG: ZF Friedrichshafen AG, a German multinational, is a prominent player in vehicle safety. The company generated €43.8 billion in revenue in 2022, with a substantial share coming from its Passive Safety Systems division. ZF’s advancements in integrated safety systems, including seatbelt interlocks and smart airbags, aim to reduce injury risks in collision scenarios, particularly in electric and autonomous vehicles.

Recent Developments

- In 2024, Aptiv (NYSE: APTV) showcased its edge-to-cloud technology solutions at the Internationale Zuliefererbörse (IZB) in Wolfsburg, Germany, highlighting advancements aimed at making mobility safer, greener, and more connected.

- In 2024, Bosch expanded its offerings in mobility technology, presenting software and services designed to make transportation safer and more convenient. At Bosch Tech Day 2024, the company shared insights into its innovative solutions shaping the future of mobility.

- In 2024, Hyundai Mobis revealed the world’s first airbags specifically designed for Purpose-Built Vehicles (PBVs), addressing the unique needs of boxy vehicles built to maximize interior space. These innovations aim to create safer and more adaptable interiors for future mobility.

- In 2024, General Motors (NYSE: GM) announced plans to prioritize autonomous driving technology for personal vehicles, building on the success of its Super Cruise system. With over 10 million miles logged monthly, GM aims to accelerate progress toward fully autonomous driving solutions.

Conclusion

The global automotive airbags and seatbelts market is poised for significant growth, driven by increasing safety awareness, stricter regulatory mandates, and advancements in vehicle safety technologies. The integration of innovative features, such as smart airbags and pre-tensioner seatbelts, highlights the industry’s commitment to enhancing passenger protection across diverse vehicle categories. As automotive production expands, particularly in emerging markets, the demand for high-performance safety systems is expected to accelerate.

Additionally, the shift towards electric and autonomous vehicles is opening new avenues for tailored safety solutions, reinforcing the critical role of airbags and seatbelts in the evolving automotive landscape. With a focus on sustainability, lightweight materials, and advanced connectivity, this market is well-positioned to address future mobility needs while improving overall road safety standards.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)