Table of Contents

Introduction

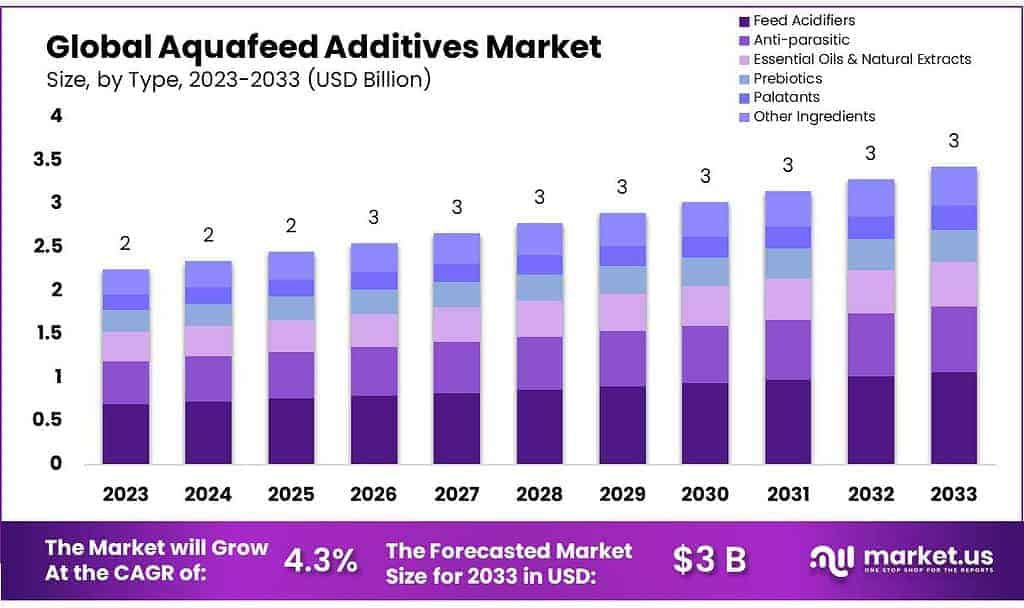

The Global Aquafeed Additives Market is projected to grow from USD 2 billion in 2023 to around USD 3 billion by 2033, reflecting a steady compound annual growth rate (CAGR) of 4.3% during the forecast period.

This growth is primarily driven by the increasing shift towards sustainable aquaculture practices, heightened awareness of fish health, and the rising global demand for protein sources.

Technological advancements in aquafeed additives, including the incorporation of probiotics, enzymes, and amino acids, are further fueling market expansion. However, the sector faces challenges, such as volatility in raw material costs, stringent regulatory frameworks, and environmental concerns linked to intensive fish farming practices.

Recent developments in the market showcase significant R&D investments by leading industry players, aiming to introduce more eco-friendly and cost-effective additives that enhance feed efficiency and promote sustainable aquaculture practices. Moreover, companies are diversifying their offerings to include additives that not only optimize growth but also minimize environmental impact.

Founded in France, Olmix has 650 employees, generates US$175 million in annual revenues, and operates eight industrial plants, including a biorefinery specialized in algae processing.

Olmix Group focuses on sustainable aquafeed solutions, leveraging its expertise in algae-based additives. The company is expanding globally, backed by consistent funding. Its latest products aim to boost productivity and health in aquaculture.

Key Takeaways

- Aquafeed Additives Market size is expected to be worth around USD 3 billion by 2033, from USD 2 billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

- In 2023, feed acidifiers held a dominant market position, capturing more than a 30% share. Helping Digestion with Acidifiers, Acidifiers are super important in aquafeed.

- Dry Form Holding a dominant market position, Dry Form captured more than a 56.3% share.

- In 2023, catfish stores were leading the market, holding more than a 22.9% share. Catfish Farms Love Aquafeed Additives, Places that raise catfish buy a lot of these special additives.

- Latin America held the highest revenue share at over 37% in 2023. This is due to the availability of local fish feed, made from basic raw materials such as fish oil or fish meal, and favorable climatic conditions

Aquafeed Additives Statistics

Aquafeed Additives in Aquaculture Diets

- The manual is aimed at mainly catfish breeders—both women (30%) and men (70%) as well as youths (25%) according to their level of involvement along the aquaculture value chain.

- In Africa, since fish feed makes up 60%–80% of production costs, it is inextricably linked to profit margins for fish farmers. Despite the high cost of feed, however, some commercial fish brands on the market are of poor quality.

- In experimental diets, fiber is used as a filler, and ash is a source of calcium and phosphorus. In practical diets, both should be no higher than 8%–12% of the formulation.

- The particle size of pellets for most adult fish is at least 4.5 mm in diameter.

- Typical soy flour contains from 44 to 48% dry protein and, according to various data, can replace from 25 to 100% fishmeal.

- Higher socioeconomic levels will be achieved, generating a greater demand for animal-sourced protein. To address this demand, animal agriculture production will need to increase by 250–300 million m.t.

Global Trends in Aquafeed Production

- In comparison to other animal production systems, aquaculture has the greatest overall efficiency. For example, the production of CO2 per kg (carbon footprint) of farmed beef is 90% higher than that resulting from 1 kg of salmon.

- China is the largest aquaculture producer in the world, with a total production of 53.94 million tons of fish in 2012, accounting for nearly 60% of the world total.

- Every year 20–30 million metric tonnes of fish, one-third of the global fish catch, is used to produce aquafeeds.

- Indigenous probiotic strains Lactiplantibacillus plantarum strains BCCa32 and BCCa36 were previously isolated and maintained in 20% glycerol (1:1) at -800C. The bacteria were grown in 50 mL of Man de Rogosa and Sharpe (MRS) broth for 18h at 370C, under anaerobic conditions. The broth was centrifuged at 8000 rpm for 12 minutes and the supernatant was discarded.

- Liquid CMS (condensed molasses solubles produced from the fermentation process of molasses to produce ethanol) is mixed with hydrated lime to obtain a desired pH of 10 – 10.5. This mixture is then spray-dried to produce a fine brown powder with low moisture (< 4 %) and low fiber content.

Grains account for 11% of the total dry matter consumed by livestock at the global level and oilseed crops by-products such as soybean cakes account for 5%.

Emerging Trends

- Sustainability-Focused Additives: There is a growing emphasis on developing environmentally sustainable additives for aquafeed. These include natural and plant-based additives that reduce the carbon footprint of aquaculture. Sustainable sourcing of raw materials, such as algae, has become a key area of research.

- Probiotics and Prebiotics for Gut Health: The use of probiotics and prebiotics in aquafeed is becoming more popular to improve the gut health of aquatic animals. These additives enhance the beneficial bacteria in fish and shrimp, leading to better digestion, improved nutrient absorption, and increased disease resistance.

- Functional Lipids for Growth Enhancement: The incorporation of functional lipids, such as omega-3 fatty acids, is being researched for improving growth rates in aquaculture. These lipids not only support healthy development but also enhance the immune response of aquatic species, leading to faster growth and improved survival rates.

- Enzyme Additives for Improved Feed Efficiency: Enzymes are being increasingly added to aquafeeds to enhance nutrient digestibility and improve feed conversion rates. This helps reduce feed waste and optimize the nutritional value of the feed, contributing to cost savings for aquaculture operations.

- Antioxidants for Disease Prevention: Antioxidants, including vitamins and polyphenols, are being used in aquafeed to support the immune system and prevent oxidative stress. These additives help improve the health of aquatic species, making them more resilient to diseases and environmental stresses. The demand for antioxidants has been growing as aquaculture producers focus on reducing the use of antibiotics and other chemicals.

Use Cases

- Improving Fish Growth and Feed Conversion: Aquafeed additives such as functional lipids and amino acids are used to improve the growth rates of fish, shrimp, and other aquatic species. These additives enhance nutrient absorption and optimize the feed conversion ratio (FCR), meaning fish can grow more efficiently with less feed. This is particularly important in commercial aquaculture, where maximizing productivity and reducing feed costs are critical.

- Disease Prevention and Immune Support: Probiotics, prebiotics, and antioxidants are incorporated into aquafeeds to boost the immune system of aquatic species. These additives help prevent diseases by promoting the growth of beneficial gut bacteria, which improves overall health and resistance to infections. This is especially useful in disease-prone environments such as aquaculture farms.

- Reducing Environmental Impact: Sustainable additives, including algae-based ingredients and plant-based proteins, are being used to reduce the environmental footprint of aquaculture. These additives help lower the dependency on fishmeal and fish oil, which are commonly used in traditional aquafeeds. This shift supports more sustainable aquaculture practices by reducing pressure on marine ecosystems.

- Enhancing Nutrient Digestibility: Enzymes are added to aquafeeds to break down complex nutrients and make them more digestible for aquatic animals. This improves the overall feed efficiency and reduces waste, making the farming process more cost-effective. By increasing nutrient absorption, these additives support better health and growth in fish and shrimp.

- Sustainable Omega-3 Fatty Acid Enrichment: Omega-3 fatty acids, sourced from algae and other sustainable sources, are added to aquafeeds to improve the nutritional profile of farmed fish. These fatty acids are important for human health, and the inclusion of omega-3s in aquafeeds ensures that farmed fish, such as salmon, remain rich in these beneficial compounds, making them a more nutritious product for consumers.

Major Challenges

- High Cost of Premium Additives: One of the key challenges in the use of aquafeed additives is the high cost of premium ingredients, such as probiotics, functional lipids, and specialty enzymes. These additives, while beneficial for growth and health, often increase the overall cost of production.

- Supply Chain Issues for Raw Materials: The supply of certain raw materials used in aquafeed additives, like fish oil or algae, can be unstable. This can result in price fluctuations or shortages, which may disrupt production. Climate change and overfishing also pose long-term risks to the availability of some key ingredients used in feed additives.

- Regulatory Hurdles: In many regions, regulatory approval for the use of new additives in aquafeed can be a lengthy and complicated process. Each new product must go through extensive testing to ensure safety and efficacy. The process can be time-consuming and expensive, leading to delays in bringing innovative additives to the market.

- Inconsistent Efficacy Across Species: Many aquafeed additives show varying levels of effectiveness depending on the species being farmed. For instance, additives that work well for one type of fish may not provide the same benefits for shrimp or shellfish.

- Environmental Impact of Additives: Some additives, particularly synthetic chemicals or those derived from non-sustainable sources, have raised concerns about their long-term environmental impact. For example, the excessive use of certain nutrients in aquafeed can lead to nutrient pollution in surrounding aquatic environments.

Market Growth Opportunities

- Increasing Demand for Sustainable Aquaculture: As the global population grows, there is a rising demand for sustainable and eco-friendly aquaculture practices. Aquafeed additives that reduce the environmental impact, such as plant-based ingredients and algae-derived supplements, are gaining popularity.

- Shift Toward Plant-Based Feed Ingredients: The shift towards plant-based proteins and additives in aquafeeds is driven by the need to reduce reliance on fishmeal and fish oil, which are traditionally used in aquaculture. Plant-based alternatives such as soy, wheat, and corn, as well as algae-based additives, are increasingly being used to improve feed formulations.

- Technological Advancements in Feed Formulation: The development of precision nutrition and advanced feed formulations using additives like probiotics, enzymes, and functional lipids presents a significant growth opportunity. These innovations enhance feed efficiency, reduce waste, and improve the overall health and growth of aquatic species.

- Expansion of Aquaculture in Developing Countries: Aquaculture is expanding rapidly in developing countries, where the demand for seafood is increasing. As these markets grow, there is a significant opportunity for aquafeed additive suppliers to provide customized solutions to meet the needs of local aquaculture industries.

- Regulatory Support for Healthier Aquaculture Practices: Governments and international organizations are increasingly supporting the use of natural additives and alternatives to antibiotics in aquaculture. This regulatory shift encourages the development and adoption of feed additives that promote animal health and reduce the use of chemicals.

Key Players Analysis

- Aker Biomarine specializes in sustainable marine ingredients, including krill oil used in aquafeed additives to support fish health and growth. Their focus is on eco-friendly harvesting methods.

- Nutriad Inc. provides nutritional feed additives, including acidifiers, antioxidants, and other specialized products for improving aquaculture performance. They focus on enhancing fish health and optimizing feed efficiency.

- Calanus AS specializes in sustainable marine ingredients, particularly from Calanus finmarchicus, used in aquafeed additives for improving fish growth and health. Their products support immune function and feed efficiency.

- Olmix Group focuses on natural solutions for animal feed, offering plant-based additives to improve aquaculture sustainability and fish health. Their products include natural minerals, antioxidants, and functional ingredients.

- Norel SA offers a range of feed additives, including natural ingredients designed to enhance aquaculture productivity and fish health. Their products help improve feed efficiency and support immune systems in aquatic animals.

- Lallemand Inc. provides probiotics, yeast-based products, and other additives to improve aquaculture feed quality. Their solutions focus on enhancing fish digestion, growth, and overall health.

- Alltech offers a variety of feed additives, including probiotics, enzymes, and organic acids, to improve aquaculture feed quality. Their solutions aim to boost fish health, growth, and feed efficiency while promoting sustainability.

- Kemin Industries provides nutritional and health-promoting feed additives for aquaculture, including antioxidants, preservatives, and digestive health solutions. Their products help enhance fish performance and maintain aquatic ecosystem health.

- Nouryon supplies specialized additives for aquaculture, including functional ingredients that support fish health, growth, and feed quality. Their products help optimize feed efficiency and contribute to sustainable aquaculture practices.

- DuPont provides feed additives for aquaculture, including enzymes, probiotics, and preservatives to improve fish health, digestion, and feed performance. Their solutions enhance sustainability and efficiency in fish farming.

- Biorigin provides natural, plant-based feed additives for aquaculture, focusing on improving fish health and feed efficiency. Their solutions support sustainable practices and enhance the overall growth and immune function of aquatic animals.

- Phileo by Lesaffre offers probiotics and yeast-based feed additives for aquaculture to promote fish gut health, improve digestion, and enhance feed utilization. Their products support sustainable aquaculture practices.

- Calanus AS specializes in marine-based ingredients, particularly from Calanus finmarchicus, to improve fish growth and health. Their additives support immune function, digestion, and feed efficiency in aquaculture.

Conclusion

The aquafeed additives market is poised for significant growth due to increasing demand for sustainable, efficient, and health-focused solutions in aquaculture. Innovations such as plant-based ingredients, probiotics, and enzyme additives are driving the sector forward, aligning with global trends toward eco-friendly practices and healthier seafood production.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)