Table of Contents

Overview

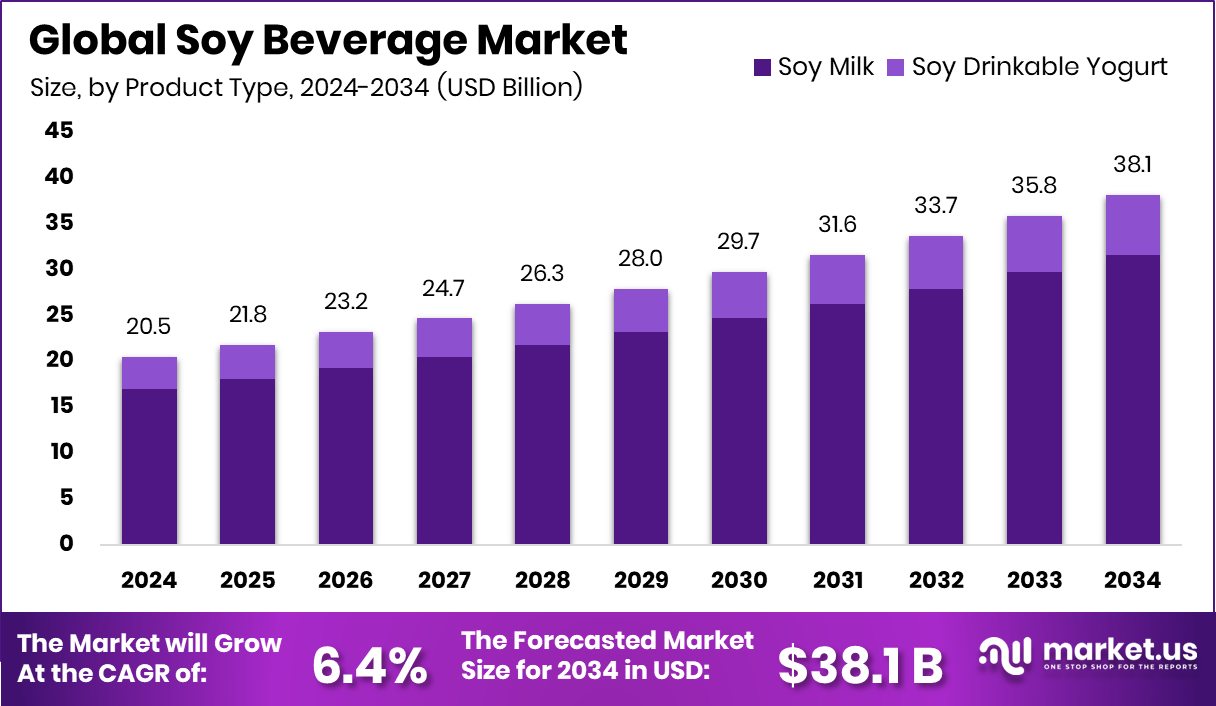

New York, NY – September 12, 2025 – The Global Soy Beverage Market, valued at USD 20.5 billion in 2024, is projected to reach USD 38.1 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2034. Soy beverages, commonly known as soy milk, are plant-based drinks produced by soaking, grinding, boiling, and filtering soybeans to create a smooth, creamy liquid with a subtle bean-like flavor.

Naturally lactose-free and often fortified with vitamins and minerals to rival or surpass cow’s milk nutrition, soy beverages are a popular dairy alternative for those with lactose intolerance, vegans, and health-conscious consumers. The Asia-Pacific region, holding a dominant 41.90% market share valued at USD 8.5 billion, is driven by growing lactose intolerance and demand for plant-based nutrition.

Market growth is fueled by a global shift toward plant-based diets, heightened by concerns over animal welfare, environmental sustainability, and the health benefits of protein-rich soy. Urbanization, busy lifestyles, and interest in functional beverages further propel demand. Innovations in flavors, expanded retail availability, and sustainable food choices also contribute to the market’s expansion.

Recent industry developments include Sironix securing USD 3.5 million to enhance soybean-based cleaning ingredient production, Prefer raising USD 2 million for beanless coffee made from soy pulp and other surplus materials, a USD 12.6 million allocation for a USD 500 million soy processing plant in the Mitchell area, and a USD 1.1 million grant to Purdue Food Science to advance commercial soy-based products across the United States, all strengthening the soy beverage supply chain and market innovation.

Key Takeaways

- The Global Soy Beverage Market is expected to be worth around USD 38.1 billion by 2034, up from USD 20.5 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- In the soy beverage market, soy milk dominates product type sales, accounting for a strong 82.3% share.

- Liquid form leads the soy beverage market, capturing 71.4% share due to convenience and wide consumer preference.

- Flavored variants hold 68.9% of the soy beverage market, driven by taste innovation and growing flavor diversity.

- Supermarkets and hypermarkets command 48.6% of the soy beverage market sales, benefiting from broad availability and consumer accessibility.

- Asia-Pacific’s 41.9% dominance stems from high plant-based beverage consumption rates.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/soy-beverage-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 20.5 Billion |

| Forecast Revenue (2034) | USD 38.1 Billion |

| CAGR (2025-2034) | 6.4% |

| Segments Covered | By Product Type (Soy Milk, Soy Drinkable Yogurt), By Form (Liquid, Powder, Concentrate), By Flavor (Flavored, Unflavored), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail Stores, Convenience Stores, Others) |

| Competitive Landscape | Vitasoy International Holdings Ltd., Earth’s Own Food Company Inc., Alpro (Danone S.A.), Eden Foods Inc., Pacific Foods of Oregon, LLC, Kikkoman Corporation, SunOpta Inc., The Hain Celestial Group, Inc., Morinaga Milk Industry Co., Ltd., Pulmuone Co., Ltd., Maeil Dairies Co., Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155291

Key Market Segments

By Product Type Analysis

Soy milk dominates with an 82.3% share

In 2024, soy milk held a commanding position in the Soy Beverage Market, accounting for 82.3% of the product type segment. Its dominance is rooted in strong consumer acceptance as a primary dairy alternative, offering high protein content, lactose-free benefits, and versatility across beverages and cooking.

Fortification with vitamins such as B12, D, and calcium has strengthened its appeal as a nutritionally competitive substitute for cow’s milk. Rising cases of lactose intolerance, along with the growing adoption of plant-based diets, continue to support its wide usage. Flavored and organic varieties further expand reach, while eco-friendly credentials reinforce soy milk’s role as the cornerstone of the category.

By Form Analysis

Liquid format leads with 71.4% share

In 2024, liquid soy beverages dominated the market by form, capturing 71.4% of sales. Their ready-to-drink convenience makes them a natural fit for urban lifestyles, while wide availability across supermarkets, convenience stores, and e-commerce strengthens their reach.

Consumers value liquid soy beverages for both direct consumption and versatile use in smoothies, coffee, and cooking. The segment is further supported by flavored and fortified variants, eco-friendly packaging, and shelf-stable formats that extend product life. Together, these advantages cement the liquid form’s leading position in the soy beverage industry.

By Flavor Analysis

Flavored varieties capture 68.9% share

In 2024, flavored soy beverages held 68.9% of the market by flavor. Varieties such as vanilla, chocolate, and strawberry have broadened appeal by masking soy’s natural beany taste, encouraging repeat purchases among younger consumers and families.

Innovations in low-sugar and natural sweetener formulations align with health-conscious trends, while seasonal and limited-edition flavors drive short-term excitement. Fortification and attractive packaging enhance their positioning as both indulgent and nutritious, further boosting flavored products’ leadership.

By Distribution Channel Analysis

Supermarkets dominate with a 48.6% share

In 2024, supermarkets and hypermarkets accounted for 48.6% of soy beverage distribution worldwide. Their ability to showcase a wide variety of brands and flavors under one roof drives consumer preference. Organized shelf placement, promotional campaigns, and sampling opportunities build consumer trust and encourage trial. Expansion of retail chains into suburban and rural areas has also improved accessibility. With loyalty programs, seasonal promotions, and health-focused displays, supermarkets remain the backbone of soy beverage sales.

Regional Analysis

Asia-Pacific leads with a 41.9% share worth USD 8.5 Billion

In 2024, Asia-Pacific emerged as the leading region, holding 41.9% of the global soy beverage market, valued at USD 8.5 billion. Strong cultural acceptance of soy, coupled with rising lactose intolerance and growing plant-based diet adoption, underpins this dominance.

Countries such as China, Japan, and South Korea are key drivers, supported by expanding retail infrastructure and government campaigns promoting plant-based nutrition. Younger consumers are embracing flavored and fortified soy beverages, while busy urban lifestyles favor ready-to-drink formats. With fitness and wellness trends on the rise, alongside strong e-commerce growth, the Asia-Pacific region is set to remain the powerhouse of global soy beverage consumption.

Top Use Cases

- Dairy Alternative for Lactose Intolerant Consumers: Soy beverages are a perfect substitute for dairy milk, offering a lactose-free option for those with lactose intolerance. They provide a creamy texture and similar nutritional benefits, like protein and calcium, making them ideal for daily consumption in coffee, cereals, or smoothies, catering to health-conscious individuals seeking plant-based options.

- Nutritional Boost for Vegan Diets: Soy beverages are packed with protein, vitamins, and minerals, making them a staple for vegans. They support muscle health and overall nutrition without animal-derived ingredients. Available in fortified versions, they ensure vegans meet dietary needs, used in recipes like shakes, baking, or as a standalone drink.

- Versatile Ingredient in Cooking and Baking: Soy beverages are widely used in cooking and baking due to their smooth texture and neutral or flavored profiles. They work well in soups, sauces, pancakes, and desserts, offering a dairy-free alternative that maintains taste and consistency, appealing to home cooks and professional chefs alike.

- Functional Beverages for Health Benefits: Soy beverages, enriched with isoflavones and low in saturated fat, promote heart health and may reduce cholesterol. Fortified options with added vitamins or minerals target specific health needs, like bone health or immunity, making them popular among consumers seeking functional drinks for wellness-focused lifestyles.

- Eco-Friendly Choice for Sustainable Diets: Soy beverages support sustainable living with a lower environmental footprint than dairy milk. They appeal to eco-conscious consumers who prioritize plant-based diets to reduce carbon emissions. Available in various flavors and packaging, they fit seamlessly into daily routines, from breakfast to on-the-go snacks.

Recent Developments

1. Vitasoy International Holdings Ltd.

Vitasoy has focused on recovery and strategic shifts following recent market challenges. Key developments include streamlining operations in unprofitable markets like Australia while doubling down on core Asian markets. They continue to innovate with new flavors and packaging for their classic soy milk line, emphasizing health and sustainability to reconnect with their core consumer base and improve financial performance.

2. Earth’s Own Food Company Inc.

Earth’s Own continues to champion sustainability, recently achieving B Corp certification. Their recent focus is on innovation within the plant-based category, extending beyond soy. They have been promoting their upgraded barista foams for coffee and expanding their product lines, including oat and almond milks, while maintaining their original soy beverages with non-GMO and carbon-neutral production commitments.

3. Alpro (Danone S.A.)

Alpro heavily promotes its sustainability agenda, aiming for all its packaging to be recyclable and for its products to be carbon neutral by 2025. Recent developments include reformulating recipes, such as reducing sugar content across its range, and launching new products like Not Milk in Europe, a pea-based drink designed to mimic dairy, showcasing innovation beyond its core soy portfolio under parent Danone’s “One Planet. One Health” vision.

4. Eden Foods Inc.

Eden Foods maintains its commitment to traditional, organic, and non-GMO soy beverages. A key recent development is their continued advocacy for pure food standards and transparency in labeling. They have focused on securing a stable supply of high-quality, U.S.-grown organic soybeans to ensure consistent production of their minimally processed, traditional-style soy milks, distinguishing themselves in a market of newer, often more processed alternatives.

5. Pacific Foods of Oregon, LLC

Pacific Foods continues to leverage its brand reputation for organic, simple ingredients. A major recent development is the expansion of its manufacturing facility in Oregon, significantly increasing production capacity for its plant-based beverages, including its popular organic soy milks. This investment, supported by parent company Campbell Soup, aims to meet growing consumer demand and improve supply chain efficiency for its retail partners.

Conclusion

The Soy Beverage Market is experiencing steady growth due to increasing demand for plant-based, sustainable, and health-focused products. With increasing awareness of lactose intolerance, veganism, and environmental concerns, soy-based beverages are gaining popularity as versatile and nutritious dairy alternatives. Innovations in flavors, fortification, and eco-friendly packaging continue to drive market expansion, catering to diverse consumer needs and preferences.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)