Table of Contents

Overview

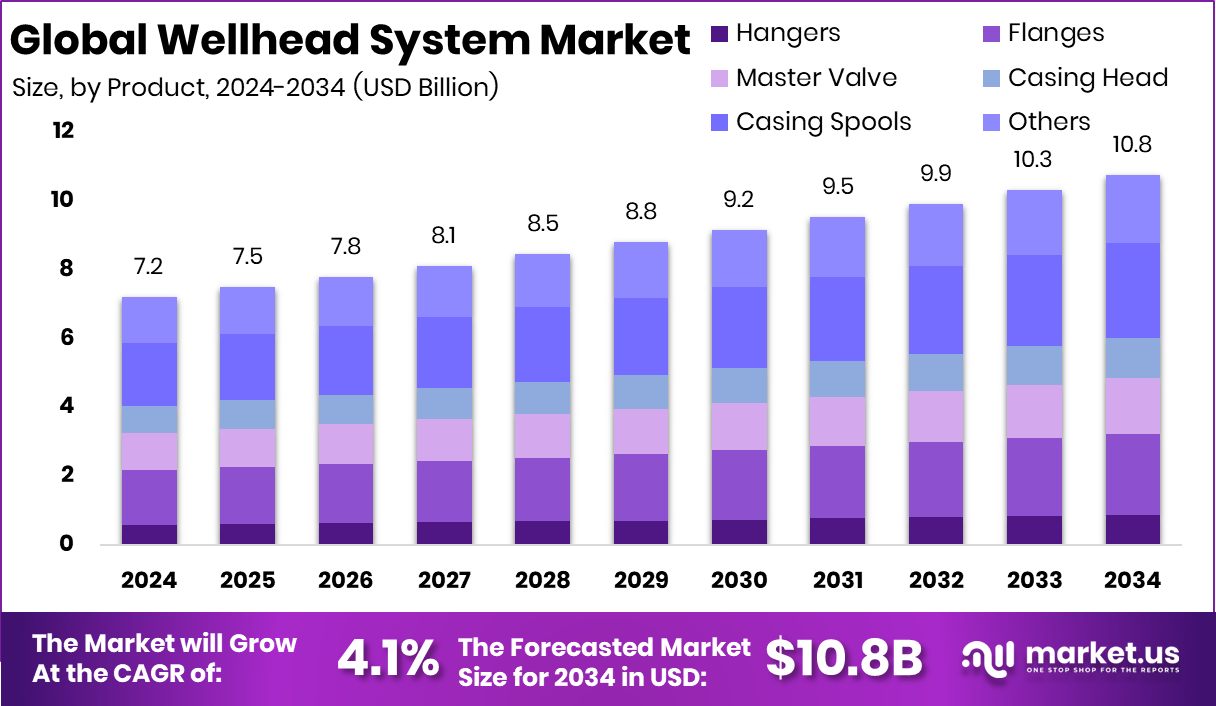

New York, NY – January 15, 2026 – The global Wellhead System Market is projected to grow steadily, reaching around USD 10.8 billion by 2034, up from USD 7.2 billion in 2024, at a 4.1% CAGR from 2025 to 2034. Demand remains strongest in North America, which holds a 43.90% share, representing nearly USD 3.1 billion in regional value.

A wellhead system is surface equipment installed at the top of oil and gas wells to control pressure, support casing, and enable safe drilling, completion, and production. These systems are critical for maintaining well integrity, managing flow, and ensuring operational safety throughout the well’s life cycle. Their role makes them an essential component of upstream oil and gas operations, both onshore and offshore.

Market growth is supported by sustained drilling activity, redevelopment of mature wells, and rising focus on safety and pressure control. Financial momentum across the energy ecosystem reinforces this trend. Plexus secured a £2 million loan as international demand strengthened, while Singapore-based OMS Energy raised USD 43 million through its Nasdaq listing to expand technology and infrastructure capabilities.

Public and private investments also underline the importance of pressure and fluid management systems. Water districts in Port Washington, Westbury, and Greenlawn received USD 11.4 million for contamination treatment projects. Additionally, Pason announced a planned USD 88.3 million acquisition of an Alberta-based energy technology company, signaling growing interest in smarter, more efficient wellhead and drilling systems.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-wellhead-system-market/request-sample/

Key Takeaways

- The Global Wellhead System Market is expected to be worth around USD 10.8 billion by 2034, up from USD 7.2 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- In the wellhead system market, casing spools held a 25.7% share due to strong demand in drilling operations.

- Onshore applications dominated the wellhead system market with a 73.9% share, supported by extensive land-based oil exploration.

- North America leads the regional Wellhead System Market, holding a 43.90% share worth USD 3.1 billion in the region.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=170693

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 7.2 Billion |

| Forecast Revenue (2034) | USD 10.8 Billion |

| CAGR (2025-2034) | 4.1% |

| Segments Covered | By Product (Hangers, Flanges, Master Valve, Casing Head, Casing Spools, XOthers), By Application (Onshore, Offshore) |

| Competitive Landscape | Forum Energy Technologies, Shanghai Wellhead Equipment Manufacture, National Oilwell Varco, GE Grid Solutions, Delta Corporation, Great Lakes Wellhead, Integrated Equipment, Jiangsu Sanyi Petroleum Equipment, JMP Petroleum Technologies |

Key Market Segments

By Product Analysis

In 2024, casing spools emerged as the leading product segment in the wellhead system market, holding a 25.7% share. This dominance reflects their essential function in supporting multiple casing strings and maintaining effective pressure control during drilling and production. Casing spools act as a critical load-bearing component within the wellhead assembly, ensuring structural stability and safe operation across varying pressure conditions.

Their widespread adoption is driven by proven reliability, standardized designs, and compatibility with a wide range of well configurations. Operators favor casing spools because they simplify installation, enable effective sealing between casing strings, and contribute to long-term well integrity. As wells age and require consistent pressure management, the role of casing spools becomes even more important. This combination of operational necessity and dependable performance continues to position casing spools as a foundational product category within the global wellhead system market.

By Application Analysis

In 2024, onshore applications dominated the wellhead system market by application, accounting for a substantial 73.9% share. This strong position highlights the continued reliance on land-based oil and gas operations, where drilling activity remains widespread across both new developments and mature fields. Onshore projects typically involve lower installation complexity and easier site access compared to offshore operations, supporting faster execution and cost efficiency.

The high share also reflects the sheer volume of active onshore wells that require dependable surface pressure control and ongoing maintenance. Wellhead systems are routinely used for drilling, workovers, and production optimization in these locations. Flexible maintenance schedules and quicker equipment replacement further support sustained demand. As a result, onshore operations continue to anchor overall market volumes, making them the primary driver of wellhead system demand globally.

Regional Analysis

North America leads the Wellhead System Market with a 43.90% share, valued at USD 3.1 billion, supported by intensive upstream oil and gas activity and a well-developed production infrastructure. Strong drilling levels, frequent replacement of aging wellheads, and a mature service ecosystem focused on safety and efficiency reinforce the region’s dominance.

Europe maintains a stable market position, driven mainly by field optimization and maintenance activities. Here, wellhead systems are widely used to extend the operational life of existing wells rather than for large-scale new developments.

Asia Pacific is experiencing steady growth as rising energy demand encourages gradual expansion of onshore projects and selective offshore developments, increasing the need for dependable wellhead installations.

The Middle East & Africa remains structurally important due to its vast hydrocarbon reserves, where wellhead systems are vital for handling high-pressure reservoirs and ensuring uninterrupted production. Latin America contributes through targeted field development and redevelopment projects, emphasizing efficient and cost-controlled surface equipment deployment.

Top Use Cases

- Pressure Control and Safety Barrier: Wellhead systems provide a strong seal at the surface of a well to safely contain the high pressures of oil or gas below ground. This prevents uncontrolled releases and keeps workers and the environment safe.

- Support for Casing Strings: They hold up and support the metal pipes (casing) that line the wellbore, keeping the well structure stable during drilling and production.

- Production Flow Control: Wellheads allow operators to start, stop, or regulate the flow of oil, gas, or other fluids from the underground reservoir into surface systems

- Monitoring and Testing Access: They provide access ports and connectors for pressure testing, sampling fluids, and checking well conditions without removing major equipment

- Support for Completion Equipment: Once drilling is done, wellheads act as a foundation for completion tools like the Christmas tree valves, pumps, sensors, and other production gear needed to run the well.

Recent Developments

- In February 2024, GE Grid Solutions, part of GE Vernova, introduced a new portfolio called GridBeats. This set of software-defined automation tools is designed to help electric utilities modernize their power grids, make operations smoother, and improve reliability using digital technologies.

- In January 2024, Forum Energy Technologies completed the acquisition of Variperm Energy Services, a company known for making downhole technology solutions like sand and flow control products used in heavy oil wells. This deal strengthens FET’s product line in downhole and artificial lift technologies by adding Variperm’s specialized equipment and global reach.

- In January 2024, NOV Inc. acquired Extract Production Services, a company that provides production and well optimization equipment for oil and gas. This deal brought new tools and capabilities to NOV’s product lineup, helping it support more stages of well operations from drilling through production.

Conclusion

The wellhead system market plays a critical role in ensuring safe, efficient, and reliable oil and gas operations across the entire well lifecycle. These systems are essential for pressure control, structural support, and secure access during drilling, completion, and production activities. Ongoing drilling programs, redevelopment of mature fields, and a strong focus on operational safety continue to support steady demand.

Onshore projects remain the primary driver, while offshore developments add selective growth opportunities. Technological improvements, digital integration, and investments in energy infrastructure are further strengthening market relevance. Overall, wellhead systems will remain a core component of upstream operations, supporting long-term production stability an