Table of Contents

Overview

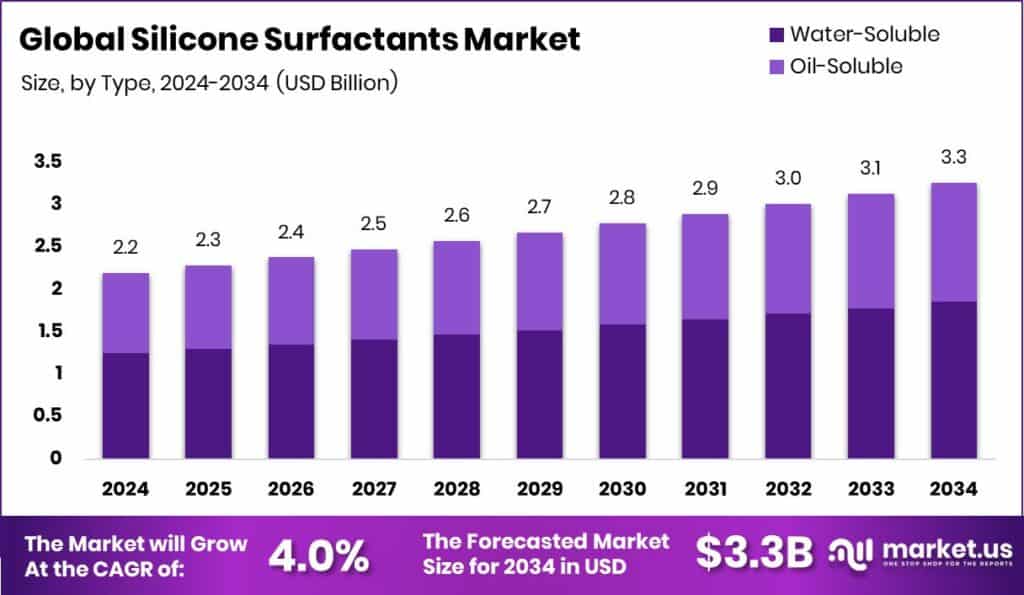

New York, NY – Dec 01, 2025 – The global silicone surfactants market is moving on a steady growth path, supported by rising demand for high-performance and sustainable formulation ingredients. The market is projected to grow from USD 2.2 billion in 2024 to nearly USD 3.3 billion by 2034, expanding at a 4.0% CAGR between 2025 and 2034. Asia Pacific continues to lead with nearly 37.4% of global value, driven by expanding coatings, personal care, and textile production supported by sustainability-focused regulations.

Silicone surfactants combine silicone and organic chemistry, giving them superior surface activity compared with conventional surfactants. They offer enhanced wetting, spreading, foam control, and durability, making them critical in coatings, agrochemical sprays, polyurethane foams, textiles, and personal care emulsions. Their performance advantages are especially valued in water-based, low-VOC, and high-temperature applications.

Growth momentum is closely linked to sustainability-driven investments in the coatings ecosystem. For example, JSW Paints secured INR 3,300 crore in financing to scale its operations, while Ecoat raised €21 million to develop next-generation eco-friendly paint technologies. These investments indirectly increase demand for advanced silicone surfactants that enable cleaner and more efficient formulations.

Innovation across specialty chemicals further supports market expansion. Distil’s $7.7 million Series A funding highlights rising interest in advanced formulation ingredients, where silicone surfactants play a role as premium additives. Looking ahead, bio-derived grades, REACH-aligned chemistries, and customized solutions for smart textiles, insulation foams, and next-generation cosmetics define the market’s long-term opportunity.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-silicone-surfactants-market/request-sample/

Key Takeaways

- The Global Silicone Surfactants Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.2 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034.

- In the Silicone Surfactants Market, the water-soluble type holds a 56.9% share due to versatile formulation benefits.

- Emulsifiers account for 34.1% of the Silicone Surfactants Market, driven by stable dispersion needs globally.

- Personal care end use leads with 38.7% in the Silicone Surfactants Market with premium sensorial performance.

- Asia Pacific demand grows with coatings, beauty, and insulation applications worth USD 3.5 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=166367

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.2 Billion |

| Forecast Revenue (2034) | USD 3.3 Billion |

| CAGR (2025-2034) | 4.0% |

| Segments Covered | By Type (Water-Soluble, Oil-Soluble), By Application (Emulsifiers, Foaming Agents, Defoaming Agents, Wetting Agents, Dispersants, Others), By End Use (Personal Care, Construction, Textile, Paints and Coatings, Agriculture, Others) |

| Competitive Landscape | Zotefoams Plc, Owens Corning, Kingspan Group Plc, Rockwool International A/S, Recticel NV/SA, Morgan Advanced Materials plc, Armacell International S.A., Aspen Aerogels, Inc., Knauf Insulation, Saint-Gobain, Palziv Inc. |

Key Market Segments

By Type Analysis

In 2024, Water-Soluble held a dominant market position in the By Type segment of the Silicone Surfactants Market, accounting for a 56.9% share. This leadership is closely linked to its excellent compatibility with water-based formulation systems that are now widely adopted across multiple industries. Water-soluble silicone surfactants dissolve quickly, provide smooth wetting, and integrate easily into formulations without complex processing steps, supporting faster production and lower energy use.

Their strong presence is also driven by growing demand from personal care products, agricultural spray solutions, and coatings where low residue, controlled foaming, and uniform surface coverage are critical. As manufacturers increasingly shift toward low-VOC and environmentally aligned chemistries, water-soluble grades help meet regulatory expectations while maintaining performance. The segment’s high share clearly reflects industry preference for safer, cleaner, and more efficient silicone surfactant solutions tailored to modern formulation needs.

By Application Analysis

In 2024, Emulsifiers secured a 34.1% share in the By Application segment of the Silicone Surfactants Market, reflecting their vital role in modern formulation technologies. These silicone-based emulsifiers are widely used to keep oil- and water-based components evenly mixed, ensuring uniform texture, smooth flow, and long-term stability. Their ability to lower surface tension and control droplet size helps prevent phase separation, even in demanding processing or storage conditions.

The strong position of emulsifiers is closely linked to their extensive use in coatings, personal care products, and specialty chemical formulations. In these applications, visual appearance, durability, and consistent performance are essential for product acceptance and shelf life. As formulators pursue higher quality and more reliable results with fewer additives, emulsifier-type silicone surfactants continue to be preferred, supporting their dominant 34.1% market share in 2024.

By End Use Analysis

In 2024, Personal Care emerged as the leading end-use segment in the Silicone Surfactants Market, accounting for a 38.7% share. This dominance is driven by strong and consistent demand from skincare, haircare, and cosmetic products where sensory performance strongly influences consumer choice. Silicone surfactants help formulators achieve smooth textures, easy spreadability, and long-lasting comfort in everyday and premium products.

Manufacturers rely on these surfactants to create lightweight, non-greasy emulsions that remain stable across creams, lotions, serums, conditioners, and sun care solutions. Their ability to improve softness, slip, and moisture retention without affecting product feel makes them especially valuable in personal hygiene and beauty applications. The 38.7% market share clearly reflects ongoing global demand for high-performance, user-friendly personal care products across mass and premium retail channels.

Regional Analysis

In 2024, Asia Pacific led the Silicone Surfactants Market with a 37.4% share, valued at USD 3.5 Bn, supported by strong demand from personal care products, construction coatings, and agricultural formulations. Wider adoption of water-based systems, low-VOC additives, and insulation materials continues to reinforce consumption across both developing and advanced manufacturing economies.

North America maintains steady growth due to preference for high-efficiency formulations used in premium personal care, modern construction materials, and advanced polyurethane applications. Innovation in surface-enhancing technologies supports ongoing usage.

Europe shows consistent demand driven by sustainability-focused regulations, encouraging the use of eco-aligned coatings and durable emulsions designed for regulated industries.

Middle East & Africa experience gradual market development, supported by infrastructure expansion and demand for durable performance additives.

Latin America records increasing interest as formulators adopt performance-driven surfactants to support rising industrial and consumer product diversification.

Top Use Cases

- Enhancing Paints & Coatings Wetting and Finish: Silicone surfactants reduce surface tension and improve wetting, helping paints, varnishes, and coatings flow smoothly and adhere uniformly on difficult surfaces. This reduces defects like craters or fisheyes and ensures a smooth, even finish — especially useful in water-based or reactive coatings.

- Stabilizing Polyurethane Foams (Insulation, Furniture, Automotive): When producing polyurethane foam (for insulation, mattresses, automotive seats), silicone surfactants help stabilize bubbles, maintain uniform cell structure, and prevent voids or collapse. This leads to foam that’s more resilient, stable, and high-quality.

- Improving Agricultural Spray Efficiency (Pesticides & Herbicides): In crop sprays, silicone surfactants lower liquid surface tension so droplets spread evenly on waxy leaves rather than beading, improving cover, absorption, and rain fastness. This boosts effectiveness of pesticides or nutrients while reducing runoff or waste.

- Creating Stable Personal-Care & Cosmetic Emulsions: In creams, lotions, shampoos and conditioners, silicone surfactants help oil and water mix smoothly, giving lightweight, non-greasy textures, better spreadability, and stable emulsions — making products comfortable and pleasant to use.

- Reducing Foam and Improving Surface Cleaners / Industrial Processes: Because of their ability to control surface tension and foam, silicone surfactants are used in cleaning agents, degreasers, or industrial processes to prevent unwanted foam formation, improving efficiency and making cleaning or process control easier.

- Textile Treatment — Softness, Water-Repellency, and Fabric Finish: In textile finishing and fabric softeners, silicone surfactants help make fabrics softer, smoother, more water-repellent, and easier to dye evenly. They give garments better feel and durability, while maintaining breathability.

Recent Developments

- In February 2025, OC agreed to sell its glass reinforcements business to Praana Group — a deal valued at about US$ 755 million. The reinforcements business (glass fibre composites for wind energy, infrastructure, industrial, transport markets) will be divested so that OC can focus on insulation, roofing, and other building products.

- In December, 2024 — Released its 2024 annual report: revenues rose ~6% (in local currency), EBIT margin improved to 17.5%. Company committed to build new production capacity in the US, Sweden, India; bought land in the UK; and initiated conversion to electric melters for lower CO₂ intensity.

- In February 2024, Kingspan signed agreements to acquire the stone-wool insulation business and assets of Karl Bachl Kunststoffverarbeitung GmbH & Co. KG (“Bachl”), expanding its insulation portfolio.

Conclusion

The silicone surfactants market is positioned for steady and long-term development, supported by growing demand for high-performance and environmentally responsible formulation solutions. Their unique ability to improve wetting, spreading, stability, and surface control makes them valuable across diverse industries such as personal care, coatings, agriculture, textiles, and advanced material systems.

Increasing focus on water-based formulations, clean chemistry, and efficient processing continues to strengthen their relevance in modern manufacturing. As industries prioritize product quality, sustainability, and consistency, silicone surfactants are likely to remain key functional additives. Ongoing innovation in bio-based alternatives, customized performance grades, and application-specific solutions is expected to further reinforce their importance across evolving industrial and consumer markets.