Table of Contents

Overview

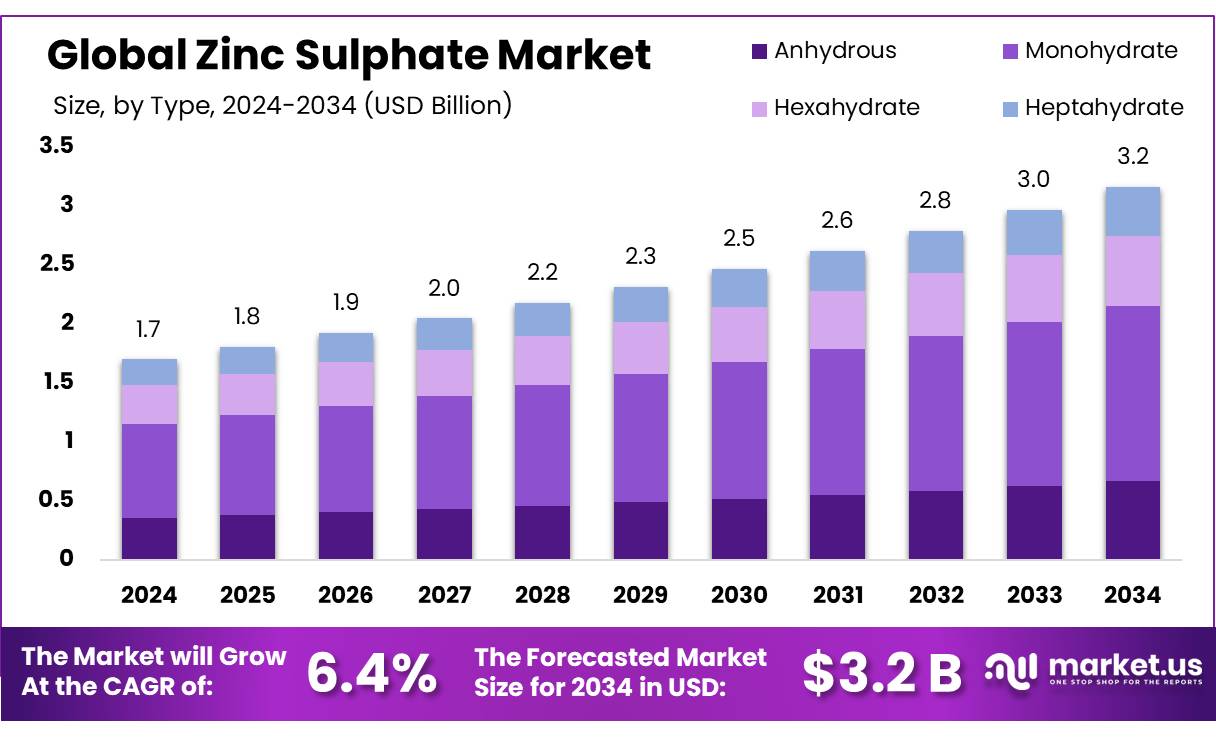

New York, NY – August 11, 2025 – The Global Zinc Sulphate Market is projected to grow from USD 1.7 billion in 2024 to USD 3.2 billion by 2034, achieving a CAGR of 6.4% over the forecast period (2025–2034). In 2024, the Asia Pacific (APAC) region led the market, accounting for a 47.3% share and generating USD 0.8 billion in revenue.

Zinc sulphate concentrates (ZSC) are critical across industries such as agriculture, pharmaceuticals, water treatment, and chemical manufacturing. These compounds, derived from leaching zinc-bearing ores or secondary zinc sources, play a vital role in addressing micronutrient deficiencies in soils and plants, enhancing agricultural productivity.

India’s zinc industry is witnessing robust growth due to rising demand across multiple sectors. With a per capita zinc consumption of just 0.5 kg compared to China’s 5.0 kg and a global average of 1.9 kg, India presents significant growth potential. Hindustan Zinc Limited, a key player, operates advanced smelters using technologies like Roast Leach Electro-winning (RLE) and Ausmelt. For example, the Chanderiya Lead-Zinc Smelter has an annual zinc production capacity of 525,000 tonnes.

The agricultural sector, expected to reach USD 24 billion by 2025, is a major driver of zinc sulphate demand. The increasing use of zinc-based fertilisers to address soil deficiencies and boost crop yields is fueling market expansion. Additionally, the pharmaceutical industry’s growing reliance on zinc supplements to treat deficiencies further supports market growth. Technological advancements and a focus on sustainable production methods are also enhancing the efficiency and environmental footprint of zinc sulphate concentrate production.

Key Takeaways

- The Zinc Sulphate Market is expected to grow from USD 1.7 billion in 2024 to around USD 3.2 billion by 2034, registering a CAGR of 6.4%.

- Monohydrate held the leading market position, accounting for more than 47.8% of the global share.

- The Micronutrient segment dominated the market, contributing over 41.2% of the total market share.

- Agriculture was the dominant application area, with more than 44.9% share in the global market.

- The Asia Pacific (APAC) region led the market, capturing 47.3% of the global share and reaching a value of approximately USD 0.8 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/zinc-sulphate-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.7 Billion |

| Forecast Revenue (2034) | USD 3.2 Billion |

| CAGR (2025-2034) | 6.4% |

| Segments Covered | By Type (Anhydrous, Monohydrate, Hexahydrate, Heptahydrate), By Applications (Micronutrient, Nutritional Supplements, Preservative, Etching and Engraving, Others), By End-use (Agriculture, Animal Nutrition, Food and Nutrition, Water Treatment, Mining, Pharmaceutical, Others) |

| Competitive Landscape | Balaji Chemicals, Bohigh Group, Changhsa Haolin Chemicals Co., Ltd, China Bohigh, Clean Agro, FUJI KASEI CO., LTD., GRILLO-Werke AG, Oasis Fine Chem, Old Bridge Minerals Inc., Prakash Chemicals, Redox, Rongqing Chemical Co., Ltd, Saba Chemical GmbH, Tianjin Topfert Agrochemical Co |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153863

Key Market Segments

By Type Analysis

In 2024, Monohydrate Zinc Sulphate commanded a leading 47.8% share of the global zinc sulphate market by type, driven by its high solubility, effectiveness in addressing soil zinc deficiencies, and cost-effectiveness. Its ease of use in soil applications and foliar sprays makes it a preferred choice among farmers, particularly in Asia and Africa. Widely used in micronutrient fertilisers for crops like rice, wheat, and maize, the monohydrate form benefits from government-led soil health initiatives in countries such as India and China.

By Applications Analysis

The Micronutrient segment led the global zinc sulphate market in 2024, holding a 41.2% share by application, driven by the critical need to address zinc deficiencies in crops to boost yield and quality. Zinc sulphate is a vital component in fertilisers, enhancing soil fertility and plant growth. National soil health programs in countries like India and China have spurred their use, particularly among small and marginal farmers growing rice, wheat, and maize.

By End-use Analysis

Agriculture dominated the global zinc sulphate market in 2024, accounting for a 44.9% share by end-use, driven by its extensive use as a micronutrient fertiliser. Zinc deficiency in soils, particularly in Asia and Africa, has fueled demand for zinc-enriched fertilisers to enhance crop yields and quality for cereals, pulses, and oilseeds.

Government initiatives promoting soil health and zinc-based fertilisers have further strengthened this segment. In 2025, agriculture is expected to maintain its leading position, supported by increasing farmer awareness, national soil health programs, and the ongoing need for higher agricultural productivity to meet global food demand, solidifying its role as the primary driver of zinc sulphate consumption.

Regional Analysis

The Asia Pacific (APAC) region led the global zinc sulphate market in 2024, capturing a 47.3% share with a market value of about USD 0.8 billion. This dominance stems from extensive agricultural operations, widespread zinc-deficient soils, and robust government backing for micronutrient fertilisers.

Key markets like India, China, Bangladesh, and Indonesia drive demand, utilising zinc sulphate extensively in crop nutrition for staples such as rice, wheat, and maize. In India, government initiatives like the “Soil Health Card” program encourage balanced fertiliser use, including zinc sulphate, to combat soil micronutrient deficiencies.

Similarly, China’s agricultural policies promote zinc-enriched fertilisers in major grain-producing regions, ensuring consistent demand. The growing animal feed sector in Southeast Asia further boosts zinc sulphate use as a nutritional supplement.

Top Use Cases

- Agricultural Fertiliser: Zinc sulphate is widely used as a fertiliser to fix zinc deficiencies in soil. It helps plants grow better, boosts crop yields, and improves soil health. Farmers apply it through soil treatments or foliar sprays, especially for crops like rice, wheat, and corn, ensuring healthier plants and higher productivity.

- Animal Feed Supplement: Zinc sulphate is added to animal feed to support livestock health. It improves immune function, growth, and reproduction in animals like poultry, swine, and aquaculture species. This micronutrient ensures animals get enough zinc, reducing deficiencies and enhancing overall productivity in farming.

- Water Treatment: Zinc sulphate is used in water treatment to control algae and moss growth. It acts as a flocculant, removing impurities from water in systems like cooling towers and ponds. This keeps water clean, prevents contamination, and maintains efficient water system operations for households and industries.

- Pharmaceutical Applications: Zinc sulphate is a key ingredient in medicines and dietary supplements. It treats zinc deficiencies, supports immune health, and reduces symptoms of colds and diarrhoea, especially in children. Its use in healthcare products is growing due to rising awareness of zinc’s benefits for overall wellness.

- Industrial Uses: Zinc sulphate is used in industries like textiles, dyeing, and electroplating. It acts as a mordant to help dyes stick to fabrics, improves colour quality, and provides corrosion-resistant coatings for metals. Its versatility makes it valuable in manufacturing processes for products like rayon and pigments.

Recent Developments

1. Balaji Chemicals

Balaji Chemicals has recently expanded its Zinc Sulphate production capacity to meet rising agricultural demand in India. The company introduced a high-purity, water-soluble grade of Zinc Sulphate for fertigation and foliar applications. They are also focusing on sustainable manufacturing processes to reduce environmental impact.

2. Bohigh Group

Bohigh Group has launched a new nano Zinc Sulphate formulation for enhanced crop absorption. The company is investing in R&D to improve micronutrient efficiency in fertilizers. They are also strengthening exports to Africa and Southeast Asia.

3. Changsha Haolin Chemicals Co., Ltd

Changsha Haolin Chemicals has developed a chelated Zinc Sulphate variant for better plant uptake. They are collaborating with agricultural institutes to optimise Zinc Sulphate use in soil-deficient regions. The company is also upgrading its production facilities for higher purity standards.

4. China Bohigh

China Bohigh has introduced a granular Zinc Sulphate product for ease of application in large-scale farming. The company is expanding its distribution network in Latin America and Europe. They are also working on eco-friendly packaging solutions.

5. Clean Agro

Clean Agro has recently partnered with agri-tech startups to promote Zinc Sulphate-enriched biofertilizers. They are focusing on organic farming solutions and have received certifications for their high-quality Zinc Sulphate products.

Conclusion

Zinc sulphate is a versatile compound driving growth across agriculture, healthcare, water treatment, and industrial sectors. Its role in addressing zinc deficiencies in crops, supporting animal health, purifying water, and enhancing industrial processes highlights its market potential. With rising demand for sustainable farming and health solutions, the zinc sulphate market is poised for steady growth, offering lucrative opportunities for manufacturers and investors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)