Table of Contents

Introduction

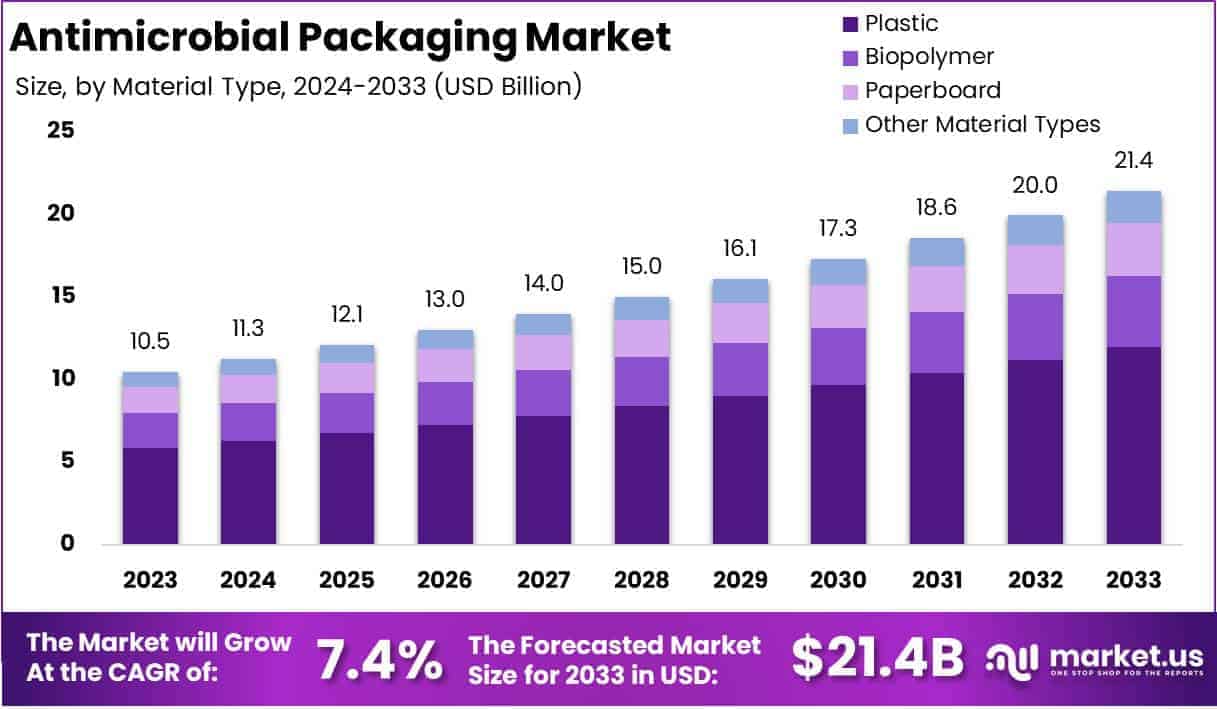

The Global Antimicrobial Packaging Market is projected to reach a value of approximately USD 21.4 billion by 2033, up from an estimated USD 10.5 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 7.4% during the forecast period spanning 2024 to 2033.

Antimicrobial packaging is an innovative packaging solution designed to extend the shelf life of products by preventing the growth of microorganisms such as bacteria, mold, and fungi. This is achieved through the incorporation of antimicrobial agents into the packaging material, which actively inhibits microbial activity.

Commonly used in the food and beverage, healthcare, and personal care industries, antimicrobial packaging enhances product safety, reduces waste, and ensures compliance with stringent health and safety regulations. The materials used range from plastics and paperboards to biodegradable polymers, and the technology often combines chemical agents with natural antimicrobial substances.

The antimicrobial packaging market refers to the global industry involved in the production, distribution, and commercialization of packaging materials that have built-in antimicrobial properties. This market spans a wide range of applications, including food and beverage preservation, pharmaceutical packaging, and medical device protection. As consumer awareness regarding food safety and hygiene grows, alongside stringent regulations for maintaining health standards in industries like food and healthcare, the antimicrobial packaging market has emerged as a key enabler of product innovation and quality assurance.

Several factors are driving the growth of the antimicrobial packaging market. Rising concerns about food safety, particularly in light of high-profile contamination incidents and global health pandemics, have fueled demand for technologies that ensure extended product freshness. Additionally, the growing pharmaceutical and healthcare sectors, which require sterile packaging for drugs and medical devices, have further amplified the need for antimicrobial solutions. Technological advancements in material science, such as the development of nanotechnology-enabled antimicrobial agents and biodegradable options, are also expanding the application scope of these solutions, driving innovation and scalability across industries.

Demand for antimicrobial packaging is primarily driven by the food and beverage sector, which accounts for the largest market share. Increasing consumer demand for fresh, minimally processed foods with extended shelf lives has made antimicrobial packaging a necessity. Similarly, the pharmaceutical industry is seeing rising demand for antimicrobial packaging due to the growing prevalence of chronic diseases, aging populations, and the need for safe and sterile drug packaging. The healthcare sector’s increased focus on infection control in hospital environments has further contributed to the adoption of antimicrobial packaging solutions for medical devices and supplies.

The antimicrobial packaging market is poised for significant growth, with ample opportunities in both developed and emerging markets. In developed economies, the emphasis on sustainability and environmentally friendly packaging is driving innovation in biodegradable antimicrobial materials, presenting new avenues for market players.

Meanwhile, in emerging markets, rapid urbanization, rising disposable incomes, and the expansion of organized retail are creating a robust demand for packaged food and pharmaceuticals, which, in turn, is propelling the need for antimicrobial packaging solutions. Additionally, as e-commerce continues to expand globally, the demand for safe and durable packaging, particularly in temperature-sensitive supply chains, offers a lucrative growth opportunity for companies investing in this technology.

Key Takeaways

- The global antimicrobial packaging market is expected to grow at a rate of 7.4% annually from 2024 to 2033, increasing from USD 10.5 billion in 2023 to USD 21.4 billion by 2033.

- Plastic is the leading material type, making up 56.1% of the market due to its affordability and durability across various uses.

- Organic acids are the most popular antimicrobial agents, holding a 32.3% share, mainly because they are highly effective in ensuring food safety.

- Pouches are the top packaging type, accounting for 43.5% of the market, thanks to their flexibility, low cost, and excellent barrier properties.

- The food and beverage sector is the largest application area, representing 43.1% of the market, driven by the need for longer shelf life and safer consumable products.

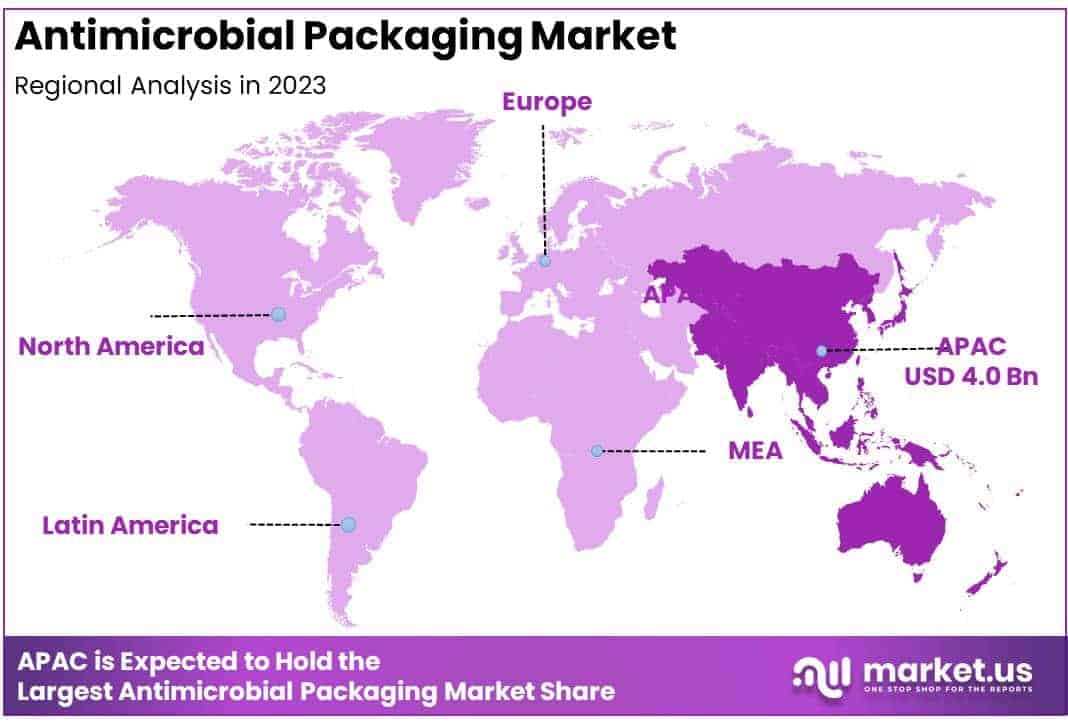

- Asia-Pacific is the leading region with 38.2% of the market share, supported by growing demand in the food and beverage industry and increasing urbanization.

Antimicrobial Packaging Statistics

- Reusable packaging can cut solid waste by up to 86%.

- It reduces CO2 emissions by up to 60% compared to single-use packaging.

- 64% of buyers prefer brands using sustainable packaging.

- Each year, unsafe food causes 600 million illnesses and 420,000 deaths globally.

- 33 million years of healthy lives are lost annually due to unsafe food.

- 30% of foodborne deaths involve children under 5 years old.

- 83% of younger consumers are willing to spend more on eco-friendly packaging.

- 77% of buyers struggle to verify sustainability claims.

- 69% of consumers distrust brands’ sustainability statements.

- 73% of people associate sustainability with recycled packaging.

- 78% believe brands should reduce plastic use.

- 52% would buy sustainable packaging if prices matched conventional options.

- Plastic packaging accounts for 40% of global plastic waste.

- Only 14% of plastic packaging is recycled globally.

- Reusing just 10–20% of plastic packaging can halve ocean plastic waste.

- 43% of consumers prioritize environmental impact when choosing packaging.

- 94% value transparency in product labeling.

- 69% of consumers see compostable packaging as highly sustainable.

- 75% prefer antimicrobial packaging for better safety and shelf life.

- 72% of Americans say packaging design influences buying decisions.

Emerging Trends

- Rising Demand for Biodegradable Materials: Antimicrobial packaging made from biodegradable and eco-friendly materials is gaining traction as environmental concerns grow globally. With over 35% of consumers preferring sustainable packaging, companies are innovating to combine antimicrobial properties with compostable materials to address both hygiene and environmental needs.

- Increased Integration of Natural Antimicrobial Agents: There is a growing shift toward using natural antimicrobial agents like essential oils (e.g., oregano, thyme) and plant extracts in packaging. This approach appeals to industries like food and beverages that require non-toxic solutions to extend shelf life while maintaining consumer health and safety.

- Expansion in Active Packaging Technologies: The adoption of active packaging, which interacts with the packaged product to prevent bacterial growth, is on the rise. Recent innovations include oxygen scavengers and moisture regulators integrated with antimicrobial materials, reducing spoilage rates by up to 50%.

- Advancements in Nanotechnology: The use of nanomaterials, such as silver and zinc oxide nanoparticles, is revolutionizing antimicrobial packaging. These nanoparticles provide long-lasting antimicrobial effects while using smaller quantities, reducing material costs by approximately 20% compared to traditional solutions.

- Focus on Pharmaceutical and Healthcare Sectors: Antimicrobial packaging is increasingly applied in pharmaceutical and medical industries. With an estimated 8% rise in demand for sterile packaging solutions, antimicrobial technologies are being leveraged to maintain the sterility of medical products during transport and storage.

Top Use Cases

- Food Preservation: Antimicrobial packaging is widely used in the food industry to extend the shelf life of perishable items like meat, dairy, and fresh produce. Studies show that antimicrobial packaging can reduce bacterial growth on fresh meat by up to 40%, preventing spoilage and reducing food waste.

- Pharmaceutical Packaging: In the healthcare sector, antimicrobial packaging helps maintain the sterility of medicines and medical devices. This reduces the risk of contamination during storage or transport, which is critical in regions with limited access to advanced healthcare infrastructure.

- E-commerce Applications: The rise of online food delivery services has created a demand for safer and more hygienic packaging. Antimicrobial films and wraps are being used to ensure that food products remain uncontaminated during transit, addressing the concerns of over 50% of customers worried about food safety in delivery.

- Cosmetics and Personal Care Products: Antimicrobial packaging is increasingly used for cosmetics and personal care items like lotions, creams, and shampoos. These products are prone to contamination after repeated use, and antimicrobial packaging can help extend their usability while ensuring consumer safety.

- Medical Equipment Packaging: Antimicrobial coatings are applied to packaging for surgical instruments, catheters, and diagnostic devices to minimize infections in healthcare settings. This has become particularly important as the global healthcare-associated infections (HAIs) rate remains as high as 10% in some regions.

Major Challenges

- High Manufacturing Costs: Producing antimicrobial packaging often involves advanced materials like nanoparticles, which can increase manufacturing costs by up to 30%. This cost burden limits adoption, particularly among small and medium-sized enterprises.

- Regulatory Barriers: Compliance with stringent regulations regarding food safety and the use of antimicrobial agents in packaging is a significant challenge. For instance, approvals from bodies like the FDA or EFSA can delay product launches by several months, impacting market timelines.

- Consumer Perception and Awareness: A lack of awareness about the benefits of antimicrobial packaging can hinder adoption. Surveys show that nearly 40% of consumers remain unaware of how antimicrobial packaging works or its role in food safety, limiting demand in some markets.

- Environmental Concerns: While antimicrobial packaging is effective, the use of synthetic materials and chemicals raises sustainability concerns. Non-biodegradable options contribute to plastic waste, leading to criticism from environmentally conscious stakeholders.

- Limited Effectiveness Against Certain Microbes: Some antimicrobial agents are not effective against all types of bacteria, viruses, or fungi. For example, packaging that protects against E. coli may not be as effective against Listeria, requiring more tailored solutions and additional R&D investments.

Top Opportunities

- Growing Demand for Food Safety Solutions in Emerging Markets: Emerging economies in Asia and Africa are witnessing an increased focus on food safety, driven by rising disposable incomes and urbanization. With food waste in these regions reaching 30-50%, antimicrobial packaging presents a key opportunity to improve supply chain efficiency.

- Innovation in Edible Packaging: The development of edible antimicrobial packaging is an emerging opportunity, particularly in the food and beverage sector. For instance, seaweed-based films infused with natural antimicrobial agents can provide dual benefits of sustainability and product protection.

- Digital Integration for Smart Packaging: Combining antimicrobial packaging with smart technologies like RFID tags or QR codes is gaining momentum. These solutions enable real-time monitoring of freshness and hygiene levels, which can reduce foodborne illnesses affecting nearly 600 million people annually.

- Adoption in Cold Chain Logistics: With the global cold chain market expanding rapidly, antimicrobial packaging can play a critical role in ensuring the safety of temperature-sensitive products such as seafood, vaccines, and fresh produce, reducing spoilage rates by up to 25%.

- Partnerships with Sustainable Material Suppliers: Collaborations with suppliers specializing in sustainable materials, such as polylactic acid (PLA) or cellulose-based films, can enable the development of eco-friendly antimicrobial packaging solutions. This approach can address the dual demands of hygiene and sustainability, a priority for over 60% of global consumers.

Asia Pacific Antimicrobial Packaging Market

Asia Pacific Leads Antimicrobial Packaging Market with Largest Market Share of 38.2%

In 2023, the Asia Pacific region emerged as the dominant player in the antimicrobial packaging market, holding the largest market share of 38.2% and contributing approximately USD 4.0 billion in revenue. This dominance is attributed to several factors, including the region’s rapidly expanding food and beverage industry, increasing consumer awareness about food safety, and the growing adoption of advanced packaging solutions across key markets such as China, India, and Japan.

Rising urbanization and disposable incomes in these countries are driving demand for packaged foods, which, in turn, fuels the adoption of antimicrobial packaging to enhance shelf life and maintain product quality. Moreover, strong government regulations focused on food safety standards further bolster the market’s growth in the region.

Asia Pacific’s robust manufacturing ecosystem, coupled with its cost-efficient production capabilities, positions it as a hub for antimicrobial packaging solutions. Notably, China and India serve as the largest contributors within the region, benefiting from large-scale production and distribution networks. The region’s strong growth trajectory reflects its critical role in meeting global demand for advanced packaging technologies.

Key Player Analysis

- Amcor plc: Amcor plc is a leading player in the antimicrobial packaging industry, offering advanced packaging solutions designed to inhibit microbial growth and ensure food safety. The company leverages its R&D capabilities to develop innovative materials that reduce contamination risks while maintaining product quality. Amcor’s revenue reached approximately USD 15 billion in FY2023, supported by strong demand across food, beverage, and healthcare sectors.

- DuPont: DuPont has established itself as a key innovator in antimicrobial materials, supplying solutions that cater to food packaging and medical applications. Its proprietary technologies, such as Tyvek® material, are widely recognized for their protective and antimicrobial properties. DuPont’s 2023 revenue totaled around USD 13.3 billion, reflecting steady growth in specialty materials and packaging innovation.

- Dunmore Europe GmbH: Dunmore Europe GmbH specializes in advanced coatings and laminates for antimicrobial packaging applications. The company integrates cutting-edge antimicrobial technologies into its packaging films to enhance hygiene and safety. Dunmore’s emphasis on custom-engineered solutions has helped it secure a significant market presence in Europe, with revenue exceeding EUR 200 million in recent years.

- Tetra Pak International S.A.: Tetra Pak is a global leader in food packaging and processing solutions, offering antimicrobial packaging that enhances product shelf life while reducing food waste. The company focuses on sustainability and innovation, introducing antimicrobial features into its recyclable packaging materials. In 2023, Tetra Pak reported net sales of approximately EUR 11.5 billion, underscoring its dominance in the market.

Recent Developments

- In 2023, Amcor (NYSE: AMCR, ASX: AMC) unveiled its Fiscal Year 2023 Sustainability Report titled “The Future of Packaging is Here.” The report highlights the company’s progress toward its long-standing sustainability goals and showcases its role as a leader in responsible packaging solutions.

- In 2023, CHARLOTTE, N.C. – SEE (NYSE: SEE) completed its acquisition of Liquibox for $1.15 billion on a cash and debt-free basis. This move strengthens SEE’s position in flexible packaging, particularly within its CRYOVAC® Fluids & Liquids segment, enhancing innovation and accelerating its shift toward sustainable, automated solutions.

- In 2023, Aptar Pharma confirmed its participation as an Official Premium Partner at Pharmapack 2024 in Paris. During the event, the company will present cutting-edge drug delivery systems across multiple therapeutic areas, aiming to advance patient care through innovative technologies and digital health solutions.

- In May 2023, Avient Corporation introduced ColorMatrix™ Ultimate™ UV390R at the Plastics Recycling Show Europe. This UV-absorbing additive enhances recyclability by reducing yellowing in recycled PET materials while maintaining effective UV protection for packaging applications.

- In May 2023, DuPont (NYSE: DD) announced a definitive agreement to acquire Spectrum Plastics Group from AEA Investors. The acquisition, funded through existing cash reserves, is set to close by the end of Q3 2023, pending regulatory approval and standard closing conditions.

Conclusion

The antimicrobial packaging market is poised for robust growth, driven by rising consumer demand for safer, longer-lasting, and more sustainable packaging solutions across industries such as food, healthcare, and pharmaceuticals. Advancements in materials science, including the development of biodegradable polymers and nanotechnology-enabled antimicrobial agents, are creating innovative opportunities to meet evolving industry and consumer needs. Additionally, increasing awareness of food safety, infection control, and waste reduction is bolstering the adoption of antimicrobial packaging globally.

While challenges such as high production costs and regulatory complexities persist, the market is expected to overcome these hurdles through technological innovation, strategic collaborations, and expanding applications in emerging economies. With its potential to enhance product quality, reduce spoilage, and ensure safety, antimicrobial packaging is set to remain a critical focus for businesses aiming to align with health, sustainability, and efficiency goals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)