Table of Contents

Overview

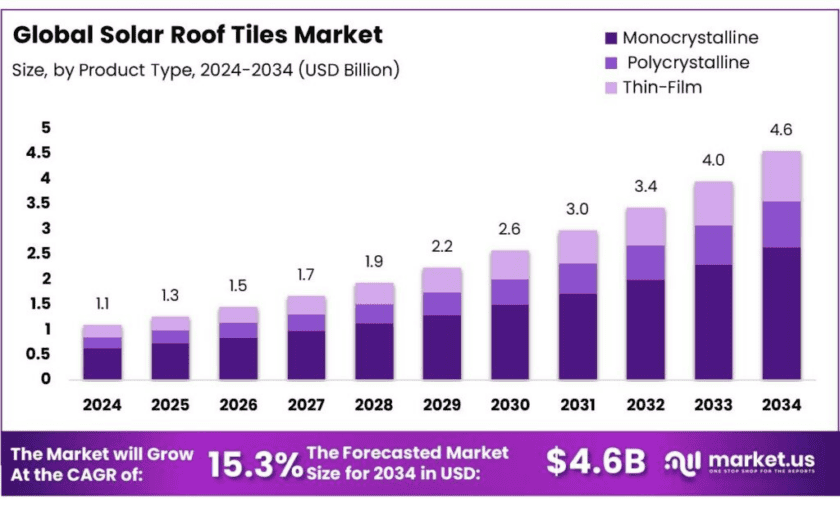

New York, NY – Dec 02, 2025 – The global solar roof tiles market is expected to reach USD 4.6 billion by 2034, growing from USD 1.1 billion in 2024, at a compound annual growth rate (CAGR) of 15.3% from 2025 to 2034. North America is projected to maintain its leadership position, holding a 35.90% share of the market, driven by strong industrial growth and rising energy production. Solar roof tiles are an innovative technology that integrates photovoltaic (PV) generation directly into roofing materials. Unlike traditional solar panels, which are mounted on racks, solar roof tiles are seamlessly incorporated into the roof structure, offering an aesthetic appeal while generating electricity.

While solar roof tiles are still emerging compared to traditional rooftop solar panels, they are gaining traction in premium residential and commercial markets due to their superior aesthetic integration and architectural value. Solar PV, which is expected to make up 80% of new renewable energy capacity additions globally between 2024 and 2030, supports the growth of this segment. According to REN21, renewable energy sources accounted for 13.5% of total final energy consumption (TFEC) in 2023.

Several key factors drive the growth of solar roof tiles, including their aesthetic benefits, increasing energy costs, rising awareness of sustainability, and government incentives. In many regions, subsidies, tax rebates, and financial incentives for rooftop solar installations are boosting demand for integrated solar solutions. For example, under India’s PM Surya Ghar: Muft Bijli Yojana, the government provides central financial assistance for residential consumers, offering subsidies of up to ₹78,000 for 3 kW systems.

Government initiatives continue to play a vital role in fostering the adoption of solar roof tiles. In India, the Ministry of New and Renewable Energy (MNRE) aims to install 30 gigawatts (GW) of rooftop solar capacity by 2027, part of a broader strategy to achieve 500 GW of non-fossil fuel capacity by 2030. State-level programs, such as Maharashtra’s SMART Solar Scheme, also offer financial incentives for consumers, further encouraging the growth of solar technologies in the region.

Key Takeaways

- Solar Roof Tiles Market size is expected to be worth around USD 4.6 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 15.3%.

- Monocrystalline held a dominant market position, capturing more than a 57.9% share of the global solar roof tiles market.

- Residential segment held a dominant market position, capturing more than a 53.2% share of the global solar roof tiles market.

- New installation segment held a dominant market position, capturing more than a 69.5% share of the global solar roof tiles market.

- North America emerged as a dominant region in the global solar roof tiles market, capturing a significant 35.90% share, equating to an estimated market value of USD 0.3 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/solar-roof-tiles-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.1 Bn |

| Forecast Revenue (2034) | USD 4.6 Bn |

| CAGR (2025-2034) | 15.3% |

| Segments Covered | By Product Type (Monocrystalline, Polycrystalline, Thin-Film), By Application (Residential, Commercial, Industrial), By Installation Type (New Installation, Retrofit) |

| Competitive Landscape | Tesla, Inc., SunTegra Solar Roof Systems, CertainTeed Corporation, Hanergy Holding Group Ltd., SolteQ, RGS Energy, Sunflare Solar, Luma Solar, GB-Sol, SunPower Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161142

Key Market Segments

Monocrystalline Solar Roof Tiles Analysis

In 2024, Monocrystalline solar roof tiles held a dominant market position, capturing more than 57.9% of the global market share. This leadership is primarily driven by their superior energy conversion efficiency, making them an attractive choice for both residential and commercial applications. Monocrystalline tiles are recognized for their longevity, reliability, and excellent performance, even under low-light conditions. These characteristics make them particularly appealing in regions with varying sunlight. Additionally, the decline in production costs and improvements in material quality have enhanced the cost-effectiveness of monocrystalline solar roof tiles, making them more accessible to a broader audience. Government incentives and subsidies for renewable energy adoption have further accelerated the growth of this segment.

Residential Application Analysis

In 2024, the residential segment dominated the solar roof tiles market, capturing over 53.2% of the total share. This dominance is driven by the growing awareness of sustainable energy solutions and the desire among homeowners to reduce energy costs. Solar roof tiles offer the dual benefit of generating clean energy and enhancing the aesthetic appeal of rooftops, making them a preferred alternative to traditional solar panels. The strong uptake in urban and suburban areas reflects a shift toward energy efficiency and sustainability. Moreover, government subsidies and programs promoting rooftop solar installations have made solar roof tiles financially viable for a larger number of households. Technological advancements in efficiency, durability, and ease of installation have also solidified the residential sector’s leading position.

New Installation Analysis

In 2024, new installations captured a dominant market share of more than 69.5% in the global solar roof tiles market. This preference is largely attributed to the increasing trend of incorporating renewable energy solutions during the construction of new buildings. Installing solar roof tiles during the initial construction phase ensures seamless integration, higher energy efficiency, and lower costs compared to retrofitting existing structures. Developers and builders are prioritizing energy-efficient designs to comply with evolving building codes and sustainability standards. Financial incentives and government policies supporting new solar installations further reinforce the growth of this segment. Technological advancements in solar roof tile design and durability have also contributed to the cost-effectiveness of new installations, strengthening their market share.

List of Segments

By Product Type

- Monocrystalline

- Polycrystalline

- Thin-Film

By Application

- Residential

- Commercial

- Industrial

By Installation Type

- New Installation

- Retrofit

Regional Analysis

North America leads with 35.90% share in 2024, valued at USD 0.3 Billion, supported by rapid urban growth and rising health awareness.

In 2024, North America held a dominant position in the global solar roof tiles market, capturing a 35.90% share, valued at approximately USD 0.3 billion. This strong market presence can be attributed to the region’s increasing adoption of renewable energy solutions, driven by rising electricity costs and a growing focus on sustainable construction practices. The United States, in particular, has played a key role in this growth, supported by policies such as the Investment Tax Credit (ITC) and various state-level incentives that have made solar technologies more financially accessible. These incentives, combined with heightened consumer awareness of environmental concerns, have led to a growing demand for solar roof tiles, which offer an aesthetically appealing and efficient alternative to traditional solar panels.

Top Use Cases

Residential Energy Generation: Solar roof tiles are becoming increasingly popular in residential applications due to their aesthetic appeal and ability to generate clean energy. Homeowners are using these tiles to reduce their electricity bills and contribute to sustainability goals. In regions like the United States, where the average residential electricity cost is around $0.13 per kWh, solar roof tiles can significantly lower energy costs over the long term. In fact, a typical 5 kW solar roof system can reduce electricity costs by $1,500 annually, depending on local energy rates and usage. Additionally, with rising consumer interest in green building practices, more homes are integrating solar roofs during new construction, with demand growing by 10-15% annually.

Commercial and Industrial Buildings: Commercial and industrial buildings are increasingly adopting solar roof tiles as part of their sustainability initiatives. In 2024, approximately 15% of all commercial building projects in the U.S. incorporated some form of solar technology, with a significant portion opting for integrated solar roofing systems due to their minimal visual impact. These businesses are not only benefiting from energy savings but are also positioning themselves as environmentally responsible entities, which is increasingly important for customers, investors, and regulatory compliance. For instance, a large office building with a 50 kW solar roof system can reduce its energy bills by over $10,000 annually, translating into significant cost savings and improved brand image.

Solar Roofing for New Builds in Europe: In Europe, the adoption of solar roof tiles is growing, particularly in countries like Germany, France, and the Netherlands, which have aggressive renewable energy targets. The European Commission’s Renewable Energy Directive aims for 32% of energy to come from renewables by 2030, encouraging the integration of solar technologies in new builds. As of 2024, Germany has set a target to install solar panels on 80% of new residential buildings, which has directly boosted the demand for solar roof tiles. This trend is anticipated to grow by 20% annually, with solar tiles accounting for a substantial portion of the installations due to their ability to seamlessly integrate into modern architecture.

Rural Electrification in Developing Regions: In developing regions, particularly in parts of Asia and Africa, solar roof tiles are being used to bring clean energy to off-grid communities. According to the International Energy Agency (IEA), more than 770 million people globally still lack access to electricity. In rural areas where electricity grids are absent or unreliable, solar roof tiles offer a practical solution by enabling decentralized energy generation. For example, in rural India, where subsidies are provided under the Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya Scheme), more households are being equipped with solar rooftop systems, with government backing contributing to the growth of the market.

Sustainability Goals for Large Corporations: Major corporations are turning to solar roof tiles to meet their sustainability goals. Companies like Tesla, Amazon, and Google have invested heavily in solar technologies to achieve carbon neutrality. As part of their environmental targets, these corporations have committed to powering their buildings with renewable energy. For instance, Amazon installed a 25 MW rooftop solar system at its distribution centers in California in 2023. Solar roof tiles are becoming an essential part of corporate sustainability strategies, offering not just energy savings but also a means to enhance their green credentials, attract eco-conscious consumers, and comply with stricter environmental regulations.

Recent Developments

Tesla, Inc. has been a key player in the solar roof tiles sector, launching its Solar Roof product in 2016 as part of its energy division. The tiles integrate seamlessly into the roof, offering both energy generation and aesthetic value. In 2024, Tesla’s Solar Roof continues to gain traction due to the growing demand for integrated solar solutions. Tesla aims to reach an installation capacity of over 1,000 homes per week by the end of 2024, focusing on markets in North America. The company’s emphasis on durability, design, and efficiency has helped it maintain a strong presence in the solar roof tile market.

SunTegra Solar Roof Systems offers integrated solar roof solutions that combine solar panels and shingles. The company’s solar roof tiles are designed for easy integration with standard roofing systems while providing excellent energy efficiency. By 2024, SunTegra is expected to have expanded its market share with its products being increasingly adopted in both residential and commercial installations, especially as demand for aesthetically pleasing renewable energy solutions grows. Their offering is gaining popularity in urban areas, with a growing focus on energy efficiency and sustainability in new residential developments.

Hanergy Holding Group Ltd. is a Chinese multinational that has made significant strides in the solar roof tiles market. Hanergy’s Solar Roof is a flexible, lightweight, and highly efficient solar product that integrates directly into the roof structure. In 2024, the company continues to build its presence in Asia and Europe, with an emphasis on enhancing solar roof tile efficiency and affordability. Hanergy is focusing on expanding its partnerships with construction companies and exploring government-led incentives to drive adoption in both residential and commercial segments.

CertainTeed Corporation, a subsidiary of Saint-Gobain, has ventured into the solar roof tiles sector with its Apollo Solar Roofing products. These are integrated solar panels designed to replace traditional roofing materials. By 2024, CertainTeed’s solar roof tiles are expected to be increasingly adopted due to their ability to blend seamlessly with standard roofing materials, offering a balance between aesthetics and functionality. The company is focusing on residential applications, especially in regions with strong solar incentives like the U.S. Their innovative product offerings are helping expand the appeal of solar roofing.

SolteQ specializes in solar roof tiles, integrating photovoltaic technology into building materials. By 2024, the company has positioned itself as a player offering high-efficiency solar roofing products, mainly targeting residential and commercial properties in Europe and North America. Their products focus on aesthetic appeal and seamless integration, offering a dual benefit of renewable energy generation and roof replacement. With an emphasis on sustainability and energy efficiency, SolteQ is expected to expand its market share as demand for integrated solar solutions grows.

RGS Energy, historically known for pioneering solar panel integration, has made a significant impact in the solar roof tiles market. In 2024, the company is actively expanding its product offerings in the United States, focusing on providing solar solutions that are aesthetically pleasing and energy-efficient. Their product line, which includes solar roof tiles, targets homeowners and commercial establishments looking to reduce energy costs and carbon footprints. With the growing interest in green construction, RGS Energy’s innovative approach is expected to further solidify its position in the market.

Sunflare Solar focuses on the development of solar roof tiles that integrate seamlessly with roof structures while maintaining aesthetic appeal. By 2024, the company’s thin-film technology has made significant strides in the solar roof tiles market. Known for being lightweight and flexible, Sunflare’s products are designed to be an efficient alternative to traditional roof-mounted solar panels. Their products cater to both residential and commercial markets, especially in areas with space constraints. As of 2024, the company is expected to grow rapidly, benefiting from innovations in solar technology and increasing demand for integrated building solutions.

Luma Solar offers cutting-edge solar roof tiles, focusing on efficiency and aesthetic integration with building designs. In 2024, Luma Solar continues to expand its market reach, particularly in residential properties, due to its innovative solar technology that blends seamlessly into the roofline. The company’s products are designed to replace traditional roofing materials while also producing clean, renewable energy. With increasing demand for green building solutions, Luma Solar is well-positioned to see steady growth through 2025, driven by the rising consumer preference for energy-efficient and sustainable home solutions.

GB-Sol, a key player in the solar roof tiles market, specializes in integrating solar technology directly into roofing materials. By 2024, GB-Sol’s solar roof tiles are gaining traction in the UK and Europe, particularly for residential and commercial applications. The company is known for its high-quality solar tiles that blend seamlessly with traditional roof tiles, offering an aesthetically pleasing and efficient alternative to conventional solar panels. As of 2024, GB-Sol continues to focus on expanding its footprint in eco-conscious markets, capitalizing on the growing demand for sustainable energy solutions.

SunPower, a major player in the solar industry, is extending its reach into the solar roof tiles sector with innovative, high-efficiency products. By 2024, SunPower’s solar roof tiles are gaining popularity due to their exceptional performance and integration with energy storage solutions. The company’s focus on producing durable and aesthetically integrated solar roof tiles positions it as a key competitor in the residential market. With the global push toward renewable energy, SunPower’s solutions are expected to see increasing adoption through 2025, benefiting from both consumer interest and government incentives.

Conclusion

In conclusion, the solar roof tiles market is poised for significant growth, driven by increasing demand for sustainable energy solutions, rising electricity costs, and favorable government incentives. With North America, Asia-Pacific, and Europe leading in adoption, technological advancements in solar tile efficiency and design are making them an attractive option for both residential and commercial applications.

As consumers seek more aesthetically pleasing and integrated solar solutions, solar roof tiles provide a unique value proposition over traditional panels. The combination of energy savings, aesthetic appeal, and government support positions the market for continued expansion, with an expected surge in adoption over the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)