Table of Contents

Overview

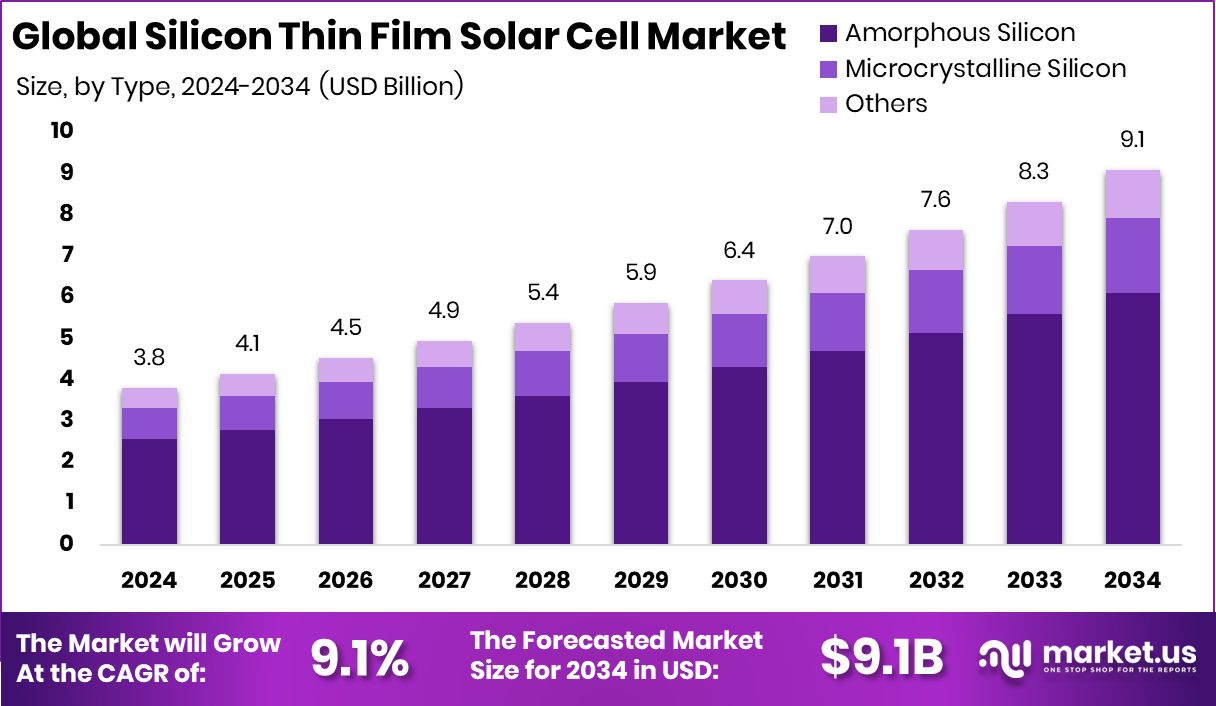

New York, NY – December 09, 2025 – The global Silicon Thin Film Solar Cell Market is on a strong growth path, projected to reach USD 9.1 billion by 2034, rising from USD 3.8 billion in 2024, at a CAGR of 9.1% between 2025 and 2034. Asia Pacific leads global adoption, holding 43.9% market share, valued at nearly USD 1.6 billion, supported by expanding rooftop and urban solar installations.

Silicon thin film solar cells use ultra-thin silicon layers deposited on glass, metal, or flexible substrates to convert sunlight into electricity. Compared with crystalline silicon panels, they consume less material, perform well in low-light conditions, and enable lightweight or building-integrated solar designs. These features make them especially suitable for space-constrained rooftops and decentralised energy systems.

Market growth is supported by long-term public research funding and financing access. The Commission of European Communities has consistently backed amorphous silicon research with about USD 2.4 million per year, strengthening efficiency gains and manufacturing capabilities. On the financing side, rooftop-focused Dugar Finance raised USD 3 million in debt, while Fibe introduced a rooftop solar financing program in partnership with 100 solar EPC companies, lowering upfront costs for consumers.

Government initiatives continue to unlock new opportunities. A Rs 2.3 crore startup challenge was launched to encourage rooftop solar innovation, while Haryana announced a Rs 200 crore fund supporting solar systems with battery storage. Together, these initiatives are accelerating thin-film solar deployment across residential and decentralised energy applications.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-silicon-thin-film-solar-cell-market/request-sample/

Key Takeaways

- The Global Silicon Thin Film Solar Cell Market is expected to be worth around USD 9.1 billion by 2034, up from USD 3.8 billion in 2024, and is projected to grow at a CAGR of 9.1% from 2025 to 2034.

- Amorphous silicon dominates the Silicon Thin Film Solar Cell Market with 67.2% share due to efficiency.

- Utility-scale applications hold 41.5% in the Silicon Thin Film Solar Cell Market, driven by solar projects.

- Rooftop installations lead the Silicon Thin Film Solar Cell Market with 69.8% supporting decentralised power needs.

- Energy end-users account for 55.5% of the Silicon Thin Film Solar Cell Market consumption globally today.

- In the Asia Pacific, the Silicon Thin Film Solar Cell Market reached a 43.9% share of USD1.6Bn

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=168189

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.8 Billion |

| Forecast Revenue (2034) | USD 9.1 Billion |

| CAGR (2025-2034) | 9.1% |

| Segments Covered | By Type (Amorphous Silicon, Microcrystalline Silicon, Others), By Application (Residential, Commercial, Industrial, Utility-Scale), By Installation (Rooftop, Ground-Mounted), By End-User (Energy, Electronics, Automotive, Others) |

| Competitive Landscape | First Solar, Sharp Corporation, Solar Frontier K.K., Kaneka Corporation, Mitsubishi Electric Corporation, Trony Solar Holdings Co., Ltd., Hanergy Thin Film Power Group Limited, Ascent Solar Technologies, Inc., Global Solar Energy, Inc., Heliatek GmbH, Solopower Systems, Inc. |

Key Market Segments

By Type Analysis

In 2024, amorphous silicon secured a leading position in the By Type segment of the Silicon Thin Film Solar Cell Market, accounting for a 67.2% market share. This strong presence is largely due to its wide use in rooftop and distributed solar systems, where lightweight construction and design flexibility are critical.

Amorphous silicon performs consistently under low-light and high-temperature conditions, making it well-suited for dense urban areas and regions with changing weather patterns. Its reduced silicon requirement and comparatively simple manufacturing process support cost-efficient production, helping drive adoption across both residential and commercial installations.

Another major advantage is its compatibility with thin and compact module designs, allowing installation in locations where space is limited or structural load capacity is a concern. As the solar industry increasingly shifts toward rooftop and building-integrated applications, amorphous silicon continues to stand out within thin film technologies.

By Application Analysis

In 2024, the utility-scale segment led the By Application category of the Silicon Thin Film Solar Cell Market, holding a 41.5% market share. This leadership is strongly tied to the ability of thin-film technology to support large solar installations that demand steady power output and effective land utilization.

Silicon thin film modules deliver stable performance under changing light conditions, which is essential for utility-scale projects spread over wide geographic areas. Their consistent design, visual uniformity, and simplified installation process further suit the needs of large solar parks and grid-connected facilities.

With the continued expansion of grid-scale solar capacity worldwide, utility-scale projects remain a major growth driver. This sustained deployment ensured that silicon thin-film solar cells retained their 41.5% dominance in utility-scale applications throughout 2024.

By Installation Analysis

In 2024, the rooftop category dominated the By Installation segment of the Silicon Thin Film Solar Cell Market, capturing a 69.8% market share. This strong performance reflects rising adoption in urban and semi-urban areas, where limited space makes rooftop systems the most practical option.

Silicon thin-film solar cells are highly suitable for rooftops because of their lightweight design and ability to fit various building structures. They also provide reliable power generation under diffused or low sunlight, which is common in densely populated locations.

By using existing roof surfaces, these systems help property owners maximise space without requiring additional land. As decentralised solar generation continues to expand, rooftop installations remain the key deployment channel, reinforcing their 69.8% dominance within the market during 2024.

By End-User Analysis

In 2024, the energy sector led the by-end-user segment of the Silicon Thin Film Solar Cell Market, accounting for a 55.5% market share. This dominance is mainly due to the widespread use of silicon thin-film technology in power generation projects that require reliable and scalable electricity production.

The energy industry benefits from the consistent performance of thin film solar cells across different environmental conditions, helping maintain steady power output for both small and large installations. Their suitability for long operational lifetimes further supports energy-focused applications, where durability and stable returns are critical.

With global energy demand rising and the shift toward cleaner electricity accelerating, the energy end-user segment remained the primary driver of adoption, securing a strong 55.5% share in the market during 2024.

Regional Analysis

Asia Pacific leads the Silicon Thin Film Solar Cell Market with a 43.9% share, valued at USD 1.6 billion. This dominance is supported by strong solar deployment across residential, commercial, and utility-scale projects. Dense cities and lower rooftop load capacity have increased demand for lightweight thin-film solar solutions, reinforcing the region’s leadership.

North America shows stable growth driven by steady solar adoption in both distributed and grid-connected systems, especially where flexible design and dependable output are required.

Europe holds a mature market position, supported by experience in thin-film technologies and a focus on efficiency, building integration, and long service life.

The Middle East & Africa are emerging markets, where thin-film solar cells suit high-temperature and variable sunlight conditions.

Latin America is gradually expanding, supported by rising interest in decentralised solar energy usage.

Top Use Cases

- Building-Integrated Solar (roofs, facades, windows): Thin-film panels are thin, flexible, and lightweight, making them ideal for incorporating into building materials such as roof tiles, curtain walls, or windows. This lets buildings generate electricity without needing bulky traditional solar panels.

- Rooftops and Urban Homes: Because thin-film modules are light and fit easily on various roof types — even those with limited load capacity — they work well in urban and semi-urban homes where space or structural strength is constrained.

- Portable / Mobile Solar (camping, boats, vehicles, RVs):Thin-film solar panels can be mounted on curved or flexible surfaces, making them suitable for use on boats, recreational vehicles, tents, or mobile installations — providing power off-grid in remote locations.

- Low-light or Shaded Environments: These solar cells perform relatively well even under cloudy skies, diffuse light, or partial shading, making them good for settings where sunlight may not be direct or constant.

- Large / Utility-Scale Solar Farms and Ground Installations: Thin-film technology can be used in large solar installations or ground-mounted solar farms, where weight and flexibility are less of a constraint, and stable power output over wide areas is important.

- Off-grid and Remote Area Electrification: Because thin-film panels can be installed with minimal structural requirements and still generate reasonable power, they are suitable for bringing solar electricity to remote, off-grid communities, rural areas or temporary setups where traditional infrastructure is lacking.

Recent Developments

- In November 2025, Kaneka signed a Power-Purchase-Agreement with a municipality in snow-heavy Hokkaido (Numata Town) to install bifacial, vertically mounted solar panel systems + battery storage, aimed at a stable energy supply and disaster-response & microgrid functionality.

- In August 2025, Solar Frontier announced a partnership with FPS to launch a service for converting legacy solar plants from feed-in-tariff (FIT) to feed-in-premium (FIP) regimes, combined with battery storage retrofits. Solar Frontier handles feasibility studies, proposals, and EPC-level conversion work, aimed at helping existing solar-power asset owners adapt to changing regulatory and market conditions.

- In September 2024, Sharp introduced four new PV modules for rooftop solar, including two bifacial modules with output up to 450 W, aimed at boosting residential and small-scale commercial solar installations.

Conclusion

The Silicon Thin Film Solar Cell Market is steadily strengthening as demand grows for flexible, lightweight, and space-efficient solar solutions. Adoption is being driven by rising rooftop installations, building-integrated designs, and the need for reliable performance under varied environmental conditions.

Thin film technology supports wider access to solar power by enabling installation on surfaces unsuitable for conventional panels. Continued innovation, supportive policies, and improved financing options are encouraging broader use across residential, commercial, and utility applications.

As energy systems move toward decentralised and cleaner power generation, silicon thin film solar cells are expected to play an important role. Their adaptability, ease of deployment, and alignment with sustainable energy goals position this technology as a valuable contributor to long-term solar development worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)