Table of Contents

Overview

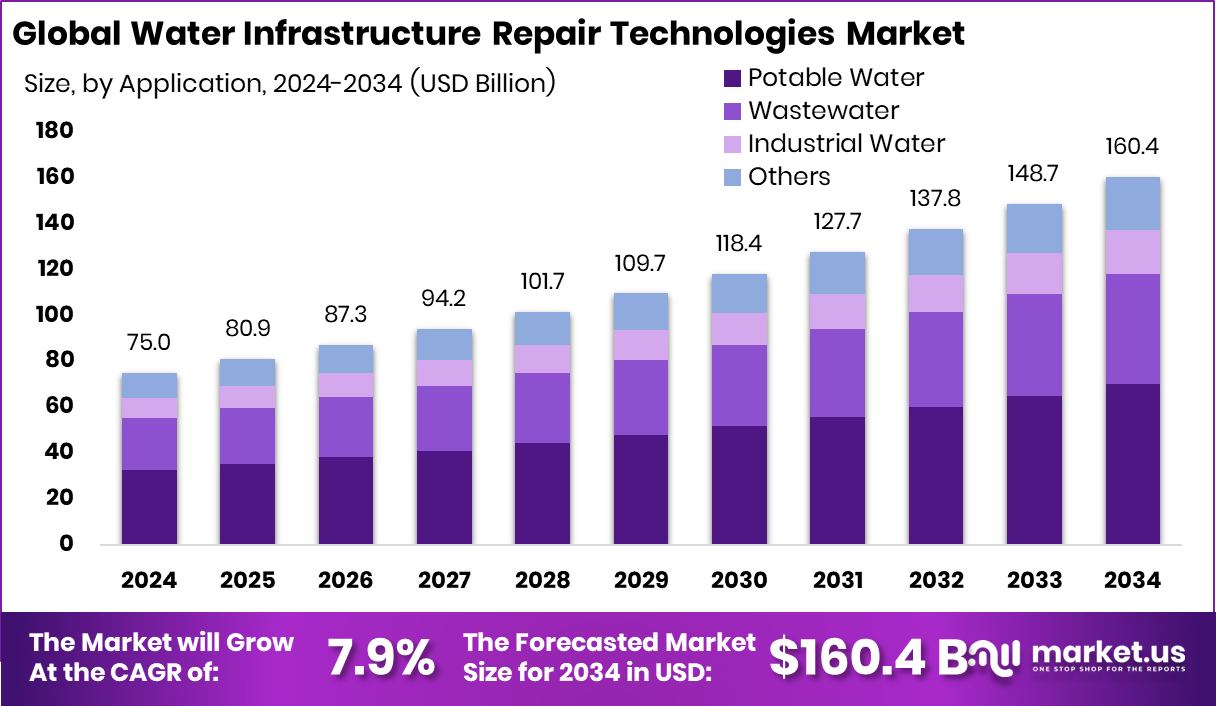

New York, NY – January 28, 2026 – The Global Water Infrastructure Repair Technologies Market, valued at USD 75.0 billion in 2024, is projected to reach USD 160.4 billion by 2034 at a 7.9% CAGR, with Asia Pacific leading at 43.70% and nearly USD 32.7 billion in value. This market centers on modern tools and materials that restore aging pipelines, leaking joints, sewer lines, and wastewater systems—helping cities cut water loss, maintain pressure stability, and extend system lifespans without disruptive excavation.

Growing investment worldwide is accelerating demand for these repair technologies. Multiple regions have expanded funding to strengthen deteriorating networks, including Bradenton’s USD 54 million for water system upgrades and the EPA’s USD 7 billion WIFIA announcement with five major loan approvals supporting water improvements. International commitments also add momentum, such as Aegea’s USD 250 million to reinforce sewage infrastructure in Manaus, Brazil, and Gov. Sanders’ USD 153 million allocation for water projects in Arkansas.

Additional capital flows continue to shape market activity. New Brunswick, California, dedicated USD 150 million for wastewater upgrades, while Northeast South Dakota secured nearly USD 140 million for water and waste improvements. Support extends further with Montana granting USD 23.7 million to 39 communities and Croatia receiving €39 million to advance wastewater treatment in Velika Gorica—collectively expanding global opportunities for advanced repair solutions.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-water-infrastructure-repair-technologies-market/request-sample/

Key Takeaways

- The Global Water Infrastructure Repair Technologies Market is expected to be worth around USD 160.4 billion by 2034, up from USD 75.0 billion in 2024, and is projected to grow at a CAGR of 7.9% from 2025 to 2034.

- The Water Infrastructure Repair Technologies Market shows strong demand for pipes and connectors, holding a 38.2% share.

- Within repair methods, spot repair dominates the Water Infrastructure Repair Technologies Market with a 47.8% contribution.

- In application areas, potable water leads the Water Infrastructure Repair Technologies Market, capturing 43.6% share globally.

- For end-use segments, drinking water distribution drives the Water Infrastructure Repair Technologies Market with 59.7% prominence.

- In 2024, the Asia Pacific dominated with a 43.70% share and USD 32.7 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=171625

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 75.0 Billion |

| Forecast Revenue (2034) | USD 160.4 Billion |

| CAGR (2025-2034) | 7.9% |

| Segments Covered | By Product Type (Pipes and Connectors, Fittings, Couplings, Valves, Others), By Repair Type (Spot Repair, Full Length Repair, Others), By Application (Potable Water, Wastewater, Industrial Water, Others), By End Use (Drinking Water Distribution, Wastewater Collection) |

| Competitive Landscape | Aegion Corporation, Mueller Water Products, Inc., 3M Company, Xylem Inc., Kurita Water Industries Ltd., Suez SA, Uponor Corporation, Advanced Drainage Systems, Inc., Atlantis D-Raintank, LLC, Brandenburger Liner GmbH & Co. KG |

Key Market Segments

By Product Type

In 2024, Pipes and Connectors dominated the Water Infrastructure Repair Technologies Market with a 38.2% share, reflecting their central role in strengthening and modernizing aging distribution networks. Utilities continued to rely on these components to restore damaged pipelines, reduce leakage, and maintain efficient water flow across urban and rural systems. Their dominance was driven by the widespread need to replace deteriorating segments quickly and reliably, especially in regions facing high water-loss levels.

As cities expanded and water demand increased, durable joints, couplings, and replacement pipes became essential for long-term network performance. Standardized components also simplified maintenance operations, enabling utilities to accelerate repair cycles and ensure consistent supply reliability. Overall, the segment’s strong share highlights its importance as the backbone of pipeline rehabilitation efforts.

By Repair Type

In 2024, Spot Repair led the Repair Type segment with a 47.8% share, driven by its efficiency in addressing localized defects without major excavation. Utilities increasingly adopted this method because it offers quick, cost-effective solutions for cracks, joint failures, and small leaks that do not require full system replacement. The appeal of Spot Repair lies in its ability to minimize service interruptions, lower labor costs, and extend asset life—all while maintaining network integrity. Its rising popularity reflects a market shift toward targeted, preventive maintenance strategies rather than large-scale overhaul projects.

By focusing on specific problem zones, utilities managed to reduce water loss, maintain pressure levels, and control operational expenses. This precision-driven approach made Spot Repair a preferred choice for municipalities prioritizing fast, minimally disruptive rehabilitation.

By Application

In 2024, Potable Water applications held the top position with a 43.6% share, underscoring the critical need to protect drinking-water infrastructure from leaks, contamination, and pressure instability. Utilities concentrated heavily on repairing pipelines that supply treated water to homes and businesses, ensuring compliance with health standards and safeguarding public safety. The segment grew stronger as aging distribution lines in many regions required continuous rehabilitation to prevent infiltration and maintain quality. Investments were primarily directed toward reinforcing vulnerable sections, upgrading joints, and improving flow consistency.

The high share also reflects growing global emphasis on water-quality protection amid rising urban populations and tightening regulatory frameworks. As potable water remains one of the most sensitive applications, repair activities are focused on ensuring uninterrupted, safe delivery through reliable and well-maintained networks.

By End Use

In 2024, Drinking Water Distribution dominated the End Use segment with a 59.7% share, highlighting its essential role in delivering treated water across widespread residential, commercial, and industrial areas. The segment’s strength comes from the extensive maintenance required to preserve long-distance distribution lines, valves, and connectors that sustain the daily water supply. Utilities intensified efforts to reduce leakage, replace worn components, and enhance the reliability of delivery systems, especially as many regions face pressure from aging infrastructure. This dominant share also reflects the priority placed on maintaining uninterrupted access to safe drinking water—a core public service.

As cities expand and networks grow more complex, the ongoing rehabilitation of distribution systems becomes indispensable. The segment’s leadership underscores the continued investment necessary to strengthen backbone infrastructure and ensure consistent, dependable water delivery worldwide.

Regional Analysis

Asia Pacific led the Water Infrastructure Repair Technologies Market with a 43.70% share valued at USD 32.7 billion, driven by its vast pipeline networks and the urgent need to modernize rapidly growing urban water systems. The region’s emphasis on leak reduction, structural rehabilitation, and improved distribution performance reinforced its dominant position. North America followed with strong demand fueled by aging municipal pipelines and the need to prevent service disruptions, supporting steady adoption of established repair methods.

Europe maintained similar progress as utilities across mature and developing cities focused on strengthening long-term infrastructure reliability. In the Middle East & Africa, rising populations and expanding water service networks increased the demand for restoration solutions.

Latin America also experienced active repair initiatives as utilities prioritized reducing losses within urban distribution systems. Overall, all regions demonstrated a growing commitment to enhancing water infrastructure performance through targeted repair and rehabilitation investments.

Top Use Cases

- Detecting and Fixing Water Leaks Early: Advanced tools like acoustic leak detection listen for the sound of water escaping pipes underground. These systems help technicians find leaks fast so they can be repaired before they waste lots of water or cause big damage.

- Repairing Pipes Without Digging (Trenchless Technology): Trenchless technologies let workers repair or replace damaged pipes without digging up roads or lawns. This saves time, reduces traffic disruption, and protects landscapes while restoring the pipeline inside.

- Cured-In-Place Pipe (CIPP) Lining: CIPP is a method of inserting a strong liner into an old pipe that hardens inside to form a new, leak-resistant inner wall. This can fix cracked or corroded pipelines without removing the old pipe entirely.

- Robotic Pipeline Inspection and Cleanup: Robots equipped with cameras and sensors can travel inside pipes to inspect for cracks or contamination and help plan repairs without manual entry. This protects workers and allows accurate diagnosis.

- Remote Wireless Leak Monitoring Systems: Wireless vibration sensors attached to water pipes can send real-time data to cloud systems to continuously monitor pipe health. This helps engineers find leaks early and decide when and where to repair.

Recent Developments

- In October 2025, Kurita’s subsidiary Fracta Leap Inc. set up a new company called InQuuater Inc. to develop and sell a product called “e-WT”, an ultrapure water supply system that ships quickly without custom design work. This system helps produce clean water fast for industries like electronics and uses advanced digital and treatment technology. Customers can operate it remotely and cut delivery and setup time.

- In October 2025, Mueller Water Products highlighted new tools and technology aimed at modernizing water infrastructure. The company talked about innovations like acoustic leak detection, pressure monitoring systems, and hydrant renewal solutions at the WEFTEC 2025 water conference. These innovations help utilities find leaks, monitor pressure, and keep fire hydrants and pipelines working better and longer.

- In June 2024, Azuria acquired Oxbow Construction, a specialist in repairing sewer and stormwater structures. Oxbow brings skills in lining, repairing manholes, and other underground water-related infrastructure work.

Conclusion

The Water Infrastructure Repair Technologies Market continues to advance as utilities worldwide focus on reducing water loss, upgrading aging networks, and improving distribution reliability. Rising investments in leak detection, trenchless repair, and pipeline rehabilitation are helping cities maintain safer and more efficient systems with less disruption.

Regions such as Asia Pacific, North America, and Europe are strengthening their repair strategies as urban growth and climate pressures increase demand for resilient infrastructure. Ongoing government funding, new technologies, and smarter monitoring tools ensure steady progress. Overall, the market remains essential for supporting long-term water security and sustainable system performance across communities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)