Table of Contents

Overview

The Global Automated Test Equipment (ATE) Market is projected to reach approximately USD 12.5 billion by 2033, up from USD 7.8 billion in 2023, with a compound annual growth rate (CAGR) of 4.8% during the forecast period from 2024 to 2033.

Automated Test Equipment (ATE) refers to systems used to automatically perform tests on products, primarily in the electronics and semiconductor industries, to ensure quality, functionality, and compliance with standards. ATE can perform a variety of tests, including electrical, functional, and environmental tests, without the need for manual intervention. The ATE market has seen significant growth driven by the increasing complexity of electronic devices, rising demand for faster testing, and the need for more accurate diagnostics.

The growth of the consumer electronics, automotive, and telecommunications sectors is further propelling demand for efficient and high-precision testing solutions. Additionally, the adoption of advanced technologies such as IoT, 5G, and AI is creating new opportunities for ATE to support the next generation of devices and systems. Market expansion is expected to continue as industries seek to reduce testing costs, improve product quality, and enhance production throughput, positioning the ATE market as a key enabler of technological advancement.

Core Findings

- The Automated Test Equipment (ATE) market was valued at USD 7.8 billion in 2023 and is expected to reach USD 12.5 billion by 2033, growing at a CAGR of 4.8%.

- Non-Memory ATE led the product segment in 2023 with a share of 64.2%, driven by its critical role in testing complex integrated circuits.

- Handlers dominated the component segment, accounting for 34.2% in 2023, due to their essential role in ensuring accurate device testing in production environments.

- The IT and Telecommunications sector was the largest end-use industry in 2023, holding 49.4% of the market share, propelled by the rising demand for high-speed communication devices.

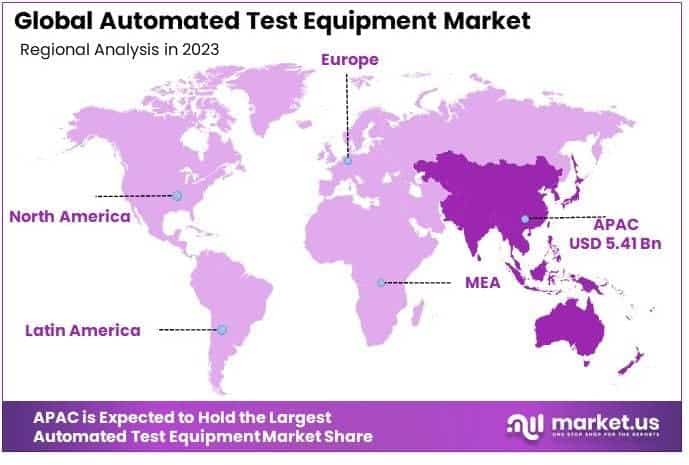

- Asia-Pacific (APAC) led the market in 2023 with a 69.4% share, valued at USD 5.41 billion, primarily due to the presence of major semiconductor manufacturers in the region.

Environment Analysis of Automated Test Equipment

The Automated Test Equipment (ATE) market continues to grow despite moderate saturation, with significant potential for expansion. Global robot density reached 162 units per 10,000 employees in 2023, indicating ongoing adoption.

Product differentiation is key, as companies like KingSpec Electronics innovate with systems like the ZS101, capable of testing up to 600 SSDs simultaneously, improving efficiency and quality. AI integration is also enhancing value chain efficiency, with companies such as Teradyne reducing test system development times significantly through AI tools.

Investment opportunities are strong, especially in regions prioritizing digital growth, such as the GCC, where investments are expected to rise from $38.4 billion in 2022 to $298.2 billion by 2032.

Strategic acquisitions, like Averna’s acquisition of Global Equipment Services from Kimball Electronics in April 2024, are reshaping export-import dynamics and strengthening global presence. Additionally, industries such as automotive are increasingly relying on ATE, with Qualcomm’s collaboration with BMW and Mercedes set to generate $4 billion in automotive revenue by 2026.

Key Segments Analysis

Non-memory ATE holds a dominant 64.2% market share due to its essential role in testing complex digital circuits, such as microprocessors and digital signal processors, crucial for consumer electronics, automotive, and telecommunications. Memory ATE focuses on testing memory chips like DRAM and flash memory, serving a more specialized market compared to non-memory ATE. Discrete ATE tests individual semiconductor devices like transistors and diodes, supporting a broader range of electronics but holding a smaller share in the market. The growth of non-memory ATE is driven by advancements in semiconductor technology and the increasing complexity of digital circuits, ensuring sustained demand.

Handlers dominate the ATE component market with a 34.2% share due to their critical role in automating the testing process, improving throughput and reducing manual labor costs. Other components such as industrial PCs, mass interconnect systems, and probers also contribute to the functionality and efficiency of ATE systems. The growth of the handlers segment is driven by the increasing demand for high-volume, high-speed testing in consumer electronics and automotive sectors.

The IT and telecommunications sector leads the ATE market with a 49.4% share, driven by the rapid deployment of 5G technologies, requiring extensive component and system testing. Other sectors like consumer electronics, automotive, aerospace and defense, and healthcare also drive ATE demand, focusing on the reliability of electronic components. The IT and telecommunications sector is expected to continue expanding, fueling further innovation and growth in the ATE market across multiple industries.

Emerging Trends

- Integration of Artificial Intelligence (AI) and Machine Learning (ML): The incorporation of AI and ML technologies into Automated Test Equipment is becoming more prevalent. These technologies enable smarter testing by identifying patterns and predicting test results, thereby improving the efficiency of testing processes. This trend is driven by the need for increased accuracy and faster turnaround times in testing complex systems like semiconductor chips and automotive electronics.

- Miniaturization of Test Equipment: As electronics continue to shrink in size, Automated Test Equipment is evolving to match these smaller form factors. This miniaturization is essential for testing increasingly compact devices such as mobile phones, wearables, and medical devices. The need for portable, compact ATE systems that can provide high accuracy testing on smaller components is propelling innovation in this area.

- Expansion in Semiconductor Testing: With the rapid advancement of semiconductor technologies, the demand for automated testing solutions for integrated circuits (ICs) and microchips is surging. These technologies are vital to ensure that new semiconductors perform correctly and are free from defects. Automated Test Equipment is increasingly being tailored for the high-frequency, high-precision testing required in this industry.

- Cloud-Based Testing Solutions: The shift toward cloud computing has led to the development of cloud-based ATE systems. These systems allow for remote testing and data analysis, which improves accessibility and reduces the need for on-site testing infrastructure. This trend is helping businesses lower their operational costs and scale testing processes more effectively.

- Increase in Demand for Autonomous Vehicle Testing: As autonomous vehicles evolve, there is a growing need for automated test systems capable of verifying the reliability and performance of complex sensors, control systems, and software algorithms used in self-driving cars. Automated Test Equipment is becoming essential to ensure safety standards and optimize performance in these highly sophisticated technologies.

Top Use Cases

- Semiconductor Manufacturing: Automated Test Equipment plays a critical role in semiconductor manufacturing by testing ICs during and after production. The equipment ensures that semiconductors meet quality standards, with ATE systems often testing hundreds of thousands of units per day. The high volume of testing required for advanced microchips makes ATE essential in semiconductor production.

- Automotive Electronics Testing: With the rise of electric and autonomous vehicles, the complexity of automotive electronics is increasing. ATE systems are used to test various automotive components, including sensors, ECU (Electronic Control Units), and ADAS (Advanced Driver Assistance Systems). These systems ensure reliability, safety, and functionality in automotive electronic parts.

- Consumer Electronics Product Development: Automated Test Equipment is widely used in the consumer electronics sector, especially for testing mobile phones, tablets, and other devices during the production process. The equipment ensures that each unit adheres to quality control standards, reduces defects, and increases manufacturing efficiency by performing numerous tests quickly and accurately.

- Telecommunications Equipment Testing: ATE systems are extensively used to test the performance and functionality of telecommunications devices like routers, base stations, and modems. Given the complexity of modern telecommunication systems, ATE is essential for ensuring these devices meet stringent standards for speed, connectivity, and reliability before they reach the market.

- Medical Device Testing: The demand for Automated Test Equipment is growing in the medical device sector, particularly for devices like pacemakers, diagnostic tools, and surgical robots. These systems are essential for validating the performance of sensitive medical equipment, ensuring compliance with health standards, and reducing the risk of failure in critical applications.

Major Challenges

- High Initial Investment Costs: The high capital expenditure required for Automated Test Equipment can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). The cost of purchasing, maintaining, and upgrading these systems can limit access to the most advanced technologies, hindering widespread adoption.

- Complexity of Test Setups: As technology becomes more sophisticated, the complexity of setting up ATE systems to accurately test newer components increases. The customization required for specific testing tasks can make setup times longer and introduce errors if not handled correctly, impacting efficiency.

- Integration with Existing Systems: One of the key challenges for industries adopting ATE is ensuring compatibility and integration with existing testing systems and production lines. Legacy systems and outdated technologies can create hurdles, requiring additional resources and time to upgrade or replace older infrastructure to ensure smooth operation.

- Testing at Increased Speeds and Volumes: As demand for faster production and more advanced products grows, Automated Test Equipment must evolve to handle testing at higher speeds and volumes without compromising accuracy. Meeting these requirements can be a significant technical challenge, requiring continuous advancements in ATE technology and data processing capabilities.

- Short Product Life Cycles: In industries like consumer electronics, where product life cycles are continually shrinking, ATE systems must be flexible enough to test rapidly evolving technologies. The short life span of products requires constant updates to testing protocols and systems, which can increase operational complexity and costs.

Top Opportunities

- Growing Demand in the Aerospace and Defense Industry: The aerospace and defense sectors require highly reliable and durable components for mission-critical applications. ATE solutions that can test high-performance systems, such as radar and communication devices, offer substantial growth potential. With the increasing complexity of these systems, the need for robust and reliable testing solutions is expanding.

- Shift Toward Smart Manufacturing: The growing adoption of Industry 4.0 principles in manufacturing creates opportunities for ATE systems that integrate with automation and IoT technologies. These smart factories require advanced testing systems capable of providing real-time performance data and enabling predictive maintenance, which can help manufacturers optimize production and reduce downtime.

- Demand for Electric Vehicle (EV) Components: The electric vehicle market is rapidly expanding, driving demand for automated testing systems capable of evaluating EV components such as batteries, power electronics, and motors. As more manufacturers enter the EV market, the need for ATE to ensure the performance and safety of these components presents a significant growth opportunity.

- Increased Adoption of 5G Technology: The rollout of 5G networks worldwide is expected to create significant demand for testing equipment. Automated Test Equipment is essential for testing 5G components like antennas, signal transmitters, and network devices. As the global adoption of 5G technology accelerates, ATE will become increasingly important for ensuring the reliability and efficiency of 5G infrastructure.

- Emerging Markets and Industrial Automation: The expansion of automation in emerging markets presents new opportunities for ATE providers. As manufacturing operations in regions like Asia-Pacific, Latin America, and Africa become more automated, there will be a growing need for high-performance Automated Test Equipment to ensure the quality and reliability of products being produced at scale.

Key Player Analysis

- Advantest Corporation: Advantest Corporation, based in Japan, is one of the leading players in the Automated Test Equipment market. It is known for providing ATE systems for semiconductor and electronics testing. The company has also been focused on expanding its presence in the 5G and Internet of Things (IoT) markets. Advantest’s test systems are widely used in high-end applications, including memory and logic IC testing.

- Teradyne Inc.: Teradyne Inc., headquartered in the United States, is a major player in the ATE market, providing test solutions for semiconductors, electronics, and wireless devices. Teradyne is well-known for its flagship product, the UltraFLEX test system, which is used for testing high-performance semiconductors. Additionally, the company has been investing heavily in the automotive sector, specifically for autonomous vehicles.

- National Instruments Corporation: National Instruments, an American company, offers ATE solutions across a wide range of industries, including electronics, aerospace, and telecommunications. The company’s software and hardware solutions allow for high-precision testing and measurement. The company’s LabVIEW software platform is integral to many of its test systems, which are widely used in research and development as well as production environments. National Instruments has a strong presence in the IoT and 5G sectors.

- Keysight Technologies Inc.: Keysight Technologies is a leading player in the ATE market, offering comprehensive testing solutions for communications, aerospace, defense, and automotive industries. The company’s test solutions are crucial in the development and testing of high-speed data transmission systems, especially in 5G and automotive applications. Keysight’s software-driven test platforms allow for flexible and scalable test solutions.

- Chroma ATE Inc.: Chroma ATE Inc., based in Taiwan, is a prominent player in the ATE market, particularly in the testing of power electronics, optoelectronics, and semiconductor devices. Chroma is known for its advanced testing solutions for renewable energy products, electric vehicles (EVs), and power electronics, all of which are experiencing rapid growth. The company’s products are widely used for the testing of batteries and power management systems in EV applications.

Regional Analysis

Asia Pacific accounts for a substantial 69.4% of the global Automated Test Equipment (ATE) market, generating USD 5.41 billion in revenue. This dominant market share is primarily driven by the region’s extensive semiconductor manufacturing industry, with leading players in countries such as China, Taiwan, and South Korea. The rapid expansion of consumer electronics, coupled with increasing automotive electronics production, has further amplified the demand for ATE in the region. These factors, along with continuous advancements in technology, position Asia Pacific as a key hub for ATE adoption and innovation.

Recent Developments

- In September 17, 2024, MACOM Technology Solutions Inc., a prominent provider of semiconductor products, will showcase its latest developments in RF, microwave, and millimeter wave technologies, as well as its broad foundry services, at Booth #402 during the European Microwave Week (EuMW) in Paris, France, taking place from September 24 to 26, 2024.

- In September 10, 2024, Advantest Corporation, a leading supplier of semiconductor test equipment, will present its advanced IC testing solutions at SEMICON India, the inaugural event, from September 11 to 13 at the India Export Mart (IEML) in Greater Noida. SEMICON India 2024 will run alongside electronica India and productronica India, forming a major platform for displaying the latest innovations in the electronics industry.

- In September 5, 2024, Cohu, Inc., a global leader in semiconductor manufacturing optimization, announced that a major multinational customer from the automotive, industrial, and computing sectors has selected Cohu’s Diamondx platform for testing power management devices. The order includes a complete test cell solution with the Diamondx tester, equipped with the new VI100 instrument, as well as other mixed signal platform enhancements, coupled with Cohu’s NY32 handler and cCompact interface.

- In January 6, 2025, QNX, a division of BlackBerry Limited, introduced QNX® Cabin, a groundbreaking framework enabling OEMs to virtualize the development of advanced digital cockpits in the cloud. This cloud-based development process allows teams to test and refine code before moving it to production System on Chip (SoC) hardware, facilitating remote collaboration and accelerating development cycles, thus enhancing overall time-to-market.

- In November 3, 2023, Keysight Technologies, Inc. successfully acquired a 50.6% stake in ESI Group SA following a binding agreement signed on June 28, 2023. The transaction, which received favorable approval from ESI Group’s workers council and relevant authorities, solidifies Keysight’s position in the electronic design automation (EDA) industry.

- In August 2024, Averna acquired Global Equipment Services, Inc., a division of Kimball Electronics. GES, known for its expertise in automation and testing solutions for industries like electronics and medical devices, strengthens Averna’s global reach. The acquisition expands Averna’s operations to 20 locations across 11 countries, including new offices in Vietnam, China, India, Japan, and the U.S., with additional support in Southeast Asia and Taiwan.

Conclusion

The Automated Test Equipment (ATE) market is poised for continued growth as industries increasingly rely on sophisticated testing solutions to meet the demands of modern, high-performance products. Driven by advancements in semiconductor technology, the rise of electric and autonomous vehicles, and the ongoing expansion of 5G and IoT networks, the ATE market is set to play a pivotal role in ensuring product quality, reducing time-to-market, and enhancing manufacturing efficiency.

However, challenges such as high initial investment costs, complexity in test setups, and the integration of new technologies must be carefully managed to sustain market expansion. As industries adopt smart manufacturing practices and demand for precision testing increases, ATE will continue to be integral to technological progress, positioning itself as a critical enabler in the evolving global marketplace.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)