Table of Contents

Overview

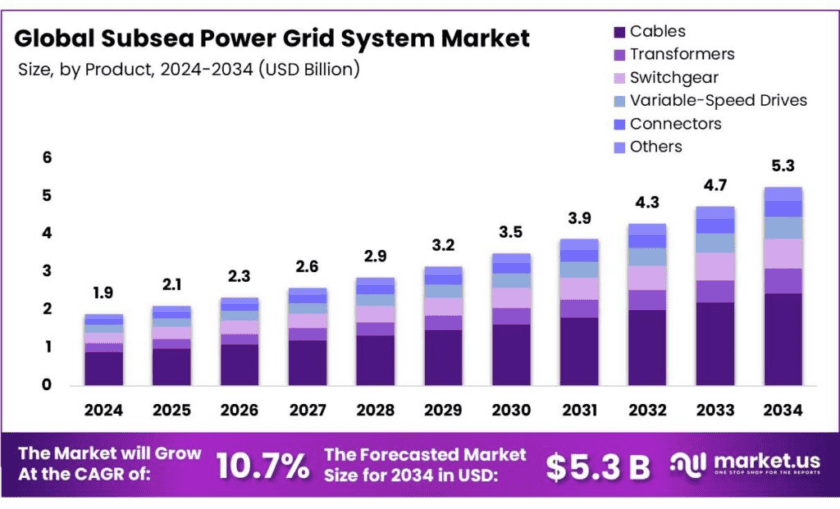

New York, NY – Dec 04, 2025 – The global subsea power grid system market is projected to reach USD 5.3 billion by 2034, rising from USD 1.9 billion in 2024, and the growth is expected to follow a CAGR of 10.7% from 2025 to 2034. Europe accounted for 38.7% of the global share in 2024, supported by strong industrial expansion and rising chemical production.

High-voltage direct current (HVDC) cables are increasingly adopted to reduce transmission losses across long distances. However, the sector faces major barriers, including high initial installation costs and geopolitical uncertainties influencing offshore infrastructure development.

- For instance, subsea interconnectors, such as the UK-Norway North Sea Link (NSL), which spans 720 kilometers, enable the transfer of surplus hydroelectric power from Norway to the UK and wind energy in the reverse direction. Such systems help stabilize national grids and reduce dependence on fossil fuels.

- For instance, the construction of the North Sea Link cost over EUR 2 billion, reflecting the immense financial commitment such projects demand. Additionally, the project took almost 5880 working days at sea to become operational.

- For instance, subsea power distribution technology developed by companies such as ABB enables the electrification of subsea pumps and compressors up to 600 kilometers from shore, significantly reducing the need for surface infrastructure.

- According to the United States Bureau of Ocean Management, in 2024, offshore federal production reached approximately 668 million barrels of oil, which was about 14% of all domestic oil production, and 700 billion cubic feet of gas, which was 2% of domestic natural gas production. Electrifying subsea operations also supports decarbonisation by allowing integration with renewable sources, such as offshore wind.

- For instance, the North Sea Link between Norway and the UK uses HVDC technology to transmit up to 1,400 MW of power across a subsea cable. HVDC systems can reduce transmission losses to less than 3% per 1,000 km, compared to up to 10% for AC systems.

Key Takeaways

- The global subsea power grid system market was valued at USD 1.9 Billion in 2024.

- The global subsea power grid system market is projected to grow at a CAGR of 10.7% and is estimated to reach USD 5.3 Billion by 2034.

- Among the component segments, around 46.5% of the subsea power grid system is comprised of cables.

- Based on installation depth, majorly subsea power grid systems are installed in shallow water, approximately 53.2%.

- Based on the applications of the subsea power grid system, captive generation held the majority of revenue share in 2024 at 50.1%.

- Europe was at the forefront of the subsea power grid system market, accounting for around 38.7% of the total global consumption.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-subsea-power-grid-system-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.9 Bn |

| Forecast Revenue (2034) | USD 5.3 Bn |

| CAGR (2025-2034) | 10.7% |

| Segments Covered | By Component (Cables, Transformers, Switchgear, Variable-Speed Drives, Connectors, Others), By Installation Depth (Shallow, Deepwater, Ultra-deep), By Application (Captive Generation, Offshore Wind Farms, Tidal & Wave Energy, Others) |

| Competitive Landscape | ABB, Prysmian Group, Nexans SA, NKT A/S, General Electric, Siemens Energy AG, Hitachi Energy, Aker Solutions ASA, TechnipFMC, Subsea 7 SA, LS Cable & System, Sumitomo Electric Industries, Southwire Company, Schneider Electric SE, Baker Hughes, Halliburton, Abu Dhabi National Energy (TAQA), Other Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161238

Key Market Segments

Component Analysis

Cables accounted for approximately 46.5% of the total subsea power grid system in 2024, making them the largest component in the market. This dominance is attributed to their essential role in physically linking offshore facilities with one another and with onshore grids across long distances. Unlike transformers, switchgear, or other node-based components, cables extend for hundreds of kilometers across the seabed and must be engineered to withstand high pressure, corrosion, and mechanical stress. Their function in supporting both high-voltage power transmission (HVAC or HVDC) and communication between subsea assets positions them as the backbone of subsea power grid systems in terms of functionality and material requirement.

Installation Depth Analysis

Shallow water installations represented nearly 53.2% of subsea power grid system deployment in 2024. This preference is driven by the lower technical and financial challenges associated with shallow waters, where installation, inspection, maintenance, and repair activities are more accessible and cost-efficient. Conventional vessels and standard equipment can be used effectively in these environments. Deep water and ultra-deep water installations, beyond 500 meters, require advanced engineering, remotely operated vehicles (ROVs), and specialized technologies to manage extreme environmental conditions, resulting in increased costs and operational risks. The concentration of offshore wind farms and oil and gas platforms in shallow waters further reinforces the dominance of this segment.

Application Analysis

Captive generation led the subsea power grid system market in 2024, with a market share exceeding 50.1%. This application remains dominant because it ensures a stable and continuous power supply to offshore oil and gas platforms that operate in remote marine locations. These facilities depend on reliable electricity for mission-critical operations, and the difficulty of connecting them to onshore grids makes subsea power systems essential. Although offshore wind, tidal, and wave energy projects are expanding, they require extensive grid integration and storage solutions and remain comparatively less mature. As a result, the high and immediate power demand from captive generation secures its leading position within the market.

List of Segments

By Component

- Cables

- Transformers

- Switchgear

- Variable-Speed Drives

- Connectors

- Others

By Installation Depth

- Shallow Water

- Deep Water

- Ultra-deep Water

By Application

- Captive Generation

- Offshore Wind Farms

- Tidal & Wave Energy

- Others

Regional Analysis

Europe Held the Largest Share of the Global Subsea Power Grid System Market

Europe accounted for approximately 38.7% of the global subsea power grid system market in 2024, with an estimated market value of around USD 735.3 million. This leading position is supported by the region’s early adoption of offshore renewable energy and its strong, established subsea infrastructure. Europe hosts some of the world’s most advanced offshore wind projects, including the Hornsea Project in the UK, which operates with a capacity exceeding 1.2 GW. The region also recorded more than 400 TWh of cross-border electricity trade in 2022, reflecting the increasing dependence on interconnected energy networks.

Further growth in the region has been supported by major investments in subsea interconnectors such as the North Sea Link and NordLink, which enable efficient cross-border electricity transmission through high-capacity subsea cables. Data from the European Network of Transmission System Operators for Electricity (ENTSO-E) indicates that Europe has more than 20 major subsea interconnectors currently in operation, significantly enhancing regional grid stability and energy diversification. Strong regulatory frameworks, ambitious climate targets, and continued emphasis on energy integration across EU member states continue to reinforce Europe’s dominant role in advancing subsea power grid technologies.

Top Use Cases

Offshore wind integration: Subsea power grid systems are used extensively to collect and transmit power from offshore wind farms to onshore networks. Large offshore projects rely on long submarine cable routes and offshore export links; for example, the Hornsea One project has an installed capacity of about 1.2 GW and uses roughly 900 km of cable routing for collection and export. Subsea HVDC or HVAC export cables enable this bulk transmission and are fundamental to scaling offshore wind capacity.

Cross-border interconnectors and electricity trade: Subsea interconnectors are used to exchange large volumes of electricity between countries and regions, improving supply security and market integration. Europe recorded roughly 423,600 GWh (≈423.6 TWh) of cross-border exchanges among ENTSO-E members in recent reporting years, and major subsea interconnectors such as the North Sea Link and NordLink each provide approximately 1,400 MW of transfer capacity, supporting high-volume bilateral trade and system balancing.

Captive generation for offshore installations: Subsea power grids supply continuous, mission-critical electricity directly to offshore platforms and remote subsea installations where onshore grid connection is impractical. Captive generation and dedicated subsea supply reduce reliance on local gas-fired generation and support electrification of platform systems, lowering operational emissions and enabling remote control of high-power equipment. Typical platform export/import arrangements often require dedicated cables sized in the MWs–hundreds of MWs range depending on facility load.

Integration of tidal and wave energy converters: Subsea grids provide the network infrastructure required to aggregate output from tidal and wave arrays and to connect these arrays to shore. As tidal and wave projects scale, subsea cables and converter stations will be required to collect distributed generation — initially at MW scale per array and growing as projects mature — enabling their commercial integration into regional grids.

Electrification of subsea and seabed equipment: Subsea power delivery enables direct electric operation of seabed pumps, compressors, and processing modules, eliminating or reducing local combustion power units. Electrification allows more compact subsea systems and lower offshore emissions; power ratings for such equipment typically range from tens to hundreds of kW for local systems up to multiple MW for large processing units, all of which rely on robust subsea cable feeds.

Long-distance bulk transmission (HVDC preference): For long subsea routes, high-voltage direct current (HVDC) technology is preferred because it reduces transmission losses over distance. Technical studies indicate HVDC losses can be on the order of ~3% per 1,000 km, materially lower than HVAC losses for equivalent long subsea routes, which supports the economics of intercontinental or long-distance offshore links. This performance drives adoption of HVDC for major subsea corridors.

Recent Developments

ABB Ltd. is positioned as a provider of high-voltage and power-conversion technologies applicable to subsea grid projects, with continued engagement in HVDC and converter systems. In FY 2024 ABB reported Orders: $33.7 billion; Revenues: $32.9 billion, underscoring broad commercial capacity to support large infrastructure contracts. In 2024 ABB introduced 20+ new electrification products aimed at DC and grid applications, and the company has a documented record of supplying frequency-converter/HVDC equipment for major transmission projects.

Prysmian Group is a leading submarine-cable manufacturer and an active supplier for subsea power grid projects, with a strong 2024 order pipeline and project wins. In February 2024 Prysmian signed contracts totalling ≈€5.0 billion for offshore grid connections and reported an order backlog above €18 billion in early 2024. FY 2024 results highlighted robust Power-Grid segment performance and expanded service capabilities for cable maintenance and rapid repair. These metrics affirm Prysmian’s central role in supplying long-distance HVDC and HVAC submarine systems.

Nexans is positioned as a principal supplier of high-voltage subsea cables and associated services, with production capacity expanded in 2024 to support 525 kV HVDC and 420 kV HVAC cable manufacture. In the first nine months of 2024 the group reported standard sales of €5,226 million (organic growth +4.0%), and full-year results and project awards through late 2024 reinforced its strong offshore order intake. Investment in Halden (Norway) and new frame agreements underpin supply for major interconnectors and wind-farm links.

NKT is focused on turnkey high-voltage subsea cable systems and retained a record high HV order backlog at end-2024 (≈€10.6 billion), supported by strong project awards across Europe. Revenue momentum was reported in 2024 (Q3 standard revenue €657 million, with 25–29% organic growth in interim quarters) and the company secured multiple framework call-offs with TenneT representing roughly €1.0 billion of contract value to be executed 2026–27. These metrics indicate capacity to deliver large HVDC/HVAC offshore corridors and rapid service/repair support.

General Electric’s energy division (GE Vernova) is positioned to supply grid and power-conversion equipment for subsea projects, including HVDC converters and grid automation tailored for offshore links. In 2024, GE Vernova recorded orders of ~USD 44.0 billion and revenue of ~USD 35.0 billion, reflecting scale and project delivery capacity that support large subsea contracts. The company’s grid solutions and power-conversion offerings are being deployed in transmission and offshore-electrification schemes, with continued investment in converter and power-electronics capabilities to address long-distance subsea transmission needs.

Siemens Energy is active in supplying HVDC converter systems and turnkey technology for offshore grid connections, enabling large wind-to-shore and interconnector projects. In fiscal 2024, orders reached €50.2 billion and revenues were €34.5 billion, supporting substantial project execution capacity. Notable 2024 contract activity included multi-billion-euro awards for offshore converter systems, underscoring a strategic focus on HVDC solutions for long-distance subsea transmission and large-scale offshore wind integration.

Hitachi Energy is engaged in supplying HVDC converters, grid automation, and large-scale power-conversion systems for subsea transmission projects; its global order backlog was reported at ¥4.7 trillion in mid-2024, reflecting strong project visibility. In December 2024 the company secured major converter contracts (reported value ~USD 2.0 billion) for Germany’s Korridor B, underlining its role in large HVDC corridors. The firm’s technology and project execution capability position it to support long-distance subsea links and offshore grid integration.

Aker Solutions supplies engineering, subsea electrification and turnkey delivery for offshore power systems and maintained robust 2024 metrics: revenues ~NOK 53.2 billion and an order backlog of roughly NOK 61 billion, supporting a significant project pipeline. The company reported Q3 2024 revenues of NOK 13.2 billion, illustrating strong near-term activity in offshore and electrification contracts. These figures indicate capacity to deliver integrated subsea electrification and support services—including installation and maintenance—required by large offshore grid and platform-electrification programmes.

TechnipFMC is a leading subsea services and technology provider for subsea power grid projects, offering integrated engineering, cable-lay, and installation capabilities for offshore electrification. In 2024 the company reported full-year orders of USD 10.4 billion and closed the year with a total company backlog of USD 14.4 billion, reflecting strong subsea demand and execution capacity. TechnipFMC’s cash generation (Q4 2024 operating cash flow USD 579 million) supports large project delivery and shareholder returns while positioning the firm to compete on major HVDC/HVAC corridor and platform-electrification contracts.

Sumitomo Electric is active in subsea transmission and expanded capacity in 2024–25 to support large HVDC projects. In 2024 the company completed the Greenlink interconnector (≈160 km subsea route) and in May 2024 commenced construction of a new subsea cable factory in the Scottish Highlands. In June 2024 Sumitomo acquired a majority stake in German cable maker Südkabel to broaden 525 kV HVDC manufacturing, and in 2025 it secured framework agreements for future UK HVDC projects—actions that strengthened local production and project delivery capability.

Conclusion

Flagship projects such as the Hornsea wind complex (individual phases exceeding 1.0 GW capacity) illustrate scale effects that increase demand for long subsea transmission routes and HVDC solutions. From a technology and economics perspective, HVDC is being preferred for long-distance subsea links because measured transmission losses are comparatively low (on the order of ~3% per 1,000 km in many studies), improving feasibility of distant offshore-to-shore and cross-sea connections.

Notwithstanding these opportunities, the sector is constrained by very high capital and repair costs and by security risks to seabed infrastructure—recent repairs to major subsea links have been reported to cost tens of millions of euros, underlining the capital intensity and operational risk profile faced by stakeholders.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)