Table of Contents

Overview

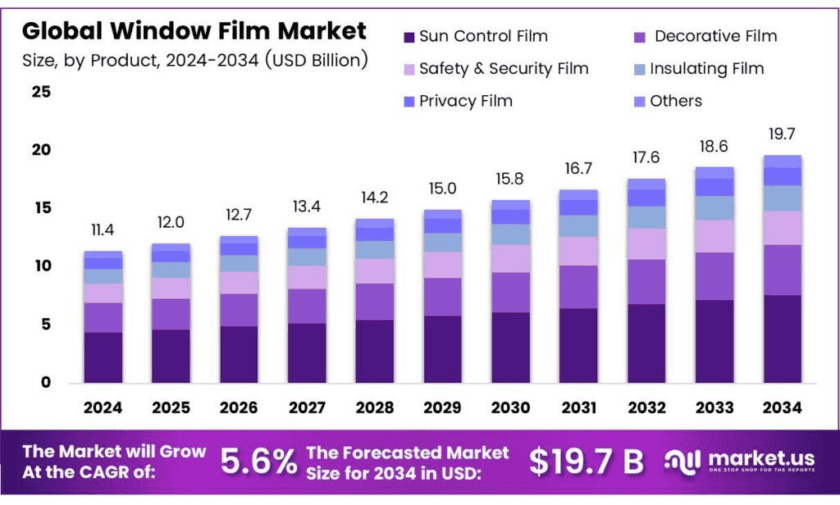

New York, NY – Dec 03, 2025 – The global window film market is projected to reach USD 19.7 billion by 2034, rising from USD 11.4 billion in 2024, and the expansion is expected to occur at a CAGR of 5.6% between 2025 and 2034. Window films, which include polymer-based, metalized, and ceramic variants, are applied to glass surfaces across residential, commercial, automotive, and marine applications to deliver functions such as solar heat reduction, UV filtration, glare control, privacy enhancement, insulation, and safety reinforcement.

Performance improvements in advanced solutions have supported demand, with leading products such as 3M Window Films reducing up to 78% of solar heat, lowering cooling loads, and blocking nearly 99% of UV radiation, thereby supporting energy efficiency and interior protection. Market growth has been reinforced by rapid urban development and rising construction activity, particularly in the Asia–Pacific region, where large-scale residential and commercial projects continue to increase film adoption.

Green building certification programs have further encouraged the use of window films as cost-effective retrofit upgrades to improve energy performance. However, growth is moderated by relatively high installation costs, limited consumer awareness in certain markets, optical clarity trade-offs associated with some film types, regulatory limits on film darkness, and competition from alternative glazing and smart-glass technologies.

Key Takeaways

- The Global Window Film Market is projected to grow from USD 11.4 billion in 2024 to USD 19.7 billion by 2034, at a CAGR of 5.6%.

- Sun control film dominated in 2024, holding a 38.6% market share due to demand for energy-efficient glazing solutions.

- Polyester-based films led in 2024 with a 43.9% share, valued for clarity, durability, and versatility in various applications.

- The automotive sector captured a 34.2% market share in 2024, driven by demand for UV protection and cabin comfort.

- North America held a 34.8% market share in 2024, valued at USD 3.9 billion, due to strong adoption of energy-efficient technologies.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-window-film-market/free-sample/

Report Scope

| Market Value (2024) | USD 11.4 Bn |

| Forecast Revenue (2034) | USD 19.7 Bn |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Product (Sun Control Film, Decorative Film, Safety and Security Film, Insulating Film, Privacy Film, Others), By Material (Vinyl, Polyester, Plastic, Ceramic, Others), By Application (Automotive, Residential, Commercial, Marine, Others) |

| Competitive Landscape | 3M, Eastman Chemical Company, American Standard Window Film, Saint-Gobain Performance Plastics Corporation (Solar Gard), Madico, Inc., Toray Plastics, Hanita Coatings RCA Ltd., Johnson Window Films, Inc., Armolan Window Films, Garware Suncontrol, Reflectiv |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161276

Key Market Segments

By Product – Sun Control Film Leads with 38.6% Share

In 2024, Sun Control Film emerged as the leading product segment in the global window film market, accounting for over 38.6% of the market share. This dominance reflects increasing consumer preference for energy-efficient glazing solutions that reduce heat gain and enhance indoor comfort. Sun control films effectively block harmful UV radiation, lower air-conditioning demands, and protect interior furnishings from fading, making them popular in both architectural and automotive applications.

The segment’s growth is supported by rising adoption of thermal management solutions in commercial buildings, residential complexes, and transport fleets, alongside regulatory initiatives promoting energy conservation in regions such as Asia-Pacific and North America. These films also contribute to carbon reduction efforts by minimizing cooling energy consumption, further solidifying their position as the preferred choice in the window film product landscape.

By Material – Polyester Dominates with 43.9% Share

In 2024, Polyester was the most widely used material in the global window film market, holding a 43.9% share. Polyester films are favored for their superior clarity, durability, and resistance to heat and chemicals, making them suitable for solar control, safety, decorative, and privacy applications across automotive, residential, and commercial sectors. Their ability to retain tensile strength and dimensional stability under varying temperatures enhances their widespread acceptance.

Polyester’s compatibility with metallization, dyeing, and lamination allows manufacturers to produce advanced film grades with improved infrared rejection and glare reduction. The ongoing emphasis on energy-efficient construction and UV protection continues to drive strong demand, with the material remaining central to sustainable building initiatives and cooling energy reduction strategies.

By Application – Automotive Segment Leads with 34.2% Share

In 2024, the Automotive segment led the global window film market, capturing over 34.2% of the market share. Vehicle manufacturers increasingly use window films to improve passenger comfort, reduce cabin heat, block UV radiation, and enhance aesthetic appeal. Advanced films with infrared rejection and glare control are being adopted to optimize energy efficiency and driving experience.

Growth in this segment is supported by global vehicle production recovery, stricter thermal management and safety regulations, and rising adoption of electric vehicles, which benefit from reduced interior cooling loads. Additionally, the customization trend—ranging from privacy tints to decorative films—strengthens demand across both OEM and aftermarket channels, further solidifying the automotive sector’s dominant position in the window film market.

List of Segments

By Product

- Sun Control Film

- Decorative Film

- Safety and Security Film

- Insulating Film

- Privacy Film

- Others

By Material

- Vinyl

- Polyester

- Plastic

- Ceramic

- Others

By Application

- Automotive

- Residential

- Commercial

- Marine

- Others

Regional Analysis

North America Leads with 34.8% Share and USD 3.9 Billion Market Value

In 2024, North America dominated the global window film market, accounting for 34.8% of the total share and a market value of approximately USD 3.9 billion. The region’s leadership is supported by early adoption of energy-efficient retrofit technologies, stringent building-code enforcement, and a substantial base of aging commercial and residential buildings seeking cost-effective energy solutions.

Growth is further reinforced by public-sector initiatives, including the U.S. Department of Energy’s Building Technologies Office (BTO) programs, and state-level incentives in regions such as California, Texas, and New York, which provide rebates and tax benefits for installing energy-saving window films. In addition to energy efficiency, window films are increasingly applied for UV protection, glare reduction, privacy, and security enhancements across offices, vehicles, and public infrastructure.

The ongoing emphasis on sustainable construction, accelerated green-building certifications such as LEED and Energy Star, and post-pandemic focus on occupant comfort and daylight optimization have strengthened demand. North America is expected to maintain its market dominance, driven by continuous construction activity, supportive government programs, and heightened consumer awareness of the environmental and comfort benefits offered by advanced window films.

Top Use Cases

Energy Savings and Cooling Load Reduction in Buildings

- Window films significantly reduce solar heat gain through glass, thereby lowering the demand on air‑conditioning systems. Studies show that buildings retrofitted with sun control films may realize 10 % to 30 % annual cooling cost savings.

- In some documented installations, buildings experienced HVAC load reduction up to 30 % after film application, especially where façades had high window‑to‑wall ratios.

- As a retrofit measure, window film offers an economical alternative compared to full window replacement, enabling older or energy‑inefficient buildings to improve thermal performance with limited disruption.

Year‑Round Thermal Comfort and Winter Heat Retention

- Beyond summer cooling, certain film types — especially low‑emissivity (Low‑E) window films — improve insulation by reflecting interior heat back inside, reducing winter heat loss through glass.

- This dual‑season performance helps stabilize indoor temperature, reduce HVAC usage across seasons, and deliver consistent occupant comfort.

UV Protection, Glare Reduction, and Interior Preservation

- Window films can block up to 95–99 % of ultraviolet (UV) radiation, protecting occupants’ skin and reducing fading or deterioration of furniture, carpets, artwork, and interior decor.

- By filtering harmful UV and much of the infrared/heat component, films help maintain the quality and longevity of interior design elements — reducing replacement or refurbishment costs over time.

- Films also reduce glare and excessive brightness from direct sunlight, enhancing visual comfort — a valuable benefit in offices, classrooms, retail environments, or homes with large glass windows.

Safety, Security, and Impact Resistance

- Specialized “safety & security” window films add a protective layer that helps hold glass fragments in place if windows are broken, reducing the risk of injury from flying shards.

- In commercial buildings, storefronts, and public infrastructure, this added safety makes window film a viable measure for enhancing building resilience against vandalism or accidental breakage.

Cost‑Effective Retrofit for Existing Glass Structures

- According to industry guidance, window film installation represents one of the simplest and most cost‑effective energy conservation measures (ECMs) available for buildings — especially compared to full window replacement or upgrading to multi‑pane glazing.

- For commercial property owners, anecdotal cases report significant electricity savings — for example, a large-scale retrofit yielding over 2.4 million kWh per year saved for a high-rise office tower.

- The payback period for such investments is often reasonable: some projects have reported payback within 3–5 years, depending on energy savings, climate, and utility cost structure.

Recent Developments

3M Company — In 2024‑2025, 3M sustained a leading role in the window‑film sector, supplying advanced ceramic‑ and multilayer‑optical films used widely in automotive and architectural glazing. Its product lines such as its ceramic-based films provide enhanced infrared rejection and UV protection, supporting high‑performance glazing demand. 3M’s strong global distribution network and R&D investments have reinforced its footprint in premium segments globally.

Eastman Chemical Company — In 2024, Eastman remained among the top global producers in the window‑film market via its brands such as LLumar, V‑Kool and SunTek. Its 2024 expansion of manufacturing capacity in North America addressed rising retrofit demand, while its films — including spectrally selective and solar‑control grades — continued to serve automotive and building applications. Eastman’s emphasis on sustainability and advanced film technologies has supported its competitive positioning in major global markets.

American Standard Window Film (ASWF) — As of 2025, American Standard Window Film operates a modern manufacturing facility in Las Vegas producing a full range of architectural and automotive films. Its product portfolio in 2025 includes solar‑control films with 99 % UV rejection and nano‑ceramic (“IRP”) films offering improved heat rejection and glare reduction. The company emphasizes production efficiency through an inline triple‑coating process and automated rewind system — a configuration described as unique in the global window‑film industry — allowing competitive pricing while supplying both residential/commercial buildings and automotive markets.

Saint-Gobain Performance Plastics Corporation (Solar Gard / Saint-Gobain) — In 2024–2025, Saint‑Gobain’s window‑film division (under brand Solar Gard) continued to expand its global presence with a strong focus on architectural and automotive glazing films offering solar control, UV protection, glare reduction, and safety features. In 2025, Solar Gard won an environmental‑sustainability award for reducing packaging waste and cutting water consumption, underlining its commitment to sustainable production. The firm remains among the top global players, leveraging its broad distribution network and product innovation to meet growing demand for energy‑efficient, safety‑oriented window films worldwide.

Madico, Inc. — In 2025, Madico continued to lead in window‑film solutions for automotive, architectural, and security applications, producing films under brands such as Sunscape®, Wincos®, Black Pearl®, and SafetyShield®. Its newly launched SafetyShield G2 system offers enhanced glass‑to‑film bonding with a peel strength of 10–12 lb, marking a significant advance in safety and security films for buildings, retail, schools, and government facilities. Madico’s films block up to 99% UV rays and reduce solar heat gain by up to 86%, delivering energy savings and comfort benefits in both hot and cold climates.

Toray Plastics (America), Inc. — As of 2024, Toray Plastics remained a global leader in producing polyester (PET) and bio‑based films for solar‑control window film applications. Its Lumirror® and BioView™ PET films are designed for high‑clarity and low‑haze solar control applications for both buildings and vehicles, matching traditional film performance while offering a sustainable feedstock base. In line with its corporate “AP‑G 2025” strategy, Toray is shifting toward environmentally friendly functional films and investing in multilayer, coated polymer technologies to meet rising demand for energy‑efficient glazing solutions.

Hanita Coatings RCA Ltd. — As of 2024–2025, Hanita Coatings continued to supply high‑performance solar‑control and security window films under its SolarZone and SafetyZone product lines, targeting both architectural and automotive glazing markets. The company leverages advanced coating and metallization technologies on polyester‑based films to deliver strong heat and glare reduction, UV protection, and safety performance. Through these offerings, Hanita supports energy‑efficiency and sustainability trends in building retrofits and vehicle glazing.

Johnson Window Films, Inc. — In 2025, Johnson Window Films remained a family‑owned manufacturer headquartered in California, producing automotive, residential, commercial, and safety window films with a history dating back to 1973. Its products are marketed as offering reliable solar control and UV protection, blocking 99% of harmful UV rays and contributing to heat reduction and glare control in vehicles and buildings. The firm continues to serve professional installers globally, maintaining technical support and product quality standards aligned with long‑standing industry practice.

Armolan Window Films — As of 2025, Armolan continues to offer a broad portfolio of high‑performance window films for automotive, residential, and commercial use. Their products include solar‑control films that reduce heat and glare (blocking up to ~80% of solar heat gain), UV‑blocking films that preserve interior furnishings, privacy and decorative films, and safety/security films that strengthen glass against breakage. Armolan’s global distribution network and decades of experience support its positioning as a reliable supplier of retrofit solutions enhancing energy efficiency, comfort, and security.

Garware Suncontrol — In 2024–2025, Garware Suncontrol remained a leading manufacturer of polyester‑based sun control and safety window films for buildings and vehicles, operating from a fully integrated, ISO‑certified production facility. Its products — available in over 50 countries — deliver UV protection (up to 99% UV rejection), glare reduction, solar heat rejection, and energy savings, making them suitable for residential, commercial, and automotive applications. As of 2025, Garware’s capacity in sun‑control films is among the highest globally, supporting strong export growth and widening adoption of energy‑efficient window solutions.

Conclusion

In conclusion, window film represents a highly effective, low‑cost solution for improving the energy performance, comfort, safety, and sustainability of both buildings and vehicles. Research shows that application of window films can reduce cooling energy consumption by 15–30%, and some studies — depending on climate, glazing type, and film specification — report reductions in annual HVAC energy needs of up to 35–40% in summer months.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)