Table of Contents

Overview

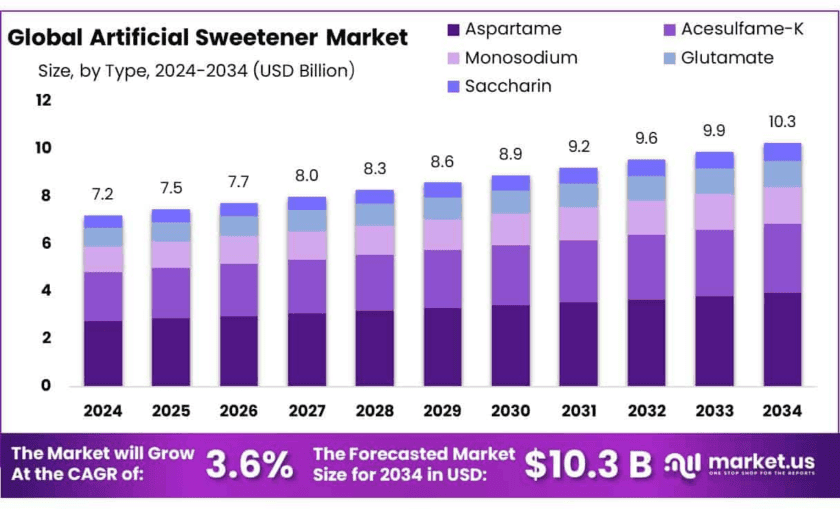

The global artificial sweetener market, valued at USD 7.2 billion in 2024, is projected to reach approximately USD 10.3 billion by 2034, growing at a CAGR of 3.6%. This market is primarily driven by rising health consciousness, increasing cases of lifestyle diseases like diabetes, and the demand for sugar-free and low-calorie alternatives. Artificial sweeteners such as aspartame, sucralose, and saccharin are widely used in beverages, bakery products, and pharmaceutical formulations, owing to their intense sweetness and low caloric content.

North America holds a dominant market share of 38.5%, with the U.S. as the largest consumer due to the increasing focus on reducing sugar consumption. Powdered sweeteners accounted for the largest market share of 72.5% in 2024, while soft drinks emerged as the leading application segment, capturing over 38.1% share. The artificial sweetener market continues to gain traction, fueled by government policies, technological advancements, and changing consumer preferences.

Experts Review

Government incentives and regulatory support play a pivotal role in shaping the artificial sweetener market. Initiatives like the U.S. FDA’s approval of low-calorie sweeteners and sugar reduction policies in Europe have fostered greater adoption. Technological innovations in the formulation of high-intensity sweeteners and natural alternatives are driving investment opportunities, particularly in the food and beverage sector. Despite the potential, investment risks persist due to growing concerns over health risks linked to artificial sweeteners.

Additionally, heightened consumer awareness regarding sugar intake, alongside a shift toward plant-based sweeteners like stevia, is reshaping the market landscape. The regulatory environment remains stringent, with ongoing evaluations by entities like the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) to ensure product safety and efficacy.

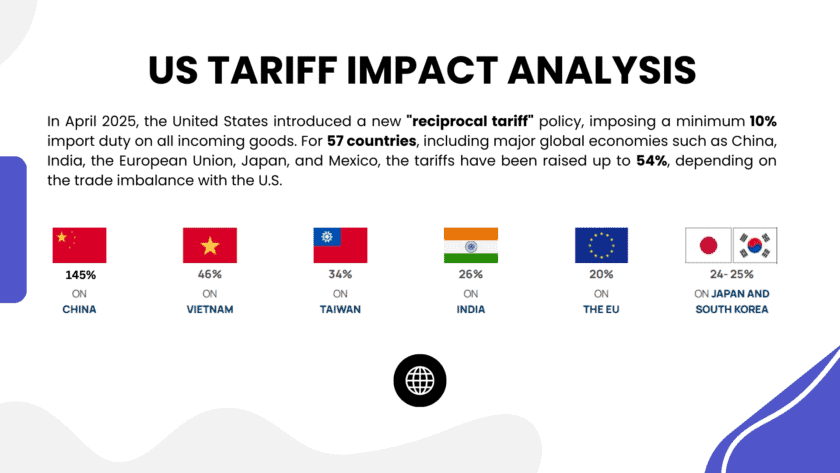

US Tariff Impact on Artificial Sweetener Market

In 2025, the global artificial sweetener market is navigating a complex landscape shaped by U.S. tariff policies, evolving trade agreements, and shifting supply chains. While President Donald Trump’s administration has imposed a 26% tariff on most Indian imports effective April 9, 2025 , ongoing trade negotiations between India and the U.S. aim to mitigate these impacts.

Tariff Implications: The 26% tariff on Indian imports could affect artificial sweetener exports, particularly those involving ingredients like sucralose and saccharin. However, certain sectors such as pharmaceuticals and semiconductors are exempt from these tariffs , potentially offering some relief to related industries.

➤ Get More Detailed Insights about US Tariff Impact @ https://market.us/report/global-artificial-sweetener-market/free-sample/

Trade Negotiations: India has proposed a trade agreement offering “literally no tariffs” on American goods , and is prepared to include a “forward most-favoured-nation” clause to ensure the U.S. receives favorable terms in future trade deals . These negotiations aim to reduce the average tariff gap between the two countries and could lead to more stable trade relations.

Key Takeaways

- Artificial Sweetener Market size is expected to be worth around USD 10.3 Billion by 2034, from USD 7.2 Billion in 2024, growing at a CAGR of 3.6%.

- Aspartame held a dominant market position, capturing more than a 38.4% share in the artificial sweetener market.

- Powder held a dominant market position, capturing more than a 72.5% share in the artificial sweetener market.

- Soft Drinks held a dominant market position, capturing more than a 38.1% share in the artificial sweetener market.

- North America holds a leading position in the global artificial sweetener market, accounting for approximately 38.5% of the market share, valued at around USD 2.7 billion.

Report Scope

| Market Value (2024) | USD 7.2 Billion |

| Forecast Revenue (2034) | USD 10.3 Billion |

| CAGR (2025-2034) | 3.6% |

| Segments Covered | By Type (Aspartame, Acesulfame-K, Monosodium, Glutamate, Saccharin), By Form (Liquid, Powder), By Application (Drinks, Baking, Canned Food, Dairy Products, Others) |

| Competitive Landscape | Ajinomoto Co., Inc., Archer Daniels Midland Company, Cargill Incorporated, DuPont, Hermes Sweeteners, Ingredion Incorporated, MORITA KAGAKU KOGYO, Nestlé S.A., Niutang Chemical, PureCircle, Sunwin Stevia International, Symrise, Tate & Lyle PLC, Wilmar International Limited |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=148348

Report Segmentation

By Type, the market includes Aspartame, Acesulfame-K, Monosodium Glutamate, and Saccharin. Aspartame held the largest market share of 38.4% in 2024, attributed to its extensive use in beverages, snacks, and pharmaceutical products. Acesulfame-K and saccharin also witnessed significant demand due to their high-intensity sweetness and low-calorie content.

By Form, the market is categorized into Liquid and Powdered sweeteners. Powdered sweeteners dominated the market with a 72.5% share in 2024, driven by their easy handling, longer shelf life, and widespread use in bakery products, beverages, and pharmaceuticals. The demand for liquid sweeteners is also gaining momentum in ready-to-drink beverages and syrups.

By Application, the market is divided into Drinks, Baking, Canned Food, Dairy Products, and Others. Soft Drinks led the application segment, accounting for 38.1% of the market share in 2024, driven by the increasing preference for sugar-free and diet beverages. The demand for sweeteners in baking and dairy products is also on the rise as manufacturers aim to reduce sugar content while maintaining taste and texture.

Regional Analysis

North America emerged as the leading market, capturing 38.5% share, valued at USD 2.7 billion. The U.S. remains the largest consumer due to the rising prevalence of diabetes and obesity, along with regulatory approvals from the FDA. Europe follows closely, driven by stringent sugar reduction policies and health-conscious consumers. Asia-Pacific presents significant growth potential due to increasing disposable incomes, urbanization, and expanding diabetic populations in countries like China, India, and Japan.

Top Use Cases

Beverage Industry: Artificial sweeteners are extensively used in the beverage sector to produce low-calorie and sugar-free drinks. Soft drinks, energy drinks, and flavored waters often incorporate sweeteners like aspartame and sucralose to cater to health-conscious consumers.

Food Processing: In the food industry, artificial sweeteners are utilized in products such as sugar-free candies, desserts, and baked goods. Their high sweetness intensity allows manufacturers to achieve desired taste profiles with minimal caloric content. For instance, sucralose is approximately 600 times sweeter than sucrose .

Pharmaceuticals: Artificial sweeteners are employed in the pharmaceutical industry to improve the palatability of medications, especially chewable tablets and syrups. Their non-cariogenic properties make them suitable for formulations intended for children and diabetic patients.

Personal Care Products: Certain personal care items, like toothpaste and mouthwash, incorporate artificial sweeteners to enhance flavor without promoting tooth decay. This application leverages the non-fermentable nature of sweeteners, which does not contribute to dental caries.

Recent Developments

Ajinomoto is a key player in the artificial sweetener market, primarily producing aspartame for industrial use. In the first half of FY2024, the company’s Seasonings and Foods segment reported sales of ¥404.7 billion, reflecting its strong position in the food additives sector.

Archer Daniels Midland Company (ADM) is a significant supplier of high-fructose corn syrup and other sweeteners. In 2024, the company reported full-year adjusted earnings per share of $4.74, indicating its stable performance in the nutrition and sweetener markets.

Cargill offers a range of sweetening solutions, including stevia-based products like Truvia. Between 2019 and 2024, beverages labeled as “sugar-free” experienced an 18% CAGR, showcasing the growing demand for low-calorie sweeteners.

DuPont provides technologies for sugar and sweetener processing, enhancing purity and efficiency. Their solutions support the production of various sweeteners, aligning with industry needs for cost-effective and high-quality products.

Hermes Sweeteners specializes in tabletop sweeteners, offering products like Hermesetas. These sweeteners provide the sweetness of sugar without the calories, catering to health-conscious consumers.

Ingredion Incorporated has expanded its sweetener portfolio with innovations like the PureCircle Clean Taste Solubility Solution (CTSS), a stevia-based sweetener that is over 100 times more soluble than traditional Reb M stevia, enhancing taste and application versatility.

Morita Kagaku Kogyo pioneered the commercialization of stevia sweeteners in 1971 and achieved large-scale cultivation by 1974. The company continues to be a significant player in the natural sweetener market.

Nestlé focuses on reducing sugar in its products, achieving a 20.38% net reduction in greenhouse gas emissions by 2024 compared to the 2018 baseline, reflecting its commitment to sustainability and healthier product offerings.

Niutang Chemical is a leading manufacturer of high-purity sweeteners like aspartame, serving the global food, nutrition, and pharmaceutical industries with over 50 years of experience.

PureCircle, a part of Ingredion, offers stevia-based sweeteners such as the Clean Taste Solubility Solution (CTSS), which provides enhanced solubility and taste, supporting the development of sugar-reduced products.

Sunwin Stevia International, through its subsidiary in China, produces traditional organic herbal extracts, including stevia, contributing to the natural sweetener market.

Symrise supplies flavorings and functional ingredients, including sweeteners. In 2024, the company reported group-wide sales of €5 billion, up €300 million from 2023, indicating strong growth in its ingredients division.

Tate & Lyle has expanded its specialty ingredients business by acquiring CP Kelco for $1.8 billion in 2024, aiming to meet the rising demand for plant-based products and enhance its sweetener portfolio.

Wilmar International is a major player in the sugar industry, with a 12% increase in sales volume to 68.7 million metric tons in FY2024, reflecting its significant role in the global sweetener market.

Conclusion

The artificial sweetener market is set to experience sustained growth driven by rising health consciousness, regulatory support, and increasing consumer demand for low-calorie alternatives. With North America holding a dominant market share, expanding applications in beverages, bakery, and pharmaceuticals are expected to propel market expansion. Despite potential health concerns, ongoing technological innovations and the rise of natural sweeteners present lucrative growth opportunities, positioning artificial sweeteners as a vital component in the evolving global food and beverage landscape.