Table of Contents

Introduction

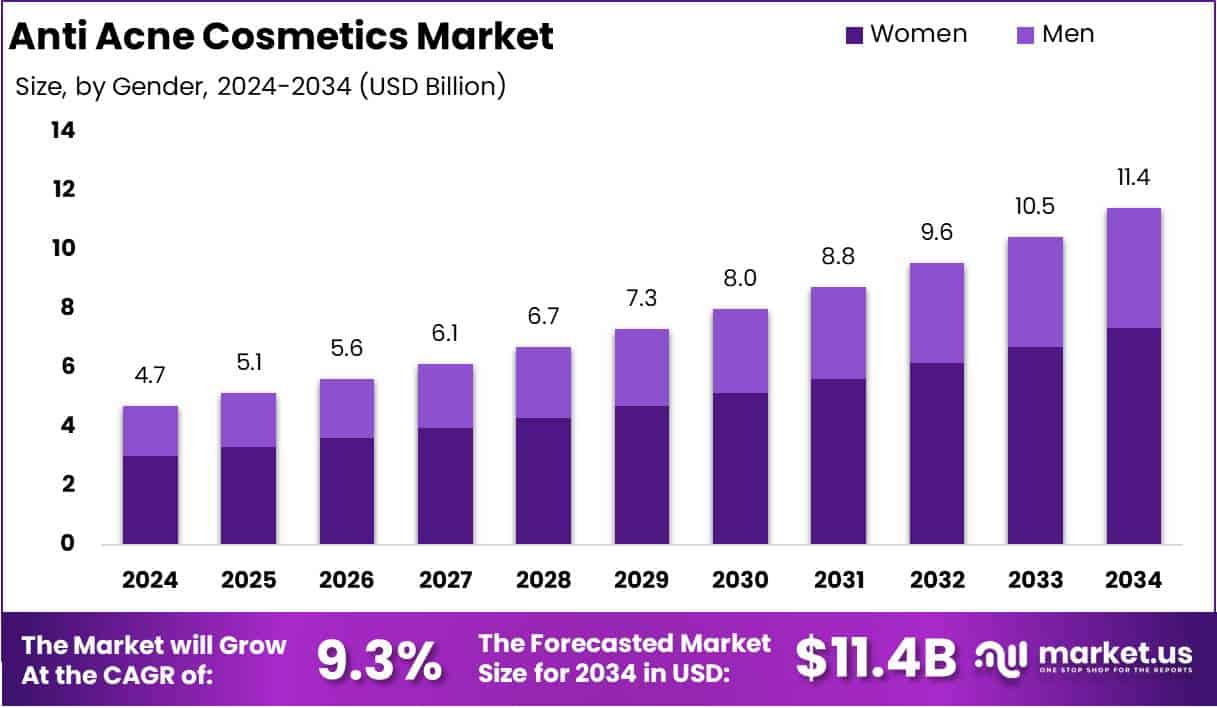

New York, NY – Feb. 06, 2025- The Global Anti-Acne Cosmetics Market is projected to reach approximately USD 11.4 billion by 2034, up from USD 4.7 billion in 2024, growing at a compound annual growth rate (CAGR) of 9.3% between 2025 and 2034.

The Anti-Acne Cosmetics market refers to a segment of the broader skincare industry that focuses on products specifically formulated to prevent, treat, and manage acne-related skin issues. These products include topical solutions like creams, gels, serums, face washes, and masks, which often contain active ingredients such as salicylic acid, benzoyl peroxide, retinoids, and natural extracts designed to reduce acne breakouts, soothe inflammation, and promote clearer skin.

The market is growing rapidly due to an increasing awareness of skincare, heightened consumer interest in self-care, and the rise in acne prevalence among adolescents and adults alike. Growth factors driving the market include a rising demand for non-prescription acne treatment solutions, growing awareness about the long-term effects of acne on skin health, and increased investment in research to develop advanced, effective, and safe cosmetic formulations.

Furthermore, the integration of innovative ingredients, such as probiotics and antimicrobial peptides, into cosmetic formulations is contributing to market growth. Consumer demand is also being driven by a preference for products with natural or organic ingredients, as well as cruelty-free and dermatologically tested claims.

The market presents significant opportunities for companies to tap into niche segments, such as customized skincare solutions and the growing e-commerce space, where consumers are increasingly turning to online platforms to purchase products. With rising disposable income, evolving beauty standards, and the continuous need for personalized skincare, the Anti-Acne Cosmetics market offers a promising outlook, especially for brands that innovate and align with consumer trends around sustainability and efficacy.

Key Takeaways

- The global Anti-Acne Cosmetics market is forecast to grow from USD 4.7 billion in 2024 to USD 11.4 billion by 2034, with a compound annual growth rate (CAGR) of 9.3%.

- Creams & lotions are the leading product category, expected to account for over 42.1% of the market share in 2024, due to their effectiveness and hydrating properties.

- Women represent the largest demographic, holding more than 64.3% of the market share in 2024, driven by growing awareness and demand for personalized solutions.

- Medspa services dominate the End-Use segment, with more than 62.2% of the market share in 2024, as consumers increasingly prefer non-invasive, professional acne treatments.

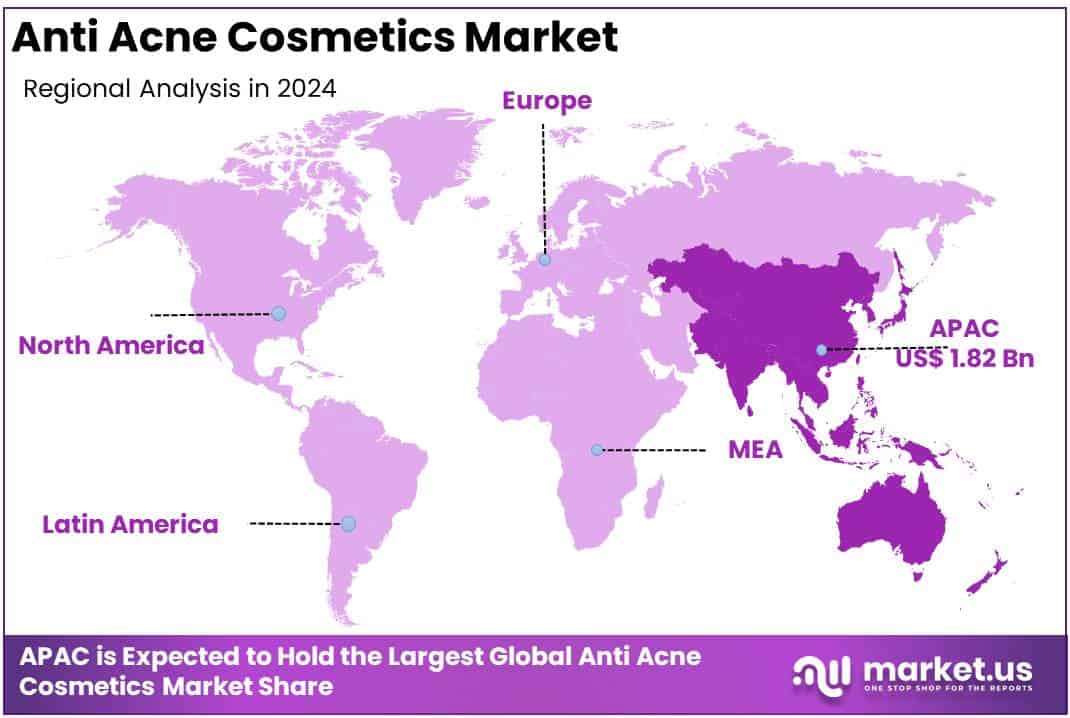

- The APAC region is the market leader, holding 41.5% of the global market share in 2024, driven by strong demand in countries like China, India, and Southeast Asia.

Anti Acne Cosmetics Statistics

- The beauty industry generates over $100 billion globally each year.

- The men’s personal care market is expected to reach $276.9 billion by 2030.

- Skincare sales are projected to hit $177 billion by 2025.

- Beauty companies spent $7.7 billion on advertising in 2022.

- Cosmetic retailers earned $17.09 billion from online sales.

- L’Oréal led the market with over $40 billion in sales in 2022.

- Skincare makes up 42% of the entire beauty market.

- 58% of shoppers spend between $1 and $100 monthly on skincare and makeup.

- 37% of consumers discover new cosmetic brands through social media ads.

- 75% of shoppers are willing to pay more for personalized experiences.

- In the U.S., the skincare market generated $21.08 billion in 2023.

- The U.S. skincare market is expected to grow by $3.7 billion from 2023 to 2028.

- By 2025, the global beauty market will reach $716 billion.

- 67% of consumers regularly use makeup products.

- Online beauty sales grew 23.6%, reaching over $5 billion.

- The average American spends nearly $200 annually on cosmetics.

- 57% of American women prefer all-natural skincare.

- The pandemic may cause a 20-30% decline in the global cosmetic market.

- The beauty services industry in the U.S. employs over 670,000 people.

Emerging Trends

- Natural and Organic Products: Consumers are increasingly preferring anti-acne products that contain natural ingredients such as tea tree oil, witch hazel, and aloe vera. This trend is driven by concerns over the potential side effects of synthetic chemicals.

- Personalized Skincare Solutions: Advances in technology have allowed skincare brands to offer personalized anti-acne treatments. Customized formulations are becoming popular due to the growing demand for products tailored to individual skin types and acne severity.

- Use of Advanced Delivery Systems: New delivery systems like microencapsulation and nanotechnology are being employed to improve the effectiveness and penetration of acne treatments into the skin. This helps increase product performance and customer satisfaction.

- Increased E-commerce Adoption: E-commerce platforms are seeing a surge in the sales of anti-acne cosmetics. Consumers prefer the convenience of buying skincare products online, often influenced by social media recommendations and online reviews.

- Hybrid Products: The rise of multi-functional skincare products is notable. Anti-acne products that also offer anti-aging, skin hydration, and sun protection are gaining traction, as consumers seek to streamline their skincare routines.

Top Use Cases

- Treatment for Active Acne: The primary use case for anti-acne cosmetics is to treat existing acne. These products typically contain ingredients like salicylic acid, benzoyl peroxide, and sulfur, which help reduce inflammation and clear pores.

- Preventive Care: Many consumers use anti-acne products to prevent breakouts before they occur. These products focus on maintaining clear skin and keeping pores unclogged.

- Sensitive Skin Solutions: Anti-acne cosmetics are also used for sensitive skin types. Special formulations are developed to treat acne while being gentle enough to avoid irritation or dryness, which is common in acne treatments.

- Post-Acne Scarring Treatment: Some anti-acne products are formulated to help with the healing process and reduce the visibility of scars after acne has cleared up. Ingredients like niacinamide and retinoids are frequently included in these products.

- Oily Skin Control: Products designed for oily skin can help reduce sebum production and minimize acne outbreaks. These products often include mattifying agents to help control shine and provide a smooth finish.

Major Challenges

- Skin Sensitivity and Irritation: Many anti-acne products contain strong active ingredients like benzoyl peroxide, which can cause dryness, irritation, and peeling. Managing skin reactions remains a challenge for both manufacturers and consumers.

- High Price of Premium Products: High-quality anti-acne cosmetics, especially those using natural or organic ingredients, can be expensive. The price barrier limits access for some potential customers, especially in developing markets.

- Lack of Regulation: In some regions, the regulation of cosmetic products is less stringent than pharmaceuticals, leading to inconsistencies in quality and safety standards. This can result in consumer distrust of certain products.

- Product Effectiveness Variability: Not all anti-acne products work for everyone, as the efficacy of treatments depends on skin type, acne severity, and other factors. This inconsistency can lead to customer frustration and a lack of brand loyalty.

- Allergic Reactions and Side Effects: Some consumers experience allergic reactions to certain ingredients in anti-acne products, such as fragrances or preservatives. This risk hampers widespread adoption of some treatments.

Top Opportunities

- Growth in Emerging Markets: As disposable incomes rise in regions like Asia-Pacific and Latin America, the demand for anti-acne products is increasing. These regions are seeing a shift towards skincare as part of personal care routines, creating a significant growth opportunity for anti-acne brands.

- Technological Integration: The integration of artificial intelligence (AI) and augmented reality (AR) for skin diagnosis is an opportunity for anti-acne cosmetic brands to enhance customer engagement and offer personalized product recommendations.

- Sustainability Focus: With growing concern about the environmental impact of cosmetics, there is an opportunity for brands to create eco-friendly packaging and promote sustainable sourcing of ingredients. This can appeal to environmentally conscious consumers.

- Product Innovation for Specific Acne Types: Innovating products that target specific types of acne—such as cystic acne, hormonal acne, or acne caused by stress—could help brands cater to a wider audience with specialized needs.

- Collaborations with Dermatologists and Influencers: Partnering with dermatologists and social media influencers can help brands establish credibility and widen their reach. This approach can also build consumer trust in the effectiveness of products.

Key Player Analysis

In 2024, key players in the global anti-acne cosmetics market are actively shaping industry trends through innovation and strategic positioning. Companies like PCA, Obagi, and SkinMedica continue to lead the market with their clinically backed formulations, focusing on products that not only treat acne but also promote overall skin health. PHYTOMER and Glowbiotics LLC are gaining traction with their use of natural and probiotic-based ingredients, appealing to the growing consumer demand for clean and sustainable skincare.

Skinbetter Science and Colorescience stand out for their technology-driven approach, offering scientifically advanced solutions that combine acne treatment with anti-aging properties. Brands like Sente and Jan Marini Skin Research are also strengthening their position by integrating cutting-edge technologies such as growth factor-based ingredients. Meanwhile, Revision Skincare, The BeautyHealth Company, and Perricone MD focus on creating multifunctional products that cater to acne-prone skin while addressing broader skincare needs, thus enhancing their market appeal and consumer loyalty.

Top Market Key Players

- PCA

- Obagi

- PHYTOMER

- SkinMedica

- Skinbetter Science

- Colorescience

- Sente

- Jan Marini Skin Research

- Revision Skincare

- The BeautyHealth Company

- Glowbiotics LLC

- Perricone MD

Regional Analysis

Asia-Pacific Anti Acne Cosmetics Market with Largest Market Share of 41.5% in 2024

The Asia-Pacific region is expected to dominate the anti-acne cosmetics market, accounting for 41.5% of the total market share in 2024, with a market value projected at USD 1.82 billion. This growth can be attributed to a combination of factors such as a large and youthful population, rising disposable income, and an increasing focus on skincare, particularly in countries like China, Japan, India, and South Korea. Furthermore, the increasing prevalence of acne due to urbanization, dietary changes, and environmental pollution is fueling the demand for acne treatment products in this region.

The market’s expansion in Asia-Pacific is also driven by the widespread adoption of both international and local brands offering a wide range of anti-acne solutions tailored to diverse skin types and concerns. Key players in the region are increasingly leveraging e-commerce platforms to reach a broader audience, particularly in emerging markets. Additionally, the rising awareness about skincare routines, especially among the younger demographic, is fostering a robust growth trajectory for anti-acne cosmetics.

Recent Developments

- In November 2024, Proactiv® introduced four new products aimed at enhancing acne treatment routines for various skin types. As a leading brand in acne skincare, Proactiv focuses on tackling acne while also improving skin texture, reducing hyperpigmentation, and addressing body blemishes.

- In August 2024, L’Oréal acquired a 10% stake in Galderma Group AG from Sunshine SwissCo AG, a consortium including ADIA and Auba Investment Pte. The deal sets the stage for a scientific collaboration between L’Oréal’s skin biology expertise and Galderma’s dermatological innovations.

- In 2025, Kim Kardashian’s SKKY Partners announced a significant minority investment in luxury skincare brand 111Skin. This partnership strengthens SKKY’s footprint in the beauty and skincare industry, with backing from Kardashian and Jay Sammons, former head of consumer at Carlyle Group.

- In 2024, Allergan Aesthetics, part of AbbVie, introduced two new products aimed at acne-prone skin: SkinMedica Acne Clarifying Treatment and SkinMedica Pore Purifying Gel Cleanser. These products offer innovative solutions for managing acne while maintaining healthy skin balance.

Conclusion

The Anti-Acne Cosmetics market is experiencing significant growth, driven by a rising demand for effective, accessible, and safe acne treatments across all demographics. Factors such as an increased focus on skincare, the popularity of natural and personalized products, and innovations in ingredient technology are fueling market expansion. Additionally, the shift towards e-commerce, alongside growing awareness of acne’s impact on overall skin health, presents new opportunities for brands to cater to evolving consumer preferences. However, challenges like skin sensitivity, product efficacy variability, and price barriers remain key considerations for both companies and consumers. The continued development of advanced formulations and sustainable, consumer-centric strategies will be crucial in maintaining growth in this competitive sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)