Table of Contents

Overview

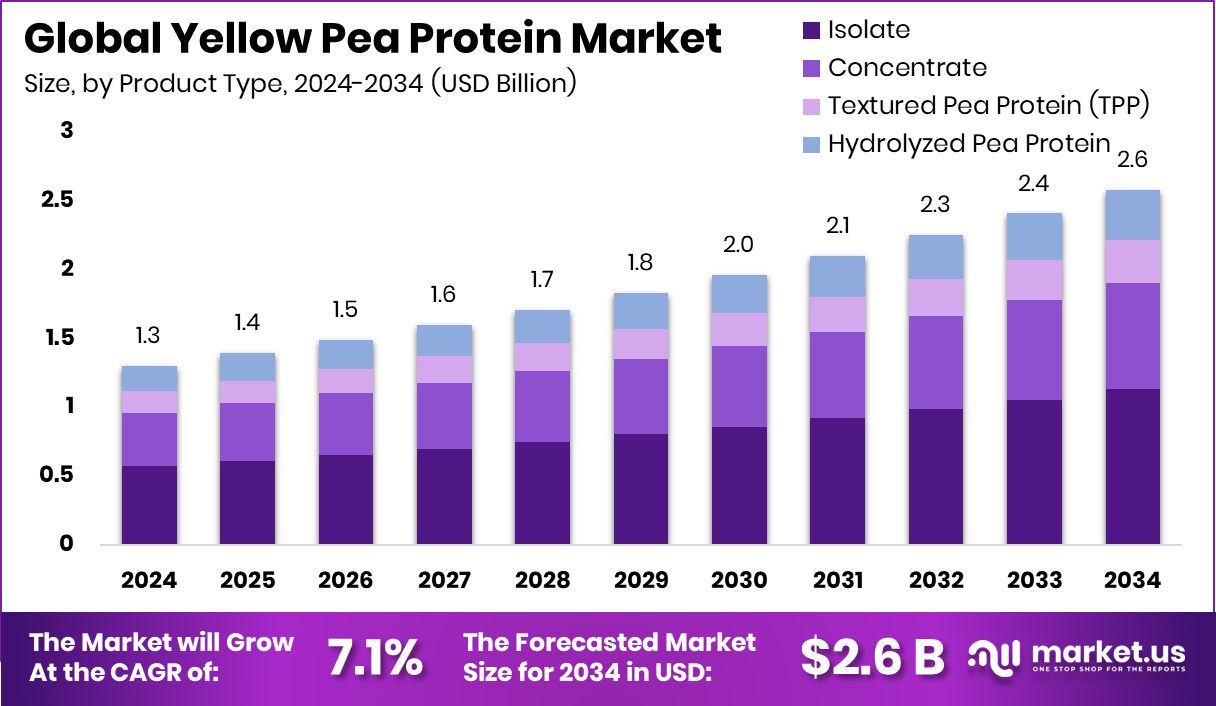

New York, NY – January 05, 2026 – The global yellow pea protein market is on a steady growth path, projected to reach USD 2.6 billion by 2034, up from USD 1.3 billion in 2024, expanding at a 7.1% CAGR from 2025 to 2034. North America remains the leading region, holding a 41.2% share and generating about USD 0.5 billion, supported by strong adoption of plant-based nutrition and sports supplements.

Yellow pea protein is produced from dried yellow peas using gentle processing methods. Its neutral flavor, clean-label appeal, and easy digestibility make it a preferred ingredient in dairy alternatives, ready-to-drink protein beverages, and meat-free foods. The broader market includes ingredient suppliers and food brands responding to rising demand for allergen-free and sustainable protein sources.

Consumer interest in fitness and affordable nutrition is accelerating demand. Budget-friendly protein powders, including popular options priced under ₹5,000 and promotional discounts of up to 40%, are helping pea protein reach a wider audience.

Innovation-driven funding is strengthening future opportunities. The German Government invested USD 780,000 to improve vegan meat textures, directly supporting pea protein applications. Ripple Foods raised USD 17 million to expand organic pea milk production. A Swiss startup secured USD 10 million to convert a dairy facility into a protein-from-beer-waste plant. Broader plant-protein momentum—including Daring Foods’ USD 65 million Series C and USD 40 million Series B, Next Gen Foods’ USD 100 million expansion round, and InnovoPro’ USD 4.25 million raise—continues to elevate the relevance and growth potential of yellow pea protein within the global alternative protein ecosystem.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-yellow-pea-protein-market/request-sample/

Key Takeaways

- The Global Yellow Pea Protein Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034.

- In the Yellow Pea Protein Market, Isolate leads with a strong 43.8% share globally.

- The Yellow Pea Protein Market sees dry forms dominating production and sales with a 76.1% share.

- In the Yellow Pea Protein Market, Meat and Poultry Analogues account for a notable 34.7% demand share.

- North America’s strong demand strengthened its 41.2%, reaching nearly USD 0.5 Bn in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=170096

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.6 Billion |

| CAGR (2025-2034) | 7.1% |

| Segments Covered | By Product Type (Isolate, Concentrate, Textured Pea Protein (TPP), Hydrolyzed Pea Protein), By Form (Dry, Wet), By Application (Meat and Poultry Analogues, Dairy and Frozen Dessert Alternatives, Sports Nutrition Powders and Bars, Bakery, Snacks and Cereals, Beverages (RTD and Concentrates), Clinical and Infant Nutrition, Pet Food) |

| Competitive Landscape | Roquette Freres, Puris, Ingredion Incorporated, NutriPea, COSUCRA Groupe Warcoing S.A., Axiom Foods, Inc., Burcon NutraScience Corporation, AGT Food and Ingredients Inc., A&B Ingredients, Inc., Cargill, Incorporated |

Key Market Segments

By Product Type Analysis

In 2024, yellow pea protein isolate dominated the product type segment with a 43.8% share, reflecting its strong acceptance across nutrition and plant-based food categories. This leadership is mainly driven by its high protein purity, mild taste, and excellent solubility, which make it ideal for protein drinks, meal replacements, and dairy alternatives. Food and beverage manufacturers increasingly favor isolates as they support clean-label positioning and allergen-free formulations without compromising performance.

Isolate is also widely used in sports nutrition and fortified foods, where fast absorption and consistent texture are essential. Compared with concentrates, isolates offer better processing efficiency and allow higher protein claims, aligning well with consumer demand for functional and health-focused products. As plant-based eating and fitness-oriented diets continue to expand globally, yellow pea protein isolate remains the preferred option, ensuring its continued dominance within the product type segment.

By Form Analysis

The dry form of yellow pea protein held a commanding 76.1% share in 2024, making it the clear leader in the form segment. Its dominance is closely linked to ease of handling, long shelf life, and compatibility with large-scale food manufacturing. Dry pea protein is widely used in protein powders, bakery products, meat alternatives, and beverage premixes, where stability during storage and transport is critical.

Manufacturers also prefer the dry form because it integrates smoothly into existing production lines without requiring major process changes. It delivers consistent functionality in terms of texture, viscosity, and dispersion, helping brands maintain uniform product quality. These operational and logistical advantages make dry yellow pea protein more cost-effective and scalable than liquid alternatives, reinforcing its strong position as the most widely adopted form in the market.

By Application Analysis

In 2024, meat and poultry analogues emerged as the leading application segment, accounting for a 34.7% share of yellow pea protein usage. This dominance reflects rising consumer demand for plant-based meat products that closely replicate the taste, texture, and appearance of animal protein. Yellow pea protein plays a critical role by providing firm structure, moisture retention, and a neutral flavor, making it well-suited for burgers, sausages, nuggets, and minced alternatives.

Its growing use is also driven by manufacturers seeking soy-free and gluten-free protein solutions that appeal to a broader consumer base. As product developers focus on improving bite, juiciness, and nutritional balance, yellow pea protein has become a core ingredient in next-generation meat substitutes. These functional benefits continue to strengthen its leading position within the application segment.

Regional Analysis

North America leads the yellow pea protein market with a 41.2% share, valued at around USD 0.5 billion, driven by strong demand for plant-based foods and high usage in meat and poultry alternatives. The region benefits from a well-developed food processing industry and a growing consumer shift toward clean-label, allergen-free protein ingredients, reinforcing its dominant position.

Europe follows with stable growth as food manufacturers increasingly use yellow pea protein in bakery products, sports nutrition, and dietary supplements. Regulatory support for plant-based foods and clean eating trends further sustains regional demand.

Asia Pacific is gaining momentum as rapid urbanization and rising health awareness push consumers toward affordable plant proteins, especially in convenience and functional foods. The Middle East & Africa show gradual adoption, supported by growing interest in alternative proteins that align with local dietary habits.

Latin America continues to progress as regional food producers add pea protein to snacks and fortified foods. Overall, rising preference for sustainable and allergen-free ingredients supports growth across all regions, with North America remaining the clear market leader.

Top Use Cases

- Plant-Based Meat Alternatives: Yellow pea protein is widely used to make plant-based burgers, sausages, nuggets and other meat-like foods. It helps create a firm texture and protein content that resembles real meat, making it popular in vegan and vegetarian products.

- Protein Shakes & Sports Nutrition: Many people add yellow pea protein powder to smoothies and shakes to boost daily protein intake, especially after workouts. It’s easy on the stomach and works well for muscle building and recovery.

- High-Protein Snacks & Bakery: Food makers add yellow pea protein to protein bars, cookies, breads and muffins to raise nutrition levels. It mixes well, helps texture, and increases protein without changing taste too much.

- Functional Ingredient in Foods: Beyond nutrition, yellow pea protein acts as a binder, emulsifier or texture improver in sauces, soups and meats. This helps improve how foods hold together or feel in the mouth.

- Nutrition for Special Diets: Because it is naturally plant-based, gluten-free and doesn’t contain common allergens, yellow pea protein is ideal for people with dietary restrictions (vegan, lactose-free, etc.).

Recent Developments

- In February 2024, Roquette expanded its NUTRALYS® pea protein range by introducing four new pea protein ingredients. These include isolate, hydrolysate, and textured versions designed to help food makers improve taste, feel, and use in plant-based foods like protein drinks, bars, and meat alternatives. This move broadens choices for manufacturers making high-protein and plant-based foods.

- In February 2024, Puris celebrated a major legal win when the U.S. Department of Commerce ruled in its favor in an anti-dumping case against cheap Chinese pea protein imports. The decision led to preliminary duties (112%–270%) on certain imports, helping protect domestic pea protein producers like Puris and supporting fairer competition. This is significant for the company’s ability to grow its pea protein business in the U.S. market.

Conclusion

The yellow pea protein market is moving toward steady and long-term growth as consumers increasingly choose plant-based and clean-label foods. Its neutral taste, easy digestion, and allergen-free nature make it suitable for many applications, including meat alternatives, beverages, nutrition products, and bakery foods. Food manufacturers value yellow pea protein for its reliable texture, functionality, and sustainability benefits.

Growing interest in fitness, vegan diets, and environmentally friendly ingredients continues to support demand across regions. Ongoing product innovation and expanding use in everyday foods are strengthening its position in the global protein landscape. Overall, yellow pea protein is expected to remain a key ingredient as plant-based nutrition becomes more mainstream worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)