Table of Contents

Overview

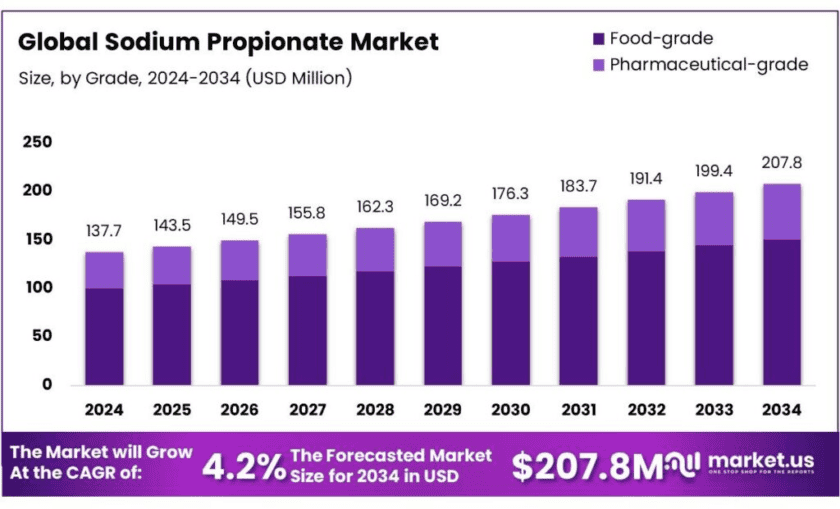

New York, NY – Dec 17, 2025 – The global sodium propionate market is projected to reach approximately USD 207.8 million by 2034, rising from USD 137.7 million in 2024, and expanding at a steady CAGR of 4.2% between 2025 and 2034. In 2024, North America emerged as the leading regional market, accounting for over 38.9% of global demand and generating revenues of nearly USD 53.5 million, supported by high industrial bakery output and strong regulatory clarity around food preservatives.

Sodium propionate, also known as E281 (INS 281), is widely used as an antimicrobial preservative in bakery and dairy applications due to its proven ability to suppress mold growth while maintaining dough stability, crumb texture, and overall product quality. In the United States, sodium propionate is recognized as Generally Recognized as Safe (GRAS) and is permitted for use as an antimicrobial and flavoring agent under current good manufacturing practices, providing long-term regulatory assurance for bread, rolls, buns, and related baked goods.

Demand for sodium propionate is closely linked to bakery production volumes and the global cereals supply chain. According to the Food and Agriculture Organization (FAO), global wheat production reached around 787 million tonnes in 2024, highlighting the scale of flour-based food manufacturing where propionate preservatives are routinely applied to extend shelf life and reduce spoilage. Similarly, the USDA Foreign Agricultural Service reported global wheat output of 792.3 million tonnes in the 2023/24 season, reinforcing the consistent and large-scale end-use base for sodium propionate across industrial and commercial bakeries.

Regulatory frameworks and policy standards continue to support the safe and effective use of propionates worldwide. The U.S. FDA’s bakery standards allow calcium propionate use without a fixed inclusion cap for certain applications, reflecting its established technological necessity in mold control. Comparable regulatory acceptance is observed in Australia and New Zealand, where food safety authorities permit propionates across bread, bakery, and flour products. From a cost perspective, production economics remain sensitive to energy pricing. In the European Union, industrial natural gas prices averaged €0.0616/kWh in H1 2024 and edged slightly higher to €0.0624/kWh in H2 2024, a trend that supported gradual margin stabilization for propionic acid and sodium propionate producers, as also noted in IEA industrial energy price assessments.

Key Takeaways

- Sodium Propionate Market size is expected to be worth around USD 207.8 Million by 2034, from USD 137.7 Million in 2024, growing at a CAGR of 4.2%.

- Food-grade held a dominant market position, capturing more than a 72.4% share of the global sodium propionate market.

- Powder held a dominant market position, capturing more than an 83.2% share of the global sodium propionate market.

- Preservatives held a dominant market position, capturing more than a 44.8% share of the global sodium propionate market.

- Food & Beverages held a dominant market position, capturing more than a 56.4% share of the global sodium propionate market

- North America held a dominant position in the global sodium propionate market, capturing approximately 38.9%, equating to a market value of $53.5 million.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-sodium-propionate-market/free-sample/

Report Scope

| Market Value (2024) | USD 137.7 Million |

| Forecast Revenue (2034) | USD 207.8 Million |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Grade (Food-grade, Pharmaceutical-grade), By Form (Powder, Liquid), By Function (Preservatives, pH Regulators, Flavor Enhancers, Mold Inhibitors, Antimicrobial Agents, Others), By End-use (Pharmaceuticals, Food And Beverages, Agriculture, Cosmetics And Personal Care, Others) |

| Competitive Landscape | Prathista Industries Ltd., Jainex Specialty Chemicals, Dr. Paul Lohmann GmbH KG, Krishna Chemicals, Macco Organiques Inc., Titan Biotech Ltd, Foodchem International Corporation, Rishi Chemicals Work Pvt. Ltd., Niacet Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161566

Key Market Segments

By Grade Analysis:

In 2024, the food-grade segment maintained a leading position in the global sodium propionate market by grade, accounting for over 72.4% of total share. This dominance is largely supported by its critical role in maintaining food safety and extending shelf life in bakery goods, dairy products, and processed foods. Food manufacturers consistently prefer food-grade sodium propionate because of its high purity, reliable antimicrobial performance, and full compliance with international food safety regulations. Growing consumer awareness around safe food ingredients and stricter regulatory oversight further reinforced demand for food-grade variants across major markets.

By Form Analysis:

The powder form continued to dominate the global sodium propionate market in 2024, capturing more than 83.2% share by form. Its widespread adoption is driven by advantages such as longer shelf stability, ease of storage, and superior blending characteristics in dry food and feed formulations. Powdered sodium propionate integrates uniformly into bakery mixes and animal feed, reducing formulation inconsistencies and handling challenges. As production of packaged foods and compound feeds increased globally, manufacturers favored powder formats due to their lower contamination risk and logistical efficiency.

By Function Analysis:

By function, preservatives held a commanding market position in 2024, representing over 44.8% of global demand. Sodium propionate’s proven effectiveness in inhibiting mold and bacterial growth has made it a preferred preservative in baked goods, dairy products, and processed meat applications. The segment benefited from rising demand for extended shelf life and improved food safety across global supply chains. Increased regulatory focus on spoilage prevention and waste reduction further supported the preservative function, reinforcing sodium propionate’s importance in both food and animal feed preservation.

By End-use Analysis:

In 2024, the food & beverages segment emerged as the largest end-use category, capturing more than 56.4% of the global sodium propionate market. This strong position reflects its extensive use in bakery, confectionery, dairy, and ready-to-eat foods, where controlling microbial growth is essential for quality assurance. The continued rise in urbanization, busy lifestyles, and demand for convenient packaged foods boosted consumption across this segment. Additionally, widespread approval by global food safety authorities has encouraged manufacturers to integrate sodium propionate into food formulations for both domestic and export markets.

List of Segments

By Grade

- Food-grade

- Pharmaceutical-grade

By Form

- Powder

- Liquid

By Function

- Preservatives

- pH Regulators

- Flavor Enhancers

- Mold Inhibitors

- Antimicrobial Agents

- Others

By End-use

- Pharmaceuticals

- Food & Beverages

- Agriculture

- Cosmetics & Personal Care

- Others

Regional Analysis

In 2024, North America emerged as the leading region in the global sodium propionate market, accounting for around 38.9% of total demand, which translated to a market value of approximately USD 53.5 million. This strong regional position is largely driven by sustained demand from the food and beverage industry, where sodium propionate is widely used as a preservative to extend shelf life and maintain freshness in bakery products, processed meats, and other packaged foods. Rising consumer preference for convenient and ready-to-eat food options has further reinforced its use across large-scale food processing operations.

Beyond food applications, the animal feed sector has played an important role in supporting market growth in North America. Sodium propionate is commonly added to feed formulations to prevent mold formation, helping preserve feed quality and nutritional integrity during storage and transport. Increasing awareness among livestock producers regarding feed safety, coupled with the expansion of commercial animal farming, has encouraged wider adoption of sodium propionate, strengthening the region’s overall market dominance.

Top Use Cases

Bakery Preservation — Mold and Spoilage Control: Sodium propionate’s most widespread application is as a preservative in baked goods. It effectively inhibits the growth of molds and some bacteria that spoil breads, cakes, pastries, and other flour-based products. Industry practice often involves adding sodium propionate at approximately 0.2%–0.5% of flour weight to standard bakery formulations to extend freshness and reduce waste. This use helps commercial bakeries maintain product quality during longer storage and distribution windows, which is especially important for sliced and packaged bread products.

Dairy and Cheese Shelf-Life Extension: Beyond bakery, sodium propionate is frequently used in processed dairy products, including cheeses and spreads. It helps slow microbial growth that can compromise product safety or flavor during storage. Because dairy matrices often provide moisture that supports microbial activity, propionate’s antimicrobial function improves shelf stability without affecting taste when used within regulatory limits.

Processed Foods — Broad-Spectrum Mold Inhibition: Sodium propionate is also applied in a range of processed foods such as meats, confections, puddings, jams, and gelatins, where moisture and storage conditions can accelerate spoilage. Its antimicrobial performance makes it valuable for manufacturers wanting to extend product life and maintain safety without relying on refrigeration alone.

Animal Feed Quality and Stability: Sodium propionate also serves in the animal feed industry to enhance the stability of dry feeds by inhibiting mold formation. Mold-contaminated feed can reduce nutritional value and harm livestock health. Propionates help maintain feed quality during storage and transportation, particularly in warm or humid climates where spoilage risk is higher.

Specialty Uses — Pharmaceuticals & Cosmetics: While smaller in volume compared with food and feed, sodium propionate is used in certain pharmaceutical and cosmetic formulations due to its antimicrobial properties. It can function as a preservative in topical products or in specific oral drug formulations where microbial control is needed.

Recent Developments

In 2024–2025, Prathista Industries Ltd. in India has been actively producing sodium propionate as part of its portfolio of natural food ingredients and animal feed supplements, using advanced fermentation technology to support clean-label preservative solutions and livestock nutrition products. The company expanded capacity and strengthened its sustainable additive offerings in 2025, aligning with rising demand for safe preservatives in processed foods and feed applications across Asia and global markets. Prathista’s certified food-grade solutions help manufacturers extend shelf life and improve product safety.

Jainex Specialty Chemicals supplies quality sodium propionate as part of its range of organic acids and salts for both food and animal nutrition applications in 2024–2025. The company’s sodium propionate is integrated into animal feed additives to enhance microbial stability and animal health, and into food formulations to extend product shelf life and safety. Jainex focuses on science-backed, certified feed and food solutions, supporting poultry, livestock, and aquaculture segments with reliable preservative and nutrition components.

In 2024–2025, Dr. Paul Lohmann GmbH KG, headquartered in Germany, continued to supply high-purity sodium propionate for food, pharmaceutical, and nutritional applications, supported by its long-standing expertise in mineral and salt-based functional ingredients. The company focuses on food-grade and pharma-grade quality, meeting strict EU and international regulatory standards. In 2025, demand remained steady from bakery and processed food manufacturers seeking reliable preservatives with consistent performance and traceable quality, reinforcing Lohmann’s role in premium sodium propionate supply chains.

In 2024–2025, India-based Krishna Chemicals actively supplied sodium propionate to domestic and export markets, primarily serving bakery, food processing, and animal feed manufacturers. The company emphasizes cost-effective production and compliance with food safety norms, supporting growing demand for mold inhibitors in packaged foods. During 2025, Krishna Chemicals strengthened its presence among small and mid-scale food processors, benefiting from rising processed food consumption and increased awareness of shelf-life enhancement solutions across South Asia and emerging markets.

In 2024–2025, Macco Organiques Inc. continued to supply sodium propionate as part of its range of high-purity mineral salts and food additives, offering FCC-agglomerate food-grade products to bakeries, food manufacturers, and animal nutrition customers worldwide. The company emphasizes dust-free, certified quality suitable for food and pharma applications, with global exports to more than 80 countries and strict quality controls under food safety standards. Macco’s product consistency supports shelf-life enhancement and preservative needs in international food supply chains.

In 2024–2025, Titan Biotech Ltd. in India produced and marketed sodium propionate for animal feed applications, where it acts as a mold inhibitor and antimicrobial agent, helping extend the shelf life and maintain nutritional quality of feed for livestock and poultry. The company’s feed-grade product blends easily into formulations and supports animal health by reducing spoilage risks. Demand remained steady in 2025 as feed producers prioritised stable, safe additives in expanding livestock and aquaculture sectors.

In 2024–2025, Foodchem International Corporation of China has been a major supplier and producer of sodium propionate, offering food-grade preservative powder (E281) used globally, especially for mold inhibition in bakery products and other processed foods. The company leverages ISO2008 and HACCP certifications to meet international safety expectations, exporting sodium propionate in bulk quantities (e.g., 18 MT/20’ FCL) and serving international food and feed manufacturers seeking consistent quality and reliable delivery.

In 2024–2025, Rishi Chemical Works Pvt. Ltd., based in Kolkata, India, has been producing and supplying sodium propionate and other bulk fine chemicals, catering to food preservative and industrial markets. The company’s product lineup includes high-purity sodium propionate alongside related food additives, supporting domestic and export demand for preservative salts used in bakeries, food processing, and industrial formulations. Rishi Chemicals’ local manufacturing presence helps meet growth in India’s processed food sector with cost-efficient preservative solutions.

Conclusion

In conclusion, sodium propionate continues to play a critical role in global food preservation and related markets, driven by its well-established effectiveness in extending shelf life and preventing mold and bacterial growth in baked goods, dairy products, and other processed foods. The compound is widely accepted and used internationally, labelled as E281 in many regulatory systems including the EU and the U.S., where it is approved as a safe food additive for mold inhibition in bakery and dairy applications.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)