Table of Contents

Overview

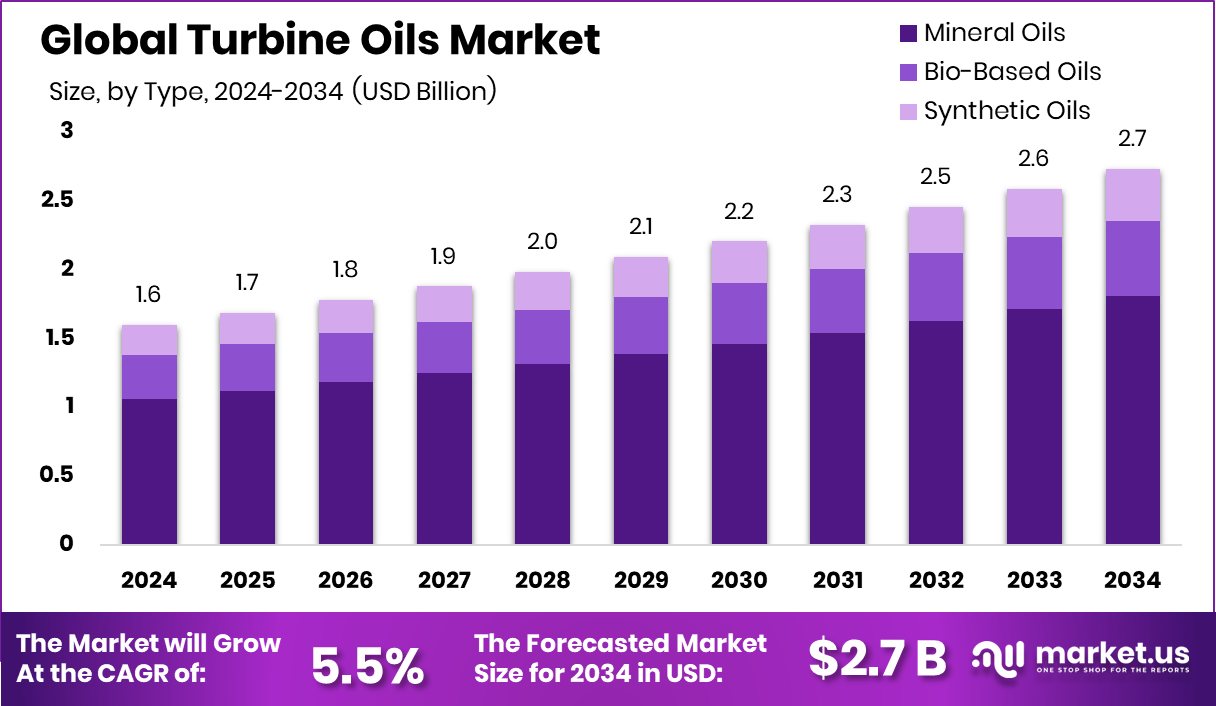

New York, NY – December 12, 2025 – The global Turbine Oils Market is on a steady growth path, expected to rise from USD 1.6 billion in 2024 to around USD 2.7 billion by 2034, expanding at a 5.5% CAGR between 2025 and 2034. The Asia-Pacific region leads with a 43.90% share, representing nearly USD 0.7 billion, driven by expanding power generation capacity and industrial activity.

Turbine oils are essential lubricants used in power generation, aviation, marine, and heavy industrial turbines. Their core function is to reduce friction, manage heat, prevent corrosion, and maintain cleanliness during long operating cycles. Because turbines often run continuously with limited downtime, high-quality oils are critical to ensuring reliability, efficiency, and lower maintenance costs across energy and industrial infrastructure.

Market growth is closely linked to rising investment in energy systems and heavy industry. Government funding plays an enabling role, such as the U.S. Department of Energy’s USD 19.5 million support for critical minerals and materials, which indirectly strengthens lubricant innovation. In Europe, the Czech government’s approval of up to EUR 360 million in industrial grants further supports turbine-related projects.

Strong financial activity across infrastructure-linked sectors also sustains demand. MIIF’s record GH¢1.96 billion income in 2024 highlights robust asset performance, while Premier African Minerals securing £500,000 signals ongoing industrial operations requiring reliable turbine lubrication.

Looking ahead, innovation is a key opportunity. ÄIO’s €1 million funding for fermentation-based oils and Neo’s USD 25 million raise for advanced oil technologies reflect growing investor interest in sustainable, high-performance turbine oil solutions.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-turbine-oils-market/request-sample/

Key Takeaways

- The Global Turbine Oils Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- In the Turbine Oils Market, mineral oils dominate with 66.30% share due to cost efficiency.

- In the Turbine Oils Market, steam turbines hold a 39.70% share driven by power plants.

- Energy generation leads the Turbine Oils Market by end-use with a 47.20% share overall.

- In Asia-Pacific, turbine oils demand reached 43.90%, generating USD 0.7 Bn revenue regionally.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=168411

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.6 Billion |

| Forecast Revenue (2034) | USD 2.7 Billion |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Type (Mineral Oils, Bio-Based Oils, Synthetic Oils), By Turbine Type (Steam Turbine, Gas Turbine, Wind Turbine, Hydraulic Systems, Others), By End-use (Automotive, Aerospace, Energy Generation, Marine, Mining, Others) |

| Competitive Landscape | BP Lubricants, Chevron U.S.A, Eastern Petroleum, Eastman Chemical Company, Exxon Mobil Corporation, FUCHS, Idemitsu, Indian Oil Corporation, Kluber Lubrication, Lubrizol |

Key Market Segments

By Type Analysis

In 2024, Mineral Oils maintained a dominant position in the By Type segment of the Turbine Oils Market, accounting for a 66.30% share. This strong leadership highlights the continued trust placed in mineral oil–based formulations across turbine applications. Their long history of use and proven reliability make them a preferred option for operators seeking stable and consistent lubrication performance.

Mineral oils are widely valued for their ability to withstand high temperatures, control oxidation, and reduce wear during continuous turbine operation. These properties help turbines maintain efficiency and reliability in power generation and industrial settings where long operating hours are common. Their compatibility with existing turbine designs also minimizes the need for system modifications or costly transitions.

Another key factor supporting this dominance is operational predictability. Mineral oils deliver consistent performance over long service intervals, helping reduce maintenance frequency and unplanned downtime. In addition, a well-established global supply network and strong operator familiarity further strengthen their position, ensuring mineral oils remain the primary choice for turbine lubrication in 2024.

By Turbine Type Analysis

In 2024, Steam Turbines held a leading position in the By Turbine Type segment of the Turbine Oils Market, capturing a 39.70% share. This dominance reflects the essential role steam turbines play in large-scale power generation and core industrial operations where uninterrupted energy output is critical.

Steam turbines function under constant high-temperature and high-pressure conditions, creating a strong demand for dependable lubrication solutions. Turbine oils used in these systems are vital for reducing friction, dissipating heat, and protecting internal parts from corrosion and mechanical wear. Reliable oil performance directly supports turbine efficiency and long operational life.

Operators place high importance on consistent oil quality to maintain extended running cycles and avoid costly, unplanned shutdowns. Since many power plants and heavy industries depend heavily on steam turbines for stable and continuous output, lubrication needs remain elevated. This ongoing reliance reinforces steam turbines’ leading contribution to turbine oil demand in 2024.

By End-use Analysis

In 2024, Energy Generation led the by-end-use segment of the Turbine Oils Market, accounting for a 47.20% share. This strong position highlights the critical importance of turbine oils in ensuring uninterrupted electricity production across large, continuously operating power facilities.

Power generation systems rely on turbines that operate for long hours under heavy loads, making effective lubrication essential for efficiency and reliability. Turbine oils used in this segment are designed to manage thermal stress, minimize mechanical wear, and safeguard equipment exposed to demanding operating conditions. Consistent oil performance helps maintain stable output and reduces the risk of equipment failure.

Frequent operating cycles and sustained load requirements drive higher oil usage and regular replacement. As modern energy infrastructure depends heavily on dependable turbine performance, demand for turbine oils remains concentrated in the energy generation sector, reinforcing its position as the largest end-use contributor in 2024.

Regional Analysis

Asia-Pacific dominates the Turbine Oils Market with a 43.90% share, valued at USD 0.7 Bn, driven by its extensive power generation base and continuous industrial operations. Heavy reliance on thermal, gas, and steam turbines, combined with long operating hours, results in high and consistent lubrication demand, positioning the region as the largest market contributor.

North America represents a mature and stable market supported by well-established power plants and industrial turbines. Strict performance standards, regular maintenance cycles, and long turbine lifespans sustain steady turbine oil consumption across energy and industrial sectors.

Europe maintains stable demand, supported by conventional power generation and industrial turbine usage. Aging infrastructure in several countries increases maintenance needs, reinforcing the role of turbine oils in heat management and equipment protection.

Middle East & Africa benefit from energy-intensive industries and large-scale turbine installations, where high temperatures and continuous operation drive lubricant demand.

Latin America shows gradual growth as energy infrastructure expands and turbine efficiency improves.

Top Use Cases

- Lubricating Steam Turbines: Turbine oil is used to reduce friction and wear in steam turbines, helping bearings and shafts move smoothly under high heat and pressure. This supports long and reliable operation.

- Lubricating Gas Turbines: In gas turbines (used in power plants and aviation), these oils reduce friction, carry away heat, and protect moving parts from damage or wear.

- Cooling and Heat Control: Turbine oils help remove heat from gearbox and bearing surfaces inside turbines, keeping machine temperatures stable and preventing overheating.

- Protecting Against Corrosion: These oils include additives that protect metal turbine parts from rust and corrosion caused by moisture or contaminants.

- Supporting Hydraulic and Control Systems: Turbine oils can also act in the hydraulic control systems of turbines (e.g., regulating valves) where smooth fluid action is needed for precise control.

- Bearing and Gear Lubrication in Combined Machinery: Beyond turbines alone, turbine oils are used in associated rotating equipment like generators, gearboxes, and compressors to ensure smooth bearing performance.

Recent Developments

- In May 2025, BP was reported to be actively seeking buyers for Castrol, with valuations in the range of $8 billion to $10 billion as part of a broader divestment strategy.

- In 2025, Chevron introduced a new premium turbine oil called GST Premium 32. This product is formulated for non-geared gas and steam turbines, offering better thermal stability and protection for power and industrial equipment.

Conclusion

The Turbine Oils Market plays a vital role in ensuring the safe, efficient, and continuous operation of turbines across energy generation and industrial sectors. Turbine oils are essential for reducing friction, managing heat, and protecting critical components from wear and corrosion under demanding operating conditions.

Growing reliance on power generation infrastructure and heavy industrial machinery continues to support steady demand for high-quality turbine lubricants. Technological improvements in oil formulations are enhancing performance, extending service life, and reducing maintenance needs.

At the same time, rising focus on operational reliability and equipment longevity reinforces the importance of turbine oils. Overall, the market remains stable and essential, driven by long-term energy needs, industrial activity, and the ongoing requirement for dependable turbine performance.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)