Table of Contents

Introduction

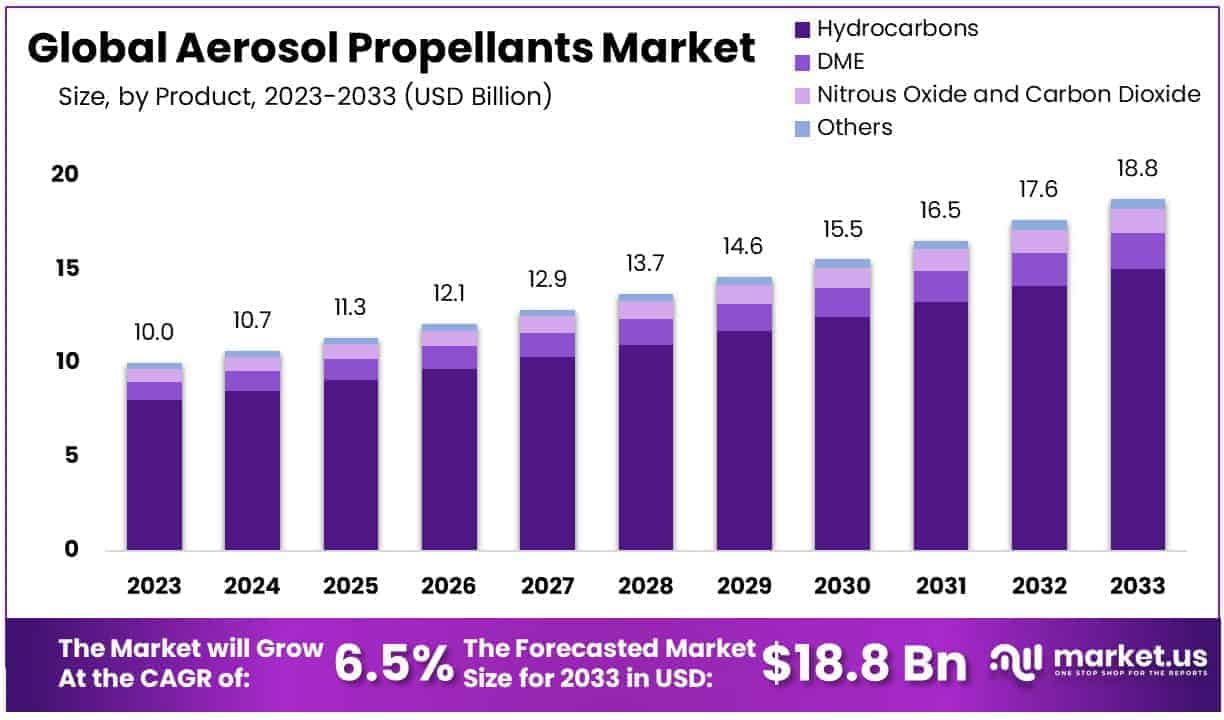

The Aerosol Propellants Market is projected to increase from USD 10.0 Billion in 2023 to approximately USD 18.8 Billion by 2033, achieving a compound annual growth rate (CAGR) of 6.50% over the forecast period from 2024 to 2033.

Aerosol propellants are chemical substances used in aerosol cans to create the force that expels the product from the can. These are typically gases like hydrocarbons, nitrous oxide, or carbon dioxide, which remain in liquid form under pressure but vaporize when dispensed. The Aerosol Propellants Market refers to the industry involved in manufacturing and distributing these propellants for various applications, including personal care, household, medical, and automotive products.

Growth in the market is primarily driven by the increasing demand for aerosol products, advancements in sustainable propellant formulations, and rising consumer preference for convenient packaging solutions. Opportunities in the market are expanding with the innovation of eco-friendly propellants, responding to regulatory pressures and environmental concerns. This shift is leading companies to explore alternatives like compressed air and natural gases, offering a significant growth avenue within the sector as consumer awareness and environmental regulations become more stringent.

Key Takeaways

- The global aerosol propellants market is projected to grow from USD 10.0 billion in 2023 to USD 18.8 billion by 2033, with a CAGR of 6.50% during 2024–2033.

- Hydrocarbons hold an 80.2% market share due to their cost-effectiveness and compatibility, especially in personal care products like deodorants and hairsprays.

- The personal care segment dominates with a 34.2% share, driven by innovative delivery systems and rising consumer health and hygiene awareness.

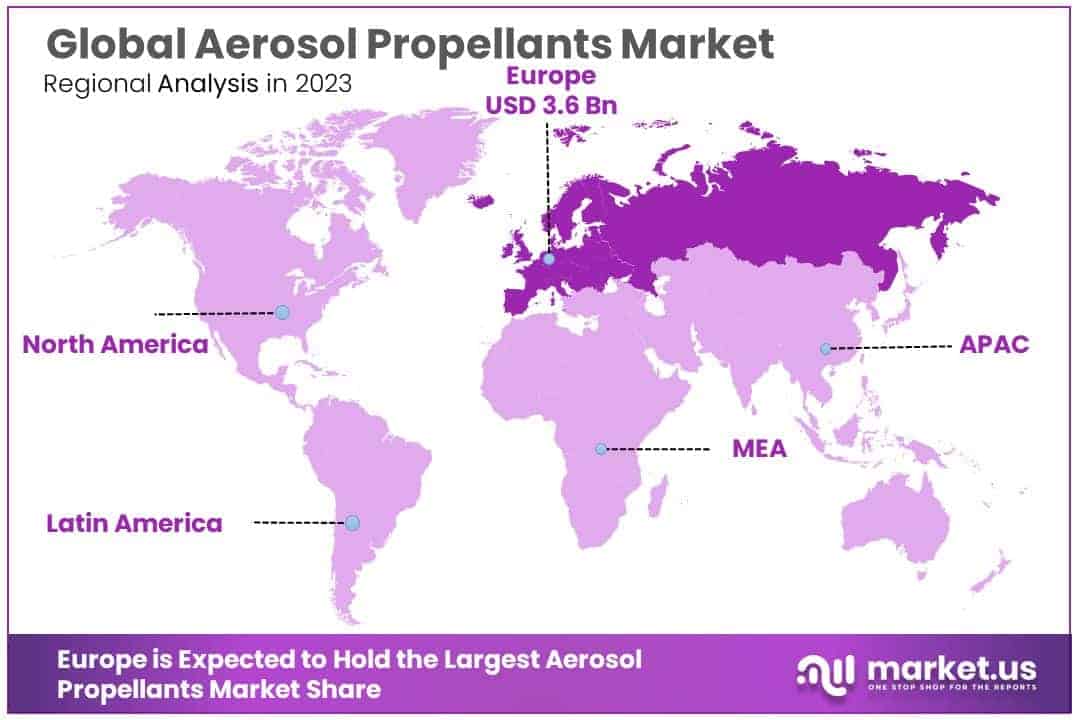

- Europe leads the market with a 36.2% share, followed by North America at 29.8%, reflecting strong demand across industries.

Key Segments Analysis

Hydrocarbons dominate the aerosol propellants market with an 80.2% share, driven by their cost-effectiveness, broad compatibility, and high vapor pressure, making them ideal for products like hairsprays and deodorants. Their lower environmental impact compared to chlorofluorocarbons (CFCs) aligns with sustainability trends, though they face regulatory challenges to reduce VOC emissions. Complementing hydrocarbons, dimethyl ether (DME) gains popularity for dual propellant-solvent functions, while nitrous oxide and carbon dioxide cater to niche applications in food and medical products, showcasing the market’s dynamic response to evolving demands and regulation

The personal care segment leads the Aerosol Propellants Market with a 34.2% share, driven by its extensive use in products like deodorants, hairsprays, and shaving creams. Growth is fueled by rising consumer spending on grooming, innovations in aerosol delivery systems, and heightened health awareness. Other key segments, including household (disinfectant sprays), automotive and industrial (lubricants, paint sprays), food (culinary aerosols), paints and coatings, and medical applications, also contribute significantly, reflecting the market’s diverse and evolving applications.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 10 Billion |

| Forecast Revenue (2033) | USD 18.8 Billion |

| CAGR (2024-2033) | 6.50% |

| Segments Covered | By Product (Hydrocarbons , DME , Nitrous Oxide and Carbon Dioxide , Others), By End-Use (Personal Care , Household , Automotive and Industrial , Food , Paints and Coatings , Medical , Others) |

| Competitive Landscape | Royal Dutch Shell, DuPont de Nemours Inc., Brothers Gas, The Chemours Company, Aeropress Corporation, Nouryon, Harp International Ltd, AVEFLOR, A.S., Exxon Mobil Corporation, Sinopec, TPC Group, Reliance Industries Limited, Honeywell International Inc., PCC Group |

Emerging Trends

- Shift to Eco-friendly Propellants: There’s a growing move from traditional hydrofluorocarbons (HFCs) to propellants with low global warming potential (GWP), like hydrofluoroolefins (HFOs). This change aims to lessen environmental harm.

- Use of Compressed Gases: Propellants such as carbon dioxide (CO₂) and nitrogen are becoming more popular. They don’t harm the ozone layer or contribute to global warming, making them environmentally friendly options.

- Focus on Safety: There’s an increased emphasis on using non-flammable propellants to improve product safety. This is especially important in household and personal care items to reduce fire risks.

- Regulatory Changes: New rules are pushing the industry to adopt sustainable propellants. This is leading to more research and development of eco-friendly alternatives.

- Technological Innovations: Advancements in aerosol technology are enabling the use of a wider range of propellants. This allows for better product performance and environmental benefits.

Top Use Cases

- Personal Care Products: Aerosol propellants are widely used in items like deodorants, hairsprays, and shaving creams. They help deliver the product evenly and efficiently.

- Household Cleaners: In products such as disinfectants and air fresheners, propellants enable easy application over large areas, enhancing user convenience.

- Food Industry: Propellants are used in products like whipped cream dispensers, allowing for controlled and hygienic dispensing.

- Medical Applications: Inhalers for respiratory conditions use aerosol propellants to deliver medication directly to the lungs, providing quick relief.

- Automotive Products: Spray paints and lubricants in the automotive sector use propellants for precise application, improving maintenance and repair processes.

Major Challenges

- Environmental Impact: Traditional propellants like HFCs have high GWPs, contributing to climate change. Reducing their use is a significant challenge.

- Regulatory Compliance: Meeting evolving environmental regulations requires reformulating products, which can be costly and time-consuming.

- Safety Concerns: Some propellants are flammable or toxic, posing risks during manufacturing, storage, and use. Ensuring safety while maintaining performance is crucial.

- Supply Chain Issues: Sourcing sustainable propellants can be challenging due to limited availability, affecting production timelines and costs.

- Performance Trade-offs: Switching to eco-friendly propellants may impact product performance, requiring significant research to achieve desired results.

Top Opportunities

- Development of Sustainable Propellants: Investing in eco-friendly alternatives can open new market segments and meet consumer demand for green products.

- Expansion in Emerging Markets: Growing economies present opportunities for aerosol products, increasing the demand for propellants.

- Innovation in Product Applications: Developing new aerosol-based products can drive demand for specialized propellants, fostering market growth.

- Advancements in Technology: Improving aerosol delivery systems can enhance product efficiency, creating opportunities for propellant manufacturers.

- Consumer Preference for Convenience: The demand for easy-to-use aerosol products supports the growth of the propellant market, as consumers seek efficient solutions.

Key Player Analysis

- Royal Dutch Shell is a prominent player in this market, leveraging its extensive experience in hydrocarbon production to supply propellants for various aerosol applications. The company’s integration across the oil and gas value chain ensures a consistent supply of raw materials essential for propellant manufacturing.

- DuPont de Nemours Inc. contributes to the aerosol propellants market by offering specialized chemicals and propellant solutions tailored for diverse industries, including personal care and household products. Their focus on innovation and sustainability aligns with the industry’s shift towards eco-friendly propellant alternatives.

- The Chemours Company, a spin-off from DuPont, specializes in chemical solutions and is a key supplier of propellants used in various aerosol products. Their commitment to research and development has led to the introduction of advanced propellant formulations that meet stringent environmental regulations.

- Honeywell International Inc. is actively involved in producing environmentally friendly aerosol propellants. Their Solstice® Propellant, for instance, is designed to have a low global warming potential, catering to the increasing demand for sustainable solutions in the aerosol industry.

- Nouryon, formerly part of AkzoNobel, offers a range of chemical products, including those used as aerosol propellants. Their global presence and focus on innovation enable them to meet the evolving needs of the aerosol market, particularly in developing sustainable and efficient propellant systems.

Regional Analysis

Europe Leads the Aerosol Propellants Market with Largest Market Share of 36.2% in 2023

In 2023, Europe emerged as the leading region in the aerosol propellants market, capturing a dominant 36.2% share of the global market. The region’s market value was estimated at USD 3.6 billion, driven by robust demand across various sectors such as personal care, healthcare, and automotive. Countries like Germany, the UK, and France contribute significantly to this leadership, underpinned by advanced manufacturing capabilities and strong consumer preference for aerosol-based products.

Europe’s stringent environmental regulations and advancements in sustainable and eco-friendly propellant technologies have further bolstered its position. The region’s growth is also supported by rising investments in research and development, catering to the increasing demand for innovative solutions in packaging and product delivery systems.

Recent Developments

- In 2024, GSK took a significant step towards its environmental goals by advancing its low-carbon version of the Ventolin inhaler to Phase III clinical trials. This innovative inhaler, using a next-generation propellant, aims to reduce greenhouse gas emissions by around 90%, aligning with the company’s net-zero climate objectives.

- In 2023, Colep Packaging and Envases Group joined forces to establish a new aerosol packaging facility in Mexico. The project focuses on three aluminum aerosol production lines to serve customers across Mexico and Central America. Paulo Sousa, CEO of Colep Packaging, emphasized this move as a key milestone in expanding the company’s presence in the aluminum aerosol market.

- In 2023, Honeywell revealed that the clinical skincare brand myDerm integrated its Solstice® Propellant in their new Mineral SPF 50 sunscreen spray. The propellant, with an ultra-low global warming potential, offers a 99% reduction in greenhouse gas emissions compared to traditional options, supporting more sustainable product solutions.

Conclusion

The aerosol propellants market is poised for significant growth, driven by increasing demand across various sectors such as personal care, household products, and automotive applications. This expansion is further supported by technological advancements and a shift towards eco-friendly propellant options. However, challenges remain, including stringent environmental regulations and the need for sustainable alternatives. To capitalize on emerging opportunities, industry players should focus on innovation, regulatory compliance, and meeting evolving consumer preferences.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)