Table of Contents

Introduction

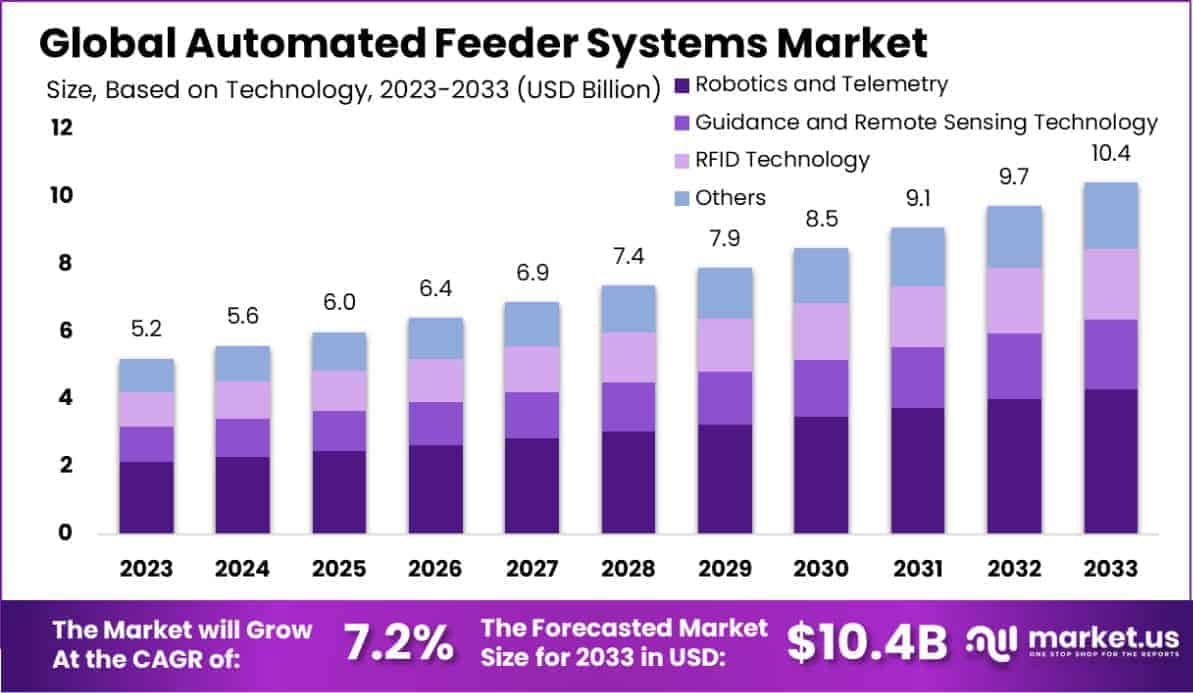

The Global Automated Feeder Systems Market is projected to reach approximately USD 10.4 billion by 2033, increasing from USD 5.2 billion in 2023, with a compound annual growth rate (CAGR) of 7.2% during the forecast period from 2024 to 2033.

Automated Feeder Systems (AFS) refer to advanced mechanical and electronic systems designed to efficiently distribute or supply materials, products, or components to a specific location or process in industries such as manufacturing, packaging, agriculture, and food production. These systems typically integrate robotics, sensors, and conveyors to automate the feeding process, eliminating manual handling and reducing operational inefficiencies.

The Automated Feeder Systems market encompasses the design, manufacturing, and integration of these solutions across various sectors, including industrial automation, robotics, and supply chain management. The market has witnessed significant growth, driven by the increasing demand for automation in industries aiming to boost operational efficiency, reduce labor costs, and minimize human error. Furthermore, the rise in labor shortages and the need for enhanced production speed and precision are contributing factors. As industries increasingly embrace automation to streamline operations and improve productivity, the demand for AFS is projected to continue its upward trajectory.

Key growth factors include advancements in robotics and AI, which enhance the intelligence and adaptability of feeder systems, enabling them to handle a wider range of tasks and materials. The market also presents considerable opportunities as businesses increasingly seek to automate complex and high-volume tasks. Emerging markets in Asia-Pacific and advancements in industries like e-commerce and food processing further boost the adoption of these systems. Additionally, the shift toward Industry 4.0 and digitalization in manufacturing presents new opportunities for AFS manufacturers to innovate and expand their market share.

Key Takeaways

- The Global Automated Feeder Systems Market is expected to reach a value of approximately USD 10.4 billion by 2033, up from USD 5.2 billion in 2023, growing at a compound annual growth rate (CAGR) of 7.2% during the forecast period from 2024 to 2033.

- In 2023, the Conveyor segment held a dominant market position in the “Based on Type” category of the Automated Feeder Systems Market, capturing 45.5% of the share.

- In 2023, Robotics and Telemetry technologies led the “Based on Technology” segment of the Automated Feeder Systems Market, accounting for 41.2% of the market share.

- In 2023, the Controlling function held a dominant market share in the “Based on Function” segment of the Automated Feeder Systems Market, with 38.2% of the share.

- In 2023, the Ruminants segment dominated the “Based on Livestock” category of the Automated Feeder Systems Market, with a 32.3% share.

- Europe held the largest market share in 2023, accounting for 39.3% of the Automated Feeder Systems Market and generating USD 2.0 billion in revenue.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 5.2 Billion |

| Forecast Revenue (2033) | USD 10.4 Billion |

| CAGR (2024-2033) | 7.2% |

| Segments Covered | Based on Type(Conveyor, Rail-Guided, Self-Propelled), Based on Technology(Robotics and Telemetry, Guidance and Remote Sensing Technology, RFID Technology, Others), Based on Function(Mixing, Controlling, Filling, Others), Based on Livestock(Poultry, Swine, Ruminants, Equine, Others) |

| Competitive Landscape | AGCO Corporation, Trioliet B.V., Pellon Group Oy, GEA Group Aktiengesellschaft, Rovibec Agrisolutions, Roxell BV, VDL Agrotech bv, Lely International N.V., Trioliet B.V., Pellon Group Oy, GEA Group Aktiengesellschaft, Rovibec Agrisolutions, Sum-it Computer, Davisway, Dairymaster, Afimilk, Other key players |

Emerging Trends

- Increased Adoption of AI and Machine Learning: Automation systems are increasingly integrating AI and machine learning to improve feeding accuracy and reduce human errors. These technologies allow feeders to adapt to changing conditions in real-time, optimizing production processes.

- Integration with IoT (Internet of Things): Automated feeders are becoming more connected, allowing for remote monitoring and control via IoT devices. This provides better operational visibility, predictive maintenance, and data-driven insights to enhance system efficiency.

- Miniaturization of Components: The trend towards smaller, more compact feeder systems is gaining traction. Smaller units are more flexible and can be incorporated into more diverse industrial applications, offering space-saving solutions.

- Energy Efficiency Focus: With growing concerns around energy consumption, automated feeder systems are being designed with improved energy efficiency. Advanced systems are using less power while delivering high performance, meeting environmental standards.

- Customization and Flexibility: More automated feeder systems are being customized to meet specific industry requirements. This includes modular designs that can easily adapt to different production lines and industries, ensuring better scalability and efficiency.

Top Use Cases

- Manufacturing and Production Lines: Automated feeders are widely used in assembly lines for feeding raw materials or components to machines. These systems ensure precise and continuous material flow, enhancing overall production speed and minimizing downtime.

- Pharmaceutical Industry: In pharmaceutical manufacturing, automated feeders ensure accurate dosing of raw materials and ingredients in pill production. This reduces human error and ensures consistency, especially when dealing with highly regulated processes.

- Food Processing: The food industry utilizes automated feeders to transport ingredients such as grains, powders, and liquids efficiently and hygienically. The systems are designed to meet stringent food safety standards, offering reliability and consistency.

- Packaging Industry: Automated feeders are crucial in the packaging process, feeding products into packaging lines without manual handling. They can handle a variety of materials such as bottles, boxes, or bags, improving speed and reducing labor costs.

- Plastic and Rubber Manufacturing: Automated feeders help deliver raw plastic pellets and rubber to extrusion machines, ensuring a smooth and continuous flow of material. This allows for better quality control and consistency in finished products.

Major Challenges

- High Initial Investment: The cost of setting up an automated feeding system can be substantial. Small to mid-sized companies may find it difficult to invest in such advanced technology, despite the long-term cost savings.

- Technical Complexity: Automated feeder systems can be complex to install and maintain. They require highly skilled technicians for setup and troubleshooting, which adds to the overall cost of ownership.

- Integration with Existing Systems: Retrofitting automated feeders into an existing production system may present compatibility issues. Integrating with legacy equipment can be difficult and costly, leading to operational disruptions.

- Maintenance and Downtime: Even though automated systems are designed for reliability, unexpected maintenance or failure can occur. This may lead to production delays, especially if spare parts are not readily available or the system requires specialized expertise for repairs.

- Limited Adaptability to Highly Variable Inputs: Automated feeders struggle when inputs are highly variable in size or shape. For instance, materials that are uneven or difficult to handle can cause feeding disruptions, requiring manual adjustments or frequent recalibration.

Top Opportunities

- Growth in Emerging Markets: As manufacturing and industrial sectors expand in regions such as Asia-Pacific, automated feeder systems offer significant potential for growth. These markets are increasingly adopting automation to enhance productivity and reduce labor costs.

- Advancements in Smart Sensors: The development of advanced sensors for real-time monitoring and feedback presents opportunities for enhanced accuracy in feeding systems. These sensors can detect blockages, material flow issues, and other irregularities, reducing downtime.

- Expansion in E-Commerce and Logistics: As e-commerce continues to grow, automated feeders have great potential in sorting, packing, and handling goods within warehouses and distribution centers. This is driven by the demand for faster, more efficient supply chains.

- Sustainability Demand: There is increasing pressure on industries to adopt more sustainable practices. Automated feeder systems that reduce waste, energy usage, and material handling inefficiencies offer manufacturers the chance to meet sustainability goals.

- Customized Solutions for Niche Industries: With growing demand for specialized solutions, companies that develop tailored automated feeding systems for niche industries (e.g., biotechnology or renewable energy) can tap into new markets, providing more value through precision and adaptability.

Key Player Analysis

In 2024, the global automated feeder systems market continues to be shaped by key players who are pushing the boundaries of technology and efficiency in animal farming. AGCO Corporation remains a dominant force, with its extensive range of high-tech agricultural machinery, including automated feeding solutions. Trioliet B.V. and Pellon Group Oy are known for their innovative, reliable systems, contributing significantly to the precision and efficiency of feeding operations.

GEA Group Aktiengesellschaft is leveraging its robust industrial expertise to enhance automation and control systems for the dairy sector. Rovibec Agrisolutions and Roxell BV also stand out for their specialized, customizable solutions that optimize feed management in livestock operations. VDL Agrotech and Lely International N.V. focus on integrating advanced sensors and data analytics, ensuring precise feed distribution while improving productivity. Companies like Dairymaster and Afimilk continue to pioneer in smart feeding technologies, focusing on animal health and performance monitoring. This broad spectrum of players showcases the industry’s commitment to innovation, quality, and automation.

Top Key Players in the Market

- AGCO Corporation

- Trioliet B.V.

- Pellon Group Oy

- GEA Group Aktiengesellschaft

- Rovibec Agrisolutions

- Roxell BV

- VDL Agrotech bv

- Lely International N.V.

- Trioliet B.V.

- Pellon Group Oy

- GEA Group Aktiengesellschaft

- Rovibec Agrisolutions

- Sum-it Computer

- Davisway

- Dairymaster

- Afimilk

- Other key players

Regional Analysis

Europe: Dominating Region in Automated Feeder Systems Market with Largest Market Share of 39.3% in 2024

Europe holds a commanding position in the global automated feeder systems market, contributing an estimated USD 2.0 billion in 2024, representing a significant 39.3% of the market share. This dominance can be attributed to several factors, including advanced manufacturing infrastructure, high automation adoption rates across various industries such as automotive, food processing, and pharmaceuticals, and strong government support for Industry 4.0 initiatives.

Furthermore, Europe’s emphasis on technological innovation and sustainability in manufacturing processes propels the demand for automated solutions, such as feeder systems, which enhance productivity and reduce operational costs. Leading countries within the region, such as Germany, the UK, and France, are major contributors to this growth due to their robust industrial base and ongoing investments in automation technologies. The European market is expected to continue its expansion through 2024, driven by the rising need for cost-effective, efficient material handling systems across multiple sectors.

Recent Developments

- In August 2024, Rockwell Automation, a global leader in industrial automation and digital transformation, held its ROKLive Southeast Asia event in Surabaya, Indonesia. The event, themed ‘Discover What’s Possible’, highlighted cutting-edge advancements in industrial technology, including AI, cloud-based manufacturing execution systems, and cybersecurity, showcasing the future of industrial operations.

- In 2025, Latent Labs launched publicly with a strong $50 million in funding aimed at advancing AI-driven programmable biology. The company focuses on drug discovery and protein design, with its Series A funding round co-led by Radical Ventures and Sofinnova Partners. Notable participants include Jeff Dean from Google and Aidan Gomez from Cohere. Latent Labs plans to partner with biotech and pharmaceutical companies to refine and enhance the drug discovery process.

- In 2025, Agro Tech Foods completed its acquisition of Del Monte Foods from Bharti Enterprises, strengthening its position in India’s food and FMCG market. The share-swap deal makes Bharti Enterprises the second-largest shareholder in Agro Tech, holding 21%, with Del Monte Foods owning 14% of Agro Tech Foods.

- In 2024, Siemens Technology and Services Pvt. Ltd. was announced as the Presenting Partner for The IET India Future Tech Congress. This partnership marks Siemens’ return after their successful involvement in the 2022 edition of the event, where they showcased their commitment to the future of technology in India.

Conclusion

The automated feeder systems market is poised for significant growth as industries worldwide continue to embrace automation to enhance productivity, reduce costs, and address labor shortages. With advancements in technologies like robotics, AI, and IoT, these systems are becoming more efficient, adaptable, and energy-conscious. The demand for automated feeding solutions is particularly strong in sectors such as manufacturing, agriculture, food processing, and pharmaceuticals, where precision and speed are crucial. While the initial investment and technical complexity of these systems remain challenges, the long-term benefits in terms of operational efficiency, sustainability, and scalability present ample opportunities for growth. As the market expands, the focus will likely shift towards more customizable, flexible solutions to meet the specific needs of diverse industries, driving further innovation and adoption across the globe.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)