Table of Contents

Overview

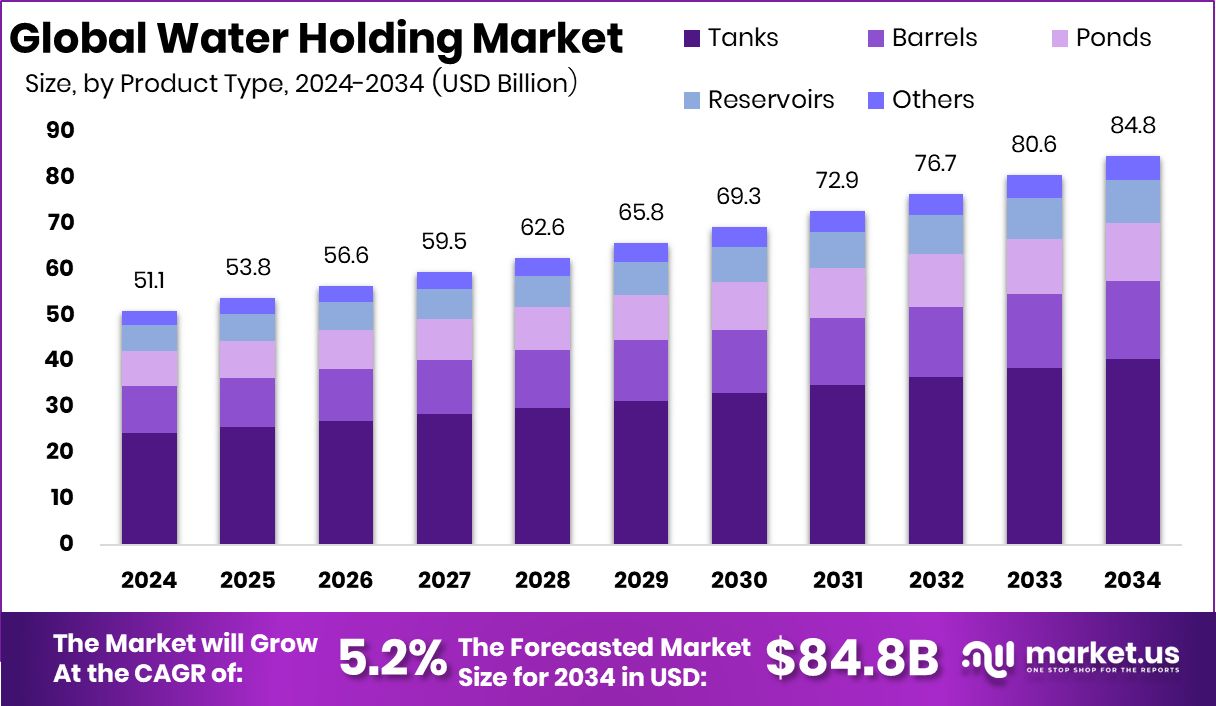

New York, NY – January 30, 2026 – The Global Water Holding Market is projected to grow from USD 51.1 billion in 2024 to USD 84.8 billion by 2034, reflecting a steady 5.2% CAGR. The Asia Pacific region remains the strongest performer, holding a 47.20% share valued at USD 24.1 billion. Water holding systems—ranging from tanks and reservoirs to groundwater recharge and community facilities—play an essential role in securing a dependable supply during droughts, rising demand, and climate-driven uncertainty.

Government initiatives worldwide are accelerating market growth. The Biden-Harris Administration’s $514 million allocation to support drinking water security in Western communities is a major push toward modern, resilient storage networks. Large-scale development efforts such as the Sites Reservoir and Harvest Water projects, expected to receive $500 million, further highlight the increasing focus on expanded storage capacity. Additional backing through $22 million Proposition 1 funding for the Kern Water Banking Project strengthens long-term resource planning.

State and regional upgrades are also shaping market prospects. California’s DWR has awarded $187 million to improve groundwater use, while the UK has extended £31 million in funding to NI Water for system enhancements. Innovation programs are emerging as well, including the $10 million WPTO funding supporting marine-energy-linked water infrastructure, opening new pathways for advanced storage technologies.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-water-holding-market/request-sample/

Key Takeaways

- The Global Water Holding Market is expected to be worth around USD 84.8 billion by 2034, up from USD 51.1 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In the Water Holding Market, tanks dominate with a strong 47.8% share across global installations.

- Plastic materials lead the Water Holding Market, securing 43.7% due to durability and wide industrial use.

- Medium-capacity units hold 47.2% of the Water Holding Market, driven by balanced cost and efficiency.

- Industrial applications account for 41.6% of the water holding market, reflecting rising demand from manufacturing sectors.

- Asia Pacific dominates this market segment, holding 47.20% worth nearly USD 24.1 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=171750

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 51.1 Billion |

| Forecast Revenue (2034) | USD 84.8 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Product Type (Tanks, Barrels, Ponds, Reservoirs, Others), By Material (Plastic, Metal, Concrete, Others), By Capacity (Small, Medium, Large), By Application (Industrial, Residential, Commercial) |

| Competitive Landscape | Veolia Environnement S.A., Suez S.A., Xylem Inc., Pentair plc, American Water Works Company, Inc., Kurita Water Industries Ltd., Aqua America, Inc., Ecolab Company, United Utilities Group PLC, Thames Water Utilities Limited |

Key Market Segments

By Product Type

Tanks remained the leading product type in the Water Holding Market in 2024, with a 47.8% share, highlighting their reliability and wide applicability. Their strong position comes from the consistent need for dependable water storage across homes, farms, and smaller industrial units. Tanks are valued for their long service life, low maintenance needs, and ease of installation, allowing users to select capacities that match their water usage patterns and space constraints.

Regions facing variable rainfall and inconsistent supply continue to rely heavily on tanks because they provide immediate and adaptable solutions. Their durable construction also makes them suitable for rural and urban environments alike. As water conservation efforts grow, tanks remain the most trusted and practical option for long-term water retention. Their convenience, cost-effectiveness, and versatility reinforce their dominance and explain why tanks maintained the largest share of the product type segment in 2024.

By Material

Plastic materials dominated the Water Holding Market in 2024 with a 43.7% share, reflecting strong user preference for lightweight and cost-effective storage solutions. Plastic tanks and storage units are easier to transport, install, and reposition than traditional metal or concrete options, making them especially suitable for residential, agricultural, and commercial needs. Their corrosion-resistant nature ensures they hold water safely for longer periods without affecting quality, an important factor in regions with varying climatic conditions. This segment benefits from the growing shift toward durable yet low-maintenance solutions as consumers and businesses seek efficient water management systems.

Plastic materials also allow for a wide range of shapes and sizes, which supports their adoption in both small and large installations. As sustainability needs expand, plastic remains the preferred choice for users seeking balance between affordability, durability, and operational convenience, securing its strong leadership in the material segment throughout 2024.

By Capacity

Medium-capacity units led the Water Holding Market in 2024, capturing a 47.2% share as users increasingly favored storage systems that offer a practical balance between size and capacity. These units are widely adopted by farms, housing communities, and small commercial operations that require dependable water reserves without the logistical challenges of extremely large storage structures. Their versatility supports daily household demands, moderate agricultural uses, and light industrial activities.

Medium-capacity systems are also more space-efficient, making them ideal for areas with limited installation space while still offering substantial water availability. Their strong performance demonstrates a rising preference for solutions that ensure continuous supply without excessive investment or maintenance burdens. As water conservation practices strengthen globally, medium-capacity units remain the most suitable category for diverse needs, reinforcing their dominance within the capacity segment in 2024.

By Application

The industrial segment led the Water Holding Market in 2024 with a 41.6% share, reflecting the substantial water requirements of manufacturing and processing environments. Industries rely on consistent water storage for essential operations such as cooling, cleaning, production cycles, and safety systems. Any disruption in water access can halt operations, making reliable storage a critical component of industrial infrastructure. The segment’s leadership underscores how companies increasingly prioritize internal water management strategies, especially amid rising concerns over supply stability and regulatory compliance.

Many industrial facilities also adopt large-scale storage units to optimize resource use and reduce dependency on external supply fluctuations. As industries continue expanding and upgrading their systems, the need for controlled and secure water reserves strengthens further. This reliance firmly positions the industrial sector as the dominant application area in 2024, emphasizing its central role in driving demand within the Water Holding Market.

Regional Analysis

Asia Pacific led the Water Holding Market in 2024 with a 47.20% share valued at USD 24.1 billion, driven by its large population, rapid urbanization, and growing industrial needs. Expanding cities and rising water stress pushed households and businesses to adopt structured and reliable storage systems, reinforcing the region’s dominant position.

North America followed with steady growth supported by infrastructure upgrades and increasing focus on efficient water use across agriculture and municipal networks. Europe also maintained a stable trajectory as countries invested in sustainable storage solutions to manage seasonal shortages.

In the Middle East & Africa, arid climates and ongoing construction activity created a strong reliance on water holding systems. Latin America saw gradual progress as both rural and urban areas sought greater water security. While each region showed distinct demand patterns, Asia Pacific stood out as the largest and most influential market, with significant potential for continued investment and expansion.

Top Use Cases

- Storing Rainwater for Everyday Use: Water holding systems like rooftop rainwater harvesting collect rainwater and store it for later use in homes for washing, gardening, or flushing toilets. This helps reduce dependence on municipal water supply, especially during dry months.

- Filling Tanks and Reservoirs for Irrigation: Farms and gardens often store water in ponds, tanks, or other structures so they have water available to irrigate crops when rainfall is low. This ensures plants get enough water even during dry spells.

- Recharging Underground Water (Aquifers): Water can be held in structures like recharge pits so it seeps slowly underground and refills groundwater sources that wells and boreholes depend on. This helps maintain water levels that might otherwise drop due to heavy use.

Recent Developments

- In May 2025, Veolia Environnement S.A. agreed to buy the remaining 30% stake in its water tech unit Veolia Water Technologies & Solutions (WTS) from the Canadian investor CDPQ for about $1.75 billion. This means Veolia now fully owns the company that makes water treatment technology and solutions. The move helps Veolia grow in water treatment and simplify how its business is run, especially in the United States, where demand for water technologies is rising.

- In April 2025, SUEZ and partners began work on what will become the largest seawater desalination plant in the Philippines (Metro Iloilo). This plant will turn seawater into safe drinking and industrial water, improving a reliable water supply for the region.

- In December 2024, Xylem completed the acquisition of Heusser Water Solutions AG, a well-known Swiss water solutions provider.

Conclusion

The Water Holding Market continues to strengthen as more regions prioritize reliable water access and long-term resource management. Growing climate variability, rising demand from households, industries, and agriculture, and the need for resilient storage systems all support steady market expansion. Governments and communities are investing more in sustainable water infrastructure, from tanks and reservoirs to modern treatment and recharge systems.

At the same time, innovations in materials, design, and water-saving technologies are making storage solutions more efficient and accessible. Overall, the market is set to progress as water security becomes a central part of environmental planning and daily living worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)