Table of Contents

Overview

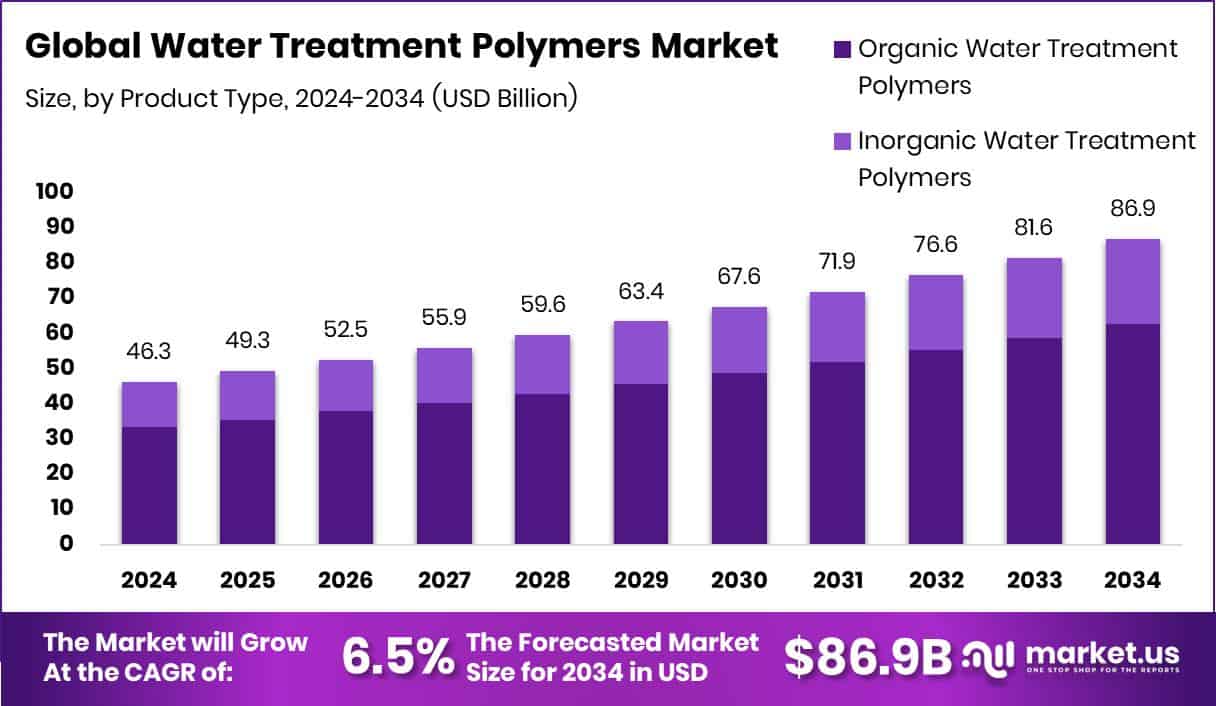

New York, NY – Dec 01, 2025 – The global Water Treatment Polymers Market is entering a strong expansion phase, driven by rising pressure on water infrastructure, industrial wastewater volumes, and urban population growth. The market is projected to reach USD 86.9 billion by 2034, up from USD 46.3 billion in 2024, growing steadily at a 6.5% CAGR. North America continues to lead with a 37.20% share valued at USD 17.2 billion, supported by consistent upgrades to aging water systems.

Water treatment polymers are critical chemicals used to improve clarification, filtration, coagulation, flocculation, and sludge dewatering. They help utilities and industries remove contaminants efficiently, reduce treatment costs, and meet stricter environmental standards. Their role has become central as water operators modernize plants and optimize existing assets rather than building entirely new facilities.

Market growth is closely tied to public and private investment flows. Governments are prioritizing water security, highlighted by national calls for USD 500 million in water infrastructure spending. Local-scale momentum is equally important, with USD 1.95 million in federal community funding directed toward wastewater treatment upgrades.

Private capital also plays a growing role, illustrated by a wastewater treatment company securing USD 50 million to expand membrane-based solutions. Globally, sanitation investments such as €130 million allocated for projects in Iraq, alongside a USD 19 million grant for wastewater system upgrades, continue to open long-term opportunities. These funding milestones position water treatment polymers as essential tools in global infrastructure modernization.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-water-treatment-polymers-market/request-sample/

Key Takeaways

- The Global Water Treatment Polymers Market is expected to be worth around USD 86.9 billion by 2034, up from USD 46.3 billion in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034.

- Organic polymers dominate the Water Treatment Polymers Market with a strong 72.1% share in 2024.

- Freshwater treatment leads the Water Treatment Polymers Market with a 62.4% contribution in 2024.

- Residential buildings account for 59.7% of the Water Treatment Polymers Market due to growing household needs

- North America reaches a market value of USD 17.2 Bn in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=166491

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 46.3 Billion |

| Forecast Revenue (2034) | USD 86.9 Billion |

| CAGR (2025-2034) | 6.5% |

| Segments Covered | By Product Type (Organic Water Treatment Polymers, Inorganic Water Treatment Polymers), By Application (Fresh-Water Treatment, Waste-Water Treatment), By End-use (Residential Buildings, Commercial Buildings, Industrial Buildings) |

| Competitive Landscape | Kemira, Ashland, Arkema, BASF SE, DuPont, Gantrade Corporation, SNF Group, Kuraray Co. Ltd, Mitsubishi Chemical Corporation, Nouryon |

Key Market Segments

By Product Type Analysis

In 2024, Organic Water Treatment Polymers led the By Product Type segment of the Water Treatment Polymers Market, capturing a 72.1% share. Their dominance is mainly driven by broad acceptance across municipal and industrial treatment facilities that increasingly favor safer, biodegradable, and high-performance solutions. These polymers support efficient clarification, improved sludge management, and stable treatment outcomes while helping operators reduce overall chemical usage.

Their strong position is also supported by rising global investment in water and wastewater infrastructure, as utilities upgrade aging plants and optimize treatment efficiency. Government-supported sanitation and wastewater improvement programs encourage the adoption of organic polymers due to their alignment with sustainability goals and regulatory compliance.

Additionally, their compatibility with modern treatment technologies, including advanced filtration and dewatering systems, enhances their long-term value. Consistent performance, operational flexibility, and environmental advantages collectively reinforce the leadership of organic water treatment polymers, allowing them to maintain a 72.1% market share in 2024.

By Application Analysis

In 2024, Fresh-Water Treatment dominated the By Application segment of the Water Treatment Polymers Market, accounting for a 62.4% share. This strong position is driven by the global priority to improve drinking water quality, modernize municipal treatment systems, and meet rising demand from growing urban populations. Water treatment polymers are widely used in freshwater facilities to enhance filtration efficiency, improve clarification, and manage sludge more effectively.

The segment continues to expand as governments increase funding for water infrastructure upgrades, supporting both new installations and the rehabilitation of aging treatment plants. Freshwater facilities also rely on these polymers to maintain consistent compliance with strict safety and quality standards while reducing operational inefficiencies. As public utilities and local communities accelerate investment in reliable and high-efficiency treatment solutions, freshwater treatment remains the primary application sustaining a 62.4% market share in 2024.

By End-use Analysis

In 2024, Residential Buildings led the by end-use segment of the Water Treatment Polymers Market, holding a 59.7% share. This dominance is closely linked to rising demand for safe and clean household water as communities confront aging water distribution systems and increasing contamination risks. Water treatment polymers play a key role in supporting household water safety by improving clarification, sediment control, and overall treatment efficiency within municipal supply networks.

Ongoing upgrades to local and community-level water infrastructure continue to drive polymer adoption, as municipalities invest in modern treatment processes to ensure reliable residential supply. Increased public funding for neighborhood water system improvements has further reinforced polymer usage, as enhanced treatment capacity directly supports growing household needs. With water quality becoming a central concern for residents, the residential segment continues to sustain its strong 59.7% market share in 2024 through consistent and essential demand.

Regional Analysis

In 2024, North America led the Water Treatment Polymers Market with a 37.20% share valued at USD 17.2 billion, supported by strong federal and state funding for water infrastructure renewal, wastewater upgrades, and tighter regulatory compliance. Aging municipal systems across the region continue to drive consistent polymer demand in both drinking water and wastewater treatment.

Europe shows stable growth as countries invest in wastewater modernization, sludge handling efficiency, and compliance with strict environmental standards, encouraging wider use of advanced treatment polymers.

Asia Pacific records fast expansion, fueled by rapid urbanization, industrial activity, and increasing need for reliable freshwater access, boosting polymer usage in municipal and industrial systems.

The Middle East & Africa advance steadily as water scarcity pushes governments toward treatment, reuse, and desalination-related projects that rely on polymers.

Latin America continues gradual progress through ongoing upgrades to community water supply and wastewater infrastructure, supporting expanded polymer applications across residential and industrial facilities.

Top Use Cases

- Coagulation & Flocculation for Clarifying Water: Polymers are used to clump tiny suspended particles (silt, clay, organic matter, microbes) together into larger flocs that settle faster. This dramatically speeds up the clarification process compared with letting particles settle naturally.

- Sludge Dewatering and Disposal Efficiency: After solids settle or are filtered, polymers help in dewatering sludge — turning watery sludge into a more solid form. That reduces sludge volume, lowers disposal costs, and makes handling and transport easier.

- Enhanced Filtration & Membrane Protection: When water passes through filters or membranes (e.g. sand filters, ultrafiltration, reverse osmosis), polymers improve filter efficiency by reducing clogging. They help particles aggregate, making downstream filtration easier and more effective.

- Treatment of Industrial or Contaminated Wastewater (Including Oil, Grease, Organics): In industries (e.g. manufacturing, refineries, food processing), wastewater often contains oils, grease, organic compounds, or heavy particles. Polymers — especially specialized ones — help in flotation or separation to remove these contaminants efficiently.

- Drinking Water Purification for Municipal Supply: For municipal systems supplying drinking water, polymers help remove turbidity, suspended solids, and impurities — improving water clarity and safety.

- Supporting Environmentally Friendly / Sustainable Water Treatment (e.g. Using Natural Polymers): There is growing use of natural or bio-derived polymers (from plants or marine sources) for water treatment. These offer a more eco-friendly alternative to conventional chemicals, reducing toxic by-products and sludge load.

Recent Developments

- In September 2025, Kemira signed an agreement to acquire Water Engineering, Inc. — a U.S.-based firm specializing in industrial water treatment services (boiler and cooling-tower water treatment, industrial wastewater, treatment chemicals, consulting) — for about USD 150 million.

- In June 2025, Ashland announced expansion of Viatel™ polymer portfolio — adding higher-molecular-weight grades targeting medical devices, wound healing, tissue engineering, etc.

- In April 2024, Arkema exhibited at the 2024 IE EXPO fair, showcasing high-performance material solutions including Kynar®, Rilsan®, and Rilsan® fine powders — identified as materials for water-treatment filtration membranes, wastewater treatment, marine anticorrosion and drinking water treatment.

Conclusion

The Water Treatment Polymers Market continues to strengthen as clean and reliable water becomes a global priority. These polymers play a vital role in improving water quality, supporting efficient treatment processes, and helping utilities manage aging infrastructure. Growing environmental awareness and stricter water regulations are encouraging wider adoption across municipal and industrial systems.

Public investment in water and wastewater upgrades, combined with rising urban demand, further reinforces long-term use. As communities focus on safety, sustainability, and operational efficiency, water treatment polymers remain essential to modern treatment solutions. Their adaptability to advanced technologies and diverse applications positions the market well for steady and sustained growth in the years ahead.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)