Table of Contents

Introduction

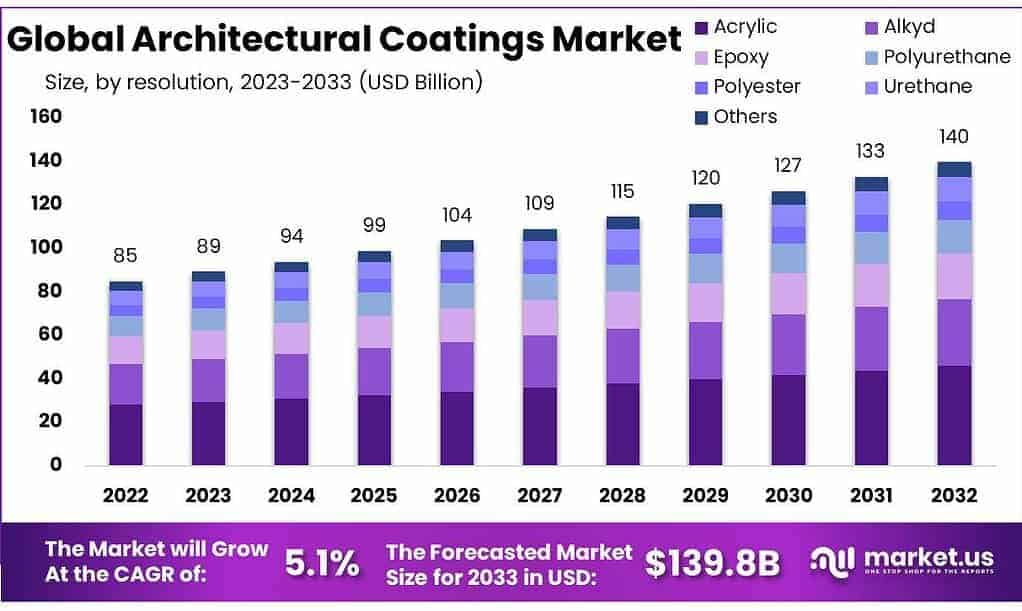

The global architectural coatings market is poised for significant growth, with a projected market size of USD 139.8 billion by 2033, up from USD 85 billion in 2023. This represents a compound annual growth rate (CAGR) of 5.1% from 2023 to 2033.

Several key factors are driving this growth, including the increasing demand for aesthetic and durable finishes in residential and commercial buildings and the rise of sustainable building practices.

Additionally, rapid urbanization and growing construction activities in emerging markets, particularly in Asia Pacific, contribute to the market’s expansion. Architectural coatings, which include paints, varnishes, and finishes used for exterior and interior applications, are integral to the maintenance and appearance of buildings.

However, the industry faces several challenges, such as fluctuating raw material prices, environmental regulations, and innovation in eco-friendly and low-VOC (volatile organic compound) coatings.

Recent developments highlight a growing shift towards sustainability, with manufacturers increasingly investing in water-based, non-toxic, and energy-efficient coatings. The rise of smart coatings, which provide additional functionalities like self-cleaning and anti-bacterial properties, also offers new opportunities for market players.

PPG Industries launched a new range of sustainable coatings in 2023, expanding its product portfolio with eco-friendly options that cater to the growing demand for low-VOC and high-performance architectural paints.

Asian Paints, in 2023, acquired a significant stake in the home improvement platform, “Home Interior Design,” to expand its market presence and enhance its offerings in the architectural coatings sector.

Key Takeaways

- Architectural Coatings Market size is expected to be worth around USD 139.8 billion by 2033, from USD 85 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

- In 2023, acrylic coatings were at the forefront, commanding a significant market share of over 33%.

- Interior Coatings Think about the paints and coatings used indoors, on walls, ceilings, and floors.

- Ceramic coatings are like strong armor, protecting against heat, rust, and wearing out. They’re often used on tiles, pottery, and building stuff to make them tougher and last longer.

- In 2023, Water Borne paints were leading the pack, grabbing over 66% of the market. These paints are made using water as a base instead of strong chemicals.

- Residential, commercial, and industrial sectors exhibit distinct demands. Residential spaces seek paints that last longer and require minimal upkeep, while industrial coatings are crucial for protecting equipment against harsh conditions.

- In 2023, the Asia Pacific region emerged as the dominant force in the global architectural coatings market, representing 48.9% of the total market revenues.

Architectural Coatings Market Statistics

Global Trends in Architectural Coatings

- Japanese paint producer Nippon Paints is among the largest architectural coating producers in China. The country accounted for a revenue of 379.1 billion yen for Nippon Paints in 2021. The architectural paints segment accounted for 82.4% of the overall revenue for the company in the country.

- The new 2,500-square-meter facility will produce Dulux products such as interior decoration, architecture, and leisure.

- PPG, a global provider of paints, coatings, and specialty materials, announced that it has reached a definitive agreement to sell 100% of its architectural coatings business in the U.S. and Canada at a transaction value of USD 550 million to American Industrial Partners (AIP), an industrials investor.

- Water-borne systems accounted for 93 % of the volume of architectural coatings in the EU and 90 % in North America. In Asia-Pacific, water-borne systems accounted for 78 % of the volume, and in Russia only about two-thirds.

- The Indian paints and coatings sector is expected to surge by 10-12% in 2024. This growth is driven by competition, decreasing prices of raw materials, and a steadily strengthening industrial environment.

Technological Advances in Paints

- Asian Paints Water base Exterior top coat must be applied at a temperature between 20°C and 40°C and humidity not above 75%.

- For architectural paints, the feel of paint to a bare hand is an important, although qualitative parameter. In a qualitative, blind comparison, in which people felt the surfaces of the film with their fingertips, the 10 loading samples from all three grades of 3M™

- Ceramic Microspheres were consistently ranked paints in order of smoothest (W-210) to smooth (W-410) to less smooth (W-610).

- Thermal Stability coated parts have high thermal stability with a maximum service temperature of 71°C to 300°C that allows them to function without degrading.

Industrial paints account for the remaining 25% and cover segments like automotive, packaging, marine, protective, powder, and other general industrial purposes. - Walsall industrial paint specialists receive £2,500 grant to drive business growth.

Emerging Trends

- Sustainability and Eco-friendly Formulations: There is a growing demand for environmentally friendly architectural coatings. Many consumers and builders are opting for paints that are low in volatile organic compounds (VOCs), which can be harmful to both health and the environment. Coatings are now being formulated with water-based technologies, natural resins, and recycled materials.

- Energy-efficient Coatings: The development of energy-efficient coatings is becoming more prominent. These coatings are designed to reflect more sunlight, reducing the amount of heat absorbed by buildings. Known as “cool paints” or “reflective coatings,” they help in lowering air conditioning costs and improving energy efficiency in buildings.

- Smart Coatings: “Smart” architectural coatings, which have the ability to respond to changes in exposure, are gaining attention. These coatings can change color based on temperature or light exposure or even provide anti-microbial properties to fight bacteria and mold. They offer additional benefits for buildings in humid or hydraulic high-performance coatings and maintain the building’s appearance over time.

- Rapid Drying and High-Performance Coatings: As the need for efficiency increases, coatings that dry faster are becoming more common. New formulations allow for quicker drying times, allowing contractors to complete projects more quickly. Additionally, high-performance coatings are being designed to last longer and withstand harsh weather conditions, reducing the frequency of maintenance and repainting.

- Decorative and Textured Finishes: There is a rising trend in the use of decorative and textured finishes, particularly in interior design. Architectural coatings are being used not only for protection but also to enhance the aesthetic appeal of spaces. Techniques like faux finishes, textured coatings, and metallic paints are becoming increasingly popular.

Use Cases

- Exterior Protection of Buildings: One of the most common uses of architectural coatings is to protect the exterior of buildings from environmental elements like rain, UV rays, and pollution. High-performance coatings are applied to walls, roofs, and facades to prevent degradation from moisture, temperature changes, and sun exposure.

- Energy Efficiency and Thermal Insulation: Architectural coatings can be used to improve energy efficiency in buildings. Reflective coatings, such as cool roof coatings, are applied to roofs and walls to reflect sunlight, reducing the amount of heat absorbed by the building. This can lower cooling costs in hot climates and improve overall energy consumption, making it a popular choice in energy-conscious construction projects.

- Interior wall finishes and aesthetic design: Architectural coatings are widely used in interior spaces to achieve a variety of finishes and textures. Paints and coatings allow for customization of color, sheen, and texture, contributing to the aesthetic appeal of homes, offices, and commercial spaces.

- Anti-Microbial Coatings in Healthcare Facilities: In healthcare facilities, anti-microbial architectural coatings are used to minimize the growth of bacteria, mold, and mildew on walls and surfaces. These coatings often contain additives that kill or inhibit the growth of harmful microorganisms, making them ideal for environments where hygiene and cleanliness are critical.

- Maintenance of Historical Buildings: Architectural coatings are essential in the preservation and maintenance of historical or heritage buildings. Specialized coatings that mimic traditional finishes but offer modern durability are applied to restore the appearance of aged structures.

Major Challenges

- Environmental Regulations and Compliance: Adhering to strict environmental regulations, particularly concerning volatile organic compounds (VOCs), is a crucial challenge. These regulations aim to reduce air pollution and enhance indoor air quality but require manufacturers to innovate continually to create compliant coatings that do not sacrifice quality, durability, or cost-effectiveness.

- Cost of Raw Materials: The industry is also grappling with the fluctuating costs of essential raw materials like pigments, resins, and solvents. These fluctuations are influenced by various factors, including supply chain disruptions, global demand shifts, and geopolitical issues, leading to increased production costs and subsequent pricing pressures in competitive markets.

- Durability and Performance in Harsh Conditions: Architectural coatings must withstand diverse and harsh environmental conditions, such as extreme temperatures, high humidity, and exposure to saltwater or UV rays. Developing products that maintain both aesthetic and protective qualities over time in these conditions is a complex and ongoing challenge for manufacturers.

- Consumer Preferences for Aesthetics vs. Functionality: There is a continuous need to balance aesthetics with functionality in product development. Consumers demand coatings that are not only visually appealing but also provide added functionalities like antimicrobial properties, energy efficiency, and weather resistance. Meeting these diverse expectations without compromising on performance adds complexity to product formulation.

- Supply Chain and Distribution Issues: The global dependency on supply chains for sourcing raw materials and distributing finished products introduces vulnerabilities. Disruptions due to natural disasters, geopolitical conflicts, or logistical challenges can delay production and affect availability, which has been particularly problematic given the rising demand for specialized coatings.

Market Growth Opportunities

- Eco-friendly Coatings: There’s a growing demand for sustainable and environmentally friendly coatings. This trend is driven by increasing environmental awareness and stricter regulations on emissions and toxic materials. Manufacturers focusing on eco-friendly products, such as waterborne coatings with lower volatile organic compound (VOC) emissions, can capture significant market share.

- Advanced Coating Technologies: The development of innovative coating solutions like UV-curable and powder coatings offers substantial growth opportunities. These technologies not only provide quick-drying solutions but also offer enhanced durability, making them suitable for both residential and industrial applications.

- High-performance Coatings: There is an increasing need for architectural coatings that offer superior durability and resistance to harsh conditions. Products that can provide long-lasting protection and aesthetics in extreme environments are particularly in demand, opening new avenues for growth.

- Coatings with Antimicrobial Properties: With a heightened focus on health and hygiene, coatings that offer antimicrobial properties are gaining popularity. This segment is expected to expand as more public and private spaces look for solutions to maintain hygienic environments.

- Expansion in Emerging Markets: Rapid urbanization and the booming construction industry in regions like Asia-Pacific provide significant opportunities for market expansion. Countries like China and India are witnessing substantial growth in both residential and commercial construction, which in turn drives the demand for architectural coatings.

Key Players Analysis

- PPG Industries has a well-established presence in the architectural coatings sector in the U.S. and Canada, which includes a vast network of over 15,000 points of sale. The company recently announced plans to sell its architectural coatings business, which has been successful in delivering innovative and value-added products to enhance customer productivity and sustainability.

- Asian Paints has been actively involved in the architectural coatings sector, achieving growth even amid challenging market conditions. In fiscal year 2024, the company reported an overall increase in sales, demonstrating resilience in its decorative and industrial coatings segments. Notably, Asian Paints’ Decorative Business in India saw volume growth of 10%, although there was a slight revenue decline due to weak demand and downtrading in certain segments.

- Nippon Paint has been enhancing its product offerings in the architectural coatings sector, particularly focusing on eco-friendly and anti-viral water-based paints. This innovation aligns with global trends toward sustainability and health-conscious products, especially in high-demand markets like Japan.

- The Sherwin-Williams Company has continued to strengthen its position in the architectural coatings sector, achieving significant financial success. In 2023, the company reported robust sales and a notable increase in segment profit, highlighting its effective pricing strategies and operational efficiency. Sherwin-Williams has focused on enhancing its product offerings and expanding its market reach, consistently outperforming in a competitive market despite facing macroeconomic challenges and fluctuating demand in various regions.

- Axalta Coating Systems actively expands its architectural coatings portfolio by introducing new colors and enhancing product lines like the Alesta AR500 and AR400 series, focusing on versatility and durability for architectural applications. They also promote advancements in architectural coatings at industry events, demonstrating their commitment to innovation in the sector.

- RPM International Inc. operates in the architectural coatings sector, offering a wide range of high-performance coatings and sealants primarily for maintenance and repair applications. They manage numerous brands like Rust-Oleum and DAP, known for market leadership in decorative and specialty coatings and sealants in North America.

- Valspar Corporation, part of Sherwin-Williams, delivers high-quality architectural coatings with a broad selection of paints and finishes for both interior and exterior applications. Their products are designed for durability and performance, catering to both professional and DIY projects.

- Midwest Industrial Coatings Inc., established in 2021, specializes in commercial and industrial coatings in the Midwest. The company is known for its work in sandblasting and applying coatings to API above-ground storage Tanks and tank interiors. Their focus on quality, service, and integrity is evident in every project they undertake, employing around 10 people and maintaining a strong safety record.

- Sumter Coatings, established in 1996, specializes in a variety of high-performance coatings tailored for architectural applications. They offer detailed support for coating specifications through platforms like ARCAT, SpecLink, and CadDetails, helping professionals in the planning and execution of their projects with expert guidance and innovative solutions.

- BASF SE actively innovates in the architectural coatings sector, focusing on creating versatile, durable, and sustainable paint solutions. Their product offerings include high-performance materials for both exterior and interior applications, emphasizing low-VOC (Volatile Organic Compounds) formulas and enhanced resistance to environmental conditions.

Conclusion

The architectural coatings market is poised for steady growth, driven by a strong demand for eco-friendly and high-performance products. Manufacturers are focusing on innovative solutions to meet environmental standards and consumer expectations for durability and aesthetics, particularly in residential and commercial construction. These trends highlight the industry’s commitment to sustainability and efficiency, shaping its future direction.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)