Table of Contents

Introduction

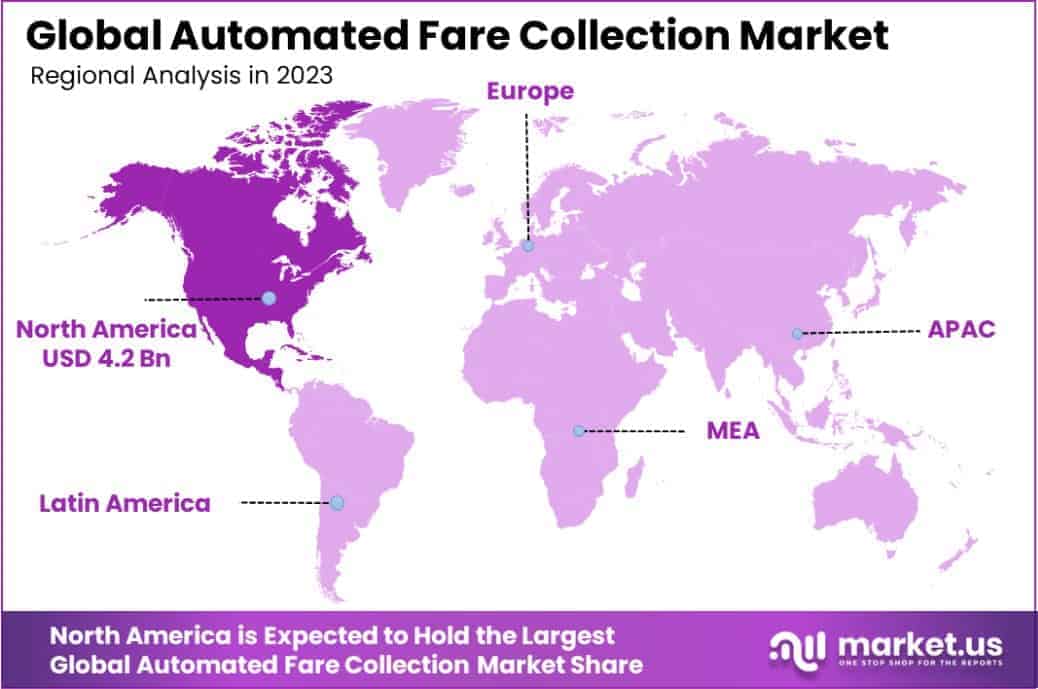

The Global Automated Fare Collection (AFC) Market is projected to reach a value of approximately USD 44.3 billion by 2033, up from USD 12.5 billion in 2023, reflecting a compound annual growth rate (CAGR) of 13.5% over the forecast period from 2024 to 2033. In 2023, North America accounted for the largest market share, holding 34.2%, with a revenue of USD 4.2 billion from the Automated Fare Collection sector.

Automated Fare Collection (AFC) refers to a system that automates the process of fare collection in public transport networks, utilizing technologies such as smart cards, mobile payments, and contactless methods. AFC systems streamline passenger transactions, improve operational efficiency, and enhance the customer experience by reducing queues and manual ticket handling. The Automated Fare Collection Market encompasses the development, deployment, and integration of such systems across various transportation sectors, including metro systems, bus networks, and railways.

Market growth is largely driven by the increasing urbanization, rising demand for seamless and contactless payment solutions, and government initiatives promoting smart city projects. Furthermore, advancements in payment technologies and the growing trend of digitalization in transportation infrastructure are fueling demand for AFC systems. Opportunities for market expansion lie in emerging economies, where infrastructure development is on the rise, and the increasing adoption of mobile wallets and RFID-based solutions is expected to drive further growth in the AFC sector.

Key Takeaways

- The global automated fare collection market is anticipated to expand from USD 12.5 billion in 2023 to approximately USD 44.3 billion by 2033, representing a compound annual growth rate (CAGR) of 13.5% from 2024 to 2033.

- In 2023, hardware components dominated the market, securing a 58.2% share within the automated fare collection sector.

- The smart card technology led the technology segment with a 32.3% market share in 2023.

- Ticket Vending Machines (TVM) were the predominant system type, holding a 32.1% share in the market in 2023.

- Railways and transportation applications held the largest share in the market, with 42.2% in 2023.

- North America emerged as a leading region in the automated fare collection market, representing a 34.2% share and generating USD 4.2 billion in revenue in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 12.5 Billion |

| Forecast Revenue (2033) | USD 44.3 Billion |

| CAGR (2024-2033) | 13.5% |

| Segments Covered | Based on Component(Hardware, Software), Based on Technology(Smart Card, Magnetic Stripe, Near-field communication (NFC), Optical Character Recognition (OCR)), Based on System(Ticket Vending Machine (TVM), Ticket Office Machine (TOM), Fare Gates, IC Cards), Based on Application(Railways & Transportation, Parking, Entertainment, Other Applications) |

| Competitive Landscape | Advanced Card Systems Ltd., Atos SE, Cubic Transportation Systems, Indra Sistemas SA, LECIP Holdings Corporation, LG Corporation, Siemens AG, Thales Group, Omron Corporation, Masabi Ltd., Nippon Signal, Other Key Players |

Emerging Trends

- Integration of Contactless Payment Systems: The adoption of contactless payment methods, such as Near Field Communication (NFC) technology, is increasing. This trend enhances commuter convenience by allowing quick and secure fare payments.

- Expansion of Mobile Ticketing Applications: There is a growing shift towards mobile ticketing platforms, enabling passengers to purchase, store, and validate tickets directly via smartphones. This development reduces the reliance on physical tickets and streamlines the boarding process.

- Implementation of Fare Capping Strategies: Fare capping policies are being introduced to ensure passengers do not exceed a maximum daily or weekly expenditure on fares. This approach promotes public transport usage by offering cost savings to frequent travelers.

- Adoption of Account-Based Ticketing (ABT) Systems: ABT systems are being implemented, allowing fare calculations and payments to be managed through user accounts rather than physical tickets. This method offers flexibility and supports integration with various payment forms.

- Integration with Mobility-as-a-Service (MaaS) Platforms: AFC systems are increasingly being incorporated into MaaS platforms, providing users with seamless access to multiple transportation modes through a single payment interface. This integration enhances user experience and supports multimodal transport solutions.

Top Use Cases

- Urban Public Transportation Systems: AFC systems are extensively utilized in city buses and metro services, automating fare collection to improve efficiency and reduce manual errors. For instance, the Maryland Transit Administration employs electronic fare collection to streamline operations.

- Railway Networks: National and regional rail services implement AFC systems to manage passenger fares, enhancing the speed and accuracy of fare processing. This automation contributes to improved service reliability and customer satisfaction.

- Parking Facilities: Automated systems are applied in parking management to handle fee collection, providing a seamless experience for users and reducing the need for on-site staff. This application leads to operational cost savings and increased user convenience.

- Theme Parks and Recreational Venues: AFC technology is employed to manage entry fees and ride access, enhancing visitor experience by reducing wait times and simplifying access control. This use case improves operational efficiency and visitor satisfaction.

- Toll Collection on Highways: Automated toll collection systems facilitate efficient vehicle throughput by allowing drivers to pay tolls electronically without stopping, thereby reducing congestion and travel times. This application enhances traffic flow and reduces emissions from idling vehicles.

Major Challenges

- High Installation Costs: The initial investment required for implementing AFC systems can be substantial, potentially deterring adoption, especially in regions with limited budgets.

- Serving Unbanked Populations: Ensuring access to AFC systems for individuals without bank accounts or credit cards presents a challenge, as these systems often rely on electronic payments.

- Data Security Concerns: Protecting sensitive user information within AFC systems is critical, with data breaches potentially leading to financial losses and diminished public trust.

- Interoperability Issues: Achieving seamless integration between different transportation modes and payment systems can be complex, potentially hindering the effectiveness of AFC solutions.

- Maintenance and Technical Support Requirements: Ongoing maintenance and the need for technical support can incur additional costs and require specialized expertise, posing challenges for transit agencies.

Top Opportunities

- Advancements in Mobile Payment Technologies: The proliferation of smartphones and mobile payment solutions presents opportunities for AFC systems to integrate with widely used platforms, enhancing user convenience.

- Development of Smart City Initiatives: The global push towards smart city infrastructures encourages the adoption of AFC systems as integral components of intelligent transportation networks.

- Expansion of Public Transportation Networks: The growth of urban populations necessitates the expansion of public transit systems, creating demand for efficient fare collection solutions to manage increased ridership.

- Government Support for Digital Payment Adoption: Policy initiatives promoting cashless transactions can drive the implementation of AFC systems, aligning with broader economic digitization goals.

- Integration with Emerging Transportation Modes: The rise of shared mobility services and micro-mobility options offers avenues for AFC systems to extend their functionalities, providing unified payment solutions across diverse transport modes.

Key Player Analysis

- Advanced Card Systems Ltd. is recognized for its development of smart cards and reader technologies that facilitate seamless transit payments. In recent years, the company has seen substantial growth, with a significant share of its revenue derived from the Asia-Pacific region. This region is known for its rapid adoption of smart transportation solutions.

- Atos SE, a leader in digital transformation, offers a comprehensive range of integrated automated fare collection solutions. Atos SE has strategically enhanced its market presence by partnering with various transportation agencies globally, which has bolstered its position in the AFC market. The company reported a robust increase in its digital services segment, contributing to a considerable percentage of its total revenue.

- Cubic Transportation Systems stands out for its role in integrating payment and information solutions for public transportation systems. Cubic’s revenue from the transportation segment prominently features contributions from major contracts with transport authorities in the United States and the United Kingdom, evidencing its significant market influence in these regions.

- Siemens AG plays a pivotal role in the market with its innovative mobility solutions, including its AFC technologies. Siemens Mobility’s recent projects across Europe and Asia underscore its commitment to enhancing urban transport efficiency. The company’s financial reports highlight a consistent upward trajectory in revenue, with a notable portion stemming from its intelligent infrastructure solutions.

- Thales Group is renowned for its expertise in defense and aerospace but has also made significant inroads in the transportation sector with its AFC systems. Thales’s involvement in high-profile rail and urban transport projects globally has solidified its market standing. The company’s latest financial disclosures reveal a steady growth in revenue, with substantial contributions from its transportation solutions division.

Regional Analysis

North America Leads Automated Fare Collection Market with Largest Market Share of 34.2%

In 2023, the Automated Fare Collection (AFC) market in North America was valued at USD 4.2 billion, representing the largest market share of 34.2% globally. This predominance in the market can be attributed to several factors, including advanced technological integration in public transportation and a robust adoption of contactless payment systems across the region.

The substantial investment in infrastructure development and government initiatives aimed at modernizing transit solutions have further bolstered the growth of the AFC market in North America. This region’s focus on enhancing passenger convenience while increasing operational efficiencies in public transit systems continues to drive the adoption of automated fare collection systems. As the market matures, further growth is anticipated, supported by ongoing technological advancements and the increasing prevalence of smart cities initiatives.

Recent Developments

- On December 18, 2023, Aurionpro Transit, an extension of Aurionpro, announced a partnership with Vix Technology to enhance transit operations. This collaboration will lead to the creation of the All-in-One Driver Console (DC120) and Mobile Data Terminal (MDT10), aimed at centralizing various in-bus functions from ticketing to communications.

- On February 19, 2024, the Metropolitan Atlanta Rapid Transit Authority (MARTA) in the United States commissioned INIT for the implementation of a new smart ticketing system, AFC 2.0. This system, which features contactless payments, will serve MARTA’s extensive network of buses, trains, and streetcars across the Atlanta area. This marks INIT’s largest ticketing initiative in the U.S. and its first to be entirely hosted on public cloud infrastructure.

- On September 17, 2024, Cubic Transportation Systems introduced Umo ScanRide, a novel fare payment solution. This technology allows for account-based fare collections via QR codes, eliminating the need for new hardware by leveraging existing smartphone technology. This offers a significant update to traditional fare systems, providing flexibility and modernization to transit agencies.

- In 2025, NXP Semiconductors, a leader in semiconductor solutions, experienced a plateau in global revenue growth, following two prosperous years. Despite this, its Indian division continues to play a pivotal role for the Dutch parent company, even amidst a slowdown in growth in FY24.

Conclusion

The global market for Automated Fare Collection (AFC) is poised for significant growth, propelled by advancements in technology and an increased focus on streamlining public transportation systems. As urban populations expand and the demand for efficient, secure, and contactless payment options escalates, AFC systems are expected to play a pivotal role in the transformation of transit services worldwide. This trend is further supported by governmental efforts to implement smart city initiatives and expand public transport networks. While challenges such as high initial costs and data security concerns persist, the ongoing innovations and strategic partnerships in the industry are likely to drive continued expansion and adoption of AFC technologies, contributing to a more integrated and efficient future for public transportation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)