Table of Contents

Introduction

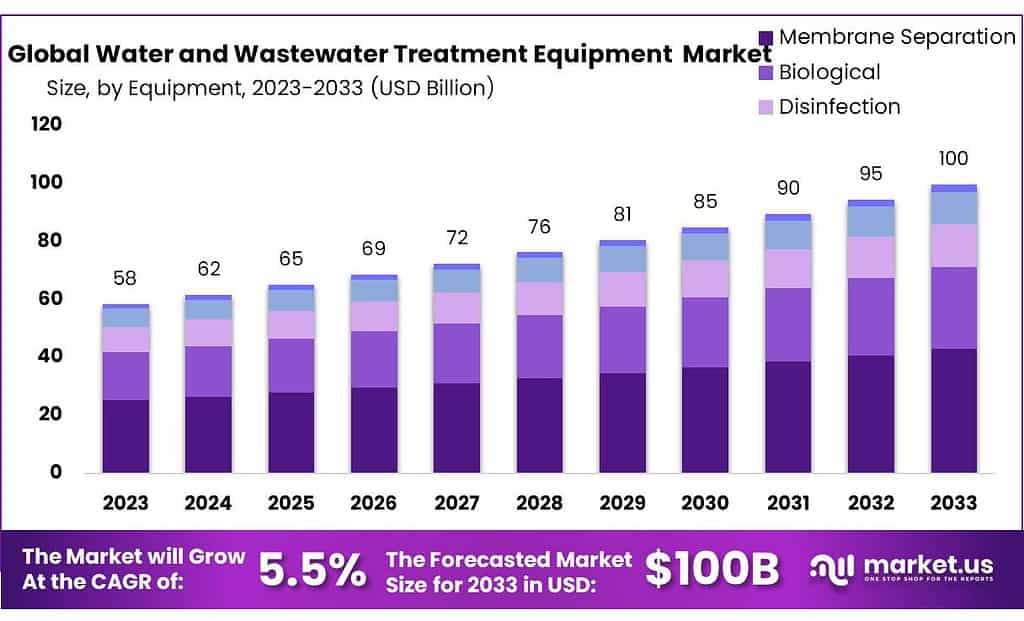

The global water and wastewater treatment equipment market is expected to experience significant growth, projected to rise from USD 58 billion in 2023 to approximately USD 100 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.5%. This growth is primarily driven by the increasing demand for clean water, accelerated by urbanization, stricter regulatory pressures for wastewater treatment and reuse, and advancements in treatment technologies.

However, the sector faces several challenges, notably the high capital and operational costs of advanced water treatment technologies. These costs can be especially burdensome in developing regions, where budget constraints are more pronounced.

Additionally, managing complex wastewater treatment projects and the need for constant technological innovation to comply with evolving regulatory standards add operational complexity.

Recent developments underscore the sector’s dynamic nature, with major companies like Veolia and Suez expanding through strategic acquisitions to enhance their technological capabilities and market presence.

A key example is Suez’s acquisition of Veolia’s former UK-based waste-treatment unit for USD 2.42 billion, highlighting the industry’s consolidation efforts aimed at strengthening service offerings and market positions.

Ecolab Inc. has strengthened its position in the water treatment market through a strategic minority equity investment in Aquatech International. This partnership enables Ecolab to enhance its comprehensive water management solutions by integrating Aquatech’s advanced water treatment technologies, which are essential for improving water quality and reducing water usage in industrial applications.

Aquatech, known for its innovative designs and engineering solutions, specializes in water reuse and recycling, making it a key player in industrial water treatment. The collaboration with Ecolab is poised to expand Aquatech’s global reach, providing integrated solutions across a range of industries.

Key Takeaways

- Water and Wastewater Treatment Equipment Market set to reach USD 100 billion by 2033, with a 5.5% CAGR from 2023.

- Membrane Separation technology captured 43.2% market share in 2023, vital for water purification.

- Filtration (34.3% market share) removes impurities, while adsorption tackles organic compounds and heavy metals.

- Primary Treatment Dominance Captured 49.3% market share in 2023, essential for removing solids and organic matter from wastewater.

- Municipal Application Dominance Captured 69.3% market share in 2023, crucial for ensuring public health and environmental protection.

- Asia Pacific Market Leadership Held a commanding 38.4% market share, driven by industrial activities and urbanization.

Water and Wastewater Treatment Equipment Statistics

- Population Served: The WWTP serves 140,000 equivalent inhabitants during the high season and 69,000 off-season.

- Wastewater Input: Wastewater is collected from various locations through 14 pumping stations.

- Flow Rates: Maximum flow rates are 745 liters per second (l/s) during the high season and 322 l/s off-season.

- Daily Wastewater Processed: Approximately 34 billion gallons are treated daily in the U.S.

- Infrastructure Investment Needed: An estimated $271 billion is required over the next 25 years for maintenance and improvements of water facilities.

Energy and Environmental Impact

- US Electricity Usage for Water Treatment: Water treatment processes account for about 4% of the total U.S. electricity consumption, or 30.2 billion kWh annually.

- Energy Efficiency with LEDs: Retrofitting HID lighting with LEDs can reduce energy consumption by up to 70%.

- CO2 Emission Reduction: Switching to LEDs can also cut CO2 emissions by up to 65%.

- Plant Lifespan: Many wastewater treatment plants are designed to last 40 to 50 years.

- Lighting in Plants: Lighting makes up about 25% to 40% of a plant’s electrical usage.

Innovation and Patents in Wastewater Treatment

- Patents: Over 42.5% of patents in the wastewater treatment (IWT) sector focus on device-related technologies.

- Patent Growth: Annual patent filings in this sector have increased almost 1,200-fold over the past 47 years, showing significant innovation and growth in wastewater technology.

Emerging Trends

Digital Water Management: The integration of AI, IoT sensors, and digital twins is transforming water systems by enabling real-time monitoring and automated control. These technologies enhance water quality, reduce waste, and optimize the allocation of resources. For instance, predictive maintenance and leak detection using AI can significantly cut operational costs and prevent service interruptions. This smart management approach also aids in optimizing water distribution and consumption, crucial for areas facing water scarcity.

Advanced Filtration Technologies: Nanotechnology is revolutionizing filtration systems, especially with the development of advanced membranes capable of removing micropollutants such as pharmaceuticals, heavy metals, and bacteria from water. These innovations improve water quality by enabling more efficient purification with fewer chemicals. For example, nano-structured filters can enhance membrane performance, extending their lifespan and reducing energy consumption.

Decentralized Water Treatment: Decentralized systems are gaining traction, especially in rural and developing regions where centralized water infrastructure may not be viable. These modular systems allow for on-site water treatment, offering greater flexibility, scalability, and lower installation costs. They are particularly suited for small communities or industries with unique water treatment needs, reducing dependence on large-scale infrastructure and increasing resilience to local water shortages.

Sustainable Materials and Processes: The water treatment sector is increasingly adopting sustainable materials and processes. Bio-based remediation methods, such as algae-based systems or microbial fuel cells, offer eco-friendly alternatives to traditional chemical treatments. Carbon-based purification materials are also being explored for their ability to filter contaminants more efficiently while minimizing environmental impact. These innovations align with growing demand for sustainable and low-carbon water management solutions.

Desalination Technologies: With rising concerns over water scarcity, desalination technologies are advancing. Modern desalination methods are incorporating renewable energy sources like solar and wind to reduce the high energy demands typically associated with these processes. Furthermore, more efficient reverse osmosis systems and innovative desalination methods are helping lower the economic and environmental costs of converting seawater into freshwater, making it a more viable solution for water-stressed regions.

Water Reuse and Recycling: As water scarcity becomes an increasing concern, water reuse and recycling technologies are gaining importance. These systems are designed to treat wastewater and make it safe for reuse in agricultural, industrial, or even potable applications. Technologies such as membrane bioreactors and advanced oxidation processes are improving the efficiency and cost-effectiveness of water recycling, particularly in arid regions where water resources are limited.

Use Cases

Industrial Applications: In industrial environments, water treatment plays a crucial role in managing waste products and ensuring compliance with environmental regulations. One key example is the use of tramp oil separators in industries such as manufacturing and automotive. These separators remove oils and greases from wastewater, preventing contamination and protecting water quality. By ensuring that wastewater is treated effectively, these systems help industries adhere to stringent environmental standards while also reducing water pollution.

Municipal Wastewater Management: Municipalities rely on advanced water treatment technologies to protect public health and the environment. Techniques like membrane filtration, advanced oxidation, and biological treatments are essential for removing pollutants and pathogens from wastewater. These processes make water safe for either discharge into natural water bodies or reuse for purposes such as irrigation or industrial applications. By utilizing these technologies, municipalities can significantly improve water quality and contribute to sustainable water management practices.

Agriculture: Treated wastewater is becoming an increasingly valuable resource in agriculture. It is being used for irrigation, offering a sustainable alternative to fresh water while simultaneously reducing the demand for synthetic fertilizers. The nutrient content of treated wastewater, which can include nitrogen and phosphorus, benefits crop growth and enhances soil quality. This approach helps conserve fresh water resources, making it particularly valuable in water-scarce regions.

Smart Water Management: The integration of digital technologies like AI, IoT, and digital twins is revolutionizing water treatment processes. These innovations enable real-time monitoring of water quality and optimize treatment operations, making the process more efficient and cost-effective. Smart water management systems not only help in improving water recovery rates but also reduce operational costs by predicting issues before they occur and streamlining maintenance activities.

Decentralized Systems for Rural Areas: For rural areas, where large-scale water treatment infrastructure may be impractical or too expensive, decentralized water treatment systems are proving to be an effective solution. These smaller, modular setups are designed to be cost-efficient, easy to install, and low-maintenance. They provide remote communities with a sustainable, reliable means of ensuring access to clean water, enhancing both public health and quality of life in areas where centralized systems are not feasible.

Major Challenges

High Capital and Operating Costs: One of the most significant barriers to the adoption of advanced water and wastewater treatment equipment is the high initial capital investment required for installation. Systems like reverse osmosis (RO) and advanced filtration can cost millions of dollars to set up, making them prohibitive for small to medium-sized enterprises (SMEs) or municipalities with limited budgets.

For example, the cost of setting up a reverse osmosis system can range from $500,000 to $10 million, depending on the size and complexity of the operation. In addition, operating costs such as energy consumption, maintenance, and labor can increase the total cost of ownership.

Energy Consumption: Water treatment processes, especially those involving desalination and reverse osmosis, are highly energy-intensive. For example, desalination plants can consume up to 3-6 kWh of energy per cubic meter of water produced. This high energy consumption not only raises operating costs but also contributes to environmental concerns, particularly in regions where energy is primarily sourced from fossil fuels. The energy costs can make water treatment less sustainable and less economically viable in areas that are already facing power shortages or high electricity costs.

Technological Limitations: Despite advancements in technology, current water treatment equipment often faces limitations in efficiency and scalability. For instance, while membrane filtration technologies like RO have made significant strides, they still struggle with issues like fouling, clogging, and high maintenance requirements. Membrane fouling, caused by the accumulation of contaminants on the membrane surface, can reduce efficiency and increase cleaning costs by up to 30%. This leads to higher downtime and reduced operational efficiency, which can be particularly challenging for industries where continuous water supply is crucial.

Water Quality Variability: Variations in water quality due to seasonal changes, pollution, or the presence of industrial contaminants can affect the performance of treatment systems. For example, water used in agricultural irrigation may contain high levels of salts or organic matter, which can damage treatment equipment if not properly managed. In industrial settings, wastewater might contain heavy metals, oils, or chemicals that require specialized treatment methods. As water quality varies across different regions, the cost and complexity of treatment equipment must be tailored to address these specific challenges. The treatment process can become less effective if the system is not designed to handle these variations, leading to inefficiencies.

Lack of Skilled Labor: Operating and maintaining advanced water treatment systems requires specialized knowledge and skilled labor. In many developing regions, there is a shortage of trained personnel to operate and maintain these complex systems. This lack of skilled labor leads to operational inefficiencies, higher maintenance costs, and potential system failures. According to the World Economic Forum, nearly 60% of water utilities in developing countries face significant challenges due to a lack of trained personnel. This shortage not only affects the quality of water treatment but also increases the risk of equipment failure and delays in meeting water treatment standards.

Environmental Impact and Waste Generation: While water treatment equipment is designed to improve water quality, some technologies, such as reverse osmosis and desalination, can generate significant amounts of brine or sludge, which need to be properly managed. Brine disposal from desalination plants, for example, can have negative environmental consequences if not treated correctly. The global volume of desalination brine is estimated to be over 142 million cubic meters per day, and improper disposal can lead to marine pollution and harm to aquatic life. Similarly, wastewater treatment plants generate sludge that requires disposal or recycling, adding to the operational complexity.

Top Opportunities

Rising Water Scarcity and Demand for Clean Water: With global water scarcity becoming a more pressing issue, particularly in regions like the Middle East, Africa, and parts of Asia, there is an increasing demand for effective water treatment solutions. According to the United Nations, over 2 billion people worldwide face water scarcity. This has created a strong market demand for water and wastewater treatment equipment. Governments and private companies are investing heavily in infrastructure and technologies to ensure sustainable water supply systems.

Technological Advancements (AI, IoT, Digital Twins): Advancements in digital technologies, such as Artificial Intelligence (AI), Internet of Things (IoT) sensors, and digital twins, are opening new opportunities for improving water management efficiency. These technologies allow for real-time monitoring, predictive maintenance, and optimized treatment processes.

For example, AI can predict equipment failures, reducing downtime and maintenance costs. IoT sensors enable continuous monitoring of water quality, while digital twins can simulate water treatment processes for better optimization. As these technologies continue to evolve, they offer a significant market opportunity for companies in the water treatment equipment sector to develop smarter, more efficient solutions.

Decentralized Water Treatment Solutions: The shift towards decentralized water treatment systems, especially in rural and developing areas, is gaining momentum. These smaller, modular systems are cost-effective, easy to maintain, and can be quickly deployed in areas where large-scale infrastructure is not feasible. For example, modular filtration and treatment units can be installed at individual homes or small communities. The global market for decentralized water treatment is growing at a rate of 8.5% annually, driven by the need for localized solutions and the growing adoption of off-grid technologies.

Water Reuse and Recycling: As the world faces increased pressure on freshwater resources, water reuse and recycling technologies are becoming essential. The market for wastewater recycling and reuse systems is rapidly expanding, particularly in industrial, agricultural, and municipal sectors. Municipalities are increasingly adopting water recycling systems to reduce dependency on freshwater, while industries are reusing treated water for processes like cooling, irrigation, and cleaning. This trend presents a significant opportunity for water treatment equipment manufacturers to innovate in wastewater treatment technologies.

Emerging Markets and Infrastructure Development: Many developing countries are investing heavily in water and wastewater infrastructure, driven by population growth and urbanization. For instance, Asia-Pacific is expected to account for the largest share of the water treatment equipment market, with countries like China and India ramping up investments in water infrastructure. In China, the government plans to invest $137 billion by 2025 in water treatment infrastructure as part of its efforts to address water pollution and supply challenges. This provides a massive opportunity for companies to expand their presence in these rapidly growing markets.

Future Outlook of the Water and Wastewater Treatment Equipment Industry

Growth in Renewable Energy: As countries and corporations increasingly commit to reducing carbon emissions, the demand for renewable energy sources continues to grow. PPAs are pivotal in facilitating the finance and development of renewable energy projects, such as solar and wind farms. This trend is likely to persist as more entities aim to achieve carbon neutrality.

Corporate Demand: There’s a significant increase in corporate PPAs where private businesses agree to purchase electricity directly from renewable energy producers. This shift is motivated by the desire to lock in energy costs and reduce carbon footprints. Companies like Google, Amazon, and Microsoft have been leading this trend, and it’s expected that more companies will follow suit.

Technological Advancements: Innovations in energy storage and smart grid technologies enhance the viability of PPAs by making renewable energy sources more reliable and efficient. As these technologies continue to evolve, they can solve intermittent issues related to wind and solar energy, making PPAs more attractive.

Regulatory Support: Many governments are implementing policies that encourage the adoption of renewable energy, such as subsidies, tax incentives, and mandates. These policies are crucial for the growth of the PPA market as they provide a more stable and predictable environment for long-term investments in renewable energy.

Diversification of Energy Sources: The diversification in renewable energy sources, including geothermal, biomass, and offshore wind, provides new opportunities for PPAs. Each of these sectors can have specific characteristics advantageous for different regions or energy needs, broadening the potential market for PPAs.

Decentralization of Energy Production: The move towards smaller, more distributed energy production facilities, including community and rooftop solar projects, could expand the role of PPAs in the residential and community sectors. This decentralization supports energy resilience and independence, appealing to a broader base of consumers.

Asia Pacific Water and Wastewater Treatment Equipment Market

The Asia Pacific region is currently leading the global water and wastewater treatment equipment market with a significant 38.4% share. This prominence is primarily due to an increasing need for sophisticated water treatment systems across various sectors, particularly within municipal and industrial domains. The rapid industrialization and urbanization seen in major countries such as China, India, Japan, South Korea, Australia, and New Zealand are key drivers behind the region’s market growth.

In North America, the market for water and wastewater treatment equipment is also expanding, driven by economic growth and a heightened focus on sustainable water management. In countries like the United States and Canada, there is a notable shift towards eco-friendly practices, which significantly contributes to the momentum in the market.

Europe, too, is seeing dynamic growth in this sector. The demand for efficient water treatment solutions is increasing across municipal and industrial settings, fueled by a strong regional commitment to improving water quality and advancing sustainable water usage practices. Europe’s proactive approach in promoting water sustainability makes it an essential player in the international arena of water and wastewater treatment.

Recent Developments

Ecolab Inc. continues to be a leader in the water and wastewater treatment equipment sector. In 2023, the company achieved significant growth, generating over $15 billion in global revenue, with water treatment solutions accounting for a substantial portion. Ecolab’s comprehensive solutions help industries reduce water usage, improve efficiency, and comply with regulatory standards. Their technologies, including water reuse systems and digital monitoring, are crucial in addressing water scarcity and pollution. The company’s continued investments in innovation and partnerships strengthen its market position.

Aquatech International LLC is a key player in the water and wastewater treatment sector, focusing on innovative water treatment solutions, including desalination and water reuse technologies. In 2023, Aquatech secured several high-profile contracts, adding over 100 million gallons per day of wastewater treatment capacity. Known for its advanced membrane filtration technologies, Aquatech is expanding globally, with projects in the Middle East, North America, and Asia. Its focus on sustainability through water recovery and energy efficiency positions it as a leader in the market.

Calgon Carbon Corporation, a subsidiary of Kuraray Co., plays a pivotal role in water and wastewater treatment. In 2023, the company reported revenue of over $1.5 billion, with a significant portion from its water treatment solutions, including activated carbon and filtration technologies. Calgon Carbon’s technologies are widely used for water purification, including removing contaminants such as heavy metals and volatile organic compounds. The company continues to expand its global presence with advanced water treatment technologies.

DuPont is a leading player in the water and wastewater treatment sector, particularly known for its filtration and membrane technologies. In 2023, DuPont’s Water & Protection segment generated approximately $9.5 billion in revenue, with a strong focus on improving water treatment efficiency and addressing water scarcity. The company’s reverse osmosis and ultrafiltration membranes are widely used in municipal and industrial water treatment, contributing to sustainable water use across the globe. DuPont is also increasing its investment in innovations for water purification.

Ecologix Environmental Systems, LLC specializes in water and wastewater treatment solutions, focusing on chemical treatment, filtration, and wastewater recycling systems. In 2023, the company saw strong growth in demand for its wastewater treatment solutions, particularly in industries such as food processing, manufacturing, and municipal systems. Ecologix offers sustainable solutions that help industries reduce water usage and treat wastewater more efficiently. Its advanced filtration systems and chemical treatments have positioned it as a reliable partner for industrial wastewater management.

Evoqua Water Technologies LLC is a key player in the water and wastewater treatment equipment sector, offering a wide range of solutions to improve water quality and efficiency. In 2023, Evoqua reported revenue of approximately $2.5 billion, with a focus on industrial, municipal, and commercial water treatment systems. The company specializes in advanced filtration, disinfection, and water reuse technologies, helping industries reduce water consumption and comply with environmental regulations. Evoqua’s innovative solutions continue to drive its expansion globally.

General Electric (GE) is a significant contributor to the water and wastewater treatment equipment sector through its GE Water & Process Technologies division. In 2023, GE’s water treatment business generated over $1.7 billion in revenue, focusing on industrial and municipal water treatment solutions. The company provides a range of services, from filtration to chemical treatments, aimed at improving water quality and resource efficiency. GE’s continued innovation in water treatment technologies, including reverse osmosis and water reuse, solidifies its market position.

Koch Membrane Systems, Inc. is a leader in providing advanced filtration and membrane technologies for water and wastewater treatment. In 2023, the company reported significant growth, with revenue reaching approximately $600 million. Koch specializes in providing solutions such as reverse osmosis and ultrafiltration for both municipal and industrial sectors. The company’s technologies help improve water quality and reduce operational costs for businesses. Koch’s innovations continue to support the growing demand for efficient and sustainable water treatment solutions.

Lenntech B.V. is a prominent Dutch company specializing in water and wastewater treatment equipment. In 2023, Lenntech’s revenue exceeded €100 million, driven by the growing need for sustainable water treatment solutions across various industries. The company’s offerings include desalination, filtration, and water reuse technologies, focusing on providing efficient and environmentally-friendly systems. Lenntech has been active in expanding its footprint in Europe, Asia, and the Middle East, offering customized solutions for water purification and wastewater management.

Ovivo is a leading provider of water treatment solutions, specializing in the design and manufacture of equipment for water and wastewater treatment. In 2023, Ovivo reported annual revenues of approximately $500 million. The company’s offerings include filtration, reverse osmosis, and membrane technologies, serving municipal, industrial, and commercial markets. Ovivo’s solutions focus on improving water quality and efficiency while minimizing environmental impact. The company continues to expand its global presence, offering innovative solutions to address the growing water scarcity and wastewater treatment needs.

Parkson Corporation is a key player in the water and wastewater treatment equipment sector, focusing on providing filtration and separation technologies. In 2023, Parkson’s revenue was estimated at $200 million, driven by the increasing demand for wastewater treatment solutions in both industrial and municipal sectors. The company’s solutions include advanced filtration systems and aerobic and anaerobic treatment technologies that improve water quality and reduce operational costs. Parkson continues to innovate, focusing on sustainable water management solutions for a wide range of industries.

Xylem, Inc. is a leading player in water and wastewater treatment, offering a wide range of solutions including advanced pumps, filtration, and treatment technologies. In 2023, the company generated approximately $5.5 billion in revenue, with water treatment accounting for a significant portion of their business. Xylem’s focus on innovation and sustainability continues to drive its growth, especially in the industrial and municipal water sectors. In 2024, the company plans to expand its digital water solutions and sustainable infrastructure projects.

Conclusion

In conclusion, the water and wastewater treatment equipment market is crucial in tackling significant water management challenges across multiple industries. As global concerns about sustainability grow and regulatory requirements become more stringent, the demand for advanced water treatment technologies is experiencing strong growth. Innovations such as Artificial Intelligence (AI), the Internet of Things (IoT), and modular water treatment systems are driving transformation in the sector, offering solutions that improve operational efficiency, reduce costs, and help companies meet environmental compliance standards.

These technological advancements are not only addressing the needs of industrial and municipal sectors but are also extending to agriculture and rural areas, showcasing the broad applicability and critical importance of water treatment solutions. As the market continues to expand, fueled by both technological breakthroughs and increasing environmental awareness, the role of water and wastewater treatment equipment in ensuring the safe, efficient, and sustainable use of water resources is becoming more vital. This dynamic and rapidly evolving sector is positioned for continued growth, supported by innovation and the global push to conserve and optimize water usage.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)