Table of Contents

Overview

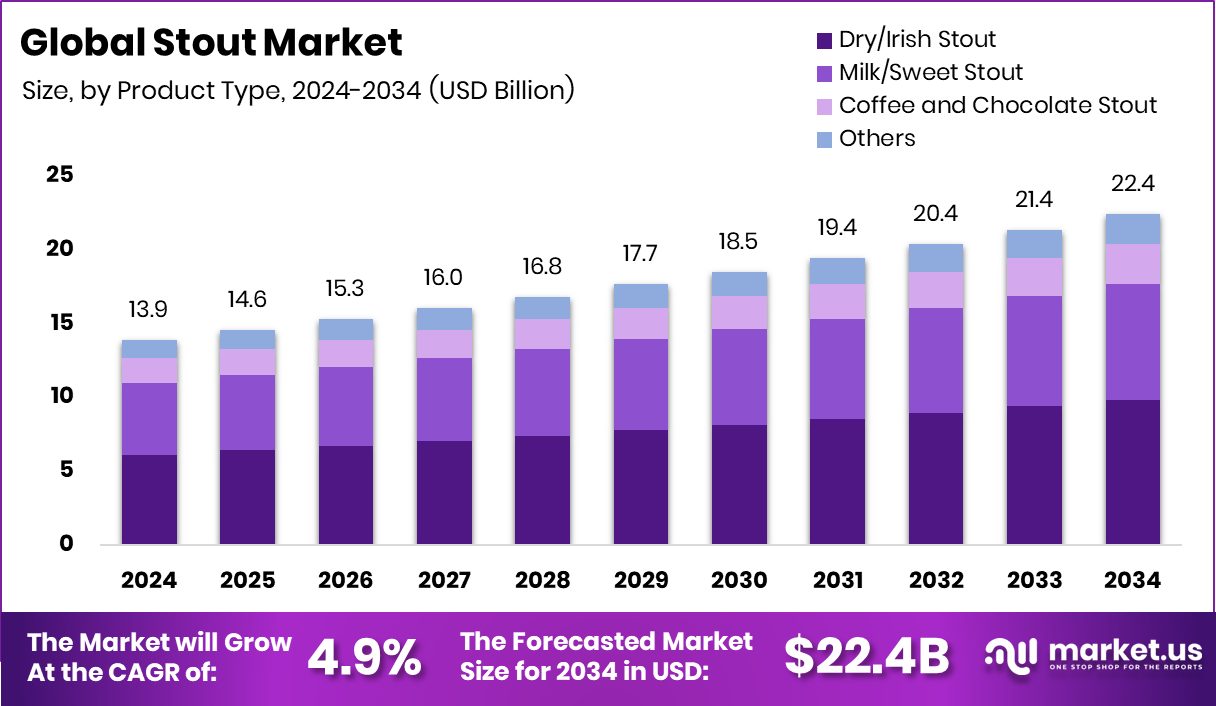

New York, NY – Nov 14, 2025 – The Global Stout Market is set to reach USD 22.4 billion by 2034, rising from USD 13.9 billion in 2024 at a 4.9% CAGR, with Europe holding a strong 45.9% share thanks to its brewing heritage and demand for premium dark beers. Stout, known for its roasted malt, coffee, and chocolate notes, has grown from its English porter roots into styles like dry, milk, and imperial stout.

Today’s stout momentum comes from the worldwide shift toward craft and specialty beverages. Consumers—especially urban millennials—are choosing richer, more distinctive flavors and supporting local, ethical brewers who prioritize natural ingredients and low-carbon processes. This cultural shift is strengthened by steady investment flows into innovative beverage startups.

Funding activity is shaping the market’s direction. Prefer secured USD 4.2 million, Voyage Foods raised USD 52 million, and Rage Coffee attracted USD 5 million in Series A financing. Larger sustainability-focused commitments, such as Clarmondial’s USD 300 million for coffee and cocoa, further support crossover innovations where stout culture intersects with sustainable coffee and cocoa alternatives.

These investments fuel experimentation with bean-free ingredients, eco-friendly brewing, and hybrid stout-inspired beverages, creating new opportunities for growth while reinforcing the market’s move toward sustainable and artisanal production.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-stout-market/request-sample/

Key Takeaways

- The Global Stout Market is expected to be worth around USD 22.4 billion by 2034, up from USD 13.9 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- Dry/Irish Stout dominates the Stout Market with 43.9%, favored for its smooth roasted flavor.

- Keg and cask formats lead the Stout Market with 39.7%, ensuring freshness and quality retention.

- On-trade channels account for 68.3% of the Stout Market, led by pubs and restaurants.

- The European market was valued at USD 6.3 billion, reflecting strong consumer demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164947

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 13.9 Billion |

| Forecast Revenue (2034) | USD 22.4 Billion |

| CAGR (2025-2034) | 4.9% |

| Segments Covered | By Product Type (Dry/Irish Stout, Milk/Sweet Stout, Coffee and Chocolate Stout, Others), By Packafing Format (Keg/Cask, Glass Bottle, Aluminium Can), By Distribution Channel (On Trade, Off Trade) |

| Competitive Landscape | Carlsberg Breweries A/S, Asahi Group Holdings Ltd., Heineken N.V., Anheuser-Busch InBev SA/NV, Kirin Brewery Co. Ltd., Diageo plc, Molson Coors Beverage Co., The Boston Beer Co. Inc., Stone Brewing Co. |

Key Market Segments

By Product Type Analysis

In 2024, Dry/Irish Stout led the Stout Market’s Product Type segment with a 43.9% share, reflecting its strong global appeal. Its smooth mouthfeel, roasted malt character, and balanced bitterness make it a preferred choice for both long-time stout drinkers and the growing community of craft beer fans.

This category’s leadership is rooted in its cultural legacy and steady demand in pubs, taprooms, and breweries, where it remains a staple. Its classic flavor profile fits well with current consumer interest in richer, full-bodied beers, helping it stay relevant despite shifting beverage trends.

As drinkers increasingly look for authentic, flavor-forward options, Dry/Irish Stout continues to stand out as the segment’s quality benchmark. Its enduring popularity solidifies its role as a key growth driver of the stout market and ensures its position at the center of evolving craft and premium beer offerings.

By Packaging Format Analysis

In 2024, Keg/Cask led the Stout Market’s Packaging Format segment with a 39.7% share, driven by the strong performance of draught stout in pubs, taprooms, and breweries. These formats deliver superior freshness, stable carbonation, and consistent flavor, which make them the preferred choice for premium and craft stout producers.

Their widespread use in hospitality venues also supports the traditional pub-driven drinking culture closely associated with stout. This connection keeps consumer loyalty high and sustains strong on-trade sales.

The segment’s dominance highlights how keg and cask formats preserve product integrity while offering an authentic serving experience. Their ability to maintain quality, enhance flavor delivery, and fit seamlessly into the craft beer ecosystem reinforces keg/cask as the most influential and relied-upon packaging format in the global stout market.

By Distribution Channel Analysis

In 2024, On Trade dominated the Stout Market’s Distribution Channel segment with a 39.7% share, supported by the strong presence of stouts in bars, pubs, and restaurants. Draught and freshly poured formats remain central to consumer preference, as many drinkers associate stout with social occasions and the authentic experience of tap-served beverages.

This channel thrives on the ambiance and communal nature of hospitality venues, where stout maintains a culturally rooted appeal. Breweries further reinforce this strength by partnering closely with pubs and restaurants to maintain quality, enhance visibility, and secure consistent sales.

The On Trade segment’s leadership reflects its essential role in shaping consumer perception, driving volume growth, and sustaining engagement within the global stout ecosystem. Its influence ensures that social drinking environments remain the heart of stout consumption.

Regional Analysis

In 2024, Europe led the global Stout Market with a 45.9% share, valued at USD 6.3 billion, supported by its rich brewing traditions and strong consumer base across Ireland, the UK, and Germany. The region’s deep-rooted pub culture and thriving craft scene continue to anchor its dominance.

North America ranked next, driven by expanding microbreweries and increasing interest in premium, locally crafted stouts.

The Asia Pacific region recorded steady growth as urban consumers embraced Western-style drinks and showed rising interest in dark, flavor-rich beers.

Markets in the Middle East & Africa and Latin America are also gradually strengthening, supported by evolving lifestyles and growing acceptance of international beverage trends, positioning them as emerging contributors to global stout expansion.

Top Use Cases

- Cooking Marinades & Stews: Dark, rich stouts are excellent for marinating and braising meats because their roasted malt flavours infuse depth and tenderness into the dish. For example, stouts can be used to deglaze a pan or slow-cook beef cheeks for a glossy sauce and soft texture.

- Flavor Pairing with Food: Stouts work especially well with robust foods like salty bar nuts, fried snacks, or beef stews thanks to their intense roasted malt, coffee- and chocolate-like notes. These flavour profiles enable stouts to complement strong savoury or salty dishes elegantly.

- Dessert Ingredient & Baking: You can use stout in desserts and baked goods—thanks to its dark malts and subtle sweetness, it’s been incorporated into cakes, puddings and glazes. For example, a stout-based chocolate-cake batter stays moist and gains a beery tang.

- Culinary Glaze for Meats: The sugar content in stout allows it to reduce into syrups ideal for glazing meats. A honey-and-stout glaze on pork or beef ribs yields a rich, savoury-sweet crust with enhanced flavour from the beer’s roasted character.

- Specialty Beverage Creation & Pairing: Beyond simple drinking, stouts are used for artisan beverage experiences: for example pairing with spicy foods where the stout’s body and roastiness balance out heat, or for non-alcoholic versions retaining full flavour.

- Nitro Dispense and Texture Innovation: In brewing technology, stouts often use nitrogen (or specialised widgets) rather than just CO₂ to create a creamy, stable head. The physical behaviour of nitrogen and bubbles in stout is studied scientifically, showing stouts as valuable for texture/foam innovation.

Recent Developments

- In November 2024, Heineken Cambodia launched a new stout beer called “ABC Smooth Stout” in Cambodia, positioning it as a premium stout offering under the company’s local branch.

- In January 2024, Asahi Europe & International (AEI), the overseas arm of Asahi Group, acquired the U.S.–based contract beverage production facility Octopi Brewing in Waunakee, Wisconsin (USA). This move gives Asahi a manufacturing base in North America and supports its global beer brands.

Conclusion

The stout market continues to evolve as consumers increasingly look for deeper flavours, authentic brewing methods, and richer drinking experiences. Growing interest in craft beer has revived traditional stout styles while inspiring new variations that blend innovation with heritage. Breweries are strengthening ties with pubs, tapping into social drinking culture, and exploring sustainable brewing practices.

Rising demand for premium and locally crafted beverages also supports the category’s expansion. As global tastes shift toward more expressive and character-driven drinks, stout remains a standout choice, offering both tradition and creativity.