Table of Contents

Introduction

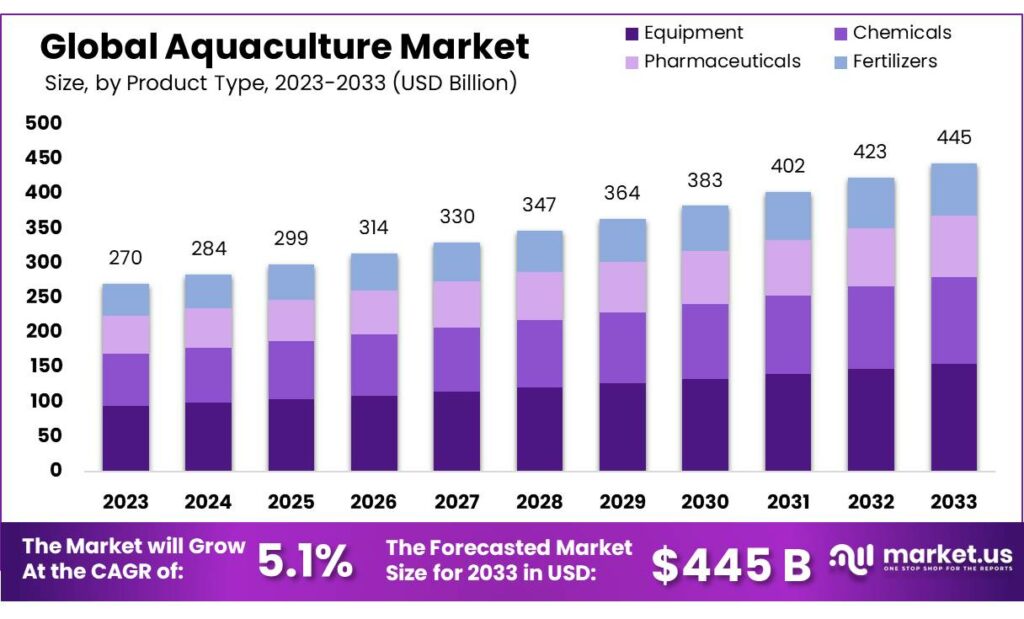

The global aquaculture market is anticipated to experience substantial growth, projected to increase from USD 270 billion in 2023 to around USD 445 billion by 2033, with a consistent growth rate of 5.1% annually. This growth is driven primarily by the escalating demand for seafood, advancements in aquaculture technologies, and increasing consumer awareness about the health benefits of seafood. The market’s expansion is further facilitated by innovations such as Recirculating Aquaculture Systems (RAS), which enhance production efficiency and sustainability by minimizing environmental impacts through water recycling and improved feed formulations.

However, the aquaculture industry faces significant challenges that could impede its growth. These include environmental concerns like pollution and the overuse of chemicals, regulatory complexities, and socio-economic obstacles such as the rising popularity of vegan diets and ethical concerns regarding animal welfare. Additionally, the industry must navigate the complexities introduced by geopolitical factors that affect supply chains and market access, particularly in a post-pandemic world where economic recovery is uneven across regions.

Recent developments in the sector include increased investments in genetic research and breeding technologies aimed at improving fish health and yield. The sector’s growth is also supported by governmental policies in key regions, which provide a conducive environment for the expansion of aquaculture practices. For example, policies in Asia-Pacific countries are particularly geared towards supporting the aquaculture sector due to its significance in the regional diet and economy.

Austevoll Seafood has recently enhanced its financial standing through strategic sales and investments. In July 2024, the company successfully completed the sale of 100% of the shares in Br. Birkeland Fiskebåtrederi AS and Talbor AS, showcasing its active repositioning within the seafood market to focus on more profitable ventures. This move is part of Austevoll’s broader strategy to optimize its asset portfolio and strengthen its core business areas.

Dainichi Corporation, on the other hand, continues to innovate within the sector. The company has been involved in environmental conservation activities and the development of sustainable aquaculture feeds. Dainichi has embraced technological advancements, including the use of AI in feed machines, which significantly enhances the efficiency of their aquaculture practices. These innovations are part of their commitment to sustainable development and are aligned with global sustainability goals.

Austevoll Seafood has recently enhanced its financial standing through strategic sales and investments. In July 2024, the company successfully completed the sale of 100% of the shares in Br. Birkeland Fiskebåtrederi AS and Talbor AS, showcasing its active repositioning within the seafood market to focus on more profitable ventures. This move is part of Austevoll’s broader strategy to optimize its asset portfolio and strengthen its core business areas.

Key Takeaways

- Market Growth: The aquaculture market to reach USD 445 billion by 2033, with a CAGR of 5.1% from 2023.

- Product Segments: Equipment dominates with 34.5% share, driven by efficiency needs.

- Culture Dynamics: Freshwater aquaculture holds 41.2% share in 2024, favored for low costs.

- Species Segment: Aquatic animals capture 34.4% share, driven by global seafood demand.

- End-User Insights: Seafood industry dominates with 62.4% share in 2024, led by global demand.

- Regional Analysis: Asia Pacific leads with 42% market share, driven by investments and sustainable practices.

- Aquaculture farming in the EU yielded approximately 1.1 million tonnes of aquatic organisms, valued at around €4.2 billion.

- The EU’s aquaculture sector ranked 11 worldwide in terms of output, with a 0.9% share of global production.

- Different aquatic organisms fetched varying prices; for instance, mussels averaged about €1.1 per kg, seabass around €6 per kg, and tuna approximately €13 per kg.

Aquaculture Statistics

- Cette meme annee, la France affiche un chiffre d’affaires total de 722 millions d’euros.

Globally, around - 10% of aquaculture production is lost attributing to disease outbreaks, resulting in substantial economic losses exceeding 10 billion USD.

- As of now, there are around 20 commercialized oral vaccines in aquaculture against myriad pathogens.

- By incorporating the Escherichia coliderived orange-spotted grouper nervous necrosis virus (NNV) VLP vaccine into the commercial feed, oral vaccination achieved a remarkable survival rate of over 50% against NNV infection.

- Drastic increase of inactivation rate was observed at low water temperature (6 ± 1 °C) when UVA- and solar-based AOPs were employed compared to 22 ± 1 °C.

- In 2018, the Food and Agriculture Organization of the United Nations (FAO) published official statistics on fisheries and aquaculture highlighting that global fish production reached 171 million tonnes, 47% of which comes from aquaculture.

- For instance, the aquaculture production reached 110.2 million tons in 2016 with a value of 243 500 million USD.

- The transmittance of SAS was measured after increasing the concentration of target bacteria in the range 280 – 400 nm.

Emerging Trends

Emerging trends in aquaculture highlight the sector’s dynamic evolution towards sustainability and technological integration. One significant trend is the development of Recirculating Aquaculture Systems (RAS), which optimize water use and minimize environmental impact. This system supports high-density fish populations in controlled environments, ensuring efficient production while protecting natural water bodies.

Another trend is the rise of smart aquaculture, utilizing data analytics, Internet of Things (IoT), and artificial intelligence to enhance fish farming operations. Technologies such as real-time monitoring of water quality and fish health help in maintaining optimal farming conditions, thus improving productivity and sustainability.

Additionally, there’s a focus on vertical aquaculture, especially in urban settings, where space is limited. Innovations like the Aqua Towers enable the cultivation of seafood within city environments, reducing food miles and providing fresh produce directly to urban consumers.

Sustainable practices are also prominent, with efforts to reduce the carbon footprint of aquaculture activities. This includes integrating solar power into aquaculture systems and exploring biosecurity measures to prevent disease and reduce the need for antibiotics.

Moreover, there’s a growing interest in polyculture and integrated multi-trophic aquaculture systems, which mimic natural ecosystems by combining different species that can interact beneficially, enhancing resource efficiency and ecological balance.

Use Cases

- Fish Production Enhancement: Aquaculture significantly contributes to global fish production, offering a sustainable alternative to wild fisheries, which are often under strain from overfishing and environmental changes. For example, in regions like Asia, aquaculture has become a dominant force, contributing heavily to food security and economic stability. In 2022, countries like China and India saw substantial production volumes, underscoring the pivotal role of aquaculture in meeting rising seafood demands.

- Sustainability Practices: With the increasing emphasis on environmental impact, aquaculture operations are incorporating more sustainable practices. This includes the use of Recirculating Aquaculture Systems (RAS) that recycle water, reducing the need for fresh water and minimizing waste. These systems are designed to optimize resource use and lessen the environmental footprint of aquaculture operations.

- Regional Development: Aquaculture also plays a crucial role in regional development, especially in areas where traditional farming or fisheries are not viable. For instance, in Latin America and the Caribbean, aquaculture has been instrumental in boosting local economies and food production, with notable increases in production volumes from countries like Ecuador and Brazil in recent years.

- Innovation and Technology: The sector is increasingly leveraging technology to enhance efficiency and productivity. This includes the use of smart technologies for monitoring water quality and fish health, improving the overall management and yield of aquaculture farms. These technologies help maintain optimal conditions, which are essential for the health and growth of aquatic organisms.

- Food Security and Nutrition: Aquaculture supports food security and nutritional needs by providing a steady source of high-quality protein. This is particularly important in regions with growing populations and increasing food demand. The controlled environment of aquaculture allows for year-round production, contributing to a more stable supply of seafood products.

Major Challenges

- Environmental Impact: Aquaculture systems can have significant impacts on natural habitats, often leading to issues like water pollution and habitat destruction. Efforts to mitigate these impacts include improving waste management practices and adopting systems like recirculating aquaculture systems (RAS) to reduce water use and pollution.

- Feed Sustainability: The reliance on fishmeal and fish oil poses sustainability challenges due to the finite nature of marine resources. The industry is exploring alternative protein sources, such as plant-based feeds and insects, to lessen dependency on marine-derived feeds.

- Disease Management: Disease outbreaks can cause massive losses in aquaculture. The sector is continuously working on improving biosecurity measures, disease resistance through genetic selection, and effective management practices to prevent and control diseases.

- Climate Change: Climate change affects aquaculture by altering water temperatures and weather patterns, which can disrupt breeding cycles and increase vulnerability to diseases. Adapting to these changes requires a resilient approach to aquaculture practices, incorporating climate-smart strategies.

- Economic Pressures: Fluctuations in market prices, high operational costs, and competition can pose economic challenges. Efficient production technologies and better market access are crucial for maintaining profitability.

- Regulatory and Social Challenges: Navigating the complex regulatory environments and addressing social issues such as conflicts with local communities and equitable resource distribution are ongoing challenges. Policies need to be inclusive and supportive of sustainable development to ensure the industry’s growth does not come at the expense of local communities or ecosystems.

Market Growth Opportunities

- The aquaculture market is positioned for substantial growth, with several key opportunities poised to enhance its expansion.

- One significant growth opportunity lies in sustainable aquaculture practices, which are essential to meet the rising demand for seafood while minimizing environmental impacts. Innovations such as Recirculating Aquaculture Systems (RAS) and Integrated Multi-Trophic Aquaculture (IMTA) are gaining traction. These systems not only improve efficiency and sustainability but also support the market’s expansion by enabling the farming of a wider variety of species.

- Furthermore, the global aquaculture market is seeing a shift towards the cultivation of high-demand species such as mollusks and carps, which are particularly favored in key markets like Asia-Pacific. This region dominates the aquaculture market, with countries like China, India, and Indonesia driving significant consumption due to their large populations and cultural preferences for seafood.

- Additionally, the expansion of freshwater aquaculture, which currently holds the largest market share due to the accessibility of freshwater environments and the lower costs associated with freshwater species like tilapia and catfish, represents a vital area for growth. These operations benefit from traditional and local farming practices, which are less impactful on the environment and offer controlled conditions that reduce disease risks.

Key Players Analysis

In 2023, Austevoll Seafood has continued to reinforce its position in the aquaculture sector by achieving record revenues, with earnings prominently driven by its diverse operations in salmon, whitefish, and pelagic fish. The company has successfully navigated market challenges through strategic initiatives and investments, focusing on sustainability and efficiency improvements across its operations. Austevoll’s growth is supported by its strong industrial holdings, including significant stakes in Lerøy Seafood Group and Pelagia, highlighting its integrated approach to seafood production and distribution.

Dainichi Corporation, a player in the aquaculture feed sector, has been noted for its contributions to sustainable feed solutions. Although specific financial updates for 2023 weren’t detailed, Dainichi’s reputation in the industry is built on innovation in feed technology, improving feed efficiency and nutritional quality which supports healthier and more sustainable aquaculture practices. This focus aligns with the global shift towards more environmentally responsible aquaculture operations.

In 2023, Eastern Fish Co. celebrated its 50-year anniversary as a prominent leader in the seafood industry, recognized for its expansive role as one of the world’s largest importers and marketers of shrimp and other premium seafood products. The company has built a legacy on strong values of integrity and environmental responsibility. Eastern Fish has made significant strides in promoting sustainability and traceability within its supply chain, aiming to meet global demands while maintaining high-quality standards and environmental stewardship. Their approach includes a comprehensive range of seafood products sourced and processed with an emphasis on quality and sustainability.

Kyokuyo Co Ltd is a major player in the seafood market, particularly known for its involvement in seafood processing and trading. While specific updates for 2023 or 2024 are not detailed, the company is renowned for its commitment to quality and innovation in seafood products. Kyokuyo’s efforts are geared towards sustainable practices and the responsible sourcing of seafood, aligning with global standards to meet consumer demand for environmentally conscious options in the seafood market.

In 2023, Lerøy Seafood Group ASA showcased a notable performance in the aquaculture sector, reflecting both challenges and growth. The company reported an 8% increase in turnover from the previous year, although they faced some operational challenges such as early harvests due to ISA detection which impacted earnings. Despite these challenges, Lerøy’s commitment to sustainability remains strong, with ongoing investments in technology to improve smolt quality and farming practices. The company expects a harvest volume of 193,500 GWT for 2024, indicating a positive outlook for future growth.

Maruha Nichiro Corporation, a major player in the global seafood market, continues to focus on sustainable seafood production. While specific data for 2023 or 2024 was not detailed, the company is known for its innovative approaches to aquaculture, including the development of environmentally friendly feed and health management practices that enhance the sustainability and efficiency of seafood production. Maruha Nichiro’s efforts are in line with the industry’s shift towards more sustainable practices to meet the growing global demand for seafood.

In 2023, Nippon Suisan Kaisha Ltd (now Nissui Corporation) focused on enhancing its aquaculture operations through advanced technologies and sustainable practices. The company has been developing next-generation aquaculture systems that integrate innovative approaches to feed, seed, and habitat, aiming to create a sustainable aquaculture industry in Japan. These efforts include the use of AI for monitoring fish growth and an automated feeding system that allows fish to feed on demand, reducing waste and environmental impact. Nissui’s commitment to sustainability is evident in its efforts to reduce carbon emissions and promote environmentally friendly aquaculture practices.

Nireus SA Ltd‘s current details weren’t specifically updated for 2023 or 2024, but the company is known for its focus on Mediterranean species such as sea bream and sea bass. Nireus emphasizes sustainable farming practices, genetic research to improve fish health and yield, and has been involved in initiatives to enhance the sustainability of its operations across various regions. The company’s approach typically involves using advanced feed formulations and farming technologies to ensure the health and efficiency of its aquaculture practices.

In 2023, SalMar ASA reported strong financial results driven by high salmon prices due to limited global supply and robust demand. The company achieved an Operational EBIT of NOK 1,884 million in the first quarter, with a total harvest of 48,500 tonnes. SalMar’s operations in Central Norway and Northern Norway were particularly productive, contributing significantly to their earnings. Additionally, the company maintained its production guidance for 2023, projecting a harvest of 243,000 tonnes in Norway, 16,000 tonnes in Iceland, and adjusting its expectation in Scotland to 27,000 tonnes due to biological challenges.

Shandong Homey Aquatic Development Co Ltd details for 2023 or 2024 were not directly available in the sources reviewed. However, the company is known for its extensive operations in aquaculture, primarily focusing on the breeding, processing, and sale of various seafood products, including fish and shrimp, in domestic and international markets. As a significant player in China’s aquaculture industry, Homey Aquatic typically leverages advancements in aquaculture technology and practices to enhance production efficiency and meet growing seafood demands.

In 2023, Surapon Foods Public Company Ltd reported a notable performance in the aquaculture sector. The company recorded a revenue of THB 5,374.55 million for the year, showcasing a resilient operation despite a slight decline from the previous year’s revenue of THB 6,009.59 million. Net income for the year improved significantly to THB 130.42 million, up from THB 83.47 million in the prior year, reflecting effective cost management and operational efficiencies. The company’s earnings per share also increased, demonstrating its profitability growth amidst the challenging market conditions.

Thai Union Group Plc continues to be a global leader in the seafood industry, known for its strong commitment to sustainable seafood production. While specific financial performance for 2023 or 2024 wasn’t detailed, the company has been at the forefront of innovation in aquaculture, focusing on enhancing product quality and environmental sustainability. Thai Union’s efforts include significant advancements in feed technology and responsible sourcing of seafood, aiming to meet the growing global demand while addressing environmental and ethical concerns.

Conclusion

In conclusion, aquaculture is set to play an increasingly critical role in the global food landscape, driving innovation and sustainability to meet future food needs effectively. Its continued growth will rely on advancements in technology, sustainable practices, and the expansion into new markets and species to ensure the sector’s resilience and continued contribution to global food security.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)