Table of Contents

Overview

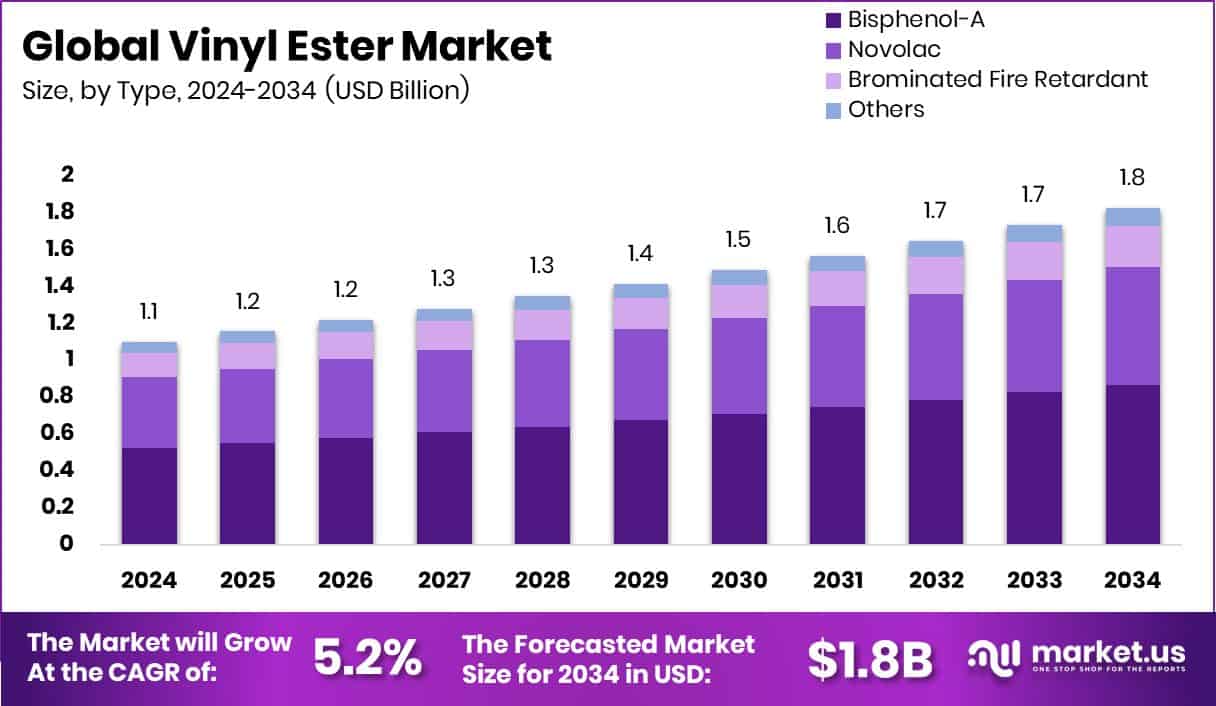

New York, NY – October 17, 2025 – The Global Vinyl Ester Market is projected to reach USD 1.8 billion by 2034, rising from USD 1.1 billion in 2024, expanding at a 5.2% CAGR (2025–2034). Growth is largely propelled by ongoing construction and marine development across the Asia Pacific, which holds 43.9% of global demand.

Vinyl ester, produced from epoxy and methacrylic acid, uniquely combines the durability of epoxy with the curing efficiency of polyester. Its superior corrosion resistance, mechanical strength, and low shrinkage make it ideal for coatings, tanks, pipes, and composite parts used in aggressive chemical or saline environments.

Rising investments in infrastructure and water systems sustain this momentum. For instance, Wisconsin communities received USD 273 million in 2024 for drinking-water infrastructure upgrades—initiatives that indirectly elevate the need for corrosion-resistant materials such as vinyl ester. Likewise, the South Dakota Department of Agriculture and Natural Resources

Resources (DANR) allocated USD 5.8 million in ARPA grants to strengthen statewide water and infrastructure projects. These funding flows create consistent demand for advanced resins in containment and structural systems. Furthermore, innovation remains vibrant: LiquiGlide secured USD 16 million to advance residue-free coating technologies, signaling strong investor interest in high-performance surface solutions that align with the evolving needs of the vinyl ester ecosystem.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-vinyl-ester-market/request-sample/

Key Takeaways

- The Global Vinyl Ester Market is expected to be worth around USD 1.8 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In 2024, Bisphenol-A dominated the Vinyl Ester Market with a 47.6% share due to superior durability.

- Pipes and Tanks accounted for a 38.8% share in the Vinyl Ester Market, ensuring efficient fluid containment.

- The Asia Pacific’s strong industrial infrastructure supported market valuation reaching USD 0.4 billion overall.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161634

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.1 Billion |

| Forecast Revenue (2034) | USD 1.8 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Type (Bisphenol-A, Novolac, Brominated Fire Retardant, Others), By Application (Pipes and Tanks, Marine, Wind Energy, FGD and Precipitators, Pulp and Paper, Others) |

| Competitive Landscape | Allnex GmbH, AOC, BUFA Composites, DIC Corporation, Hexion Inc., INEOS Composites, Interplastic Corporation, Nivitex Fibreglass & Resins, Poliya, Reichhold LLC |

Key Market Segments

By Type Analysis

In 2024, Bisphenol-A dominated the Vinyl Ester Market by Type, capturing a 47.6% share. This leadership stems from its high mechanical strength, chemical resistance, and strong adhesion, making it essential for demanding industrial uses. Bisphenol-A-based vinyl esters are widely applied in corrosion-resistant tanks, marine components, and chemical processing pipes, where durability in harsh conditions is vital.

Their cost-effectiveness and compatibility with fiberglass reinforcements further enhance adoption across construction, coatings, and infrastructure sectors. Combining performance, process efficiency, and long-term reliability, Bisphenol-A remains the preferred resin type among manufacturers, sustaining its dominant position in the global vinyl ester landscape.

By Application Analysis

In 2024, the Pipes and Tanks segment led the Vinyl Ester Market by Application, accounting for a 38.8% share. This dominance is driven by vinyl ester’s exceptional resistance to corrosion, chemicals, and moisture, making it the preferred material for industrial pipelines, process vessels, and storage tanks. Its resilience under high temperatures and harsh environments supports extensive use in water treatment, chemical processing, and marine industries.

Additionally, growing investments in infrastructure and energy projects continue to boost demand for reliable, long-life materials. The segment’s strong share underscores an increasing shift toward durable, low-maintenance composites that minimize operational costs and enhance service longevity in critical industrial applications.

Regional Analysis

In 2024, Asia Pacific led the global Vinyl Ester Market, commanding a 43.90% share valued at USD 0.4 billion. The region’s dominance stems from rapid industrialization, infrastructure growth, and expanding marine and chemical processing sectors across China, India, Japan, and Southeast Asia. Rising investments in corrosion-resistant materials for construction and water treatment further reinforced this leadership.

North America ranked second, driven by robust demand from the oil & gas and transportation industries, particularly in the U.S. Europe maintained stable consumption supported by environmental policies favoring durable, low-emission materials.

Meanwhile, the Middle East & Africa gained momentum through infrastructure and desalination projects, and Latin America showed gradual progress with increasing vinyl ester use in industrial storage and marine components, signaling emerging opportunities for regional market expansion.

Top Use Cases

- Keel or ballast tanks in boats: Builders use vinyl ester inside keel tanks or ballast compartments in boats, because it tolerates contact with fuel, water, and chemicals while integrating well with composite hulls.

- Chemical containment linings: Vinyl ester is used to line the interiors of chemical containment areas, bunded zones, or spill-interception basins, where acids, solvents, or corrosive fluids may leak.

- Fiberglass reinforced structural parts: By combining vinyl ester resin with glass fibers (FRP composites), parts such as structural shells, panels, or reinforcement bars are made, benefiting from toughness and chemical resistance.

- Industrial floor & concrete surface lining: Vinyl ester coatings are applied on concrete or steel floors and surfaces in chemical plants or factories. They resist spills of acids and alkalis, protecting the substrate underneath.

- Marine hull and coating systems: In the marine industry, vinyl ester compounded with glass flake is used to coat or build boat hulls, decks, and offshore structures — the resin shields metal or composite substrates against saltwater corrosion.

- Corrosion-resistant tanks & pipes: Vinyl ester resins are widely used to make tanks, process vessels, and pipelines that must resist acidic, alkaline, or saline environments. Their strong chemical resistance ensures long service life in harsh conditions.

Recent Developments

- In August 2024, Allnex introduced ULTRATEC™, a new anti-static tooling gelcoat system based on vinyl ester. Its surface becomes static dissipative (resistance between 10⁶ to 3×10⁸ Ω), improving safety (less electrostatic discharge) and easing demolding in composite tooling. Production began in Australia.

- In October 2024, Nippon Paint Holdings signed a definitive agreement to acquire AOC, a global specialty formulator that produces vinyl ester (VE), unsaturated polyester, coatings, composites and more. The acquisition aims to make AOC a subsidiary of Nippon Paint.

- In March 2024, BÜFA Composite Systems launched a sustainable product portfolio under the label BÜFA®-future. This includes resins and gelcoats that are styrene-reduced, styrene-free, bio-based, or contain recycled content. It also covers special flame-retardant or conductive composites.

Conclusion

The Vinyl Ester Market continues to evolve as industries demand stronger, longer-lasting, and more corrosion-resistant materials. Its use across marine, chemical, and infrastructure sectors highlights its versatility and reliability. Growing awareness of durability and reduced maintenance has driven steady industrial adoption. Companies are innovating with sustainable and high-performance resin formulations that meet stricter environmental standards.

Government investments in water treatment and infrastructure, coupled with advancements in composite technologies, are further shaping the industry’s future. Vinyl ester remains a preferred material for critical applications that demand superior resistance to heat, chemicals, and harsh environments—ensuring its lasting relevance in modern manufacturing.