Table of Contents

Introduction

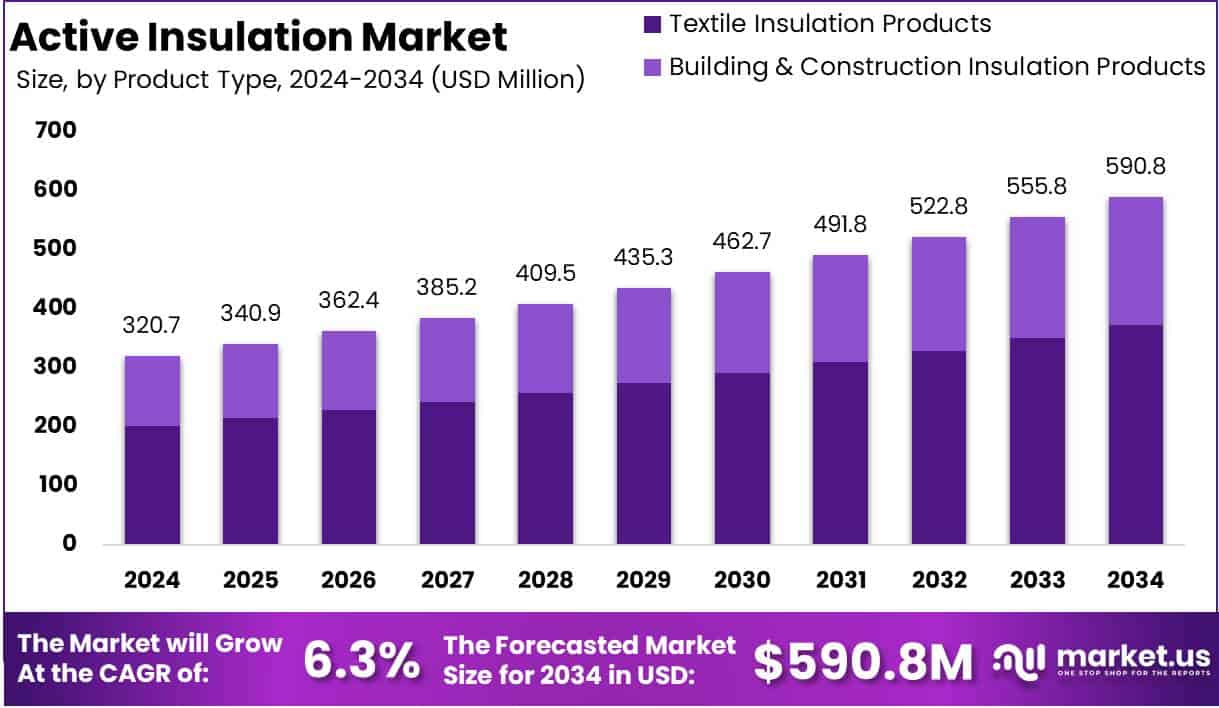

The Global Active Insulation Market is projected to reach approximately USD 590.8 million by 2034, up from USD 320.7 million in 2024, reflecting a compound annual growth rate (CAGR) of 6.3% during the forecast period from 2025 to 2034.

The Active Insulation Market is witnessing significant expansion, driven by increasing demand for high-performance insulation materials across industries such as construction, automotive, and textiles. Active insulation refers to advanced insulation materials that regulate heat transfer dynamically by adapting to changing environmental conditions, ensuring optimal thermal comfort and energy efficiency. Unlike passive insulation, active insulation materials respond to temperature fluctuations, thereby enhancing energy conservation and sustainability.

The market for active insulation is growing due to rising concerns over energy efficiency regulations, stringent building codes, and increasing adoption of eco-friendly materials. The construction industry, particularly in residential and commercial sectors, is a primary driver, fueled by the need for enhanced thermal management and reduced energy consumption. Additionally, the automotive industry is incorporating active insulation in electric vehicles (EVs) to improve battery efficiency and passenger comfort.

Growing demand for high-performance outerwear in the textile industry, particularly for sportswear and extreme weather apparel, is another key factor propelling market growth. Opportunities in this market are expanding as advancements in nanotechnology and smart materials facilitate the development of innovative insulation solutions. Government incentives promoting green buildings and energy-efficient transportation further contribute to market expansion.

Moreover, the growing trend of sustainable construction and green retrofitting in developed economies is expected to accelerate adoption. However, high initial costs and limited awareness in emerging markets may pose challenges to growth. Nevertheless, as technological advancements continue to enhance material efficiency and cost-effectiveness, the active insulation market is expected to witness steady growth over the coming years, presenting lucrative opportunities for key players in the industry.

Key Takeaways

- The global active insulation market is projected to grow from USD 320.7 million in 2024 to USD 590.8 million by 2034, registering a CAGR of 6.3% during the forecast period.

- Textile insulation products held a dominant position in 2024, accounting for over 63% of the market share.

- The textile sector emerged as the leading end-use segment in 2024, contributing to more than 59% of the market share.

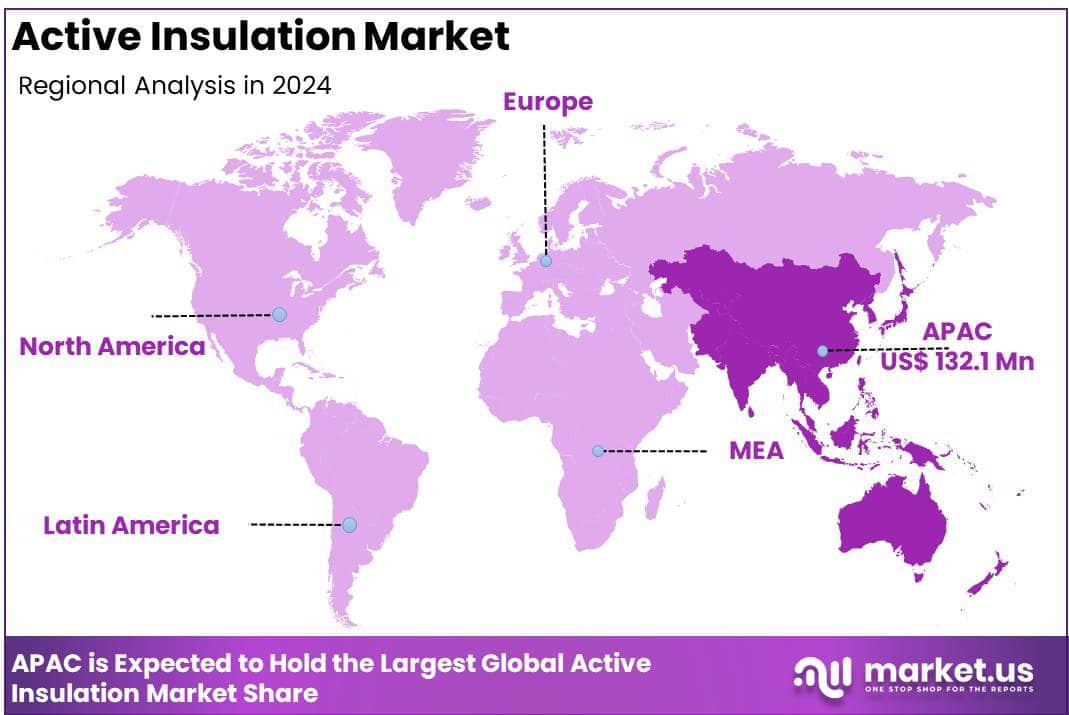

- Asia Pacific led the global active insulation market in 2024, securing the largest market share of 41%, with a market valuation of USD 132.1 million.

Active Insulation Statistics

- Insulation reduces carbon dioxide emissions by 780 million tons annually.

- An uninsulated home can lose up to 60% of its energy through walls.

- Heating and cooling account for 50% to 70% of energy use in an average American home.

- Insulation saves over 600 times more energy yearly than compact fluorescent lights, Energy Star appliances, and Energy Star windows combined.

- It slows heat transfer but does not block airflow.

- Cellulose insulation contains 85% recycled paper.

- Mineral wool insulation consists of 75% post-industrial recycled content.

- Fiberglass insulation includes up to 60% recycled materials.

- Insulation pays for itself within five to six years and continues saving money for decades.

- Heating and cooling make up 54% of an average utility bill.

- Proper insulation can reduce energy costs by up to 40%.

- Around 40% of UK homes have poor wall insulation, leading to higher utility bills.

Emerging Trends

- Integration of Bio-based Materials: There is a growing shift towards incorporating bio-based materials in insulation products. Innovations such as mycelium-based composites and algae-derived materials are being explored for their sustainability and performance benefits.

- Development of Fast-Growing Bio-materials: Materials like hemp, straw, flax, kenaf, bamboo, and eucalyptus are being utilized due to their rapid growth and renewability, offering sustainable alternatives for insulation applications.

- Advancements in Phase Change Materials (PCMs): PCMs are being integrated into insulation systems to enhance thermal regulation by absorbing and releasing heat, thereby improving energy efficiency in buildings.

- Adoption of Vacuum Insulation Panels (VIPs): VIPs are gaining traction due to their superior thermal resistance, allowing for thinner insulation solutions without compromising performance.

- Emphasis on Acoustic Insulation: There is an increasing focus on materials that provide both thermal and acoustic insulation, addressing the need for noise reduction in urban environments.

Top Use Cases

- Building and Construction: Active insulation materials are extensively used in residential and commercial buildings to enhance energy efficiency and occupant comfort.

- Automotive Industry: Insulation materials are applied in vehicles to improve thermal comfort and reduce noise, contributing to a better driving experience.

- Textile Industry: Active insulation is utilized in performance apparel, such as sportswear and outdoor clothing, to provide thermal regulation and breathability.

- Aerospace Sector: Insulation materials are critical in aerospace applications to manage extreme temperatures and ensure passenger comfort and safety.

- Electronics: Insulation is used in electronic devices to manage heat dissipation, ensuring optimal performance and longevity of components.

Major Challenges

- High Production Costs: Manufacturing insulation materials often involves energy-intensive processes, leading to elevated production costs.

- Regulatory Compliance: Navigating complex regulatory standards for safety, energy efficiency, and environmental sustainability can be resource-intensive for manufacturers.

- Market Competition: The presence of numerous players in the insulation market leads to intense competition, necessitating continuous innovation and differentiation.

- Consumer Awareness: Educating consumers about the benefits and proper installation of advanced insulation materials remains a challenge.

- Environmental Concerns: Addressing the environmental impact of traditional insulation materials and transitioning to sustainable alternatives require significant investment and research.

Top Opportunities

- Development of Bio-based and Recyclable Materials: Investing in sustainable insulation solutions, such as bio-based and recyclable materials, presents significant growth opportunities.

- Retrofit Projects: The growing emphasis on energy efficiency in existing buildings offers a substantial market for insulation retrofitting.

- Technological Innovations: Advancements in nanotechnology and material science can lead to the development of more efficient and cost-effective insulation products.

- Emerging Markets: Rapid urbanization and industrialization in emerging economies present opportunities for market expansion.

- Government Initiatives: Supportive policies and incentives for energy-efficient construction and renovation projects can drive the demand for advanced insulation materials.

Key Player Analysis

The Global Active Insulation Market in 2024 is characterized by the presence of key players adopting strategic initiatives to strengthen their market position. 3M continues to leverage its innovation capabilities, offering high-performance insulation solutions across multiple industries.

Armacell remains a leader in flexible insulation materials, catering to the construction and industrial sectors. H. Dawson Wool and MacCann & Byrne (Ecological Building Systems) focus on sustainable insulation solutions, aligning with the growing demand for eco-friendly products.

Imerys, Knauf Digital GmbH, and Koch Industries (Invista) are capitalizing on advanced material technologies to enhance thermal efficiency. Milliken & Company, Owens Corning, Rockwool A/S, and Saint-Gobain Group dominate the market with diversified insulation offerings and robust distribution networks.

Neo Thermal Insulation (India) Private Limited and Polybond strengthen their presence in emerging markets with cost-effective solutions. PrimaLoft Inc., Ultralight Outdoor Gear Ltd, and W. L. Gore & Associates, Inc. focus on high-performance outdoor and technical applications. Remmers GmbH and Unger-Diffutherm GmbH prioritize sustainable and energy-efficient insulation materials, contributing to market growth.

Top Key Players

- 3M

- Armacell

- H. Dawson Wool

- Imerys

- Knauf Digital GmbH

- Koch Industries (Invista)

- MacCann & Byrne (Ecological Building Systems)

- Milliken & Company

- Neo Thermal Insulation (India) Private Limited

- Owens Corning

- Polybond

- PrimaLoft Inc.

- Remmers GmbH

- Rockwool A/S

- Saint-Gobain Group

- Ultralight Outdoor Gear Ltd

- Unger-Diffutherm GmbH

- W. L. Gore & Associates, Inc.

Regional Analysis

Asia Pacific Leads the Active Insulation Market with the Largest Market Share of 41% in 2024

Asia Pacific dominates the global active insulation market, accounting for 41% of the total market share in 2024, with a market value of approximately USD 132.1 million. The region’s leadership can be attributed to the rising demand for energy-efficient insulation solutions in the construction and textile sectors, particularly in emerging economies such as China, India, and Japan.

The rapid urbanization, infrastructure expansion, and increasing adoption of sustainable building materials are key factors driving market growth. Additionally, the region benefits from a strong manufacturing base and cost-effective production capabilities, further propelling demand for active insulation materials. China, being the largest contributor, continues to dominate due to large-scale construction activities and government initiatives promoting energy-efficient solutions.

The textile industry in countries like Bangladesh and Vietnam also plays a crucial role, as active insulation fabrics witness heightened demand in sportswear and outdoor apparel. The presence of key industry players and favorable regulatory policies supporting green buildings further bolster market expansion across the region.

Recent Developments

- In 2023, Kingspan Group plc, a leading provider of high-performance insulation and building solutions, secured a significant agreement with Schramek GmbH to acquire approximately 51% of Steico SE shares, with an option to purchase an additional 10% in the future. This strategic acquisition expands Kingspan’s portfolio, enhancing its commitment to sustainable and energy-efficient building solutions. Steico’s expertise in wood-based insulation complements Kingspan’s market reach, reinforcing its mission to drive innovation and sustainability in the construction industry.

- In 2023, HD® Wool Apparel Insulation, in collaboration with Rudholm, gained recognition in the Sourcing Journal for its advancements in outerwear insulation. The natural and renewable insulation, designed for outdoor and lifestyle apparel, offers superior temperature regulation and moisture management. Committed to sustainability, HD Wool Apparel Insulation supports regenerative farming through the Ecological Outcome Verification program, ensuring continuous progress in land restoration and sustainable sourcing.

- In 2023, Polartec®, a brand under Milliken & Company, announced the winners of the Polartec Apex Awards, recognizing excellence in textile innovation. The awards celebrate designers and brands that push the boundaries of functionality and durability in performance, sport, and lifestyle apparel. Selected from numerous entries, the winning garments exemplify cutting-edge material technology, reinforcing Polartec’s leadership in sustainable and high-performance textiles.

Conclusion

The active insulation market is set for strong growth, driven by rising demand for energy-efficient solutions across construction, automotive, and textile industries. The market is expected to expand significantly, with the construction sector leading adoption to enhance building efficiency, while the automotive industry integrates active insulation for better thermal management. In textiles, these materials are gaining popularity in performance apparel. Innovations in bio-based and recyclable materials further support market expansion. Despite challenges like high production costs and regulatory hurdles, ongoing advancements ensure steady growth and new opportunities for industry players.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)