Table of Contents

Overview

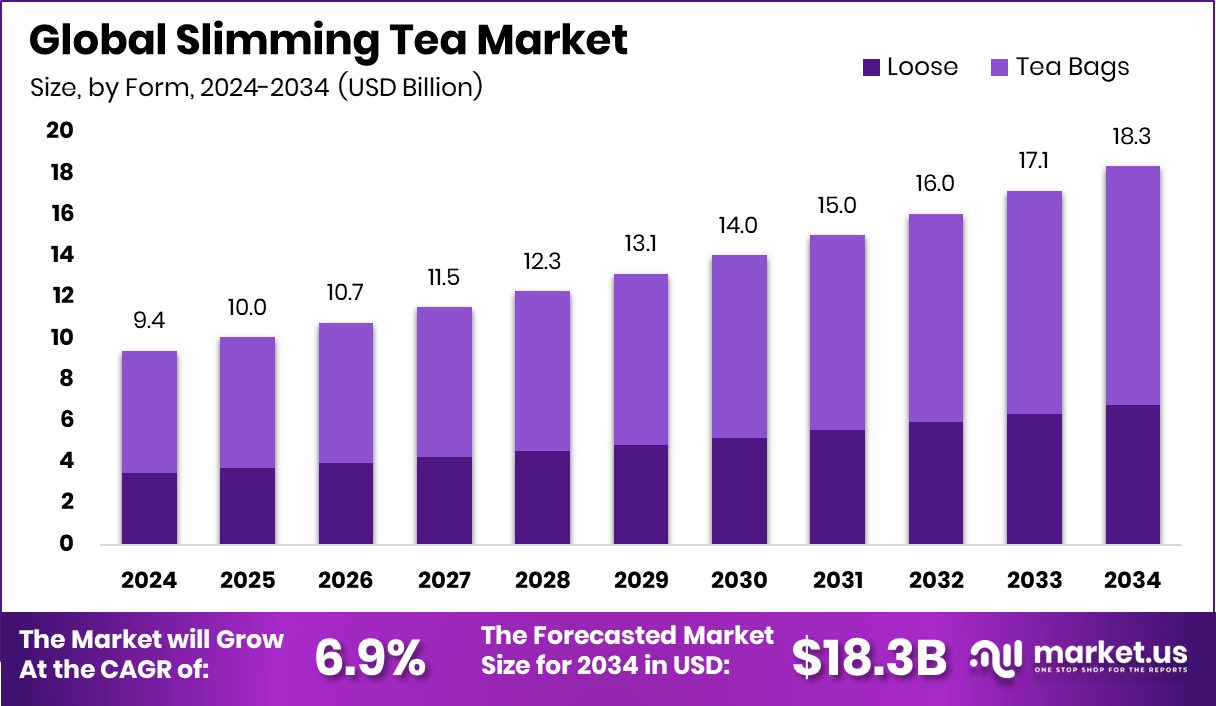

New York, NY – February 10, 2026 – The Slimming Tea Market is steadily expanding, expected to grow from USD 9.4 billion in 2024 to USD 18.3 billion by 2034, supported by a 6.9% CAGR. Asia Pacific remains the leading region, accounting for 43.80% of global share with USD 4.1 billion in value. Slimming tea itself has evolved from a simple digestive drink into a functional wellness beverage made from green tea, oolong tea, and plant-based blends that help consumers manage metabolism, bloating, and overall daily wellness.

The market’s momentum is strengthened by rising investor interest across the broader tea and beverage ecosystem. An alcoholic tea brand securing £1.4 million, a China-based bubble tea chain jumping 43% during its Hong Kong debut, and East Forged completing a $1.5 million capital raise collectively show confidence in tea-driven product innovation. Additional support comes from VAHDAM India, raising $3 million, helping expand global tea distribution networks and boosting market accessibility.

Digital commerce continues to unlock new opportunities. An Assam-based D2C tea brand raising ₹3 crore in a Pre-Series A round from NEDFi Ventures highlights how regional sourcing, online retail growth, and wellness-focused branding are reshaping demand patterns. These combined developments reinforce slimming tea’s growing presence in global consumer lifestyles.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-slimming-tea-market/request-sample/

Key Takeaways

- The Global Slimming Tea Market is expected to be worth around USD 18.3 billion by 2034, up from USD 9.4 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- In the Slimming Tea Market, tea bags dominate by form with a 63.2% share.

- Conventional products lead the slimming tea market by nature, accounting for 68.5% share.

- Green tea drives the Slimming Tea Market end-use, holding a 49.7% consumption share.

- Supermarkets and hypermarkets lead the slimming tea market distribution channels with 39.4% share.

- Asia Pacific growth reflects strong demand, holding 43.80% and reaching USD 4.1 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=172434

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 9.4 Billion |

| Forecast Revenue (2034) | USD 18.3 Billion |

| CAGR (2025-2034) | 6.9% |

| Segments Covered | By Form (Loose, Tea Bags), By Nature (Organic, Conventional), By End Use (Green Tea, White Tea, Oolong Tea, Others), By Distribution Channel (Supermarket/Hypermarket, Online Retailers, Specialty Stores, Mass Grocery Stores, Others) |

| Competitive Landscape | Sira Impex Pvt. Ltd., Tea Treasure, Hyleys, 21stCentury Healthcare, Inc, Okuma Nutritionals, Kudos Ayurveda, Triple Leaf Tea Inc., Others |

Key Market Segments

By Form

Tea bags continue to dominate the Slimming Tea Market, accounting for 63.2% of total share in 2024. Their popularity comes from how easy and practical they are for everyday use. Consumers focused on weight management often want something simple—no special brewing tools, no loose leaves, no cleanup. Tea bags fit perfectly into this preference by offering quick preparation and consistent taste. Portion control is another advantage, as each bag contains a fixed amount of ingredients, making it suitable for calorie-conscious buyers.

For brands, tea bags ensure uniform dosing of herbal blends and active slimming components, supporting product reliability. The format is also widely available across both offline and online retail shelves, making it accessible to all user groups. Travel-friendly packaging, affordability, and familiarity strengthen repeat purchases. Overall, the dominance of tea bags highlights how convenience-driven choices shape modern wellness habits and keep this format at the center of market demand.

By Nature

Conventional slimming tea products held a strong 68.5% share in 2024, remaining the primary choice for most consumers worldwide. The biggest driver behind this leadership is affordability. Many buyers, especially in cost-sensitive regions, prioritize a lower price point over organic certification when selecting wellness beverages they consume daily. Conventional farming enables higher production volumes and easier sourcing, helping brands maintain stable supply chains and predictable pricing year-round.

Retailers also benefit from the faster turnover of conventional variants, which keeps shelves moving and ensures consistent stocking. Even though awareness of organic and natural formulations is rising, conventional slimming teas still meet consumer expectations for taste, familiarity, and perceived effectiveness. Their wide availability across supermarkets, local stores, and online platforms reinforces this dominance. Overall, the continued lead of conventional products reflects the importance of accessibility and trusted everyday value in shaping purchase decisions.

By End Use

Green tea remained the leading end-use category in 2024, capturing 49.7% of the global Slimming Tea Market. Its long-standing reputation for supporting metabolism, boosting fat oxidation, and offering natural antioxidant benefits makes it a go-to choice for individuals focused on weight and wellness. Consumers also appreciate that green tea delivers broader health advantages, including digestive balance and heart wellness, making it more than just a slimming drink.

Brand innovation has further strengthened this dominance, with companies launching flavored, blended, and functional green tea variants that appeal to both new users and loyal drinkers. Green tea’s traditional roots and clean, natural image continue to build trust among consumers seeking plant-based solutions. As more people move toward functional beverages that support daily health goals, green tea’s favorable profile ensures it stays at the forefront of end-use demand in the slimming tea category.

By Distribution Channel

Supermarkets and hypermarkets led the distribution landscape in 2024 with a 39.4% share of the Slimming Tea Market. These stores attract large and diverse customer traffic, giving shoppers the chance to compare different brands, check ingredients, and evaluate pricing in one convenient location. This is especially important for health-focused products like slimming tea, where trust and credibility guide purchasing decisions.

Large retail chains often run promotions, bundles, and in-store discounts that further increase product visibility and encourage trial. They also act as key launch platforms for new slimming tea variants, helping brands reach mainstream consumers quickly. While online shopping is gaining momentum, physical stores remain vital for first-time buyers who prefer to read labels and assess quality before committing. The enduring strength of supermarkets and hypermarkets highlights the continued relevance of traditional retail in shaping consumer behavior within the wellness beverage sector.

Regional Analysis

Asia Pacific leads the Slimming Tea Market with a dominant 43.80% share valued at USD 4.1 billion, driven by its long-standing tea culture, strong preference for herbal wellness drinks, and rising lifestyle-related demand for metabolism-supporting beverages. Daily tea habits across countries like China, Japan, and India naturally support higher adoption of slimming tea products, while growing urbanization and wellness awareness reinforce consistent market growth.

North America shows stable traction, largely influenced by weight-management trends and consumers shifting toward functional, natural beverages. Europe maintains moderate but steady demand, supported by traditional herbal tea usage and increasing health consciousness.

The Middle East & Africa region remains relatively niche, with uptake improving as retail access and awareness widen. Latin America represents an emerging opportunity, where interest in plant-based wellness drinks is gradually shaping consumption patterns. Collectively, these trends highlight Asia Pacific’s firm leadership, with other regions progressing but not surpassing its strong market position.

Top Use Cases

- Supporting Metabolism & Fat Burning: Many teas used in slimming blends contain compounds that may help the body burn more calories and fat. For example, green tea’s catechins and caffeine are linked with boosting metabolic rate and increasing fat oxidation. This means your body may burn more energy throughout the day.

- Helping with Appetite Control: Some herbal components in slimming teas are thought to reduce hunger or make you feel fuller longer. When you feel less hungry, it can be easier to eat fewer calories overall. While evidence is limited for dramatic effects, this use is commonly cited in herbal tea guides.

- Digestion Improvement: Herbal teas like ginger and peppermint have been traditionally used to support digestion. Improved digestion can help reduce bloating and make your stomach feel more comfortable after meals.

- Reducing Bloating & Water Retention: Certain tea types, like hibiscus or herbal blends, can reduce bloating by helping your body manage fluid balance. This can make your abdomen feel less swollen.

- Low-Calorie Beverage Swap: Replacing sugary drinks with calorie-free tea helps cut calories from your overall diet. Even though tea itself doesn’t melt fat, choosing tea over sugary beverages naturally supports calorie control.

- Easy Hydration Support: Drinking tea contributes to your daily fluid intake. Staying well hydrated supports digestion, energy levels, and may reduce confusion between thirst and hunger. This helps people stay on track with weight-related goals.

Recent Developments

- In October 2025, Kudos Ayurveda’s “Active Slim Tea” herbal slimming tea (2 g tea bags) was highlighted online for its metabolism-boosting and weight management support, showing continued product availability and relevance in the wellness tea segment.

Conclusion

The slimming tea market continues to strengthen as more people look for natural and gentle ways to support everyday wellness. Growing interest in herbal drinks, shifting lifestyles, and the move toward cleaner ingredients are helping the category remain relevant across regions. Brands are focusing on better blends, easy formats, and wider online access to meet changing consumer habits. With rising awareness of metabolism-friendly beverages and a preference for plant-based routines, slimming tea holds a stable place in the broader functional tea segment. Overall, the market is set to grow steadily as wellness becomes a daily priority for many.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)