Table of Contents

Overview

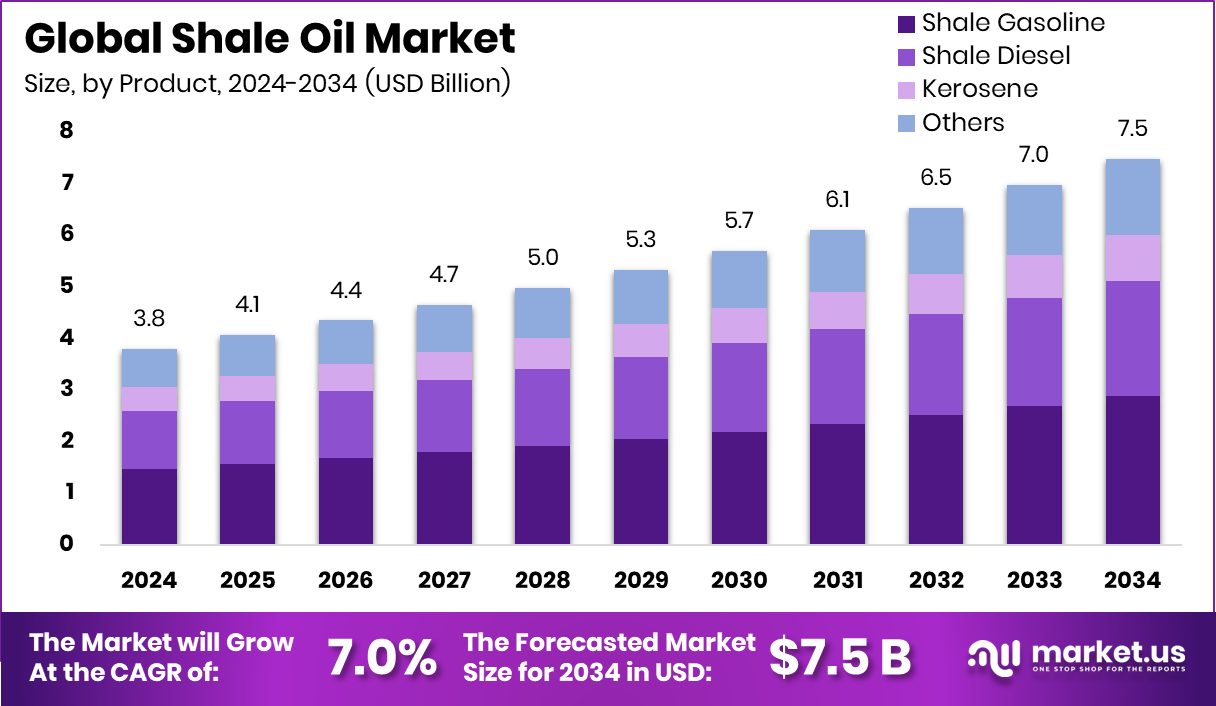

New York, NY – January 08, 2026 – The global shale oil market is projected to grow steadily, rising from USD 3.8 billion in 2024 to around USD 7.5 billion by 2034, at a 7.0% CAGR between 2025 and 2034. North America remains the core production hub, accounting for 49.40% of global revenue, valued at USD 1.8 billion, supported by mature infrastructure and advanced extraction technologies.

Shale oil is an unconventional crude trapped in dense shale formations and recovered using specialized drilling and stimulation techniques. Its commercial importance lies in expanding recoverable oil reserves beyond conventional fields and strengthening the domestic energy supply. The shale oil market covers exploration, extraction, processing, and downstream utilization, with performance closely tied to drilling activity, infrastructure readiness, and fuel demand trends.

Growth is reinforced by sustained capital inflows into upstream assets. Global oil and gas dealmaking reached USD 105 billion in 2024, underlining investor confidence. Large-scale funding initiatives further support the sector, including a USD 10 billion planned investment for Jafurah gas and shale-linked infrastructure and a USD 4 billion corporate bond borrowing plan for major gas infrastructure development.

Demand remains stable as lower fuel prices encourage consumption, while shale oil’s short development cycle helps balance supply gaps. On the policy side, transition-focused funding such as the EU’s €354 million support for Estonia’s oil shale phase-out, alongside education grants of USD 2.35 million and USD 14,575 to the Utica Shale Academy, is reshaping long-term industry capabilities without slowing near-term market activity.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-shale-oil-market/request-sample/

Key Takeaways

- The Global Shale Oil Market is expected to be worth around USD 7.5 billion by 2034, up from USD 3.8 billion in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034.

- Shale Gasoline dominates the Shale Oil Market by product, holding 38.5% share due to demand.

- In-situ Technology leads the Shale Oil Market by technology, accounting for 67.2% adoption at industry-wide levels.

- Fuel application dominates the Shale Oil Market, representing 52.3% share, driven by energy consumption growth.

- North America leads regional shale oil demand, holding a 49.40% share worth USD 1.8 billion.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=170320

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.8 Billion |

| Forecast Revenue (2034) | USD 7.5 Billion |

| CAGR (2025-2034) | 7.0% |

| Segments Covered | By Product (Shale Gasoline, Shale Diesel, Kerosene, Others), By Technology (In-situ Technology, Ex-situ Technology), By Application (Fuel, Electricity, Cement and Chemicals, Others) |

| Competitive Landscape | ExxonMobil Corporation, Royal Dutch Shell plc, Chevron Corporation, BP plc, Marathon Oil Corporation, Pioneer Natural Resources Company |

Key Market Segments

By Product Analysis

In the shale oil market, shale gasoline stands out as the leading product, holding a 38.5% global share in 2024. Its dominance is closely linked to strong downstream demand, as shale gasoline blends efficiently into transportation fuels and aligns well with existing refinery systems. Refineries favor shale gasoline because it requires minimal process adjustments, ensuring smooth integration into fuel production chains.

The 38.5% share also reflects consistent demand from industries that rely on lighter hydrocarbon fractions to improve fuel efficiency and meet quality standards. As shale extraction technologies advance, producers continue to prioritize outputs that deliver higher market acceptance and reliable pricing. Shale gasoline’s favorable chemical composition supports this preference, reinforcing its commercial appeal. Overall, its leading position highlights shale gasoline as a core revenue-generating product, maintaining a stable role within the shale oil value chain and sustaining its importance in global product segmentation.

By Technology Analysis

In 2024, in-situ technology dominated the shale oil market by technology, accounting for 67.2% of global adoption. This leadership reflects the industry’s growing preference for extraction methods that recover resources directly within shale formations, reducing surface-level disruption. In-situ processes allow operators to manage heat and conversion underground, supporting more controlled and continuous production.

The strong 67.2% share indicates that producers value technologies offering scalability and adaptability across varying geological conditions. In-situ methods are especially favored where surface mining is impractical or environmentally constrained. Their widespread use improves operational stability while supporting long-term production planning. As shale projects expand globally, the dominance of in-situ technology underscores its role as a foundational approach, shaping extraction strategies and reinforcing its position as the primary technological backbone of the shale oil market.

By Application Analysis

Fuel applications led shale oil consumption in 2024, capturing a 52.3% share of total demand. This dominance highlights shale oil’s primary role as an energy source, particularly for transportation and industrial fuel systems. Fuel use remains the most consistent and volume-driven application, providing a stable demand base for shale-derived products.

The 52.3% share reflects continued reliance on shale oil to supplement conventional fuel supplies, especially in regions facing supply constraints or price volatility. Shale oil’s ability to respond quickly to market conditions enhances its attractiveness for fuel applications. This strong positioning confirms fuel usage as the most economically significant segment, anchoring shale oil’s commercial relevance and reinforcing its importance in meeting ongoing energy demand across major producing regions.

Regional Analysis

North America leads the global shale oil market with a dominant 49.40% share, generating approximately USD 1.8 billion in market value. This leadership is supported by a well-established shale resource base, advanced extraction technologies, and mature infrastructure across key shale basins. Consistent production levels and large-scale commercial operations allow the region to anchor global shale oil supply, making it the largest revenue contributor to the overall market.

Other regions—including Europe, Asia Pacific, the Middle East & Africa, and Latin America—represent developing segments with comparatively smaller market shares. Their participation is mainly driven by early-stage exploration, regulatory considerations, and gradually improving production capabilities. Although Europe and Asia Pacific are showing growing interest in unconventional oil resources, shale oil development remains limited in scale. Similarly, the Middle East & Africa and Latin America continue to assess shale potential, but geological complexity, economic viability, and operational challenges currently restrict their overall market contribution.

Top Use Cases

- Fuel for Power Generation: Shale oil can be burned like other petroleum-based fuels to generate electricity. In places such as Estonia and China, much of the shale oil is used in power plants where its heat generates electricity for homes and businesses.

- Transportation Fuels: Once refined, shale oil can be converted into essential fuels such as gasoline, diesel, marine fuel, and aviation jet fuel, which enable vehicles, ships, and airplanes to operate. These products are similar to what comes from conventional crude oil.

- Heating Oil: Shale oil is also processed into heating oil, which people use to heat homes, industrial buildings, and factories, especially where an electricity or natural gas supply is limited.

- Chemical Industry Feedstock: Shale oil provides raw material for making chemicals. After refining, its components feed chemical processes to produce items like waxes, solvents, and other industrial chemicals.

- Cement and Construction Materials: Byproducts from shale oil extraction are used in cement production and other construction materials. For example, residues can be mixed during cement making or used as part of industrial inputs.

- Marine and Industrial Fuel: Shale oil is used as a marine fuel for ships and as a fuel for heavy industrial boilers and machinery. Its heat energy makes it suitable for large vehicles and industrial power systems.

Recent Developments

- In July 2025, Chevron completed its purchase of Hess Corporation, a major U.S. oil producer, after legal and regulatory steps were finished. The deal brought Hess’s oil and shale-linked assets (including Bakken Formation acreage) into Chevron’s portfolio.

- In March 2025, Shell held its Capital Markets Day to outline its strategy for growing oil and gas value with lower emissions. While this event covered the full energy portfolio, it reinforced Shell’s intent to sustain and invest in core operations that include oil production and fields tied to unconventional resources like shale.

- In May 2024, ExxonMobil finished its merger with Pioneer Natural Resources, one of the biggest shale oil producers in the U.S. This deal brings together Exxon’s resources with Pioneer’s large shale acreage in the Permian Basin, making ExxonMobil a much stronger player in shale oil and gas development. The combined business now has some of the richest oil resources in the region.

Conclusion

The shale oil market continues to play an important role in the global energy landscape by supporting supply stability and energy security. Its growth is driven by advanced extraction technologies, strong infrastructure, and steady demand for fuel and industrial applications. Shale oil’s ability to respond quickly to price changes makes it a flexible source compared with conventional oil. While environmental regulations and high production costs remain challenges, ongoing efficiency improvements and responsible operational practices are helping the industry adapt. Overall, shale oil is expected to remain a strategic energy resource, supporting fuel needs and complementing traditional oil production as the energy transition progresses.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)