Table of Contents

Introduction

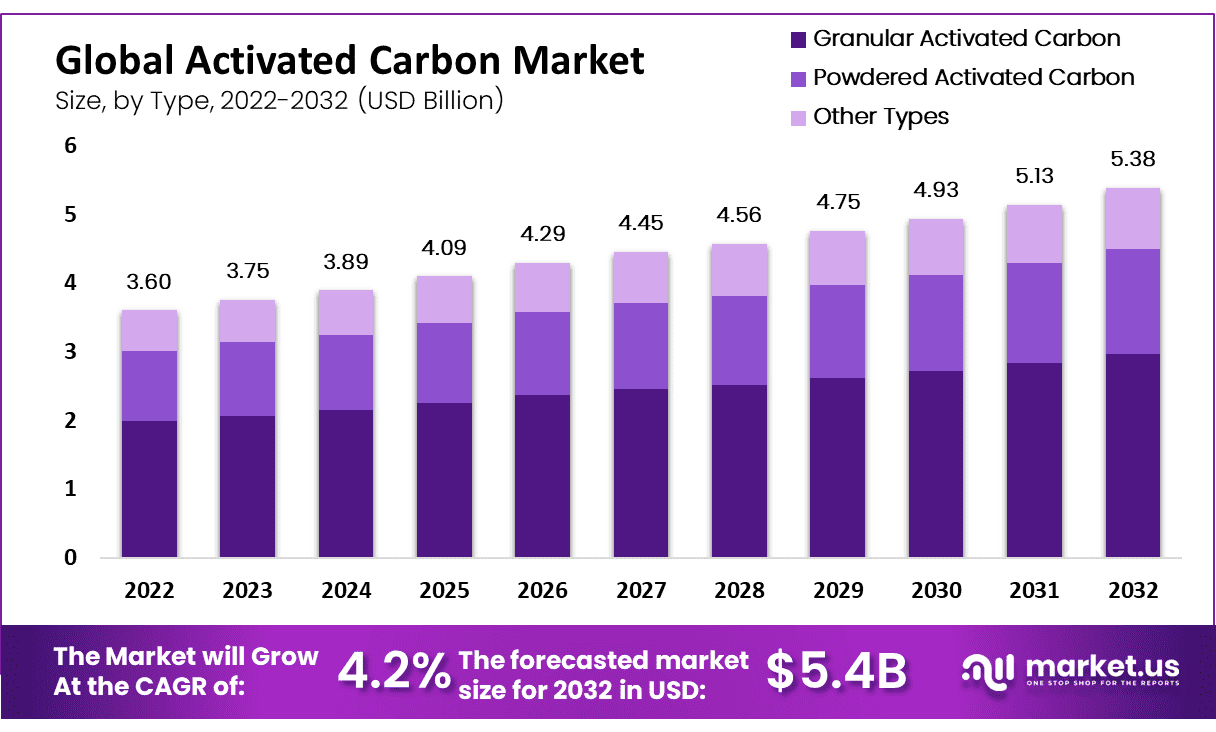

The global activated carbon market is projected to experience robust growth, with the market size anticipated to reach approximately USD 5.4 billion by 2032, up from USD 3.6 billion in 2022. This growth represents a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2023 to 2033. The market’s expansion is driven by increasing applications across various industries, including water and air purification, pharmaceuticals, and food processing.

Rising environmental concerns and stricter regulations regarding air and water quality are propelling the demand for activated carbon, which is widely used for its adsorption properties to remove contaminants. Recent developments include advancements in manufacturing technologies and the introduction of innovative activated carbon products that offer enhanced performance and sustainability.

For instance, the development of bio-based activated carbon from renewable sources is gaining traction as a sustainable alternative to traditional materials. However, the market faces challenges such as fluctuating raw material prices and the high cost of activated carbon production, which can impact overall profitability. Additionally, the market must navigate regulatory challenges and competition from alternative purification technologies.

Despite these hurdles, the growing emphasis on environmental protection and technological advancements in activated carbon are expected to drive continued market growth. Overall, the activated carbon market is set for a positive trajectory, with opportunities for expansion in both established and emerging sectors.

CarbPure Technologies has recently made significant strides in the activated carbon market by launching a new line of high-performance, environmentally friendly activated carbon products. This innovation targets applications in air and water purification, emphasizing sustainable production methods. CarbPure’s focus on green technologies aligns with the increasing demand for eco-friendly solutions, marking a strategic move to capture a larger share of the growing market.

Cabot Corporation has expanded its presence in the activated carbon market through a strategic acquisition of a specialty carbon manufacturer. This move enhances Cabot’s production capabilities and broadens its product portfolio to include advanced activated carbon solutions for diverse applications, such as industrial air and water treatment. The acquisition is expected to strengthen Cabot’s market position and drive innovation in its product offerings.

Boyce Carbon has recently secured funding to enhance its research and development efforts in activated carbon technology. The investment will focus on developing new, high-efficiency activated carbon products and expanding production facilities to meet increasing market demand. Boyce Carbon’s emphasis on innovation and scaling up production capabilities positions it to capitalize on growth opportunities in various sectors.

Jacobi Carbons Group has introduced a new range of activated carbon products designed for specific industrial applications, including water treatment and air purification. The company has also invested in advanced manufacturing technologies to improve product performance and sustainability. Jacobi Carbons’ recent product developments and technological advancements are aimed at meeting the evolving needs of its global customer base.

Statistics

- In 2016, China exported 17k tons wood wood-based activated carbon, at 16% CAGE, valued at 62 million dollars. Fujian at 40% of market shares.

- One of the most challenging aspects of an activated carbon operation is the relatively low yield; roughly just 15% of the original feedstock quantity exits the process as a product, though output is dependent on the type of feedstock, as well as its carbon content.

- For biomass to effectively undergo carbonization, the moisture content must be less than 10% (by weight). Since raw biomass typically comes in at anywhere between 40-60% moisture, most facilities require a drying process before the actual conversion process.

- Activation occurs at around 1,750°F with the injection of saturated steam.

- The activated carbons produced have surface areas (CO2 adsorption) as high as 1200 m2/g and CCl4 numbers of 70–80.

- Activation at 800°C in steam for 2–3 hours, following initial carbonization, produces an activated carbon in about 10% yield (by weight) of the initial cherry stone.

- The activation temperature is 700 – 1000 °C. After the water gas reaction, the carbon is partially burned.

- a cube of activated carbon with an edge length of 1.0 cm, for example, has an inner surface area that is 10,000 times larger.

- For comparison: 2.0 grams of activated carbon has an inner surface area roughly the size of a soccer field.

- This also increases the inner surface area of the activated carbons to 500 to 1500 m²/g.

- Granular activated carbons generally range in particle sizes of 0.2 mm to 5 mm and can be used in both gas and liquid phase applications.

- Extruded activated carbons are cylindrical pellet products ranging in size from 1 mm to 5 mm.

- Ideally, the amount of physical moisture contained within the activated carbon should fall within 3-6%.4

- The hull structure is dominated by 0.4-micron pores which facilitate access to internal microporosity.

Emerging Trends

- Sustainable Production: There is a growing emphasis on producing activated carbon from renewable and eco-friendly sources. Companies are developing activated carbon from agricultural by-products and other sustainable materials to reduce environmental impact. For example, some manufacturers are now using biochar, which is derived from biomass, as a feedstock for activated carbon production.

- Advanced Adsorption Technologies: Innovations in activated carbon technologies are enhancing its adsorption capabilities. New materials and treatments are being developed to improve the efficiency of activated carbon in removing contaminants from air and water. This includes advancements in the development of high-capacity activated carbons that offer superior performance in challenging applications.

- Increase in Industrial Applications: Activated carbon is increasingly being used in specialized industrial applications beyond traditional water and air purification. Its use is expanding into areas such as gold recovery in mining, pharmaceutical manufacturing, and even in the production of energy storage devices like batteries.

- Regenerative Technologies: The development of regenerative activated carbon technologies is gaining traction. These methods allow for the recycling and reuse of activated carbon, reducing waste and operational costs. Regenerative techniques include thermal reactivation and chemical regeneration, which help extend the lifecycle of activated carbon products.

- Smart and Functional Carbons: The market is seeing the introduction of smart and functional activated carbon products. These include carbon materials with embedded sensors or those designed for specific applications like pollutant detection or targeted environmental remediation, making them more versatile and effective.

Use Cases

- Water Purification: Activated carbon is widely used in water treatment facilities to remove contaminants and impurities. It is highly effective in adsorbing chlorine, volatile organic compounds (VOCs), and other pollutants. The global market for water treatment using activated carbon is projected to reach USD 1.8 billion by 2027, driven by increasing demand for clean drinking water.

- Air Purification: Activated carbon filters are commonly used in air purifiers to remove airborne pollutants such as odors, smoke, and volatile organic compounds. The air purification segment is growing, with the market expected to reach USD 2.5 billion by 2026. This growth is fueled by heightened awareness of indoor air quality and increasing urbanization.

- Industrial Processes: Activated carbon is used in various industrial processes, including gold recovery in mining, where it helps extract gold from ore. In 2023, the use of activated carbon in gold recovery was valued at approximately USD 400 million, reflecting its critical role in the mining industry.

- Pharmaceuticals: Activated carbon plays a role in the pharmaceutical industry by assisting in drug manufacturing and purification processes. It is used to remove impurities and ensure the purity of medications. The market for activated carbon in pharmaceuticals is growing, with expectations to reach USD 250 million by 2025.

- Food and Beverage Industry: In the food and beverage industry, activated carbon is used to decolorize and purify various products. It helps in removing unwanted colors and flavors from liquids. The food-grade activated carbon market is projected to grow to USD 500 million by 2024, driven by increasing demand for high-quality processed foods.

Major Challenges

- High Production Costs: The production of activated carbon involves complex and energy-intensive processes, including carbonization and activation. These processes can be costly, contributing to high production expenses. The cost of raw materials, such as coal and coconut shells, has risen, which affects the overall cost of activated carbon. As of 2023, production costs are estimated to constitute 50-60% of the final product’s price.

- Raw Material Supply and Price Volatility: The supply and price of raw materials used for activated carbon production, such as coal and coconut shells, are subject to fluctuations. For instance, the price of coconut shells has increased by approximately 20% over the past two years due to supply constraints. This volatility can impact production stability and pricing.

- Regulatory Challenges: Activated carbon products must comply with various environmental and health regulations, which can vary by region. Adhering to these regulations can be challenging and costly. For example, the European Union has stringent regulations on carbon emissions and waste management, which can impact the production and disposal of activated carbon.

- Competition from Alternative Technologies: The market faces competition from alternative purification technologies, such as advanced oxidation processes and membrane filtration. These technologies are sometimes seen as more efficient or cost-effective, posing a challenge to the activated carbon market. The growth of alternative technologies is expected to influence market dynamics and could affect activated carbon’s market share.

- Disposal and Environmental Concerns: The disposal of spent activated carbon presents environmental concerns. Used carbon must be properly managed to prevent environmental contamination. Additionally, the process of reactivating spent carbon can be energy-intensive and costly. Addressing these environmental and disposal issues is crucial for sustainability.

Market Growth Opportunities

- Expansion in Emerging Markets: The demand for activated carbon is rising in emerging markets due to increasing industrial activities and growing environmental concerns. Regions such as Asia-Pacific and Latin America are witnessing substantial growth, with the Asia-Pacific activated carbon market expected to reach USD 2.2 billion by 2027. This growth is driven by rapid urbanization and industrialization.

- Advancements in Technology: Innovations in activated carbon production and application technologies present significant growth opportunities. For example, developments in regeneration technologies, such as thermal and chemical reactivation, can improve the efficiency and cost-effectiveness of activated carbon. The market for advanced activated carbon technologies is projected to grow at a CAGR of 5.5% through 2030.

- Increased Use in Air and Water Purification: Growing awareness about environmental pollution and stricter regulations on air and water quality are boosting the demand for activated carbon. The global air and water purification market, which extensively uses activated carbon, is expected to reach USD 9.6 billion by 2026, providing ample opportunities for growth in these segments.

- Emerging Applications in New Industries: Activated carbon is finding new applications in industries such as pharmaceuticals, food and beverage, and energy storage. For instance, its use in energy storage solutions, such as supercapacitors, is an emerging trend. The market for activated carbon in energy applications is expected to grow significantly, with a projected CAGR of 6.3% over the next decade.

- Sustainability and Green Initiatives: The push towards sustainable and eco-friendly products is creating opportunities for activated carbon made from renewable resources. Companies focusing on bio-based and recyclable activated carbon are likely to benefit from increasing consumer preference for sustainable solutions. This segment is expected to grow, with a market potential of USD 700 million by 2025.

Key Players

CarbPure Technologies specializes in producing advanced activated carbon solutions aimed at improving environmental sustainability. The company has recently launched innovative products focused on enhancing water and air purification processes. CarbPure’s emphasis on developing eco-friendly and high-performance activated carbon aligns with the growing demand for green technologies. Their efforts are expected to strengthen their market position and contribute to the overall growth of the activated carbon industry.

Cabot Corporation is a major player in the activated carbon market, known for its comprehensive range of products used in air, water, and industrial applications. Recently, Cabot expanded its capabilities through the acquisition of a specialty activated carbon manufacturer, enhancing its production capacity and product offerings. This strategic move allows Cabot to better meet the increasing demand for advanced activated carbon solutions and reinforces its leadership in the industry.

Boyce Carbon is a prominent player in the activated carbon sector, focusing on producing high-quality carbon products for water and air treatment applications. The company has recently secured substantial funding to advance its research and development efforts, aiming to create innovative and efficient activated carbon solutions. Boyce Carbon’s commitment to technological advancements and expanding its production capacity is expected to enhance its competitive edge and support its growth in the rapidly evolving activated carbon market.

Jacobi Carbons Group is a leading global supplier of activated carbon, providing a wide range of products for applications such as water purification, air treatment, and industrial processes. Recently, Jacobi Carbons has introduced new activated carbon products tailored to specific industry needs and invested in upgrading its manufacturing facilities. These efforts aim to improve product performance and sustainability, reinforcing Jacobi Carbons’ position as a key player in the activated carbon market.

CarboTech AC GmbH is a notable player in the activated carbon market, specializing in high-quality carbon products for air, water, and industrial applications. The company has recently expanded its product line to include advanced activated carbon solutions designed to meet stringent environmental standards. CarboTech’s focus on innovation and quality enhancement is aimed at addressing the growing demand for effective and sustainable purification technologies, positioning the company as a significant contributor to the global activated carbon industry.

Kuraray Co. is a major force in the activated carbon market, known for its production of high-performance activated carbon used in diverse applications such as water treatment, air purification, and industrial processes. Kuraray has recently invested in expanding its production facilities and enhancing its product offerings to cater to the growing global demand. The company’s focus on technological advancement and capacity expansion aims to strengthen its market presence and support its growth in the activated carbon sector.

Haycarb (Pvt) Ltd. is a prominent manufacturer in the activated carbon sector, focusing on sustainable and high-performance products for air and water treatment. Recently, Haycarb has introduced new activated carbon solutions that enhance environmental sustainability by using renewable resources and improving product efficiency. The company’s commitment to innovation and eco-friendly practices aims to address growing global environmental concerns and strengthen its position in the competitive activated carbon market.

Kureha Corporation is a key player in the activated carbon industry, renowned for its advanced carbon products used in diverse applications such as water purification and air filtration. Kureha has recently expanded its product range and invested in new technologies to enhance the performance and sustainability of its activated carbon offerings. These developments reflect Kureha’s strategic focus on meeting increasing market demands and maintaining its competitive edge in the global activated carbon market.

Donau Carbon GmbH is a significant player in the activated carbon industry, specializing in providing tailored solutions for air, water, and industrial process applications. The company has recently expanded its portfolio to include advanced technologies for regenerating and recycling activated carbon. Donau Carbon’s focus on innovative and cost-effective solutions is aimed at enhancing the performance and sustainability of its products, addressing the increasing demand for effective environmental management technologies.

Calgon Carbon Corporation is a leading name in the activated carbon market, known for its extensive range of products used in air and water treatment. Recently, Calgon Carbon has expanded its offerings through strategic acquisitions and investments in new technologies. This includes advancements in carbon reactivation processes and new product innovations designed to meet evolving environmental and industrial needs. Calgon Carbon’s continued investment in these areas supports its strong market presence and growth.

Carbon Activated Corporation is a prominent supplier in the activated carbon industry, offering a wide range of products for applications in air and water treatment. Recently, the company has expanded its operations and product lines to include advanced carbon solutions designed for enhanced performance and sustainability. Carbon Activated’s focus on innovation and efficiency aims to meet the increasing demand for effective environmental technologies and solidifies its position as a key player in the global activated carbon market.

Albemarle Corporation is a major player in the activated carbon sector, known for its high-quality products used in water and air purification. Albemarle has recently bolstered its market position by investing in advanced manufacturing technologies and expanding its activated carbon product range. This strategic focus on innovation and capacity expansion is designed to address growing market needs and enhance Albemarle’s competitive edge in the global activated carbon market.

Osaka Gas Chemicals Co. is an established player in the activated carbon market, specializing in producing high-performance carbon products for air and water purification. The company has recently advanced its product offerings with innovative activated carbon solutions designed for enhanced efficiency and sustainability. Osaka Gas Chemicals Co.’s commitment to research and development, alongside its focus on meeting stringent environmental standards, positions it as a key contributor to the growing global demand for effective carbon-based purification technologies.

Silcarbon Aktivkohle GmbH is a notable manufacturer in the activated carbon sector, known for its diverse range of high-quality carbon products used in various applications, including air and water treatment. Recently, Silcarbon has focused on expanding its product line and enhancing its production capabilities to meet increasing market demands. The company’s emphasis on technological advancements and sustainable practices aims to strengthen its market position and support its growth in the activated carbon industry.

Evoqua Water Technologies LLC is a leading player in the activated carbon market, offering advanced solutions for water and air purification. The company recently expanded its product portfolio to include innovative activated carbon technologies aimed at improving treatment efficiency and sustainability. Evoqua’s focus on integrating cutting-edge technology and expanding its service offerings supports its strong position in the market, addressing the growing demand for effective environmental solutions.

Oxbow Activated Carbon LLC is a key supplier in the activated carbon sector, known for its high-quality products used in air, water, and industrial applications. Recently, Oxbow has enhanced its market presence by investing in advanced production technologies and expanding its product range. These developments are designed to meet increasing customer demands for effective and reliable activated carbon solutions, reinforcing Oxbow’s competitive position in the global market.

Conclusion

In conclusion, the activated carbon market is experiencing significant growth driven by increasing environmental regulations and rising demand for efficient purification solutions. With the market expected to reach approximately USD 5.4 billion by 2032, from USD 3.6 billion in 2022, at a CAGR of 4.2%, there are considerable opportunities for innovation and expansion.

Key players are investing in advanced technologies and expanding their product portfolios to meet evolving market needs. Despite challenges such as high production costs and environmental concerns, the market’s growth is supported by technological advancements and rising applications across various industries. As companies continue to innovate and address environmental issues, the activated carbon sector is poised for continued expansion and development.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)