Table of Contents

Introduction

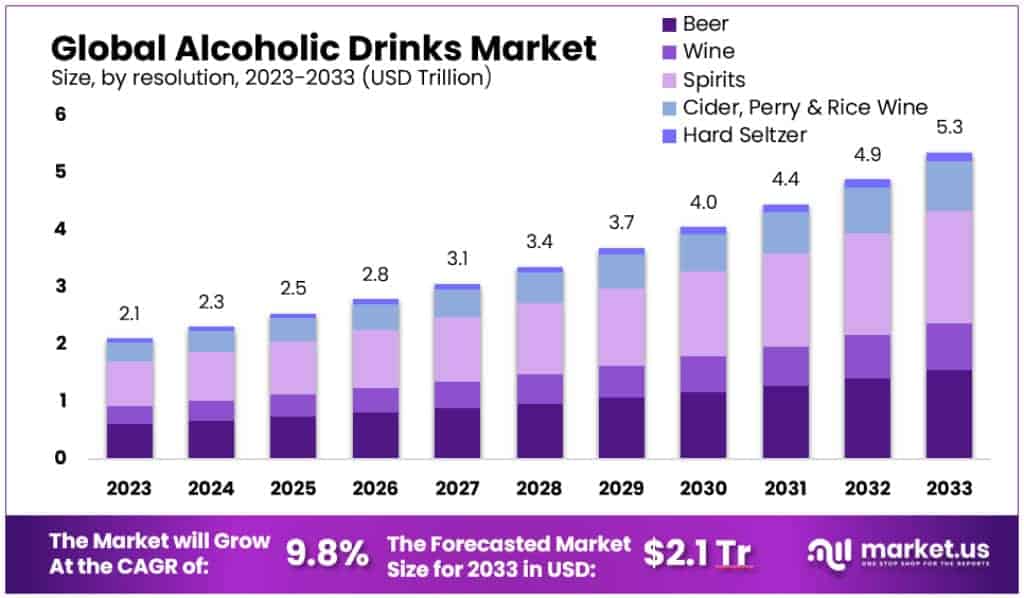

The global alcoholic drinks market is poised for significant growth, projected to increase from USD 2.1 trillion in 2023 to approximately USD 5.3 trillion by 2033, representing a compound annual growth rate (CAGR) of 9.8%. This expansion is underpinned by several key growth factors, challenges, and recent developments that shape the landscape of this dynamic industry.

A major driver of this market is the rising trend of premiumization, where consumers increasingly opt for higher-quality alcoholic beverages. This shift is fueled by growing disposable incomes and changing consumer preferences, particularly among young adults and in emerging markets.

The expansion of online retail platforms for alcohol sales, which saw significant growth during the COVID-19 pandemic, continues to play a crucial role, making it easier for consumers to access a variety of alcoholic beverages from home.

However, the industry faces notable challenges, including an increasing consumer shift towards health-conscious drinking. This has led to a higher demand for low-alcohol or non-alcoholic alternatives, impacting traditional alcoholic beverage sales.

Additionally, the market must navigate regulatory hurdles and health concerns that can stymie growth. For instance, the increased health awareness among consumers is pushing many towards beverages with reduced alcohol content, reflecting a broader trend of moderation driven by both health and economic concerns.

In 2023, Bacardi Limited has been particularly active, implementing environmental initiatives and expanding its product lines. They have launched a new system in Puerto Rico to reduce greenhouse gas emissions by 50% for their BACARDÍ rum, marking a significant step towards their Net Zero ambitions.

In 2023, Beam Suntory Inc. reported a 7% increase in net sales and a 13% rise in operating income. Significant contributions came from their core whiskey brands like Jim Beam and Maker’s Mark, as well as their Japanese whiskey portfolio, which saw strong demand, especially during the House of Suntory’s 100th anniversary.

Key Takeaways

- The global alcohol market is expected to reach a value of USD 5.3 trillion by 2033, up from USD 2.1 trillion in 2023.

- The market is projected to grow at a CAGR of 9.8% during the forecast period from 2023 to 2033.

- These beverages are categorized into three main types: beers, wines, and spirits, typically having alcohol content ranging from 3% to 50%.

- Spirits hold the dominant market share, accounting for over 36.5% of the market.

- Liquor stores dominate distribution channels, capturing over 27.5% of the market.

- In 2023, the Asia Pacific region will dominate the market with a 38.2% share, with a value of USD 798 billion.

Alcoholic Drinks Statistics

Global Alcohol Consumption and Preferences

- Wine contains around 12% pure alcohol per volume1 so one liter of wine contains 0.12 liters of pure alcohol. So, a value of 6 liters of pure alcohol per person per year is equivalent to 50 liters of wine. Or, 67 standard bottles of wine (which have a volume of 0.75 liters).

- The prevalence of drinking across North Africa and the Middle East is notably lower than elsewhere. Typically, 5 to 10 percent of adults across these regions drank in the preceding year, and in several countries, this was below 5 percent.

- 63% of men drank alcoholic beverages compared to 57% of women.

- 70% of those aged 35 to 54 years consumed alcohol compared to both younger (60%) and older consumers (52%).

- Beer remains a significant part of global alcohol consumption, accounting for about 40% of total alcoholic beverage consumption worldwide, reflecting its popularity across various cultures.

Regional and Demographic Alcohol Trends

- According to Numerator, 90% of Millennials purchased alcohol during the 52 weeks ending in May 2021, compared to 84% of 21 and older Gen Z shoppers. Gen Zs reasons for not buying included “alcohol’s impact on their mood, level of alertness, and even image on social media.”

- Beer: Men, consumers between 18 and 34, not college-educated, and those with an income less than $40,000 and between $40,000 and $99,999.

- Wine: Women, those aged 55 and older, were college-educated, and had annual household incomes of $100,000 and greater.

- Spirits: A higher percentage were men, aged 18 to 34, not college-educated, and those with an annual household income of $40,000 and $99,999.

- Moldova’s wine industry employs 1 out of every 10 Moldovans and makes up nearly 15% of the country’s annual budget. While wine may be a central part of Moldova’s economy and culture, it’s also responsible for higher-than-average alcohol consumption. Per citizen, Moldovans drink an average of 11.36 liters of alcohol per year.

Alcohol Types and Global Consumption

- Unsweetened, distilled, alcoholic drinks that have an alcohol content of at least 20% ABV are called spirits. For the most common distilled drinks, such as whisky (or whiskey) and vodka, the alcohol content is around 40%.

- Alcohol by volume (ABV) and alcohol proof are two measures of alcohol content, or the concentration of alcohol in a drink. Alcohol by volume is the number of milliliters of ethanol per 100 milliliters (or 3.4 fl.oz.) in a solution, while alcohol proof is twice the percentage of alcohol by volume. For example, a drink that has 50% ABV will be 100 proof.

- A standard beer, whether it be a lager or an ale, has between 4% to 6% ABV, although some beers have higher or lower concentrations of alcohol. For example, “light beers” only have between 2% to 4% ABV while “malt liquors” have between 6% to 8%.

- Worldwide consumption in 2019 was equal to 5.5 liters of pure alcohol consumed per person aged 15 years or older. This is a decrease from the 5.7 liters in 2010. Distilled alcoholic beverages are the most consumed, followed by beer and wines. The regions with the highest consumption are the WHO European Region (9.2 liters) and the Region of the Americas (7.5 liters).

- According to data collected by the World Health Organization, an estimated 2.3 billion people currently drink alcohol. While alcohol consumption is clearly a worldwide trend, some countries have higher-than-average alcohol consumption rates.

Emerging Trends

- Expansion of Ready-to-Drink (RTD) Options: RTDs have surged to a market size of $10.7 billion in 2023, with their success driven by the convenience and variety they offer. These products cater to the fast-paced lifestyles of consumers who appreciate the ease of pre-mixed beverages.

- Focus on Health and Wellness: Consumer interest in healthier lifestyle choices has fueled the growth of non-alcoholic and low-alcohol beverages. In 2023, sales for these alternatives reached $565 million, marking a 35% increase from the previous year, underscoring a shift towards moderation and wellness in drinking habits.

- Premiumization Trend: There is a clear consumer preference for high-quality, premium alcoholic beverages. Buyers are increasingly seeking out products with distinctive narratives and exceptional quality, willing to spend more for beverages that provide unique and authentic experiences.

- Eco-Conscious Choices: Sustainability is becoming a critical factor in consumer purchases within the alcohol market. Customers are gravitating towards brands that commit to transparent and sustainable practices, particularly in the premium sector, where the sourcing and quality of ingredients are crucial.

- Diversification and Innovation: The alcoholic drinks industry is experiencing a broadening in the variety of available products, especially in the craft beer and spirit-based RTD segments. This growth is driven by consumer demand for novel flavors and high-quality options, with spirit-based RTDs enjoying rapid expansion due to their flavorful and convenient nature.

Use Cases

- Public Health Impacts: Alcoholic drinks contribute significantly to public health issues, including chronic diseases like cancer, liver disease, and cardiovascular problems. Excessive alcohol consumption leads to approximately 178,000 deaths annually in the United States, with these conditions developing from long-term alcohol use.

- Economic Costs: The economic burden of excessive alcohol use in the U.S. is substantial, costing approximately $249 billion in 2010. This includes direct costs related to healthcare and indirect costs due to lost productivity and other factors. Each alcoholic drink consumed incurs an additional economic cost of about $2.05.

- Safety and Accident Rates: Short-term excessive alcohol use is closely linked with increased rates of accidents and injuries, including motor vehicle crashes, falls, and violence. These incidents not only affect those who drink but also significantly impact community safety and emergency services.

- Mental Health and Social Issues: Alcohol use is associated with various mental health issues, including depression and anxiety, and can exacerbate social problems such as domestic violence and child neglect. These impacts extend beyond individual drinkers, affecting families and communities.

- Resource Allocation for Prevention and Treatment: Significant resources are allocated towards preventing and treating alcohol-related issues. This includes public health campaigns, funding for treatment facilities, and law enforcement efforts to manage the consequences of excessive drinking. Effective prevention strategies can reduce these impacts, which underscores the importance of continued investment in public health initiatives.

Major Challenges

- Regulatory Complexity: The alcoholic drinks industry faces stringent federal and state regulations, which can vary widely and impact how products are distributed and sold. For instance, the three-tier distribution system in the U.S. complicates the process for small producers to get their products to market due to state-specific laws that can favor larger, established companies over new entrants or smaller craft producers.

- Market Competition and Consolidation: There’s significant competition within the industry, with larger firms often dominating market share. This is particularly challenging for small-scale producers like craft breweries, which, despite their growth, still hold a relatively small portion of the market. As of recent estimates, craft breweries account for approximately 24% of the U.S. beer market’s retail sales but only about 12% by volume.

- Taxation and Economic Burden: Excise taxes on alcohol vary by product type and production volume, which can disproportionately affect smaller producers. For example, distilled spirits face a federal excise tax rate of $2.70 per proof gallon for the first 100,000 gallons, but this rate increases significantly for higher volumes.

- Public Health Concerns: Alcohol consumption is linked to various public health issues, which can influence regulatory pressures and public perceptions. For instance, the rate of alcohol-related visits to emergency departments and alcohol-associated liver diseases is on the rise, particularly among younger adults and women.

- Supply Chain Vulnerabilities: The production of key ingredients like hops and barley is susceptible to climate change, which poses a risk to the supply chain and, consequently, to the stability of production costs and product availability.

Market Growth Opportunities

- Expanding Exports: The U.S. alcoholic beverage sector has shown a promising trend in exports. In 2023, the U.S. exported $3.79 billion worth of wine, beer, and spirits, with distilled spirits exports alone totaling $2.23 billion. The European Union, Canada, and Mexico are significant markets, indicating robust international demand.

- Regulatory Easements: Recent reductions in import duties for alcoholic beverages in regions like Hong Kong highlight a growing opportunity for U.S. exporters to increase market share in Asian markets. Such regulatory changes can significantly boost trade by making American products more competitively priced in these regions.

- Emerging Markets: Countries like Colombia present new market opportunities due to their free trade agreements, which provide duty-free access for a majority of U.S. food and beverage exports, including alcoholic beverages. U.S. exports to Colombia grew by 2% in 2023, reaching a record $20.3 million.

- Health and Wellness Trends: There’s a notable shift towards products that cater to health-conscious consumers. In markets like Colombia, demand for high-protein, high-calcium dairy products is surging, indicating a broader trend that could influence alcoholic beverages, particularly those perceived as healthier options.

- Cultural and Seasonal Influence: The U.S. market sees significant seasonal peaks in alcohol sales during cultural and holiday seasons, such as the Oktoberfest and the year-end holidays. Understanding these patterns can help producers and retailers time their market entry and promotional efforts to maximize sales.

Key Players Analysis

- Bacardi Limited, as the world’s largest privately held spirits company, continues to influence cocktail culture with its diverse portfolio of premium brands like Bacardi rum, Grey Goose vodka, and Patrón tequila. In 2024, Bacardi focuses on trends such as innovative aging and blending of spirits, and a surge in demand for NoLo (non-alcoholic) beverages.

- Carlsberg A/S has experienced growth in its alcohol-free and ‘beyond beer’ beverage categories, with a 6% increase in its alcohol-free portfolio and a 10% rise in the ‘beyond beer’ category, which includes ready-to-drink products. This performance reflects a broader trend in the industry where health consciousness is driving demand for low and no-alcohol options.

- Anheuser-Busch InBev SA/NV, a major player in the alcoholic drinks sector, has recently reported a 2.7% increase in revenue for the second quarter of 2024, along with a significant growth in EBITDA by 10.2%. This performance highlights a successful strategic execution, despite a slight decline in total volumes by 0.8%. The company’s digital platforms are playing a crucial role, with about 70% of its revenue being generated through B2B digital channels.

- In 2023, Beam Suntory Inc. reported a 7% increase in sales, with significant growth in its premium bourbons and Japanese whiskies. The company’s Ready-to-Drink (RTD) brands also saw robust sales growth, indicating a strong consumer reception for these products. This performance underscores Beam Suntory’s effective strategy of focusing on premium and luxury spirits, which continues to drive its global market presence.

- Diageo Plc reported a significant 10.7% jump in sales, achieving a total of £17.1 billion. This growth was largely driven by a strong performance in their premium-plus brands and substantial gains in their Scotch and Tequila segments. Particularly noteworthy were their Scotch sales, which rose by 12%, and Tequila sales, which saw an impressive 19% increase, driven largely by brands like Don Julio and Casamigos.

- Constellation Brands Inc. achieved a strong performance in its beer business in 2023, with an 8% increase in net sales and a 16% rise in operating income from this segment. This growth was driven by popular brands like Modelo Especial and Corona Extra. The company also saw significant demand for its high-end Power Brands in the Wine & Spirits segment, helping to drive overall corporate growth despite some challenges in the wine and spirits categories.

- United Spirits Ltd., a Diageo subsidiary in India, saw a notable increase in net sales by 17.7% in the second quarter of fiscal 2023, driven by strong consumer demand and significant growth in its ‘prestige and above’ portfolio. This segment alone grew by 23.1% due to innovative strategies and brand renovations.

- In 2023, Molson Coors Beverage Company saw positive results across its key brands, driven by increased pricing and higher sales volumes. This performance reflects their focus on premiumization, successfully appealing to a broader consumer base through strategic marketing and product innovation. Despite facing industry-wide challenges like cost inflation, the company maintained its commitment to growth, emphasizing the success of its core brands like Coors Light and Miller Lite, alongside innovations in their product lineup.

- In 2024, Heineken N.V. showcased a solid performance, particularly in its premium beer segment which saw notable growth. The brand’s flagship, Heineken®, expanded its volume by 9.2%, supported by strong market performance in Brazil, China, Vietnam, and the DRC. Heineken® Silver also demonstrated significant growth, particularly in Vietnam and China.

- Pernod Ricard SA reported a 10% organic growth in net sales for fiscal year 2023, reaching €12.13 billion. The company saw broad-based growth across all regions, supported by strong pricing execution. Notably, their strategic international brands like Jameson, Absolut, and Martell each grew by 11%. Pernod Ricard continues to focus on premiumization and has reaffirmed its financial guidance through 2025, aiming for the upper end of 4% to 7% growth in net sales.

- Brown-Forman Corporation experienced modest growth, with net sales increasing slightly by 3% in the first half of fiscal 2024. Despite facing ongoing market challenges and normalization trends following two years of stronger growth, the company has adjusted its full-year expectations. It now anticipates flat organic net sales and a slight increase in organic operating income.

- Kirin Holdings Company, Limited has demonstrated resilience and growth in its alcoholic beverages sector, particularly focusing on enhancing its core brands and expanding its health science business. In recent financial results, Kirin showed a strong performance, especially in their core brands which continue to drive their market presence. The company has strategically increased its investment in these core brands to solidify its foundation for future growth.

- Asahi Group Holdings, Ltd. saw a 3.8% increase in total revenue in the first half of 2024, bolstered by effective pricing strategies and premiumization efforts across all divisions. Despite some regional downturns, particularly in Oceania, overall core operating profit increased by 6.2%. These financial results highlight Asahi’s adept management in adjusting to market conditions to maintain a growth trajectory.

- Thai Beverage Public Company Limited experienced a stable performance in fiscal year 2024, achieving a revenue increase of 2.2% across its diverse portfolio of beverages and food. The growth was driven by advancements in both the beer and non-alcoholic segments, which saw revenue boosts of 2.4% and 4.2% respectively. However, the company faced challenges such as elevated interest costs and income taxes which resulted in a slight decline in profit after tax and minority interests by 0.8%.

Conclusion

The alcoholic drinks market in 2024 is defined by a vibrant mix of innovation and evolving consumer preferences. Notably, there’s a strong demand for hard seltzers and ready-to-drink (RTD) cocktails, driven by their convenience and the expanding variety of options.

Meanwhile, natural and organic wines are gaining traction, particularly among younger consumers who appreciate their unique profiles and sustainable production methods. Additionally, low- and no-alcohol beverages continue to grow in popularity, reflecting a broader shift towards health-conscious consumption habits.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)