Table of Contents

Overview

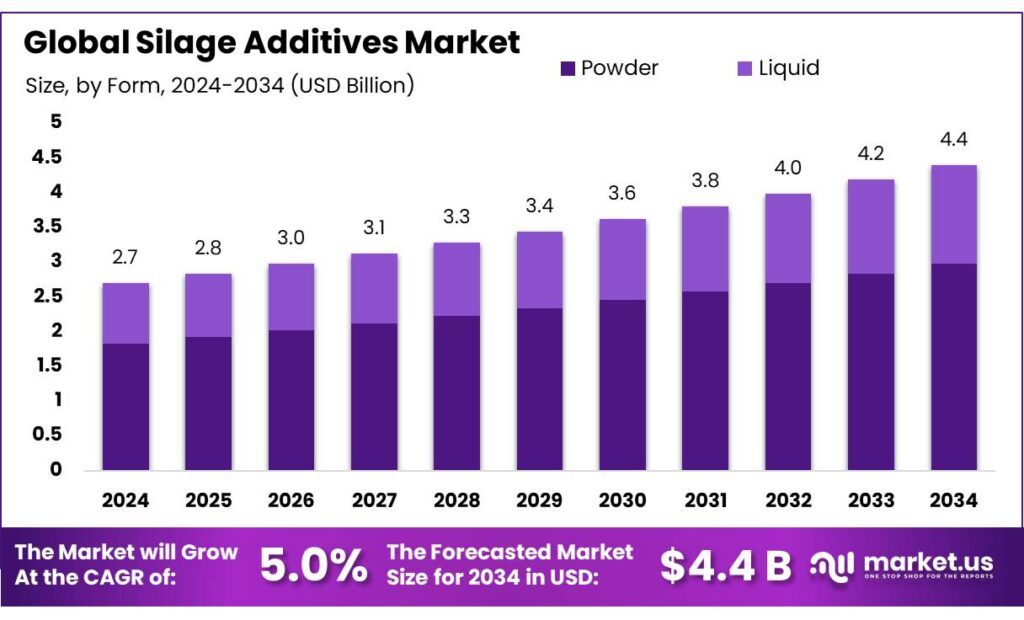

New York, NY – September 30, 2025 – The Global Silage Additives Market is projected to reach USD 4.4 Billion by 2034, increasing from USD 2.7 Billion in 2024, at a steady CAGR of 5.0% (2025–2034). In 2024, North America led the market with a 43.8% share, accounting for USD 1.1 billion in revenue.

Silage additives, including lactic-acid bacteria inoculants, enzymes, and organic acids, are key technologies for enhancing fermentation, minimizing dry matter (DM) losses, and ensuring aerobic stability during feed-out. Their importance is rising as dairy and beef producers aim to improve forage quality, which directly supports milk and protein yields. According to the FAO, global milk production stood at 944 million tonnes in 2023, with the OECD-FAO Outlook forecasting growth at 1.8% annually, reaching 1,146 million tonnes by 2034.

This upward trend reinforces the demand for high-quality, well-preserved forage. The industry operates at scale. In the United States, the USDA reported 2024 corn silage production at 123 million tons, harvested from 6.10 million acres, underscoring the vast need for preservation efficiency. Meanwhile, the U.S. dairy herd numbered 9.37 million milking cows in late 2024, further highlighting reliance on stable silage.

In India, milk output reached 239.3 million tonnes in 2023–24, with per-capita availability at 471 g/day, making effective forage preservation critical for supply stability. Regulation plays a significant role in market adoption. In the European Union, silage inoculants are regulated under Regulation (EC) No 1831/2003, with the EFSA continuously reassessing strains for safety and performance.

Its 2024 opinion reaffirmed Lactiplantibacillus plantarum DSM 18114 as an approved additive. In the U.S., most silage inputs fall under the FDA’s GRAS and feed-additive frameworks. The FDA’s 2024 GFI 293 clarified its policy for AAFCO-defined ingredients, while numeric limits apply; for instance, formic acid is permitted up to 2.25% of silage DM (or 0.45% for direct-cut silage) with labeling and safety requirements. Such clarity reduces risk for producers and fosters product innovation.

Key Takeaways

- Silage Additives Market size is expected to be worth around USD 4.4 billion by 2034, from USD 2.7 billion in 2024, growing at a CAGR of 5.0%.

- Homofermentative Inoculants held a dominant market position, capturing more than a 26.7% share of the silage additives market.

- Powder held a dominant market position, capturing more than a 67.8% share of the silage additives market.

- Stimulation Treatment held a dominant market position, capturing more than a 58.3% share of the silage additives market.

- Corn held a dominant market position, capturing more than a 38.4% share of the silage additives market.

- Cereals held a dominant market position, capturing more than a 73.1% share of the silage additives market.

- North America held a dominant market position in the global silage additives sector, capturing more than a 43.8% share, equating to approximately USD 1.1 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-silage-additives-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.7 Billion |

| Forecast Revenue (2034) | USD 4.4 Billion |

| CAGR (2025-2034) | 5.0% |

| Segments Covered | By Product Type (Homofermentative Inoculants, Heterofermentative Inoculants, Combination Products, Acids and Acid Salts, Molasses or Sugar, Enzymes, Non-Protein Nitrogen Compound), By Form (Powder, Liquid), By Function (Stimulation Treatment, Inhibition Treatment, Others), By Crop Type (Corn, Alfalfa, Sorghum, Oats, Barley, Rye, Others), By Application (Cereals, Pulses, Others) |

| Competitive Landscape | Archer Daniels Midland Company, ADDCON GROUP GmbH, BASF SE, Cargill Inc., Brett Brothers Ltd., Evonik Industries AG, LALLEMAND Inc., DuPont de Nemours, Inc., Kemin, Eastman |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157248

Key Market Segments

By Product Type Analysis

Homofermentative Inoculants lead with a 26.7% market share, driven by efficient fermentation

In 2024, Homofermentative Inoculants commanded a 26.7% share of the silage additives market, favored for their ability to enhance silage fermentation. These inoculants convert forage sugars into lactic acid, rapidly lowering pH to preserve nutrients and extend silage shelf life with minimal spoilage. Their popularity stems from cost-effective, reliable results in improving feed quality for livestock. Ongoing advancements in strain development and formulations are expected to further strengthen their market dominance, meeting farmers’ demands for high-quality, nutrient-rich feed.

By Form Analysis

Powder holds a 67.8% share, valued for convenience and stability

In 2024, Powdered silage additives captured a 67.8% market share, preferred for their ease of use, long shelf life, and versatile application. Easily mixed with forage, powders ensure uniform fermentation and allow farmers to adjust quantities based on forage type or moisture levels. Their stability without refrigeration and suitability for large-scale operations make them a top choice. As demand grows for efficient, cost-effective silage preservation, powdered additives will maintain their leading position in the market.

By Function Analysis

Stimulation Treatment leads with a 58.3% share, boosting silage quality

In 2024, Stimulation Treatment accounted for a 58.3% share of the silage additives market, critical for optimizing fermentation and preserving nutrient-rich silage. By incorporating bacterial strains or enzymes, these treatments accelerate fermentation, reduce nutrient loss, and enhance feed digestibility for livestock. Farmers value their cost-effectiveness in minimizing spoilage and improving feed quality. With rising demand for sustainable, high-quality feed, stimulation treatments will continue to dominate the silage additives market.

By Crop Type Analysis

Corn leads with a 38.4% share, fueling demand for silage additives

In 2024, Corn held a 38.4% share of the silage additives market, driven by its role as a high-energy livestock feed staple. Silage additives enhance corn silage fermentation, preserving nutritional value and reducing spoilage for better feed efficiency. As farmers prioritize quality and digestibility in livestock diets, the demand for additives tailored to corn silage will grow, reinforcing its dominant market position.

By Application Analysis

Cereals dominate with a 73.1% share, ensuring high-quality feed

In 2024, Cereals captured a 73.1% share of the silage additives market, driven by their widespread use in livestock feed, particularly corn, wheat, and barley. Silage additives optimize cereal fermentation, preserving nutrients and minimizing spoilage to enhance feed quality. As cereals remain central to global livestock diets, the demand for effective additives will persist, supported by growing awareness of feed quality and precision farming practices.

Regional Analysis

North America dominates with a 43.8% share, valued at USD 1.1 billion in 2024

In 2024, North America led the global silage additives market, securing a 43.8% share with a market value of approximately USD 1.1 billion. This dominance is driven by the region’s advanced agricultural infrastructure, widespread livestock farming, and sophisticated silage management techniques.

The United States significantly contributes to this leadership, with corn silage production reaching 130 million metric tons and forage output surpassing 73.6 million metric tons in 2023. These volumes highlight the strong demand for silage additives to optimize fermentation, preserve nutrients, and enhance feed quality for livestock.

Top Use Cases

- Enhancing Fermentation in Dairy Farms: Dairy farmers add microbial inoculants to fresh grass clippings before ensiling. These good bacteria speed up the process by turning sugars into lactic acid, which quickly lowers the pH. This keeps the silage fresh longer, locks in more proteins and energy, and helps cows produce richer milk with less waste from bad fermentation.

- Preventing Spoilage in Beef Cattle Operations: In large beef ranches, additives like organic acids are mixed into corn silage to stop yeasts and molds from growing when silos are opened. This aerobic protection means the feed stays safe and tasty for weeks, cutting down on discarded silage and keeping cattle healthy and gaining weight steadily.

- Boosting Digestibility for Sheep and Goats: Sheep herders use enzyme-based additives on legume forages like alfalfa to break down tough fiber walls during storage. This makes the silage easier for small ruminants to chew and absorb, improving their nutrient intake and wool or meat growth without needing extra feed supplements.

- Improving Stability in Mixed Crop Silos: For farms blending corn straw with other crops, combined additives of bacteria and sugars ensure even fermentation despite uneven moisture. This balances the mix, reduces clostridia bacteria that cause rot, and creates reliable feed that supports steady livestock performance across seasons.

- Reducing Waste in Tropical Grass Harvests: In warmer climates, farmers apply acid preservatives to high-moisture tropical grasses to control unwanted fermentation and effluent runoff. This saves valuable dry matter, minimizes nutrient leaching, and provides consistent, mold-free silage that enhances overall herd efficiency and farm profitability.

Recent Developments

1. Archer Daniels Midland Company

ADM is advancing its silage additive portfolio by focusing on microbial-based solutions that enhance fermentation stability and aerobic durability. Recent developments include products combining homofermentative and heterofermentative bacteria strains to improve dry matter recovery and prevent spoilage upon feedout. Their research emphasizes consistent performance across diverse forage types, helping farmers maximize the nutritional value of their silage.

2. ADDCON GROUP GmbH.

ADDCON is a leader in chemical silage additives, recently emphasizing its salt-based FORMOLAC and FORMOLAC TITAN products. Their development focuses on highly concentrated formulations of salts like sodium diacetate and potassium sorbate, which ensure strong antifungal and antibacterial effects. This controls fermentation, reduces dry matter losses, and significantly improves aerobic stability, making silage safer and more nutritious for livestock.

3. BASF SE

Through its Nutrition & Health division, BASF focuses on developing innovative preservatives and mycotoxin managers. A key recent area is the use of propionic acid-based additives to enhance aerobic stability and prevent spoilage. BASF also invests in R&D for solutions that mitigate mycotoxin formation during storage, ensuring silage safety and protecting animal health while minimizing total feed costs for producers.

4. Cargill Inc

Cargill is integrating data-driven insights and microbial technologies into its silage additive range, such as the Cargill TrueGold product line. Recent developments include unique bacterial inoculants that promote efficient fermentation for both haylage and corn silage. Their focus is on providing proven, research-backed solutions that help farmers improve feed efficiency, support animal gut health, and increase the overall return on investment from silage.

5. Brett Brothers Ltd.

Brett Brothers specializes in silage additives for the UK and Irish markets, recently promoting their SuperSile and SiloGrain ranges. Their developments include high-potency inoculants and non-corrosive acid-based treatments designed to suit local climatic conditions and forage types. The company focuses on user-friendly products that ensure rapid pH drop, inhibit undesirable bacteria, and maximize nutrient preservation for livestock producers.

Conclusion

Silage Additives is a smart investment for modern farming, transforming basic forage into reliable, nutrient-packed feed that drives better animal health and productivity. With farmers facing tougher weather and tighter margins, these simple tools offer easy ways to cut spoilage, boost digestion, and support sustainable practices. Expect more eco-friendly options and blended formulas to gain traction, helping the livestock sector thrive while keeping operations efficient and green.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)