Table of Contents

Overview

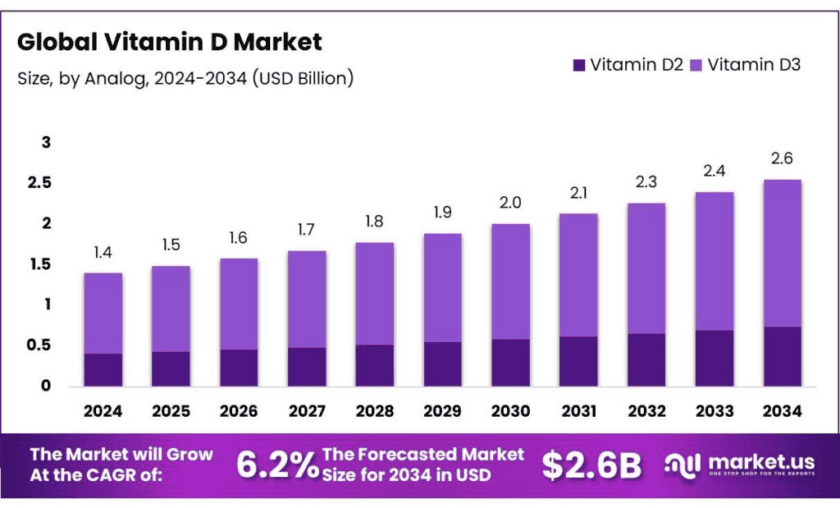

New York, NY – Dec 04, 2025 – The global Vitamin D market is projected to reach USD 2.6 billion by 2034, up from USD 1.4 billion in 2024, growing at a CAGR of 6.2% between 2025 and 2034. In 2024, North America dominated the market with a 43.9% share, generating approximately USD 0.6 billion in revenue. Vitamin D, a fat-soluble vitamin, is essential for calcium and phosphorus absorption, supporting bone and dental health, while also contributing to immune regulation, muscle function, and inflammation reduction.

Market growth is driven by the rising prevalence of vitamin D deficiency, which affects around 15% of the global population with serum 25(OH)D levels below 30 nmol/L, according to a 2023 study in The Lancet Regional Health. Increased consumer awareness about bone and immune health, along with government initiatives, has further fueled demand. For example, the U.S. FDA approves vitamin D3 fortification in food products, India launched ‘Project Dhoop’ to enhance student exposure to natural sunlight, and Australia mandates fortification of edible oils with a minimum of 55 mg/kg of vitamin D, reflecting policy efforts to reduce deficiency and support population health.

Key Takeaways

- Vitamin D Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 6.2%.

- Vitamin D3 held a dominant market position, capturing more than a 71.2% share of the global vitamin D market.

- Dry held a dominant market position, capturing more than a 68.7% share of the global vitamin D market.

- Functional Food & Beverage held a dominant market position, capturing more than a 34.4% share.

- Adults held a dominant market position, capturing more than a 48.9% share of the global vitamin D market.

- North America held a dominant position in the global vitamin D market, capturing more than a 43.9% share, valued at approximately USD 0.6 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-vitamin-d-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.4 Bn |

| Forecast Revenue (2034) | USD 2.6 Bn |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Analog (Vitamin D2, Vitamin D3), By Form (Dry, Liquid), By Application (Functional Food and Beverage, Feed and Pet Food, Pharmaceuticals, Personal Care, Others), By End-User (Adults, Pregnant Women, Children) |

| Competitive Landscape | Zhejiang Garden Biochemical High-Tech Co. Ltd., Taizhou Haisheng Pharmaceutical Co. Ltd, Xiamen Jindawei Vitamin Co. Ltd., Fermenta Biotech Ltd., BASF SE, Dishman Group, Zhejiang Medicine Co. Ltd., Zhejiang Xinhecheng Co. Ltd., Glanbia Plc, Divi’s Nutraceutical, McKinley Resources Inc., New Gen Pharma Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161308

Key Market Segments

By Analog Analysis – Vitamin D3

In 2024, Vitamin D3 accounted for approximately 71.2% of the global vitamin D market, establishing a dominant position. Its widespread adoption is driven by high bioavailability and effectiveness in supporting bone health, immune regulation, and overall wellness. Naturally synthesized in the skin through sunlight exposure, Vitamin D3 maintains stable blood levels for longer periods, making it the preferred analog. Extensive use in preventive healthcare, fortified foods, and pharmaceuticals reinforces its market leadership, and increasing awareness of vitamin D deficiency continues to drive demand for D3 capsules, soft gels, and functional food formulations.

By Form Analysis – Dry Form

Dry formulations of vitamin D held a leading market share of around 68.7% in 2024. Their dominance is supported by stability, extended shelf life, and ease of integration into capsules, tablets, and powdered supplements. The form allows manufacturers to maintain potency over time, making it suitable for pharmaceutical and functional food applications. Consumers favor dry vitamin D products for convenience in storage, transport, and consumption without refrigeration. The ability to blend easily into fortified foods and beverages further strengthens the market position of dry formulations globally.

By Application Analysis – Functional Food & Beverage

In 2024, the Functional Food & Beverage segment accounted for over 34.4% of the vitamin D market, leading other applications. Growth is driven by rising consumer awareness of vitamin D’s benefits for immunity, bone health, and overall wellness. Manufacturers are fortifying dairy products, cereals, plant-based beverages, and snacks to help consumers meet daily nutritional needs conveniently. Ready-to-drink beverages and nutrient-enriched powders are also gaining popularity, reinforcing the strong market position of this segment amid the increasing trend toward preventive healthcare and daily supplementation.

By End-User Analysis – Adults

Adults represented the largest end-user segment in 2024, capturing approximately 48.9% of the global vitamin D market. Strong demand is driven by heightened awareness of vitamin D’s role in bone maintenance, immune support, and prevention of chronic conditions such as osteoporosis and cardiovascular diseases. Adults actively consume supplements in the form of capsules, soft gels, and fortified foods to support preventive healthcare. Lifestyle factors, limited sun exposure, and dietary gaps further increase reliance on supplementation, ensuring sustained growth and consistent market demand within this demographic.

List of Segments

By Analog

- Vitamin D2

- Vitamin D3

By Form

- Dry

- Liquid

By Application

- Functional Food & Beverage

- Feed & Pet Food

- Pharmaceuticals

- Personal Care

- Others

By End-User

- Adults

- Pregnant Women

- Children

Regional Analysis

North America Market Analysis

In 2024, North America dominated the global vitamin D market with a 43.9% share, valued at approximately USD 0.6 billion. This leadership is supported by the region’s advanced healthcare infrastructure, high consumer awareness of vitamin D’s role in bone health, immune support, and overall wellness, and proactive public health programs. The prevalence of vitamin D deficiency—driven by limited sun exposure, dietary patterns, and lifestyle choices—has increased demand for supplements. Additionally, the aging population is increasingly adopting vitamin D to prevent and manage conditions such as osteoporosis and rickets, reinforcing the region’s market prominence.

Top Use Cases

Muscle Strength, Falls & Aging‑Related Mobility: Beyond bones, vitamin D contributes to muscle function, balance, and neuromuscular coordination. It may help reduce muscle weakness and lower the incidence of falls, a major cause of morbidity among older adults. This benefit becomes particularly relevant in aging populations, supporting mobility and reducing long-term fracture risk.

Immune Function & Potential Disease‑Modulating Effects: Vitamin D exhibits immune‑modulating and anti‑inflammatory properties. Evidence suggests that persons with low vitamin D levels have increased risk of infections, autoimmune diseases, and possibly certain chronic conditions. Supplementation in deficient individuals has been associated with improved immune markers and reduced inflammation in some studies.

Public Health & Nutritional Deficiency Correction: Given the widespread global prevalence of vitamin D deficiency — reported at 50–90% in some regions, including children and adults — supplementation or dietary fortification represents a major public health tool. Fortified foods, supplements, and controlled sun exposure help address deficiency, especially in populations at risk due to lifestyle, geographic location, or limited sun exposure.

Use in Clinical / Preventive Contexts (Ageing, Chronic Disease Risk Management): Vitamin D intake is often part of preventive health strategies for at-risk groups: older adults, individuals with limited sun exposure, those with bone‑density issues, or those with chronic diseases influencing absorption. Clinical guidance typically recommends serum 25(OH)D monitoring, and supplementation (e.g. 800–1000 IU/day) is considered for those with sub‑optimal levels to support bone and musculoskeletal health, and possibly immune resilience.

Recent Developments

Zhejiang Garden Biochemical High‑Tech remains a leading global manufacturer of Vitamin D₃ (cholecalciferol). In 2024, the company reported robust demand for its Vitamin D₃ products, with its diversified product portfolio—including feed‑grade, food‑grade, and pharmaceutical‑grade D₃—serving customers across Europe, North America, South America, and East Asia. Its technical datasheets show batches of Vitamin D₃ in crystal form with ≥ 97.0% purity and product specifications of up to 40 million IU/g. The company’s vertical integration—from raw material sourcing (lanolin/cholesterol) to finished Vitamin D₃—supports large‑volume supply and helps meet growing global demand for supplements, fortified foods, and nutraceuticals.

Taizhou Hisound Pharmaceutical is an established Chinese producer specializing in Vitamin D series products (D₂, D₃) and related derivatives. As of 2024, the company maintains manufacturing facilities in Zhejiang’s chemical/pharma materials base, producing Vitamin D₃ in various forms including crystals, oils, and beadlets—suitable for food, feed, and pharmaceutical applications. The firm emphasizes quality control and regulatory compliance, supplying feed‑grade and pharmaceutical‑grade D₃ to global markets, thereby contributing to the global vitamin supply chain with cost‑effective, scalable production capacity.

Xiamen Jindawei Vitamin Co. Ltd., now operating under the name Xiamen Kingdomway Group Co., Ltd., remains a major global supplier of vitamin D3. After a reconstruction and expansion project completed by late 2023, the company’s capacity reached an annual output of 200 tons of vitamin D3 oil, 2.2 tons of D3 crystallization, and 1,500 tons of D3 powder — supporting both nutritional and feed‑grade markets. Their product range continues to serve human nutrition, dietary supplements and global export markets under GMP‑ and quality‑certified standards.

Fermenta Biotech maintained its status as a leading global Vitamin D3 manufacturer in 2024. The company’s portfolio includes crystalline, oil, resin‑in‑oil, cold‑water dispersible (CWD) and feed‑grade powder formats — enabling broad application across human supplements, fortified foods, feed, and nutraceuticals. In March 2025, Fermenta was awarded “Best Innovation of the Year” for its plant‑based Vitamin D3 product, VITADEE™ Green, underscoring its commitment to sustainable, clean‑label nutrition and strengthening its position for global food and nutraceutical markets.

In 2025, BASF re‑entered the vitamin D space with a new combined product, Lutavit A/D3 1000/200 NXT, which bundles vitamin A and vitamin D3 in a single microencapsulated formulation for animal nutrition. This launch followed a production disruption in mid‑2024 at its Ludwigshafen site, which had impacted vitamin output including D3; BASF indicated that full restoration of its vitamin manufacturing operations would extend into 2025. The new formulation is positioned to offer stable, high‑quality vitamin D3 supply for premixes, pellets and feed applications, reflecting BASF’s strategy to leverage its large‑scale production and global distribution.

As of 2024, Dishman remains a significant player in vitamin D production and supply globally. Its WHO‑cGMP compliant manufacturing facility in Bavla, Gujarat, supports production of Vitamin D3, analogues, and soft-gel formulations for pharmaceutical, nutraceutical and feed clients. The company offers multiple dosage forms (soft‑gels, powders, oils) and serves clients seeking custom formulations and contract manufacturing services. In light of rising global demand for vitamin D supplemental and fortified products, Dishman’s integrated production and regulatory‑compliant infrastructure positions it well to meet both current and future market needs.

Zhejiang Medicine remains a major Chinese producer of fat‑soluble vitamins and related nutritional compounds as of 2024. The firm’s production portfolio includes key vitamins and nutrients — including vitamin D3 — alongside synthetic vitamin E, β-carotene, and other micronutrients. Its vitamin/nutrition segment generated substantial revenue, with the life‑nutrition products accounting for ≈ ¥3,272.6 million yuan (~ 41.99% of total revenue) in 2023, indicating significant scale and market reach. Zhejiang Medicine’s broad export network and GMP‑certified production lines enable supply of vitamin D and other micronutrients across global supplement, food‑fortification, and pharmaceutical markets.

Glanbia plc, through its nutrition division, supplies nutritional and functional ingredients — including vitamin and mineral premixes — to the global food, beverage, and supplement industry. In the 2024 fiscal year, the group reported revenues of approximately USD 3.8 billion, with its Nutritionals segment (vitamins, micronutrients, and other nutritional ingredients) forming a key part of its business mix. As a leading supplier of premixes and micronutrient blends, Glanbia is well‑positioned to deliver vitamin D ingredients and formulations for fortified foods, beverages, and dietary supplements worldwide.

McKinley Resources Inc., headquartered in Dallas, Texas, is listed among global suppliers of raw‑material vitamins, including Vitamin D3 (cholecalciferol), often formulated with carrier oils such as palm oil, per its 2024‑catalogue. The company serves cosmetic and supplement markets, supplying Vitamin D3 for use in skin‑care, wellness, and nutrition products. Its role as a vitamin supplier positions McKinley as a supporting player in global vitamin‑D supply chains.

Conclusion

In conclusion, Vitamin D remains a cornerstone nutrient with broad relevance for public health and wellness. Evidence confirms its central role in supporting bone strength, calcium‑phosphorus balance, and skeletal integrity. Furthermore, observational and mechanistic data suggest vitamin D contributes to immune regulation, reduced inflammation, and overall health maintenance beyond skeletal benefits. Given that about 15.7% of the global population has serum vitamin D levels below critical thresholds (< 30 nmol/L), and nearly 50% are below 50 nmol/L, there remains substantial unmet need for adequate vitamin D status worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)