Table of Contents

Overview

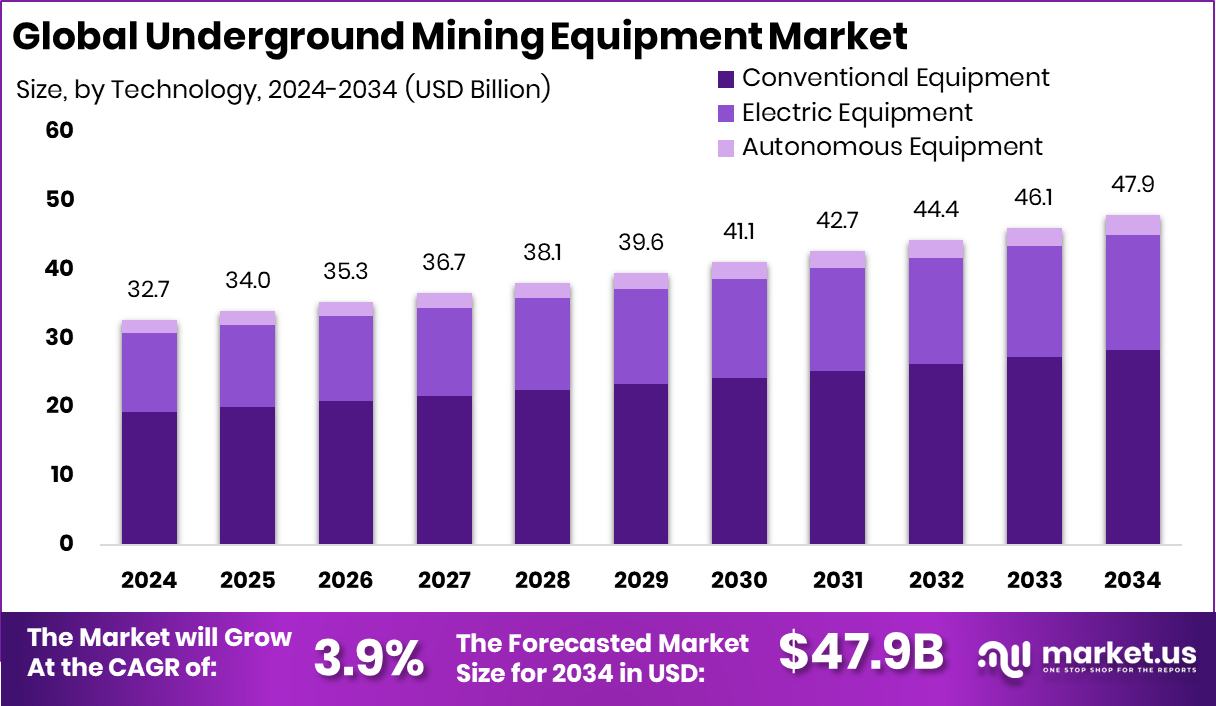

New York, NY – February 18, 2026 –The global underground mining equipment market is projected to reach about USD 47.9 billion by 2034, rising from USD 32.7 billion in 2024, growing at a steady CAGR of 3.9% from 2025 to 2034.

Underground mining equipment includes specialized machines used to extract minerals and ores from deep below the earth’s surface. These operations take place in narrow, high-risk environments, so equipment such as drilling rigs, loaders, haul trucks, roof bolters, and conveyor systems must be durable, compact, and built with strong safety standards. Such machinery is essential for efficient drilling, blasting, material handling, and tunnel support in coal, metal, and non-metal mines.

Market momentum is supported by major public and private investments. The Interior Department announced more than $119 million to reclaim abandoned coal mines, followed by nearly $725 million in additional funding to accelerate land restoration efforts. These initiatives directly increase demand for underground equipment used in cleanup and rehabilitation work.

On the private side, Vitol and Breakwall provided $150 million in financing for a metallurgical coal project, driving the need for advanced underground extraction machinery. Additionally, Southwest Virginia secured an $11 million boost for reclaiming abandoned coal mines, further supporting equipment deployment for restoration and regional redevelopment projects.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-underground-mining-equipment-market/request-sample/

Key Takeaways

- The Global Underground Mining Equipment Market is expected to be worth around USD 47.9 billion by 2034, up from USD 32.7 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- In the Underground Mining Equipment Market, mining loaders held 28.5% share due to high material handling demand.

- The underground mining equipment market saw conventional equipment dominate with 59.1% share across operations.

- In the Underground Mining Equipment Market, hard rock mining led applications, accounting for 55.8% demand.

- Asia Pacific accounts for 45.20% of the Underground Mining Equipment Market, reaching USD 14.7 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=172935

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 32.7 Billion |

| Forecast Revenue (2034) | USD 47.9 Billion |

| CAGR (2025-2034) | 3.9% |

| Segments Covered | By Product Type (Mining Loaders, Mining Trucks, Mining Drills and Bolters, Continuous Miners, Mining Shearers, Mining Excavators), By Technology (Conventional Equipment, Electric Equipment, Autonomous Equipment), By Application (Hard Rock Mining, Coal Mining, Others) |

| Competitive Landscape | Caterpillar Inc., Sandvik AB, Epiroc AB, Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, Atlas Copco, Komatsu Mining Corp. (Joy Global), RDH Mining Equipment |

Key Market Segments

By Product Type Analysis

In 2024, mining loaders led the Underground Mining Equipment Market with a 28.5% share, reflecting their essential role in underground material handling. These machines are widely used for loading, hauling, and transferring ore within tight tunnel spaces, making them vital to daily mining operations. Their strong demand is supported by ongoing underground mine expansion and the need for faster, more efficient ore movement.

Mining operators prefer loaders for their high durability, compact design, and ability to handle heavy loads under tough conditions. Manufacturers are focusing on improving payload capacity, operator comfort, safety systems, and machine reliability. Their consistent use across coal and metal mining ensures stable demand, particularly in established underground mining regions focused on productivity and operational efficiency.

By Technology Analysis

Conventional equipment dominated the market in 2024, accounting for 59.1% of total adoption. These machines remain widely preferred due to their proven reliability, lower initial investment, and simpler maintenance requirements. Many mining operations continue using conventional systems because they integrate smoothly with existing infrastructure and trained workforces.

In regions where automation is still developing or limited by high costs, conventional equipment remains the practical choice. These machines are also easier to service in remote mining sites where technical support may be limited. Despite growing interest in advanced and automated technologies, conventional underground equipment continues to form the operational foundation of many mining sites, ensuring steady output and dependable performance in demanding underground environments.

By Application Analysis

Hard rock mining was the leading application segment in 2024, representing 55.8% of total equipment demand. This segment requires heavy-duty machinery capable of operating in dense, abrasive rock conditions under high pressure and vibration. Equipment used in hard rock mining must be strong, durable, and built for continuous operation.

Demand is driven by the extraction of key metals such as gold, copper, and nickel, which require advanced underground techniques. Mining operators prioritize machines with long service life, enhanced safety systems, and minimal downtime to maintain productivity. Due to its technical complexity and large operational scale, hard rock mining continues to generate significant and consistent demand for underground mining equipment globally.

Regional Analysis

The Underground Mining Equipment Market reflects diverse regional trends shaped by mining activity levels and resource distribution. Asia Pacific leads with a 45.20% market share, valued at USD 14.7 billion, supported by large-scale underground mining operations and strong demand for loaders and haulage systems. The region benefits from extensive hard rock mining and continuous equipment use across established mining hubs.

North America represents a mature and stable market, where demand focuses on productivity improvements and extending mine life. Europe maintains steady growth due to regulated mining practices and operational efficiency priorities.

The Middle East & Africa show targeted demand in mineral-rich areas, while Latin America sustains consistent equipment usage driven by underground metal mining operations requiring reliable and durable machinery.

Top Use Cases

- Drilling Tunnels and Blast Holes – Machines like jumbo drills are used to bore holes into rock underground. These holes help miners place explosives or create pathways for tunnels.

- Loading and Hauling Ore – Loaders and haul trucks pick up broken rock and ore from the mining face and transport it to conveyors or lifts. These machines are built to work in tight underground spaces.

- Supporting Mine Roofs – Roof bolters and support rigs install strong steel bolts or beams to hold the roof in place, helping prevent dangerous cave-ins.

- Continuous Cutting of Coal or Soft Rock – Continuous miners use rotating cutting heads to break up coal or soft rock without stopping, speeding up extraction.

- Ventilation and Safety Systems – Large underground mines use dedicated machines and systems to circulate fresh air, reduce harmful gases, and keep workers safe.

- Material Conveyor Systems – Conveyors move rock and ore from deep inside the mine toward processing areas or surface lifts, cutting down on manual hauling.

Recent Developments

- In October 2025, Caterpillar announced an agreement to acquire Australian mining software firm RPMGlobal Holdings Limited in October 2025. RPMGlobal makes digital software used for planning and managing mining operations. This deal will help Caterpillar add data and planning tools to its machines and services.

- In May 2024, Sandvik won a major order from Hindustan Zinc (India) to supply a range of underground mining machines, including development drills, production drills, trucks and loaders. This expanded Sandvik’s equipment fleet with advanced tools that help improve mining productivity and safety underground.

Conclusion

The Underground Mining Equipment Market continues to evolve as mining companies focus on deeper deposits, safer operations, and higher productivity. Demand remains steady due to the essential role of underground machinery in drilling, hauling, ground support, and material handling. Operators are prioritizing durable, reliable equipment that can perform in confined and demanding environments.

At the same time, innovation in automation, electrification, and digital monitoring is gradually reshaping underground operations. Environmental responsibility and worker safety are also influencing equipment design and purchasing decisions. Overall, the market reflects a balance between proven conventional systems and emerging advanced technologies supporting sustainable and efficient mining practices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)