Table of Contents

Overview

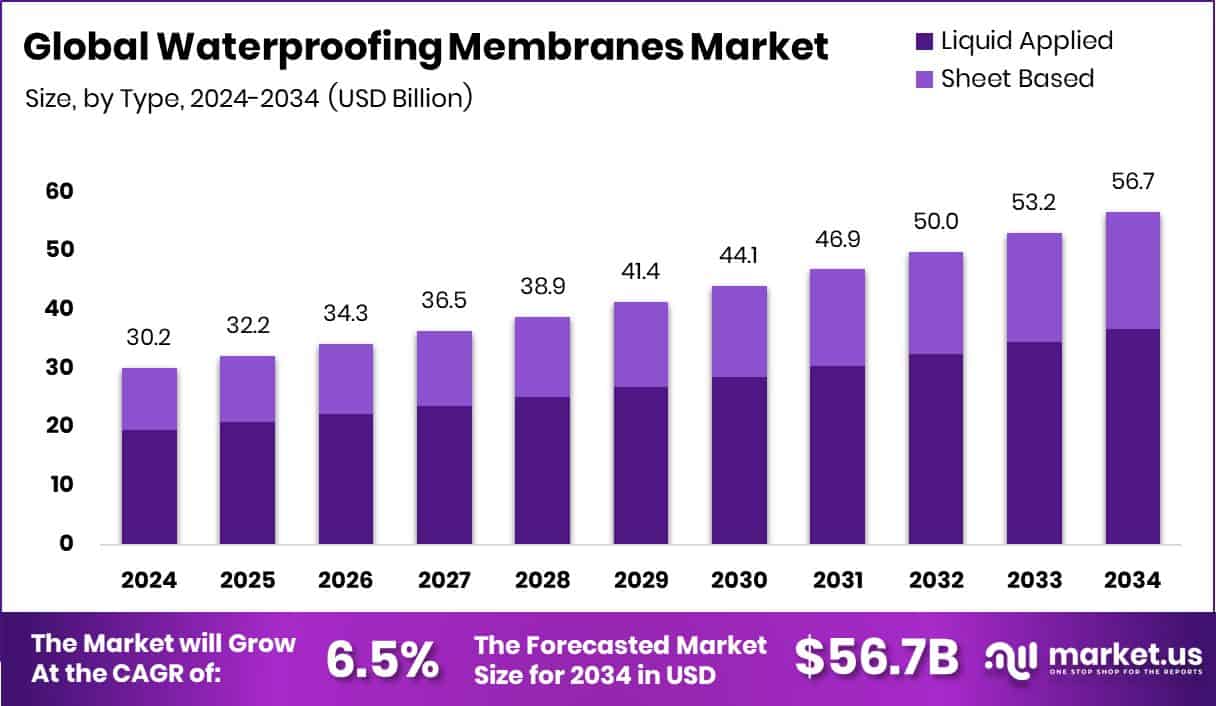

New York, NY – October 23, 2025 – The global waterproofing membranes market is projected to reach USD 56.7 billion by 2034, rising from USD 30.2 billion in 2024, with a 6.5% CAGR from 2025–2034. Asia Pacific dominates with a 45.9% share, valued at USD 13.8 billion.

Waterproofing membranes act as protective barriers in construction—safeguarding roofs, basements, tunnels, and bridges from water intrusion while improving durability and reducing maintenance. Market expansion is largely driven by urbanization, aging infrastructure, and the shift toward sustainable construction.

A significant driver is infrastructure renovation funding, such as the $32 million allocated for the Louisiana State Capitol’s exterior restoration, which boosts demand for advanced waterproofing systems. Local initiatives also contribute; for example, Coral Springs’ $50,000 grant supports renovation of an old office building on University Drive, promoting the use of membranes in urban property upgrades.

Furthermore, private investment confidence is evident through SBI Mutual Fund’s ₹7700 crore stake acquisition in a large-cap construction-linked company, signaling robust support for infrastructure growth. Collectively, public funding, municipal redevelopment programs, and private capital inflows are accelerating the adoption of waterproofing membranes in both new and existing construction projects worldwide.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-waterproofing-membranes-market/request-sample/

Key Takeaways

- The Global Waterproofing Membranes Market is expected to be worth around USD 56.7 billion by 2034, up from USD 30.2 billion in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034.

- The waterproofing membranes market is dominated by liquid-applied types, accounting for 64.9% share.

- New construction projects drive the Waterproofing Membranes Market significantly, holding 59.3% of overall usage.

- Roofing applications lead the Waterproofing Membranes Market, contributing 34.1% of total market demand.

- Residential end use remains strong in the Waterproofing Membranes Market, capturing 31.2% market share.

- The Asia Pacific’s strong growth reflects rising urbanization and infrastructure demand worth USD 13.8 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=160063

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 30.2 Billion |

| Forecast Revenue (2034) | USD 56.7 Billion |

| CAGR (2025-2034) | 6.5% |

| Segments Covered | By Type (Liquid Applied (Silicone, Polyurethane, Cementitious, Others), Sheet Based (Modified Bitumen, Thermoplastic Polyolefin, EPDM, Fluoropolymer Sheet, Fiber-reinforced Polymer, PVC, Others)), By Usage (Refurbishment, New Construction), By Application (Roofing, Basement and Foundation, Walls and Facades, Landfills and Tunnels, Others), By End Use (Residential, Commercial, Industrial, Infrastructure) |

| Competitive Landscape | BASF SE, Kemper System America, Inc., GAF Materials Corporation, Paul Bauder GmbH & Co. KG, CICO Technologies Ltd., Fosroc Ltd, GAF Materials Corporation, Alchimica Building Chemicals, Maris Polymers, Isomat S.A., Bayer MaterialScience AG |

Key Market Segments

By Type Analysis

In 2024, Liquid Applied dominated the By Type segment of the Waterproofing Membranes Market with a 64.9% share, reflecting its superior versatility and performance. These membranes provide seamless, flexible coverage that adapts easily to irregular surfaces, ensuring consistent protection against water intrusion. Their ease of application and strong adhesion make them ideal for both new constructions and renovation projects.

The segment’s dominance is further supported by rising investments in infrastructure repair and modernization, where durability and cost efficiency are key priorities. With ongoing global focus on sustainable and long-lasting building solutions, liquid-applied membranes are expected to maintain their leading position in the coming years.

By Usage Analysis

In 2024, New Construction dominated the By Usage segment of the waterproofing membranes market with a 64.9% share, reflecting the growing adoption of advanced waterproofing systems during the early stages of infrastructure and building projects. This segment’s strength is linked to developers prioritizing long-term durability, energy efficiency, and reduced repair costs through integrated waterproofing from the start.

The surge in modern residential and commercial construction, coupled with government-backed infrastructure programs, further boosts this trend. Expanding investments in urban development and smart city projects also continue to strengthen the preference for durable waterproofing membranes in new construction, sustaining its leading market position.

By Application Analysis

In 2024, Roofing dominated the By Application segment of the Waterproofing Membranes Market with a 34.1% share, emphasizing its essential role in safeguarding structures from water penetration and weather-related wear. Roofing membranes provide long-term protection, energy efficiency, and structural safety across residential, commercial, and industrial buildings.

The segment’s strong position reflects the constant need for durable roof sealing solutions, given that roofs face the highest exposure to rain, sunlight, and temperature changes. Ongoing growth in construction and renovation projects further reinforces roofing’s leadership, as developers prioritize reliable waterproofing materials to extend building lifespan and reduce maintenance costs.

By End Use Analysis

In 2024, the Residential segment led the By End Use category of the Waterproofing Membranes Market with a 31.2% share, underscoring the growing emphasis on water protection in housing construction. Homeowners increasingly invest in durable waterproofing systems to prevent roof leaks, basement seepage, and wall dampness, ensuring structural safety and long-term reliability.

The segment’s dominance is fueled by the rise in residential construction and renovation activities worldwide, where waterproofing membranes are vital for maintaining building integrity. As demand for high-quality, moisture-resistant homes continues to climb, the residential sector remains the primary driver of waterproofing membrane adoption across the global market.

Regional Analysis

In 2024, the Asia Pacific dominated the Waterproofing Membranes Market with a 45.9% share, valued at USD 13.8 billion, driven by rapid urbanization, infrastructure expansion, and rising residential and commercial construction. Countries across the region continue to invest heavily in modern housing and public infrastructure, boosting demand for advanced waterproofing systems.

North America and Europe follow with strong shares supported by the renovation of aging structures and the adoption of innovative building materials. The Middle East & Africa show gradual growth through large-scale commercial and government-funded projects, while Latin America expands moderately with urban development. Overall, Asia Pacific remains the key growth hub, shaping the global market’s direction.

Top Use Cases

- Roofs (Flat or Low-Slope Roofs): Waterproofing membranes are applied over roofs—especially flat or low-slope surfaces—to prevent rain, snow, or runoff from seeping into the building. They form a continuous barrier that keeps water out.

- Below-Grade Structures (Foundations, Basements, Tunnels): For any part of a building or infrastructure that’s below ground level, waterproofing membranes stop moisture from the surrounding soil or groundwater from entering. They protect against hydrostatic pressure and dampness.

- Terraces, Balconies, and Decks: These outdoor living surfaces are exposed to rain, wind-driven water, and joint/edge leaks. Waterproofing membranes here ensure the surface stays dry, preventing stains and leak-through into floors below.

- Water-Retaining Structures (Pools, Ponds, Reservoirs): In structures that hold water (or may be in constant contact with water), waterproof membranes ensure the water stays in and prevent seepage outwards. They also protect the underlying soil or structure.

- Infrastructure – Tunnels, Bridges, Rail & Transit Stations: Large infrastructure projects often have challenging conditions: deep underground, heavy loads, water pressure, and complex shapes. Membranes are used to protect the structure from seepage and damage.

Recent Developments

- In December 2024, the company (via its German parent) introduced the “New KEMPERATOR” machine, an advanced laying device for their fleece-reinforced liquid waterproofing membranes (like Kemperol 2K-PUR, 1K-SF, etc.). While this is more equipment than strictly a membrane product, it supports their waterproofing offering by enabling faster and more consistent installation of their liquid-applied membrane systems.

- In April 2024, BASF and Oriental Yuhong Waterproof Technology Co., Ltd. (Oriental Yuhong), a major Chinese company in construction waterproofing, signed a Memorandum of Understanding (MoU) “to expand and upgrade collaboration … including waterproof materials, architecture coatings, and insulation materials.”

Conclusion

The waterproofing membranes market is expanding steadily as construction industries focus on enhancing building durability and sustainability. Growing awareness of water damage prevention and the need for long-lasting structures drives consistent adoption across residential, commercial, and infrastructure sectors. Technological advancements in liquid-applied and sheet membranes have improved flexibility, ease of installation, and environmental compatibility.

Increasing government investments in infrastructure, alongside private real estate projects, continue to strengthen market momentum. With evolving urban landscapes and an emphasis on sustainable materials, waterproofing membranes are set to remain an essential component in modern construction, ensuring safety, longevity, and efficient structural performance worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)